January 2021: More to come in ‘21

With the wholesale transformation of the power industry from the inside out and other energy transition mega-trends, capital will continue to flow into renewables from ESG, energy funds, and retail, writes ROTH Capital Analyst Jesse Pichel. Look for a greater mix of unsubsidized economic solar projects to support improving revenue visibility, increasing earnings quality, and multiple expansions.

With the wholesale transformation of the power industry from the inside out and other energy transition mega-trends, capital will continue to flow into renewables from ESG, energy funds, and retail, writes ROTH Capital Analyst Jesse Pichel. Look for a greater mix of unsubsidized economic solar projects to support improving revenue visibility, increasing earnings quality, and multiple expansions.

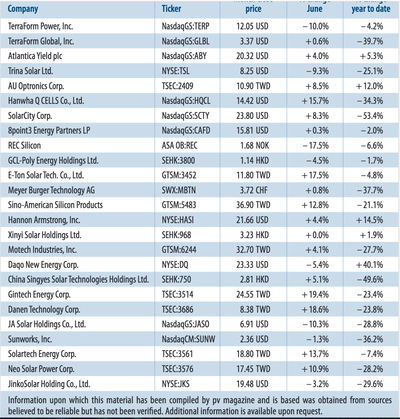

In December, the Guggenheim Solar ETF (TAN) increased 23.2% vs. the S&P 500 and the Dow, which both increased 2.6%. The TAN gained 233.6% vs. the S&P 500 and the Dow, which increased by 16.3% and 7.2% in 2020. The top five solar PV stock performers in the U.S. market for December were ReneSola (SOL), Daqo New Energy (DQ), Enphase Energy (ENPH), Canadian Solar (CSIQ), and SunPower (SPWR). They increased by 45%, 42%, 36%, 22% and 21%, respectively. The top five in 2020 were SOL, ENPH, DQ, Sunrun (RUN), Sunworks (SUNW), with gains of 708%, 572%, 460%, 402%, and 310%.

Global demand will remain strong in 2021. Roth Senior Analyst Phil Shen believes there will be 25-30% growth for U.S. residential PV in 2021, given the extension of the 26% ITC for another two years, increasing demand for backup power, and the potential easing of Covid-19 restrictions.

The ITC/PTC extension reduces a potential pull-in of demand in 2021, but supports higher medium-term growth. The extent of growth will be driven in part by how quickly constraints in the system – labor, BOS, inverters, and possibly even modules – can be relieved. Recent ABS issuances have priced in a range of ~2.3-3.2% compared with pre-Covid levels of ~3.5-4.0%. The reduction in rates was due in large part to a decline in base rates, though solar ABS issuances provide some evidence of spread compression.

The industry continues to forecast a glass supply gap of 8-10 GW in 2021, with large-sized glass capacity expected to satisfy only 50-60% of total demand. Prices for polysilicon have bottomed-out and rebounded, increasing ~1% WoW, signaling the end to three consecutive months of slow but steady declines. Driven by planned expansions in wafer capacity, Tier-1 players including Longi, Trina, and Jinko have locked in up to 812k MT of polysilicon supply over the next several years, in anticipation that supply stays largely unchanged up to 2022.

Jesse Pichel

December 2020: The Biden effect

Solar stocks continued to outperform the broader market in November, writes Jesse Pichel of ROTH Capital Partners. Tailwinds from the election results drove positive sentiment in the United States, while the end of the exemption from Section 201 tariffs for bifacial products could be bad news for module imports.

Solar stocks continued to outperform the broader market in November, writes Jesse Pichel of ROTH Capital Partners. Tailwinds from the election results drove positive sentiment in the United States, while the end of the exemption from Section 201 tariffs for bifacial products could be bad news for module imports.

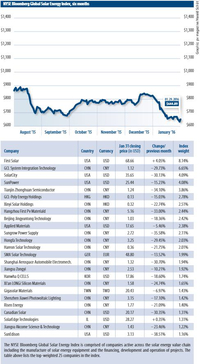

In November, the Guggenheim Solar ETF (TAN) increased 13.5% vs. the S&P 500 and Dow, which increased by 8.8% and 10.4 %, respectively. Year to date, the TAN gained 153.3% vs. the S&P 500 and the Dow, which increased 10.1% and 2.5% respectively.

The top five solar stock performers in the U.S. market for November were Sunworks (SUNW), ReneSola (SOL), Sunnova Energy (NOVA), SunPower (SPWR), and Enphase Energy (ENPH). They increased 93%, 73%, 45%, 36% and 32%, respectively. The main driver for the surge is the Joe Biden tailwind, as investors bet on a clean energy revolution, much higher solar penetration, and an ITC extension in the near term.

Residential outlook

In the past earnings season, residential solar stocks – including SPWR, NOVA and Sunrun (RUN) – reported a healthy quarter and strong guidance. ENPH also delivered a third-quarter beat as well as faster-than-expected energy storage growth in both the United States and Europe. Roth Research Analyst Phil Shen expects the U.S. residential market to have greater growth of 25-30% in 2021.

