The haphazard policy landscape facing the African solar industry has been laid bare by a survey of the sector carried out by industry body the Africa Solar Industry Association (AFSIA).

The Africa Solar Outlook 2021 report, the first of a planned annual series by the membership organization, attempts to shine a light on the progress being made by the PV sector across an under-served continent but cannot help but highlight national government failings in its country-by-country analysis.

With numerous reports having extolled the benefits of setting national solar and renewable energy targets, the case of Cape Verde highlighted by AFSIA illustrates the importance of following through on such commitments, when it comes to attracting solar investment.

Forgotten

The island archipelago off the west coast of Africa had, until March, maintained an ambitious target of sourcing all of its electricity from renewables by last year, according to the AFSIA report–although the hyperlink to the policy statement provided in the report fails. That goal has reportedly been scaled back to a much less ambitious 30% by 2025 and 50% by 2030.

Whether the revised target can be met, in a nation which has only 8.8 MW of installed solar capacity–according to AFSIA and the International Renewable Energy Agency (IRENA)–remains to be seen. The same can be said for Djibouti, a solar-free nation which in 2019 said it would have an entirely renewable energy system by last year, and of the eight other African nations which boasted clean energy ambitions ranging from 5-50% by last year.

Kenya was forced to admit defeat on plans for a fully renewable power mix by last year, and pushed the target back a decade and Niger‘s plan for 100 MW of solar “by 2021” could at least be said to be theoretically achievable, given a generous interpretation of the word “by”. Niger currently has 7 MW of solar, according to the AFSIA study, albeit with plans for a further 150 MW by the 14 governments which comprise the West African Power Pool.

Confusion

Similar policy confusion apparently haunts Algeria, one of the countries tipped in the report to be likely to join South Africa and Egypt in solar's ‘gigawatt club' of nations. pv magazine has reported on previously-trailed plans by the Algerian authorities to develop the 4 GW Tafouk 1 solar field, via five 800 MW procurement rounds up to 2024. However, the AFSIA study cited a report by African clean power news site Afrik21 in August, which referred to comments made by Algerian minister of energy transition and renewable energies, Chems-Eddine Chitour, which apparently cast doubt on the project.

Chitour reportedly said, in an interview with “national radio”: “Frankly, I don't know anything about the 4,000 megawatts and I don't like the effects of the announcement.” With the minister appointed in June, as part of the cabinet chosen by president Abdelmadjid Tebboune, who took office in January 2020, the nation's solar ambition now appears to have been scaled back to two 500 MW tenders to be comprised of 50 MW, 100 MW and 150 MW sections of generation capacity.

