Grid parity monitor

PV energy is improving cost competitiveness in the commercial segment

CREARA has released a new issue of its Grid Parity Monitor (GPM) series. This is the third issue focused exclusively on the commercial sector (30 kW PV systems) which analyzes countries in Europe and LatAm (Brazil, Chile, France, Germany, Italy, Mexico, and Spain).

The latest issue of the GPM, sponsored by BayWa, evaluates the cost-competitiveness of photovoltaic technology with retail electricity prices in the commercial segment and assesses local regulations for self-consumption in each country.

As opposed to residential electricity consumers, commercial consumers can attain a good match between electricity consumption and PV generation (i.e. consumers with peak electricity demand during the day). Therefore, 100% on-site (instantaneous) self-consumption is possible, reducing the need for solutions to manage PV excess generation (such as storage systems or net metering mechanisms).

Although the relevant savings resulting from PV self-consumption can include not only variable costs (avoided costs from grid electricity) but also fixed costs (such as capacity cost reductions), the GPM considers only the former savings. As such, it may offer a conservative stance on grid parity, so the authors of the report stress that a case-by-case analysis is needed to assess the economics of each specific situation.

According to the study, in the last semester of 2015, there has been a mix of developments for PV economics in the countries under analysis:

· The decrease in grid electricity prices seen by several LatAm countries in the past (which reversed in 2014) has been registered again in 2015, especially in Mexico and Chile. This has negatively impacted the competitive position of PV in those countries.

· In the European countries the grid electricity prices have stayed stable or increased in 2015, except for Italy where they decreased. The LCOE of PV installations has not changed significantly.

Even if a high self-consumption ratio can be attained in the commercial segment, the regulatory support is still vital for the development of the market. In countries such as Brazil policies encourage self-consumption. On the other side of the spectrum, poor regulation can hinder the self-consumption market, as is the case of Spain, where the latest law has introduced a fee on on-site self-consumption and no compensation for the excess PV generation fed into the grid, if the excess electricity is not sold to the market through an electricity trader.

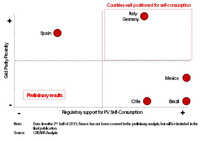

The matrix below shows the positioning of each country in terms of grid parity proximity in the commercial segment and regulatory support:

In countries such as Germany and Italy, both at grid parity and with a proper regulation, PV systems for self-consumption represent a viable, cost-effective, and sustainable power generation alternative.

The GPM is a series of studies about PV competitiveness against conventional electricity prices in several sectors and countries. The GPM is an independent analysis, which is updated regularly, uses a rigorous and transparent methodology and is available free of charge at: http://www.leonardo-energy.org/photovoltaic-grid-parity-monitor

Contact: gpm( at )creara.es

Generation parity of utility-scale PV projects can be reached in electricity wholesale markets without incentives

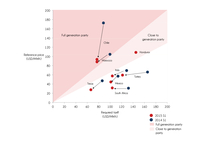

The results of the ninth issue of the study “PV Grid Parity Monitor,” carried out by the consulting firm CREARA, sponsored by BayWa, Exosun and PVHardware, and in cooperation with Copper Alliance, shows that photovoltaic (PV) generation parity (the moment when profitability requirements of PV investors are completely fulfilled with wholesale electricity prices) is an economic reality in Chile and Morocco and is close in Honduras. The geographic scope of the analysis has been expanded as Honduras and South Africa have been included in this new edition.

While the first Grid Parity Monitor (GPM) issues focused on residential (3kW) and commercial (30 kW) PV installations for self-consumption this report is the second analysis that covers large scale PV plants. The plant considered in the analysis has an installed capacity of 50 MWp using a single-axis tracking system under a project finance scheme. The GPM report analyzes the competitiveness of the PV technology and assesses local regulation in a location with high irradiation in 8 different countries: Chile, Honduras, Italy, Mexico, Morocco, South Africa, Turkey, and USA (Texas).

An outline of the electricity market is given to allow full understanding of PV generation parity proximity in each of the analyzed countries. This GPM report provides a summary of the market situation so that the reader is able to identify which electricity prices must be chosen to evaluate PV generation parity and which are the main difficulties a PV plant will face in the considered market.

Two countries have achieved generation parity, Chile and Morocco, and a third country, Honduras, is showing required tariffs relatively close to the reference price. PV technology costs have fallen since the first issue of the GPM utility-scale. As explained by David Pérez, partner of CREARA and in charge of the study, “initial investment costs, which are considered in dollars, have decreased significantly in the last semesters in all countries included in this analysis, but the strong dollar has reduced the impact on the final results.”