As the bifacial exclusion on the Section 201 tariff has been removed, the bifacial panels that were previously coming into the United States free of Section 201 tariffs will now be subject to the current 20% rate. This could be an incremental positive for companies like First Solar (FSLR) but an incremental negative for JinkoSolar (JKS) and Canadian Solar (CSIQ), as the U.S. is a source of meaningful margin contribution.

The market is also paying close attention to the Xinjiang Uighur risk for the solar supply chain. There are a couple of paths that could lead to a ban on solar imports with suspected links to forced labor in Xinjiang, and solar module manufacturers are already taking action to rearrange their supply chains to avoid Xinjiang exposure.

Author: Jesse Pichel, Roth Capitcal Partners

November: 2020: Riding strong residential growth

Solar stocks have seen significant upside in October, writes ROTH Capital Partners’ Jesse Pichel. The Guggenheim Solar ETF (TAN) increased 9.4% vs. the S&P 500 and the Dow, which increased by 3.0% and 2.8%, respectively. Year to date, the TAN gained 139% vs. the S&P 500 and the Dow, which rose 7.8% and fell 0.2%, respectively.

Solar stocks have seen significant upside in October, writes ROTH Capital Partners’ Jesse Pichel. The Guggenheim Solar ETF (TAN) increased 9.4% vs. the S&P 500 and the Dow, which increased by 3.0% and 2.8%, respectively. Year to date, the TAN gained 139% vs. the S&P 500 and the Dow, which rose 7.8% and fell 0.2%, respectively.

The top five solar stock performers in the U.S. market for October were ReneSola (SOL), JinkoSolar (JKS), Sunworks (SUNW), Daqo (DQ), and SunPower (SPWR). They increased 77%, 64%, 36%, 34% and 27%, respectively. The market sees positivity in China’s 14th Five-Year Plan and potential for 60 GW to more than 80 GW per year of demand. There is also a high probability of Joe Biden being elected in November and with it an ITC extension that could support solar, including standardized national permitting.

ROTH recently hosted the eighth U.S. residential solar webinar and a few takeaways include: (1) Originations were unaffected by the wildfires and hurricanes, and showed significant (more than 50%) YoY growth in Q3; (2) Inverter share mix between SolarEdge and Enphase continues to appear stable, with GNRC continuing to chip away with its storage product; and (3) Storage is growing meaningfully with solar installations on an absolute basis, but attach rates appear to be relatively flat on a nationwide basis.

ROTH Analyst Phil Shen reiterates his view for U.S. residential solar installations to be up more than 10% YoY in 2020. He sees growth in parts of the second half accelerating to 15-20% YoY levels and is incrementally more positive on the outlook for growth beyond 2020. While U.S. residential solar sales have returned in a strong way, the backlog appears to be growing. With Covid-19 infections rising, constraints are hitting, with the work of installation crews being impacted.

Early this month, Sunrun (RUN) completed the acquisition of Vivint Solar. The two companies now serve about 500,000 customers, with the capacity to supply more than 3 GW of solar PV energy. Another big movement in solar universe was Array Technologies’ (ARRY) IPO. The New Mexico-based ground-mounted system manufacturer went public for a total offering of more than $1 billion. We will now remove Vivint Solar and add ARRY in our stock tracker.

Author: Jesse Pichel, Roth Capital Partners

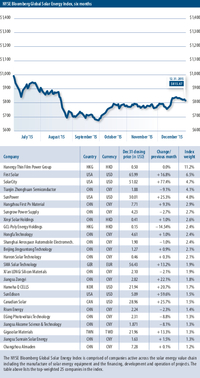

October 2020: Will China double down

Solar stocks outperformed the broader market in September. In September, the Guggenheim Solar ETF (TAN) increased 0.2% vs. the S&P 500 and Dow, which decreased by 6.5% and 5.1%, respectively. Year to date, the TAN gained 87% vs. the S&P 500 and Dow, which rose 2.1% and decreased 4.8%.

The top five solar stock performers in the United States market for the month of September were Sunworks (SUNW), Sky Solar (SKYS), JinkoSolar (JKS), Azure Power (AZRE), and ReneSola (SOL), which increased 207%, 86%, 54%, 25%, and 15%.

According to PV InfoLink, despite the lack of specific targets or subsidies for renewables so far, China’s 14th Five Year Plan is expected to drive yearly solar installations of around 45 GW. PV Infolink expects the proportion of renewables in China’s energy mix to increase from 15.3% as of year-end 2019 to a targeted 18-20% during the Five Year Plan’s lifetime, with the majority of the increase to come from China doubling down on solar and wind.

China is currently soliciting comments on a draft of the upcoming plan, with this consultation period set to end in November. The official draft will likely be submitted in March 2021, with a final announcement of the new plan and relevant policies in the second half of next year.

Supply chain

In terms of the supply chain, as of Sept. 23, multicrystalline-grade polysilicon was at $9.84/kg, flat week on week (WoW). Monocrystalline grade poly was at $13.80/kg, flat WoW, while multi wafers were at $0.05/W, flat WoW. Mono wafers were at $0.07/W, flat WoW, while multi modules were at $0.17/W, flat WoW. Mono modules were at $0.20/W, down 1.3% WoW.

