With China and India’s rising carbon emissions increasingly under the spotlight, the achievements of the two nations in the transition to a renewable energy future can be too easily overlooked.

The COP27 climate change summit in Sharm El Sheikh in November failed to achieve progress on multilateral decarbonization, with several of the world’s fastest-growing economies arguing they should be treated as developing countries because of their lower contribution to historical emissions. Regardless of the merits of that argument, India and China are leading the world with their coherent approach to utility-scale solar and other renewable energy sources.

Getting connected

The transition from fossil-fueled power to renewables is not a simple swap from one type of generation to another. Coal, gas, and oil – as well as nuclear – power stations are large static plants, connected to feed power outwards through a passive transmission and distribution network. Solar and wind plants are smaller resources, typically more widely distributed.

Wiki-Solar

We know substantial changes to transmission grids are needed to accommodate a high penetration of renewables. Developed countries – particularly in Europe and Australia – have appeared blind to the changes required, or at least resistant to making them. The deployment of utility-scale solar in those regions has been depressed in recent years by a lack of connection capacity in the right locations.

India and China, by contrast, have invested substantially in transmission infrastructure to support new utility-scale solar and wind capacity. Indian Prime Minister Narendra Modi, when he was chief minister of Gujarat, inaugurated the first multi-plant solar park at Charanka 10 years ago. In a pioneering approach that has now been replicated in dozens of similar solar parks around India – large sites where multiple solar projects are co-located by one agency – Gujarat provided a high-capacity grid connection to which all the plants could connect.

This approach has now evolved to include transmission infrastructure across larger distances. Five solar parks and clusters – the latter instances of multiple nearby projects without central organization – around the Thar desert in Rajasthan house nearly 20 GW of solar capacity, feeding power through India’s Inter-State Transmission System to states as far away as Maharashtra. Rajasthan overtook California this year to become the world’s top state or province for cumulative utility-scale solar capacity.

China, likewise, has installed extensive transmission capacity to evacuate power from huge solar power stations in its arid western and northern regions to the populous cities on its eastern seaboard. The 5 GW cluster in Qinghai’s Gonghe County connects to a transmission line almost 2,000 km long, all the way to Beijing. The Tengger Solar Park, in Ningxia, is now being expanded by a further 3 GW and new gigawatt-scale projects are in development in Sichuan.

Catching up

Overall, developed countries are losing market share in utility-scale solar.

Popular content

The brightest spot is the United States, but even here the regional situation is patchy, depending on how states embrace solar. The Pacific Southwest, which used to dominate US solar capacity, is losing ground, while formerly “solar-skeptic” states including Texas and Florida are now catching up. North Carolina has always been an enthusiast and is still the fourth biggest state for utility-scale solar capacity – ahead of sunnier Nevada and Arizona. Canada has done little since the end of Ontario’s solar initiative in the last decade.

Europe, which was the leading market for big solar capacity until 2013, has been losing ground ever since. Many formerly leading countries have suffered from a lack of grid connections. Only Spain is adding significantly to its installed capacity. Germany and France are making only cautious advances, the United Kingdom has no coherent renewables strategy beyond offshore wind, and progress remains at a snail’s pace in Italy.

Australia too has suffered from connection problems, though it is steadily rising up the international league table. South America is catching up, with a large pipeline of projects in development. However, these tend to take a long time to mature, so South American policymakers and developers could perhaps learn from the holistic approach adopted in China and India.

Emission reductions

Utility-scale solar must be a major contributor to reducing emissions if the 1.5 C maximum global temperature rise target is to be met and the contribution this segment of the solar market can make is already evident.

Image: Wiki-Solar

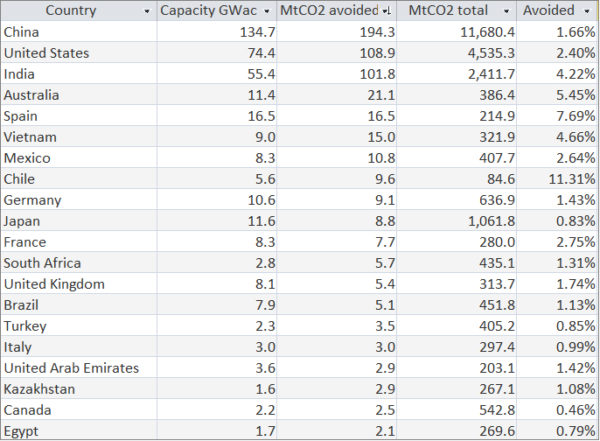

The table above estimates emissions, in million metric tons (MT), that the top big-solar countries are avoiding as a result of their operating PV capacity. It uses national averages for the annual output per megawatt of generation capacity and for the carbon emissions per megawatt-hour produced, so it is subject to a margin of error. Nonetheless, the figures show most countries are mitigating a few percent of their emissions through the electricity delivered by large solar plants.

Chile comes out on top, thanks to an ambitious renewables program and high levels of solar radiation. Spain, India, Vietnam, and Australia also rank highly, for similar reasons. The rest of Europe, Japan, and Canada could all do better.

Overall, with utility-scale solar deployment continuing to accelerate year on year, the segment can be expected to make a valuable and growing contribution to climate change mitigation.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Australia also has about 16 GW of small rooftop solar, increasing by 3 GW a year and regularly outperforming the utility scale solar and now providing 8 – 10 GWh a day in spring/summer. Saving even more emissions. India, Germany and the U.S. also saving a lot of emissions through their constantly increasing rooftop solar.