‘Being a woman in solar is about more than creating your own career’

This week, Women in Solar Europe (WiSEu) gives voice to Soledad Andrade, Business Development and Operations Specialist at Spain’s Youdera. She says, in its early days, she was often the only woman in meetings or on-site visits, making it harder to prove her value. However, as more women join the sector, it has become a more comfortable and supportive environment for development and growth.

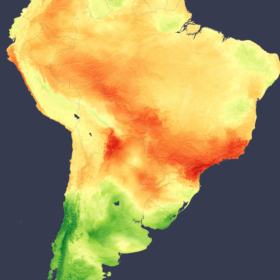

Year-to-year solar variability peaks in Europe, Australia, Argentina, and China

In a new weekly update for pv magazine, Solcast, a DNV company, reports that the regions with the highest year-to-year variability in irradiance include Central and Northern Europe, East Coast Australia, Northern Argentina, and China, with Africa exhibiting the most stable irradiance year-on-year.

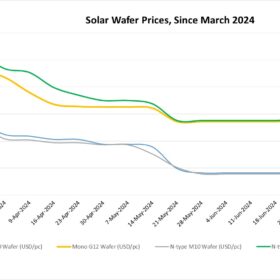

Wafer prices near bottom, size evolution and capacity globalization continue

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

China’s solar dominance not an issue

In a new monthly column for pv magazine, the International Solar Energy Society (ISES) explains why potential trade disruptions in the global PV supply chain are substantially different from those related to coal, oil and gas.

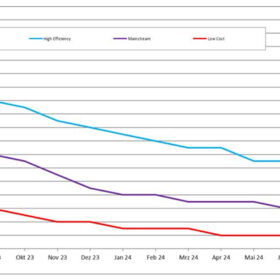

Leasing models could help German solar installers cope with falling panel prices

Martin Schachinger, the founder of pvXchange.com, explains how German solar installers are navigating the current slide in PV module prices – now as low as €0.08($0.09)/kW. He says that solar leasing could offer new opportunities, particularly in the nation’s commercial and industrial (C&I) sector.

‘Scarcity of female peers, role models can lead to isolation, lack of natural allies’

This week, Women in Solar Europe (WiSEu) gives voice to Camille Zimmermann, Investment Director at France-based equity firm Omnes. She says that, when there are women at the helm of companies, it seems there is no problem in finding other talented women to join the ranks of their organizations.

Jet stream shift brings winter sunshine to Brazil, cloud to Argentina

In a new weekly update for pv magazine, Solcast, a DNV company, reports that Rio de Janeiro recorded the sunniest June in over 18 years, with solar irradiance 15% above the long-term average. This was part of a band of higher than average sunshine extending through Bolivia, Paraguay, and parts of Brazil. Conversely, southern Argentina saw an irradiance drop of up to 30% below the long-term average as it experienced its cloudiest June in the same period.

Weak demand continues to exert downward pressure on solar module prices

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

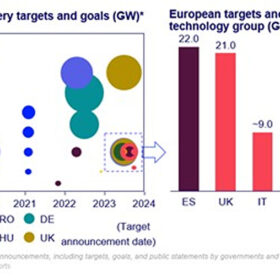

Tackling merchant risk – A deep dive into Europe grid-scale energy storage contracted revenue

Current market conditions are propelling grid-scale project deployment in a more diversified European energy storage market. Anna Darmani, principal analyst – energy storage EMEA, at Wood Mackenzie, examines revenue streams in different parts of Europe and emerging routes to the market.

‘Early in my career, I had the tendency to behave and perform like a man’

This week, Women in Solar Europe (WiSEu) gives voice to Mary Riccio-Kjærgaard, CEO and owner of Danish PV installer Risskov Teknik & Solar Aps. She explains how the idea of leadership is still being negatively influenced by cultural stereotypes and says women can accomplish more and go further by simply being “female leaders.”