As the public listed companies will be reporting earnings for the previous quarter in the coming weeks, we will update readers in the next issue on their latest financial situations.

Author: Jesse Pichel, ROTH Capital Partners

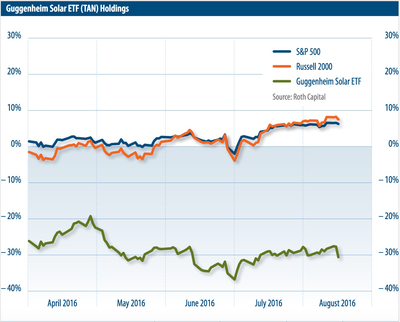

September 2020: Stocks rally on storage demand

With power outages in two U.S. states this month, many are looking to storage solutions to ensure reliable power supply. This, writes Jesse Pichel of Roth Capital Partners, could prove a short-term driver for storage stocks.

Solar stocks outperformed the broader market in August. In August, the Guggenheim Solar ETF (TAN) increased 15% vs. the S&P 500 and Dow, which increased 3.1% and 5.7%, respectively. YTD, the TAN gained 67% vs. the S&P 500 and Dow that increased 4.4% and decreased 2.1%. The top five solar stock performers in the U.S. market for August were SolarEdge (SEDG), First Solar (FSLR), Sunrun (RUN), Vivint Solar (VSLR), and SunPower (SPWR). They increased 25%, 25%, 24%, 23% and 22%, respectively.

The power outage in New Jersey and another season of wildfires and associated rolling blackouts this month in California are reminding many of the need for more stable power supplies, while driving new demand for energy storage.

Based on our channel check, some companies’ storage product lead times may now be the end of November, if orders are placed now. This could be a catalyst for storage-related stocks in the short term. As major solar companies are still reporting their earnings this month, we will have a greater update for you in the next issue.

In other news, we learned this week that GCL Xinjiang may be targeting a resumption of production sooner than expected. PV InfoLink believes the company may have a little bit of product as early as September. SSX also believes this may be the case, but expects polysilicon pricing to remain strong in October as volumes for resumed production are likely going to be low to start.

In terms of the supply chain, as of Aug. 12, multicrystalline grade polysilicon was at $8.79/kg, up 1.7% WoW; mono grade poly was at $12.39/kg, up 3.6% WoW; multi wafer was at $0.05/W, up 3.2% WoW; multi module was at $0.17/W, flat WoW; and mono module was at $0.19/W, up 1.4% WoW.

Jesse Pichel, ROTH Capital Partners

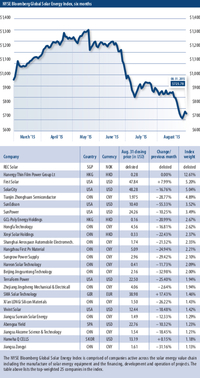

August 2020: Signs of a strong second half

Solar stocks enjoyed another good month in July, writes ROTH Capital Partners Jesse Pichel. A major acquisition deal is driving investor confidence in the United States, new wafer capacity is coming online, and the temporary loss of some polysilicon manufacturing capacity is pushing prices up slightly.

Solar stocks outperformed the broader market in July. The Guggenheim Solar ETF (TAN) increased 27% vs. the S&P 500 and the Dow, which increased 4.9% and 3.4%, respectively. Year to date, the TAN gained 48% vs. the S&P 500, which increased 0.7%, and the Dow, which fell 6.5%. The top five solar stock performers in the U.S. market for July were Vivint Solar (VSLR), Sunrun (RUN), Sunworks (SUNW), Daqo New Energy (DQ), and SunPower (SPWR). They increased 112%, 95%, 52%, 50% and 35%, respectively.

One key driver for solar stocks this month was Sunrun’s acquisition of Vivint Solar. Another factor was the increase in polysilicon prices due to new wafer capacity coming online, although some polysilicon capacity did go offline in China.

On July 6, Sunrun announced a definitive agreement to acquire Vivint Solar for an enterprise value of $3.2 billion (based on July 6 closing prices) in an all-stock transaction. Both stocks rallied on the announcement, with VSLR up 38% and RUN up 23%. The rally indicated investor confidence in the cost advantages of scale driving growth and profitability, and also a healthy to strong second-half recovery in the U.S. residential solar market.

As for the supply chain, polysilicon prices continue to recover. According to China Silicon Industry, prices rose 2.2% week on week as new wafer capacity continues to come online and more than 10,000 MT of polysilicon capacity in China and abroad undergoes maintenance.

Additionally, there were reports on July 20 that multiple flash explosions took place at a large GCL polysilicon facility, taking an estimated 50 MT of production capacity offline, or around 10% of global production. With the GCL polysilicon facility taking 10% of global poly production offline, we see pricing moving higher until the capacity resumes production. ROTH research increased its poly average selling price forecast 5% for Q3 2020 to $8.20/kg from $7.45/kg, 13% for Q4 2020 to $8.80/kg from $7.80/kg, and 5% for Q1 2021 to $8.40/kg from $8.00/kg.

