The low price of increasingly important electric vehicle battery material nickel could prove a handicap rather than a boost to EV adoption, according to U.K.-based analyst Wood Mackenzie.

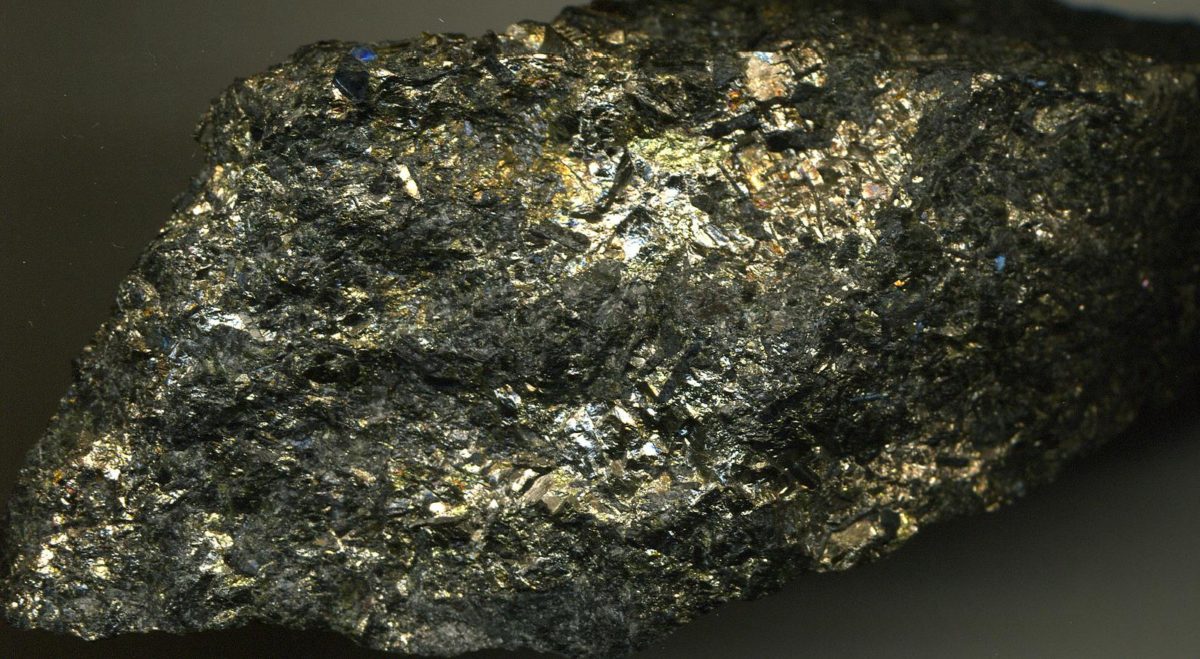

The business information provider’s Global battery raw materials long-term outlook H1 2019 report spells out how a relative abundance at present of a material used in stainless steel production has kept a lid on the nickel price which has dampened investment in expanding production.

WoodMac research director Gavin Montgomery pointed out demand for the material will rise as EV adoption takes off, especially as manufacturers raise the nickel content of battery chemistries to counter the expense of cobalt.

That could lead to supply shortages by the middle of the next decade as the lead-in time for new nickel mining operations can be up to a decade. “Investment needs to happen now,” said Montgomery in a WoodMac statement issued this morning to publish the report.

Changing the recipe

Battery manufacturers such as South Korea’s SK Innovation have reportedly announced plans to follow China’s lead in commercializing production of NMC811 batteries by beginning large scale output this quarter. NMC (nickel-manganese-cobalt) batteries contain that mix of elements in the cathode with graphite used in the anode and the figures refer to the ratio of raw materials. With NMC523 and 622 products – containing, for example, five parts nickel, two parts manganese and three parts cobalt in the former – currently dominating, the shift to an 811 mix will reduce costs by using smaller amounts of rare, costly cobalt as well as reputedly offering up to 10% greater energy density.

However, unless investment is made in expanding nickel production – or alternative battery types such as sodium-ion products take off – the savings could have a limited benefit.

The WoodMac report states Indonesia will play a key role in the global nickel trade and also highlights the price crash suffered by cobalt and lithium carbonate during the first half. The high price commanded by cobalt – more than half of which is currently sourced from the Democratic Republic of Congo – until the start of the year will help ensure oversupply until at least 2024, especially as cobalt content is reduced in EV batteries, according to WoodMac.

Lithium falls

The price of lithium carbonate has fallen more than $7,000/ton since June 2018, according to WoodMac, even without South American brine producers managing to ramp up production. With the analyst predicting the market for the commodity will experience double-digit annual growth until EV batteries make up 80% of lithium demand by 2030, the price falls seen for lithium and cobalt have fuelled predictions EVs could reach price parity with internal combustion engine vehicles as early as 2025.

WoodMac predicts the price of graphite will remain stable, thanks to increased output from East Africa, and the same will be true of manganese, which will remain far more important for the steel industry than for EVs in the immediate future.

The analyst estimates EVs and hybrid models will make up 7% of all vehicle sales by 2025, 14% by 2030 and 38% by 2040.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

6 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.