The fact that generation parity has not been reached in a country does not imply that utility-scale PV plants will not be built. Others reasons that might create a favorable situation and therefore may trigger such an investment are, for example, a RPS (Renewable Portfolio Standard) system, a FiT program or a convenient PPA scheme which has been granted to the investor. Given the volatility in many of the wholesale markets and the fast decline of PV prices (which are much higher in the utility segment than in residential or commercial segments), the competitiveness of utility-scale installations should be analyzed over time.

The GPM is a series of studies about PV competitiveness against conventional electricity prices in several sectors and countries. The GPM is an independent analysis, which is updated regularly, uses a rigorous and transparent methodology and is available free of charge at: http://www.leonardo-energy.org/photovoltaic-grid-parity-monitor

Contact: gpm( at )creara.es

Small-scale PV for self-consumption is already cost competitive in Mexico

CREARA has released the third issue of its Grid Parity Monitor (GPM) Series, exclusively focused on Mexico, a market with high irradiation throughout the country and regulatory support that fosters the installation of PV systems.

The most recent GPM, sponsored by Jinko, analyzes the cost-competitiveness of photovoltaic technology for the residential segment (PV systems of 3kW), the commercial segment (PV systems of 30 kW) and the utility-scale segment (PV systems of 50 MW).

This latest issue compares PV generation costs with retail electricity prices at a residential or commercial level, whereas for the utility-scale segment PV costs are assessed against wholesale prices.

As such, the GPM introduces both the “grid parity” and the “generation parity”concepts:

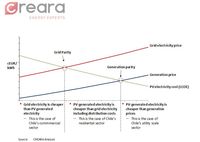

- Grid Parity (for residential and commercial segments) is defined as the moment when PV LCOE is competitive with retail electricity prices, assuming that 100% of the electricity is self-consumed instantaneously.

- Generation parity (for utility-scale PV) is attained when the investor reaches the breakeven point, obtaining the required return from the investment (where wholesale prices are equated to the resulting revenues).

The analysis of PV competitiveness in Mexico shows that the potential for market development varies significantly between segments:

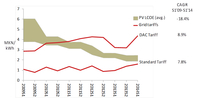

- In the residential sector, full grid parity has been reached only for DAC consumers (households with high electricity consumption that pay more than twice the price of the average residential tariff).

The graph above illustrates the situation in the residential segment in Mexico.

On the other hand, cost competitiveness of PV is not as favorable in commercial and utility-scale segments:

- In the commercial sector, only consumers with contracted power below 25 kW have reached grid parity; for other consumers PV LCOE is still higher than the electricity price, mainly due to the low variable electricity prices for this segment.

- In the utility-scale segment, generation parity was reached in 2012 and S1 2013, in Sonora, but a most recent decrease in wholesale market prices has reverted the situation of PV. In any case, an in-depth analysis of the particular business case is required to properly asses the investment opportunity.

In 2013, Mexico's Government implemented an in-depth energy reform for the oil and gas industry, as well as for the electricity market. This reform led to extensive changes in legislation in 2014 that will be finished with market rules in 2015. The introduction of these changes could impact the development of the PV market.

It is necessary to emphasize that, given the volatility of electricity prices and the decreasing trend of PV prices, PV competitiveness is a phenomenon that must be carefully watched over time.

The GPM is a series of studies about PV competitiveness against conventional electricity prices in several sectors and countries. The GPM is an independent analysis, which is updated regularly, uses a rigorous and transparent methodology and is available free of charge at: http://www.leonardo-energy.org/photovoltaic-grid-parity-monitor

Contact: gpm( at )creara.es

PV energy is improving cost competitiveness in the commercial segment

CREARA has released the second issue of its Grid Parity Monitor (GPM) Series. Focused exclusively on the commercial sector (30 kW PV systems), it analyzes countries in Europe and LatAm (Brazil, Chile, France, Germany, Italy, Mexico, and Spain.

Sponsored by BayWa and Gesternova, the latest issue of the GPM evaluates the cost-competitiveness of photovoltaic technology with retail electricity prices in the commercial segment and assesses local regulations for self-consumption in each country.

As opposed to residential electricity consumers, commercial consumers can attain a good match between electricity consumption and PV generation (i.e. consumers with peak electricity demand during the day). Therefore, 100% on-site (instantaneous) self-consumption is possible, reducing the need for solutions to manage PV excess generation (such as storage systems or net metering mechanisms).

Although the relevant savings resulting from PV self-consumption can include not only variable costs (avoided costs from grid electricity) but also fixed costs (such as capacity cost reductions), the GPM considers only the former savings. As such, it may offer a conservative stance on grid parity, so the authors of the report stress that a case-by-case analysis is needed to assess the economics of each specific situation.