Jesse Pichel, ROTH Capital Partners

July 2020: V for recovery

In June, the Guggenheim Solar ETF (TAN) increased 6.7% vs. the S&P 500 and Dow increased 0.3% and 0.8%, respectively. Year to date (YTD), the TAN gained 17% vs. the S&P 500 and Dow, which fell 5.5% and 10.3%. Top five solar stock performers in the U.S. for June were Sky Solar (SKYS), Daqo New Energy (DQ), Sunworks (SUNW), Vivint Solar (VSLR), and Sunnova (NOVA). They increased 58%, 49%, 36%, 26% and 17%, respectively.

In June, the Guggenheim Solar ETF (TAN) increased 6.7% vs. the S&P 500 and Dow increased 0.3% and 0.8%, respectively. Year to date (YTD), the TAN gained 17% vs. the S&P 500 and Dow, which fell 5.5% and 10.3%. Top five solar stock performers in the U.S. for June were Sky Solar (SKYS), Daqo New Energy (DQ), Sunworks (SUNW), Vivint Solar (VSLR), and Sunnova (NOVA). They increased 58%, 49%, 36%, 26% and 17%, respectively.

Earlier this month, we hosted our fifth U.S. residential solar webinar. Results from the SolarWakeup survey showed sales down in May year on year, but flat vs. Feb 2020. Survey participants expect 2020 U.S. residential sales to be flat or slightly down (16% expecting improvement, 35% expecting flat, and 47% expecting decline) and our webinar participants suggested they are seeing a “V-shaped” recovery, with Q2 representing a YoY dip, but Q1, Q3, and Q4 expected to show YoY gains.

As for the solar supply chain, new production capacity for wafers in China has gradually come online, stimulating demand for polysilicon. At the same time, maintenance for a number of larger polysilicon producers is still underway. Despite the growing impetus from polysilicon producers to raise prices, they have still held steady in the last week of June.

Downstream wafer companies are facing mounting risk for further price reductions as capacity continues to expand, and are unwilling to support higher prices upstream. This is expected to change soon, with a number of polysilicon producers already beginning to quote slightly higher prices.

As of June 24, multi-grade polysilicon was $4.10/kg, flat WoW, down 43% YTD; mono grade polysilicon was $8.33/kg, flat WoW, down 19% YTD; multi wafer at $0.04/W, flat WoW, down 28% YTD; multi cell at $0.06/W, flat WoW, down 15% YTD; multi module at $0.17/W, down 0.8% WoW, down 13% YTD; and mono PERC module at $0.20/W, down 0.7% WoW, down 13% YTD.

Jesse Pichel, ROTH Capital Partners

June 2020: Ahead of the curve

In May 2020, the Guggenheim Solar ETF (TAN) increased by 12%, versus the S&P 500 and the Dow that increased 4.5% and 4.3% respectively. Year to date, the TAN has gained 9.6% vs. the S&P 500 and Dow that decreased 5.8% and 11% respectively.

In May 2020, the Guggenheim Solar ETF (TAN) increased by 12%, versus the S&P 500 and the Dow that increased 4.5% and 4.3% respectively. Year to date, the TAN has gained 9.6% vs. the S&P 500 and Dow that decreased 5.8% and 11% respectively.

The top five solar stock performers in the United States market for May were Sky Solar (SKYS), SolarEdge (SEDG), Enphase (ENPH), Sunnova (NOVA), and Sunrun (RUN) that increased 57%, 27%, 24%, 19% and 19%, respectively. The strength in residential power electronics suppliers SolarEdge and Enphase, as well as rooftop solar specialists Sunnova and Sunrun, indicates strong expectations among investors for the U.S. residential market.

Our recent checks suggest that U.S. residential volumes through the month of May 2020 might have accelerated substantially, and that we could see a strong third quarter on the way.

Also our recent U.S. residential solar webinar panel, hosted by research analyst Phil Shen indicated that 2021 could be a “monster” year with strong growth in this market.

Supply chain

As for the PV supply chain, pricing throughout the solar ecosystem continues to be quite challenged, despite the demand rush in China ahead of the June 30 installation deadlines. Although demand excluding China may be picking up as expected, the overall environment remains weak.

As of May 27, multi-grade poly was at $4.23/kg, flat WoW, down 41% YTD; mono grade poly was at $8.31/kg, flat WoW, down 19% YTD; multi wafer at $0.04/W, flat WoW, down 26% YTD; multi cell at $0.06/W, flat WoW, down 15% YTD; multi module at $0.18/W, down 1.5% WoW, down 10% YTD; and mono module PERC at $0.20/W, down 1.3% WoW, down 9.3% YTD.

Jesse Pichel, ROTH Capital Partners

May 2020: Looking past the pandemic

Solar stocks rebounded and outperformed the broader market in April. The Guggenheim Solar ETF (TAN) increased 19% vs. the S&P 500 and Dow, which increased by 13% and 11%, respectively. Year to date, the TAN declined 2.2% vs. the S&P 500 and Dow, which decreased 9.9% and 14.7%, respectively.

