Sale process begins for German microinverter maker Solarnative

Solarnative launched insolvency proceedings and started searching for new investors in June.

Sinovoltaics shuffles PV module manufacturer financial stability ranking

The third edition of the Sinovoltaics financial stability report ranking lists India-based Abhishek Corp, Insolartion Energy, Waaree Renewable Technologies, and Solex Energy, all based in India, followed by U.S.-based First Solar as the top five. Six additional manufacturers entered the global ranking.

EneCoat to accelerate perovskite PV production

EneCoat Technologies, a Japanese solar perovskite developer, has raised JPY 5.5 billion ($35 million) from new and existing investors to finance new collaborations based on its low-temperature production process.

SunPower stock crashes 70%

The company’s share price fell below $1 as it announced it is halting some operations and ending its lease and power purchase agreement offerings, among other actions.

BlackRock’s climate infrastructure unit increases stake in Brite Energy Partners

BlackRock’s climate infrastructure business has increased its stake in Brite Energy Partners. The KRW 100 billion ($72 million) investment will help to scale the South Korean independent power producer’s solar portfolio and expand its energy storage and EV charging operations.

Masdar raises $1 billion with second green bond

Abu Dhabi-based Masdar has raised $1 billion through a new bond issuance. It says the investment will fund equity commitments on new greenfield projects, several of which are in developing economies.

ILB Group to acquire Malaysian solar business, assets

Malaysia’s ILB Group Bhd is acquiring Armani Sinar and its solar assets for MYR 98 million ($21 million) in cash. This deal will increase its PV capacity from 13 MW to 30 MW.

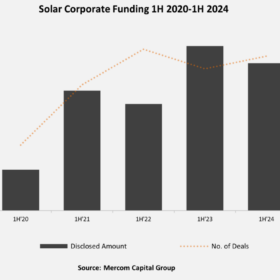

Solar corporate funding hits $16.6 billion in H1

Corporate funding in the solar sector reached $16.6 billion in the first half of this year, according to Mercom Capital Group. It says most funding came via debt financing, as venture capital and public market financing fell.

Hungary refinances rebate scheme for residential solar

The Hungarian government is investing an additional HUF 30 billion ($83.9 million) into its HUF 75.8 billion rebate program for residential solar and storage systems. The scheme, which launched in January, is now expected to support more than 25,000 households.

The Hydrogen Stream: Germany grants €4.6 billion to 23 green H2 projects

The German government has granted €4.6 billion ($5 billion) for 23 green hydrogen projects, while BP has revealed separate plans to develop a 100 MW green hydrogen installation in Germany.