Popular content

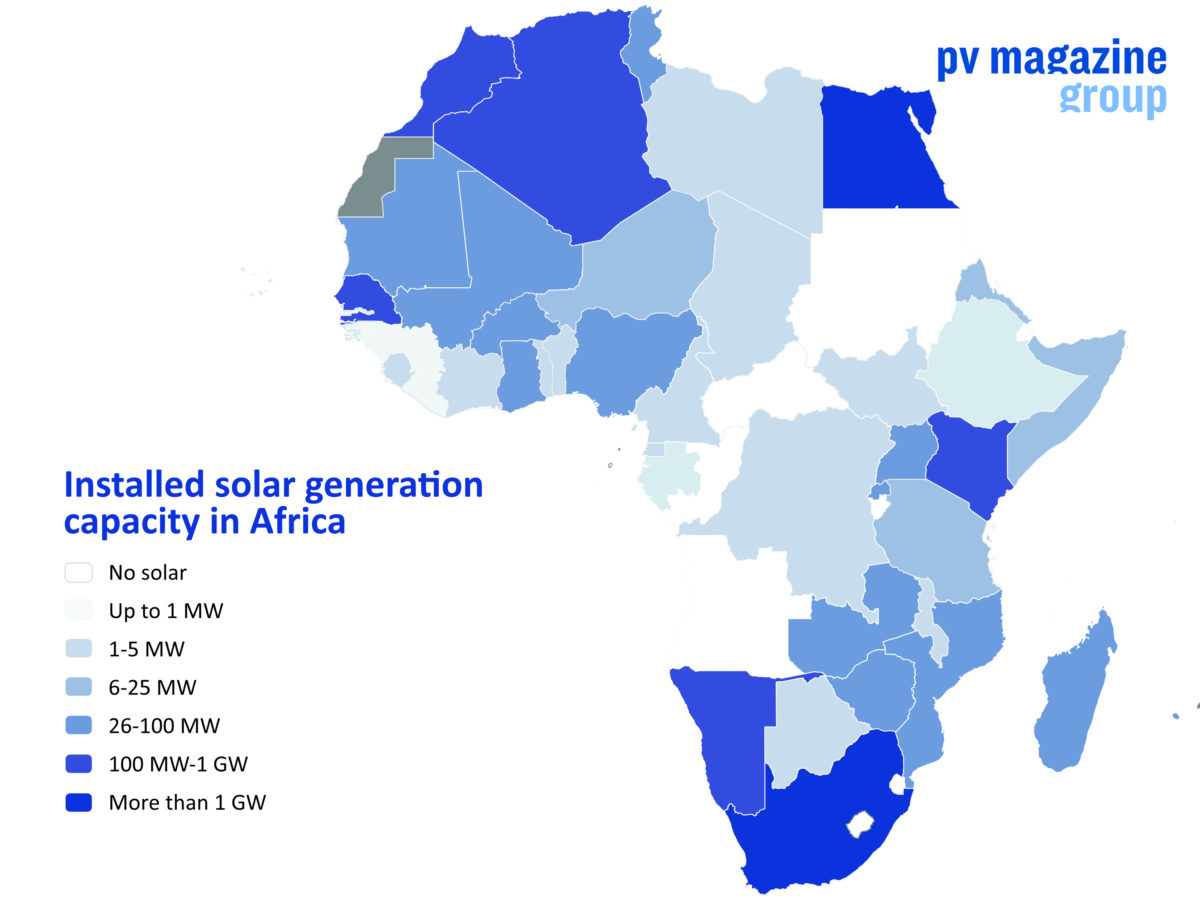

There are, however, reasons for optimism in the AFSIA report, which tips Morocco, with its 2 GW solar pipeline; and the Democratic Republic of Congo (DRC), which has reportedly signed contracts for 1 GW of photovoltaics, to follow in the footsteps of solar pioneers Egypt–with its 1.76 GW-plus of capacity–and South Africa, which boasts around 2.9 GW and has plans in place to procure 6.8 GW more.

Mention is made of the heady plans by southern neighbors Namibia and Botswana to install 4.5 GW of PV and concentrating solar power (CSP) capacity, starting with 275 MW of photovoltaics and 500 MW of CSP. The DRC plans 1 GW of solar for Kinshasha city, and three remote cities elsewhere in the huge nation will benefit from ‘mini' grids which could prove to be the world's largest, after the award of a contract to a consortium comprised of French power company Eranove, Madrid-based developer AEE Power and U.K. government-backed electricity network company Gridworks.

While policy support appears patchy on a continental scale, the AFSIA study highlights exemplars in the island nations of Mauritius and the Seychelles. The former offers solar tax incentives, net metering for small residential systems, feed-in tariff (FIT) payments for registered household solar owners and free installation of small PV systems for 2,000 small and medium-sized businesses. Net metering, solar rebates and household PV loans are available in the Seychelles, where the authorities exempt all solar components from goods and services tax.

Mozambique

However, policy is not always enough, with the report noting in Mozambique there has been a “FIT available since 2014 but no success thus far.”

Elsewhere, in Sudan–where the UAE government is financing 500 MW of large scale solar capacity–the electricity price rose 500% at the start of the year, again illustrating the choppy waters investors often have to navigate in Africa.

With hurdles such as those, turning ambition into reality can be a tough business in nations such as Ethiopia, which has plans for 1.33 GW of solar under the World Bank's Scaling Solar program but, according to AFSIA and IRENA, has thus far installed only 500 kW of mini-grid and solar home system generation capacity.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

30 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.