The top five solar stock performers in the United States for April were Vivint Solar (VSLR), Enphase (ENPH), SunPower (SPWR), Sunrun (RUN), and Hannon Armstrong (HASI), which increased by 45%, 45%, 45%, 39% and 37%, respectively.

As highlighted last month, the worldwide outbreak of Covid-19 has caused panic across global markets and investors remain cautious. From a supply chain perspective, module prices have continued to fall and polysilicon has dropped below cost.

As of April 29, multicrystalline-grade polysilicon stood at $5.37/kg, flat week-on-week. Monocrystalline grade polysilicon settled at $8.76/kg, down 1.6%, while multi wafers reached $0.04/W, down 4%. Mono wafers settled at $0.07/W, flat, while multi cells reached $0.07/W, down 1.1%. Mono PERC cells reached $0.10/W, up 1.3% for the week, while multi modules reached $0.19/W, down 0.7%. Mono PERC modules, meanwhile, settled at $0.21/W, down 0.7%.

It’s now time to think ahead once again. While we are still fighting the global Covid-19 pandemic, recent market strength indicates investors’ expectations that the economy will begin to reopen in the coming months.

On April 24, solar research analyst Phil Shen hosted a first-quarter 2020 earnings preview webinar, and highlighted some key solar themes observed during and after the pandemic: 1) Oversupplied upstream industry leads to lower pricing; 2) Utility-scale costs are 10-20% higher; and 3) Lower cost of installations and capital for U.S. residential post-Covid-19.

Jesse Pichel, ROTH Capital Partners

April 2020: Covid-19 and oil supply shock

In the last edition, we were concerned about the looming outbreak of Covid-19, but we never imagined it would decapitate global economies, while the Saudis devastated the U.S. fossil fuels industry.

As we write this note, U.S. Congress is voting on a $2 trillion virus aid package that may include the extension of the ITC and other carbon-reduction measures.

In March, the S&P 500 and Dow dropped significantly, by 22.0% and 24.5%, respectively. The Guggenheim Solar ETF (TAN) decreased 37.6% and the U.S. solar market saw the most impact in the residential sector, where Vivint (VSLR), Sunrun (RUN), Sunworks (SUNW), Enphase (ENPH), and SolarEdge (SEDG) fell 64%, 56%, 47%, 44%, and 44%.

Investors fear that Covid-19 will slow solar projects due to a “domino effect” of delays through the supply chain, an inability to install or finance, and a general lack of demand. For U.S. residential, there is a 30% cancellation or postponement of bookings and the sales funnel is likely to halt. The shape of the recovery (in Q3, Q4, or 2021) will very much depend on the U.S. government stimulus and that of the global economies.

An ITC extension may be included in the coronavirus package. According to ROTH Capital Analyst Phil Shen, it’s likely that the ITC extension would not be included in the Phase 3 rescue package expected to be passed shortly after the time of writing, but it appears it could now be in the House bill. If not, then it could be in the Phase 4 bill to be passed in the coming weeks. The extension could be as much as three years and could also take the form of a Section 1603 Treasury grant. We would view an ITC extender as a longer-term positive for PV, and not a near-term cure to the economic impact of the virus.

ROTH held a virtual conference and hosted 12 renewable energy companies including ENPH, NOVA, RUN, VSLR, GNRC (NC), SPWR, TPIC, Nordex (XTRA: NDX1 – NC), REC Silicon (OSE: REC – NC), AZRE, SUNW, Sunlight Financial (Private). Companies had not yet seen demand destruction from Covid-19, but clearly anticipated it. As the impact is shifting from Asia to Western countries, we are seeing a potential oversupply situation brewing as China’s supply chain ramps up post-coronavirus, while global PV demand deteriorates. Stimulus in China may somewhat offset the global oversupply.

Jesse Pichel, ROTH Capital Partners

March 2020:‘Sector rotation has begun’

In February, the Guggenheim Solar ETF (TAN) increased 17.6% versus the S&P 500 and Dow, which increased 0.4% and decreased 0.6%, respectively. The top five solar stock performers in the U.S. market were Enphase (ENPH), Vivint (VSLR), Daqo (DQ), JinkoSolar (JKS), and SolarEdge (SEDG), with respective increases of 62%, 42%, 40%, 38%, and 36%. We believe strong performance was due to sector rotation into environmental social and corporate governance (ESG) out of oil and gas, and a strong U.S. solar residential market.

As we highlighted in our December 2019 report, we see growing interest from the investor community in ESG, where solar plays a critical role. In BlackRock’s 2020 client letter, CEO Larry Fink announced that sustainability was its “new standard” for investing. Also earlier, Microsoft CEO Satya Nadella revealed plans to be carbon negative by 2030. We believe that the sector rotation has begun. We not only see investors moving away from oil and gas to sustainability, but also observe new funds established for ESG only. Tesla (TSLA)’s stock is one example of this. The stock has gained 86% year to date and is trading on analysts’ 2024 forecasts for $32 EPS, or 25x P/E. As ESG becomes the main investment theme of 2020, we speculate that long-term investors may also look toward midterm earnings in 2023-24.