According to the study, in the last semester of 2014, there has been a further improvement of PV economics:

- The decrease in grid electricity prices experienced in the past by several LatAm countries has reversed, which has positively impacted the competitive position of PV in those countries.

- Of the European countries analyzed, France is still the only one where grid parity has not been reached, mainly due to the relatively low variable prices of grid electricity in the country.

Even if a high self-consumption ratio can be attained in the commercial segment, the regulatory support is still vital for the development of the market. In countries such as Germany and Brazil, policies encourage self-consumption.

On the other side of the spectrum, poor regulation can hinder the self-consumption market, as is the case of Spain, where the latest law proposal included a fee on on-site self-consumption and no compensation for the excess PV generation fed into the grid (this policy has not entered into force, but it has virtually halted the self-consumption market).

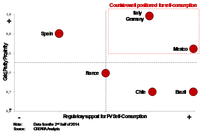

The matrix in the accompanying graphic shows the positioning of each country in terms of grid parity proximity in the commercial segment and regulatory support.

In countries such as Germany, Italy and Mexico, both at (or nearly at) grid parity and with a proper regulation, PV systems for self-consumption represent a viable, cost-effective, and sustainable power generation alternative.

The GPM is a series of studies about PV competitiveness against conventional electricity prices in several sectors and countries. The GPM is an independent analysis, which is updated regularly, uses a rigorous and transparent methodology and is available free of charge at: http://www.leonardo-energy.org/photovoltaic-grid-parity-monitor

Contact: gpm( at )creara.es

- Graphic: Solarpraxis AG/Harald Schütt

PV is an attractive alternative for consumers in Chile

CREARA has released a new issue of its Grid Parity Monitor (GPM) Series, exclusively focused on Chile, a promising market with a regulation that fosters the PV market and high irradiation levels in the north of the country (Copiapó was used as reference).

The latest GPM release, sponsored by Jinko and Solar Del Valle, analyses the cost-competitiveness of photovoltaic technology for the residential segment (PV systems of 3 kW), the commercial segment (PV systems of 30 kW) and the utility scale segment (PV systems of 50 MW) in Chile.

The GPM evaluates PV competitiveness according to the following criteria:

- Grid Parity (residential and commercial segments) is defined as the moment when PV LCOE becomes competitive with retail electricity prices, assuming that 100% of the electricity is self-consumed instantaneously.

- Generation parity (utility scale sector) is defined as the moment when profitability requirements of PV investors are completely fulfilled with wholesale electricity prices.

The analysis of PV competitiveness in Chile shows that the potential for market development varies significantly between segments:

- In the residential sector, PV Grid Parity has already been reached albeit to different extents in different locations of Chile. In Santiago, Grid Parity is only partial while in the north, full Grid Parity has been reached.

- In the commercial sector, PV technology is still far from being competitive against grid electricity, mainly due to the low variable electricity prices for this segment (the tariff structure places a significant weight on the fixed component of the electricity price).

- In the utility scale segment, relatively high wholesale electricity prices and irradiation levels have brought generation parity forward, creating an attractive investment opportunity particularly in the north of the country.

Provided that a good match of generation and consumption curves is not always possible, 100% of instant self-consumption is not likely to happen in residential and commercial systems. Therefore, net metering/net billing or equivalent mechanisms that compensate the prosumer for the excess PV electricity exported to the grid will be crucial to achieve economic feasibility for this kind of installations. In Chile, the recent net billing regulation is, on a first evaluation, a proper incentive for the PV self-consumption market.

For PV utility scale plants, the GPM offers a realistic, albeit theoretical, overview of PV competitiveness. Thus, a case-by-case analysis of the particular business case is required to properly asses the investment opportunity. In this line, the fact that generation parity has not been reached in a given location does not imply that utility scale PV plants will not be built, as there are other reasons that may trigger such an investment, such as a convenient PPA scheme.

Given the volatility of electricity prices and the decreasing trend of PV prices, PV competitiveness is a phenomenon that should be monitored overtime. This is the main focus of the GPM studies: the periodical assessment of PV competitiveness.

The GPM is a series of studies about PV competitiveness against conventional electricity prices in several sectors and countries. The GPM is an independent analysis, which is updated regularly, uses a rigorous and transparent methodology and is available free of charge at: http://www.leonardo-energy.org/photovoltaic-grid-parity-monitor

Contact: gpm( at )creara.es

In January 2014, Creara and Eclareon (Spain) merged their business to form Creara Energy Experts (from now on CREARA) and consolidate their leadership in sustainable energy services.