Keen to avoid the perceived mistakes of the solar cell and module industry, and to cater to the accelerating electric vehicle (EV) market, Europe has ambitious plans to establish a prominent domestic battery manufacturing presence.

In the opening remarks of a 2018 speech, Vice-President for Energy Union Maroš Šefčovič stated that the EU Battery Alliance, launched a year prior, aimed to establish Europe as the global leader in sustainable battery technology.

“Our objective for the alliance is simple, but the challenge is immense. We want, almost from scratch, to create competitive and sustainable, battery cell manufacturing in Europe supported by a full EU-based value chain,” he said.

Accelerating fast

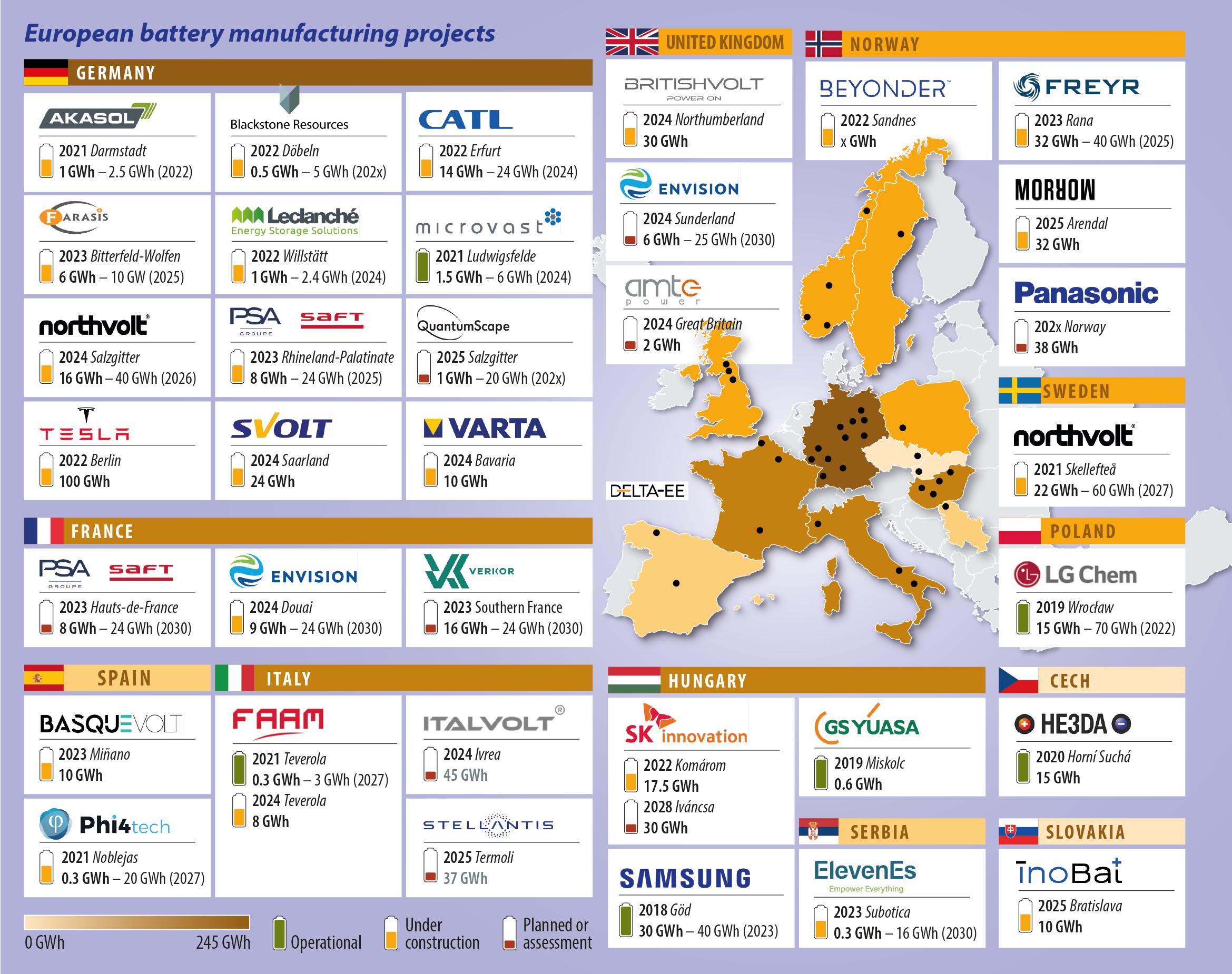

In the July 2021 edition of pv magazine, analyst João Coelho wrote that Delta-EE had identified six operational gigafactories in the EU, equivalent to a total Li-ion cell production capacity of 62GWh. “By 2025, this is expected to increase to 25 plants and a production capacity of around 591GWh,” he said.