Coronavirus panic

On the bear side, the worldwide outbreak of coronavirus (Covid-19) has caused panic across global markets. As of Feb. 25, China had more than 77,000 confirmed cases. South Korea, Japan, and Italy had reported 977, 862, and 323 cases. The S&P 500 fell more than 6% from last week’s closing and South Korea stocks dropped nearly 4%. With cities being locked down and travel discouraged, the global economy will slow down sharply in the first quarter and throughout 2020, depending on the virus. As we are still in the early stages of a global outbreak, investors remain cautious about the market.

Jesse Pichel, ROTH Capital Partners

February 2020: And they're off

The strong performance of Sunrun, Vivint, and Sunnova dovetails with positive investor sentiment around the U.S. residential solar sector. Roth Capital analyst Phil Shen forecasts 25% year-on-year growth in the U.S. residential PV market this year.

There are two unfolding macro events for investors that could impact the solar industry: 1) U.S.-China trade; and 2) the coronavirus virus outbreak in China.

On Jan. 15, President Trump and Chinese Vice Premier Liu He signed a deal that cut some U.S. tariffs on Chinese goods in exchange for a Chinese pledge to purchase more American farm products, as well as energy and manufactured goods. China will also address some U.S. complaints about intellectual property. With the Phase 1 U.S.-China trade deal, negotiators have secured a Chinese commitment to purchase U.S.-produced polysilicon – U.S. polysilicon manufacturers have been locked out of the Chinese market since 2014.

As a result, REC Silicon stock gained 65% in one day. In an act of defiance, China’s Ministry of Commerce reinstated countervailing duties against U.S. polysilicon for an additional five years. Our checks indicate that this should not impact the Phase 1 deal, but the exact quantity of U.S. polysilicon remains unknown.

The coronavirus outbreak in China has concerned the global investor community. U.S., Japanese, and German stock markets declined 1.5%, 2.0%, and 2.8% on 1/27. China’s economy will slow significantly in Q1 and even throughout 2020, depending on the development of the outbreak. As China represents most of the supply and demand in the PV industry, the effect of the outbreak on solar can’t be understated at this stage.

Roth is hosting a Booth Tour at the 2020 Intersolar North America conference. The tour will include meetings with management teams of public and private companies spanning the solar ecosystem, including module vendors, BOS/ inverter suppliers, distributors; and industry experts. Soon after, Roth will host 16 companies at its annual OC Conference.

Jesse Pichel, ROTH Capital Partners

January 2020: New markets, renewed strength

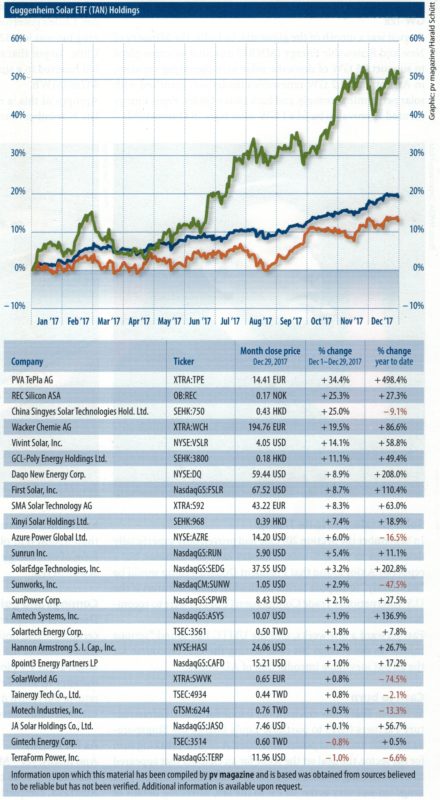

It has been an exciting year for solar stocks. The Guggenheim Solar ETF (TAN) increased by 64% versus the S&P 500 and Dow, which gained 27% and 21%, respectively. The top-performing sectors were the inverter and module/cell segments, which grew by 168% and 78%, respectively.

It has been an exciting year for solar stocks. The Guggenheim Solar ETF (TAN) increased by 64% versus the S&P 500 and Dow, which gained 27% and 21%, respectively. The top-performing sectors were the inverter and module/cell segments, which grew by 168% and 78%, respectively.

The top five stocks in the U.S. market were Enphase, SolarEdge, Jinko, Daqo, and Vivint Solar, gaining 444%, 162%, 118%, 108%, and 103%, respectively. In Europe, the top performers were centrotherm and SMA at 109% and 103%. Solar stocks were driven by several themes this year. One was China’s demand destruction, and its surprising replacement by new markets and renewed strength from existing ones. Supply and demand were more balanced, and the average selling price decline moderated versus 2018. Strong U.S. residential solar demand and the unfolding U.S.-China trade war were also key developments. And solar stocks are high beta stocks and generally outperform when the overall market is strong.

The major impact of the subsidy cut in China has been the collapse of upstream pricing and the decline of PV demand from 53 GW in 2017 to 44 GW in 2018 and 23 GW in 2019. Multi-grade and mono-grade poly are at $7.5 and $10.4/kg, down 29% and 11% YTD. Multi and mono wafers are at $0.05 and $0.09/W, down 17% and flat. Multi and mono PERC cells are at $0.08 and $0.12/W, down 30% and 26%, while multi and mono PERC modules are at $0.21 and $0.23/W, down 3.6% and 12%. The rate of ASP decline in 2019 was less than half the +40% ASP decline in 2018. According to ROTH Capital Partners, PV installations in EMEA and America rose 85% and 39% YoY in 2019. The U.S. residential market remains strong. ROTH continues to see +25% growth in this market for 2019 and 2020. Sunnova raised $170 million in the first U.S. solar IPO in years, Vivint and Sunrun gained 103% and 35% YTD. The strength in the U.S., combined with Huawei’s exit from the inverter market, drove Enphase and SolarEdge’s shares stocks up 444% and 162% YTD. For 2020, we believe resi- and storage will be the two main themes. We see interest from investors in ESG, where solar plays a critical role and investor sentiment will remain impacted by the U.S.-China trade war.

Jesse Pichel, ROTH Capital Partners

December 2019: November blues

Solar stocks underperformed the broader market in November. The Guggenheim Solar ETF (TAN) decreased 1.4% vs. the S&P 500 and Dow, which increased 1.8% and 2.1%, respectively.

Solar stocks underperformed the broader market in November. The Guggenheim Solar ETF (TAN) decreased 1.4% vs. the S&P 500 and Dow, which increased 1.8% and 2.1%, respectively.

The Top five solar stock performers in the U.S. market were JinkoSolar (JKS), Applied Materials (AMAT), ReneSola (SOL), Atlantica Yield (AY), and First Solar (FSLR), which increased by 11%, 10%, 7.5%, 7%, and 4%, respectively. Sunworks (SUNW) went down 34% after delivering a Q3 loss and weak Q4 guidance, while Canadian Solar (CSIQ) fell 13.6% with a miss on Q3 revenue and earnings.

Key takeaways

Residential solar demand in the United States remains strong, with expected +25% year-on-year growth for 2019 and for 2020. However, labor issues and module supply will be the two biggest constraints with the strong demand ahead.

As the residential solar market shifts to new homes, ROTH Capital Partners analyst Phil Shen believes it will help solar leasing firms, since more than 90% of California’s new construction will be lease-financed.

The outlook for China remains weak. Shen has cut his 2020 China forecast to 29 GW (from 50 GW) and global demand forecast to 116 GW (from 137 GW), indicating that this weakness will likely continue for a few quarters, until lower module pricing results in demand creation in the rest of the world.

There are some updates on relevant policies. In the United States, for example, the Section 201 tariff exemption for bifacial products repeal is now halted, as Invenergy filed a complaint with backing from the Solar Energy Industries Association (SEIA). Abby Hopper and SEIA issued a release indicating that the solar investment tax credit (ITC) could be extended by five years. It would appear that investors believe that an ITC extension is not yet priced into stocks and would be a meaningful positive for the industry. Storage and wind are also expected to benefit from possible tax credit extensions.

According to Ne21.com (Century New Energy Network), China’s renewable energy subsidy will probably be canceled before 2021.

Jesse Pichel, Roth Capital Partners

November 2019: How long?

Solar stocks underperformed the broader market in October. The Guggenheim Solar ETF (TAN) rose 0.2% versus the S&P 500 and the Dow Jones industrial average, which increased 1.9% and 0.7%, respectively.

The top four solar stock performers in the U.S. market were Sky Solar (SKYS), Sunworks (SUNW), SolarEdge (SEDG) and Enphase Energy (ENPH), which increased by 40%, 29%, 9.5% and 8%, respectively.

Solar stocks have not performed very well since last month, which might be driven by China: 1) a negative outlook for China demand in 2020; 2) a new coal benchmarking pricing mechanism and lower coal prices; and 3) the ongoing uncertainty of the U.S.-China trade war. ROTH Capital Partners analyst Phil Shen has indicated that this negative sentiment could last for six to nine months, and will depend on how long China’s demand weakness lasts, and on how long it takes for unsubsidized, economic demand to grow. We believe the PV market is transitioning to a greater global mix of unsubsidized demand, where revenue visibility will improve, earnings quality will increase, and multiples will expand.

Post-SPI, we believe U.S. residential solar will grow much faster than expected (+25% YoY this year and next year versus consensus of mid-teens YoY growth). Resi stocks were up 8.2% in October and 62.5% year to date. We see more growth for residential backup power after recent intentional blackouts in California’s PG&E territory. The trend of ratepayers becoming disgruntled with their utility will benefit the U.S. residential sector.