In its latest report, “How Europe’s Gigafactory Boom Will Transform the Storage Market,” released in December, the European research and consultancy company said it now expects 35 gigafactories to be operational by late 2025. Speaking to pv magazine in late January, Coelho added that the new projects identified are expected to create a total of 664GWh in just four years.

Looking at the current figures, there is a way to go if Europe is to achieve its ambitions. Indeed, Delta-EE said global production capacity of Li-ion cells is estimated to reach 740GWh by the end of 2021 with Europe accounting for just 8% of that total. However, Coelho said he is confident that the timelines will be met, because of the massive demand for EVs.

In terms of where these factories will be built, Germany is the top location so far, although France and Italy are expected to become the second and third biggest markets by 2030 in terms of annual manufacturing capacity, overtaking Hungary, which is currently in second place.

Walking the talk

The companies leading the charge are Tesla, Northvolt, and LG Chem, says Delta-EE, which estimates that they will comprise 27% of the total share of Li-ion production capacity by 2030. Volkswagen plans to secure around 240GWh of cell manufacturing capacity by then.

While US disruptor Tesla is expected to become the leading producer in Europe, work on its gigafactory in Germany’s Berlin Brandenburg has stalled. Production was supposed to have kicked off last summer; however, delays continue beyond the company’s projected production timeline, and the company did not respond to queries.

As the map depicts, many other established industry giants like Volkswagen, LG Chem, Samsung, Saft, CATL, SEAT, and Panasonic are also getting in on the game. Unfortunately, like Tesla, they are difficult to pin down for more details.

This means a new entrant, Sweden-based Northvolt (established in 2017), is currently spearheading production following the December 2021 announcement that its first Li-ion battery rolled off the production line at its Swedish manufacturing facility in Skellefteå. “The cell is the first to have been fully designed, developed and assembled at a gigafactory by a homegrown European battery company,” said the company in a press release.

Speaking to pv magazine, Jesper Wigardt – VP communications and public affairs at Northvolt – said the company aims to have 150GWh of capacity in Europe by 2030. “We will have to see whether that figure needs to be raised given the tremendous pace of the market here but that is the goal that stands today,” he said, adding that to achieve this, at least another two more factories will need to be built. One deal is already underway via a joint venture with Volvo Cars and the two are gearing up to announce the location soon. Meanwhile a third is expected to be built in Germany.

Germany-based Akasol has also been producing battery modules and systems in its 1GWh Gigafactory 1 in Darmstadt for the EV market, since mid-2020. Unlike Northvolt, however, its battery cells are sourced from various cell manufacturers around the world, as opposed to being produced in Europe. CEO Sven Schuz tells pv magazine that capacity will be expanded this year to 2.5GWh and if there is demand, to 5GWh by 2025. “Our second European serial production facility in Langen [operational since 2017] is fully installed with a production capacity of 800MWh,” he said, adding to a 400MWh gigafactory in the US, currently ramping up to 1.5GWh in the fourth quarter. “BorgWarner Inc., an American car manufacturer, is the majority shareholder and will mainly cover future funding,” said Schuz.

Several other startups are also aiming to kick off EU battery production, like France’s Verkor – with the aid of EU-funded sustainable energy research body EIT InnoEnergy, energy and automation digital solutions company Schneider Electric, and Paris-based engineer IDEC Group – which said in August 2020 that it intends to set up a battery fab in Rodez, northeast of Toulouse, France.

The 200-hectare factory will cost an initial €1.6 billion and create more than 2,000 jobs, while supporting thousands more in its supply chain, according to Verkor. Production is slated to start in 2023 with an initial annual manufacturing capacity of 16GWh, which could rise to 50GWh.

Meanwhile, Italian startup Italvolt announced last February that it wants to build a €4 billion EV battery manufacturing facility in Italy. The site for the project is currently being identified, and the factory’s initial capacity should reach 45GWh. The project’s first phase is expected to be finalized by the end of 2024.

And in Spain, the Spanish minister of industry, commerce and tourism, Reyes Maroto, announced last March that the government intends to create a public-private consortium led by car manufacturer SEAT-Volkswagen and Spanish energy company Iberdrola to set up the first EV battery factory in Spain. No time frame nor specific investment figures for the project were provided, but a location close to the SEAT factory in Martorell, near Barcelona, was suggested.

Most of the battery production is focused on Li-ion technology to supply the automotive industry. As Delta-EE highlighted in its report, “Li-ion cell production will be largely focused on supplying the automotive industry, with ~90% of annual capacity in 2025 allocated to powering EVs. The remaining ~10%, just below 60GWh, may be available for stationary storage applications.”

There are, however, some companies – like the aptly named Basquevolt located in the Basque Country – which are focusing on other technologies. It is planning to establish a 10GWh solid-state battery manufacturing facility with technology developed by CIC energiGUNE. “After more than 10 years of research this technology is expected to reach the mass production by 2027,” a company spokesperson told pv magazine.

Basquevolt noted that Li-On battery technology may not match demand and cost requirements, with solid-state able to offer further energy density and safety breakthroughs in time. Concerning costs, they said that their technology is expected to be reduced by 40% compared to current technologies, without elaborating further.

Another company focusing on solid state batteries is US-based QuantumScape Corporation. The company is working together with Volkswagen and is planning a 1GWh European manufacturing facility. While Germany’s Salzgitter was expected to be the chosen location, as the map depicts, a spokesperson tells pv magazine that the final site selection is pending. “Regardless of the location, we remain committed to bringing QuantumScape’s solid-state lithium-metal batteries to Volkswagen’s growing electric fleet,” they said.

In terms of financing, the company has raised $730 million in gross proceeds from its business combination with Kensington Capital in November 2020 and close to $500 million through a secondary offering in 2021. Volkswagen has also invested $300 million, with Bill Gates also a noted investor.

Sustainability on the agenda?

As Vice-President for Energy Union Maroš Šefčovič said in 2018, Europe’s goal is to become the global leader in sustainable battery technology. Given current high carbon footprint and energy intense processes used in battery manufacturing, the raw materials involved and the issue of waste at end of life; sustainable batteries do not yet exist.

But how many of the current plans are factoring in true sustainable action? A lot of companies have incorporated statements into their press releases talking about the creation of a circular industry; however, to date no specific details have been released.

Replying to pv magazine, Basquevolt’s spokesperson said that every product and its manufacturing process will be designed with a carbon-neutral target in sight. “The repurpose and reuse of batteries is also part of the company DNA, and the battery cells will be designed to facilitate that process,” they added, without expanding.

Akasol’s Sven Schulz said that batteries sent back to the company will either be remanufactured to be operated in a second life application, or they will be recycled.

Thus, to date, Northvolt appears to be the only one that has devised concrete plans. As Jesper Wigardt explained, to produce one kWh of capacity between 60 kWh to 100 kWh of energy need to go into production, thus the company located its fab in Sweden where there is an abundance of hydropower. In the other locations it is considering renewable energy sources.

Another strategy has been to form a cooperation with a startup Sweden to build a fertilizer plant to use the “tremendous amounts” of salt that occur as a byproduct during production and thus, stop it being flushed into the oceans.

Northvolt has further established a recycling program, Revolt, which uses a hydrometallurgical recycling process to recover up to 95% of the metals in a battery “to a level of purity on par with fresh virgin material.” Via Revolt Ett, Northvolt is also working on a giga-scale recycling plant located adjacent to the Northvolt Ett Gigafactory.

It says that recovered materials from the facility will supply the neighboring factory with recycled metals sufficient for 30GWh of battery production annually.

Currently Northvolt’s supply chain is based primarily out of Europe, said Wigardt. However, the company is looking to establish a more regionalized base. “The Nordic region is interesting and there are other parts of Europe where you have interesting materials, like lithium in Portugal, for instance and other metals available in other places in Europe, so we hope to be a catalyzer of all of growth for that industry here,” he said.

In the second quarter of 2022, pv magazine’s UP Initiative will be focusing on the topic of battery sustainability further, so stay tuned.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.