China module pricing continues to decline and does not look set to recover in the fourth quarter, however mono polysilicon pricing is expected to increase in November, while multi is expected to have limited upside. Average module auction price in September was RMB 1.86/W ($0.26/W). In a 1.1 GW October auction, the lowest price for mono PERC 370W+ was RMB 1.74/W, while the average price was around RMB 1.80/W. China domestic mono grade polysilicon is now at $10.6/kg – flat compared to September.

We’re adding Generac to our PV tracking, given its recent entry into the sector, and removing Intevac, given its exit.

Jesse Pichel, ROTH Capital Partners

October 2019: Solar stocks sink after SPI

What happened in Salt Lake, didn’t stay in Salt Lake, as solar stocks underperformed the broader market in September. The Guggenheim Solar ETF (TAN) decreased 3.9% vs. the S&P 500 and Dow, which gained 1.7% and 1.9%, respectively.

What happened in Salt Lake, didn’t stay in Salt Lake, as solar stocks underperformed the broader market in September. The Guggenheim Solar ETF (TAN) decreased 3.9% vs. the S&P 500 and Dow, which gained 1.7% and 1.9%, respectively.

Solar Power International was well attended by hundreds of investor groups. The TAN was flat during SPI 2017 and down 3% during SPI 2018, while it decreased more than 6% during this year’s event, wiping out gains from the first half of September.

Several factors are responsible for stock declines during and after SPI, including a weaker outlook for China in the first half of 2020 and a potential price decrease for coal power. ENPH and to a lesser extent, SEDG, are seeing profit take sharp returns year-to-date and potential new entrants such as Generac could create competition. The weaker U.S. economic outlook and a broader sell-off of growth stocks looms, and investors want to lock in profits before 2020. Stocks with big gains saw the largest declines.

But it’s not all bad news. Roth Capital Partners hosted 16 companies at its seventh investor symposium at SPI and conducted investor booth tours with a range of distributors, developers, inverter companies, industry experts and private module manufacturers. Major takeaways include:

- U.S. residential fundamentals are strong and growing faster than the industry in 2018. with experts expecting 30-50% YoY growth through 2020.

- Our keynote speaker, John Marciano – partner and co-head of global project finance at Akin Gump – pegs a 60% probability for an ITC extension, with timing next year before the elections as opposed to by year-end 2019.

- Although the inverter space has become more competitive, with new offers from Generac, Delta, Tigo and others, Roth analyst Phil Shen does not see much near-term pressure on ENPH and SEDG, given healthy fundamentals.

- Panels selling at $0.25 or below abroad are over $0.40 in the United States, but much of the tariff-free capacity is sold to big utilities.

- PV InfoLink expects Chinese demand to decrease to 32 GW from previous expectations of 35 GW. It expects 2020 demand to reach 38.5 GW.

Jesse Pichel, Roth Capital Partners

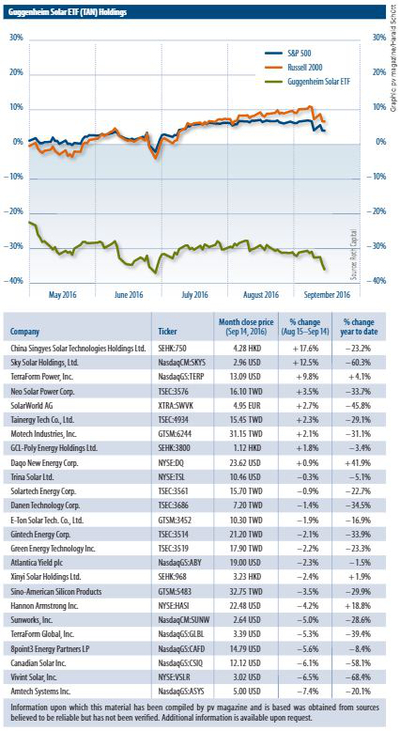

September 2019: Trade war shadows all but solar

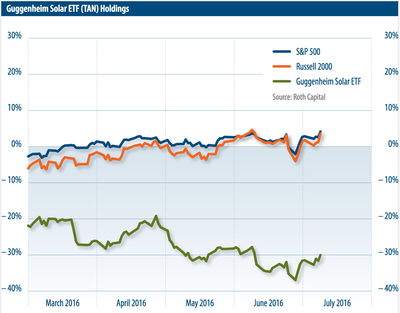

Graph: pv magazine/ Roth Capital Partners

Solar stocks outperformed the broader market in August. The Guggenheim Solar ETF (TAN) increased by 2.0% vs. the S&P 500 and Dow that decreased 0.9% and 1.1% respectively. Canadian Solar (CSIQ), Azure Power (AZRE), First Solar (FSLR), SolarEdge (SEDG) and Enphase (ENPH) all delivered a strong Q2 and strong guidance for Q3.

A number of upstream solar company stocks in China and the U.S. increased on expectations for greater China demand in H2 2019. NEA is expected to release a list of solar projects that secured subsidies for 2019.

The top five performers were SolarEdge (SEDG), Daqo New Energy (DQ), Enphase (ENPH), TerraForm Power (TERP) and Canadian Solar (CSIQ) that increased 22%, 19%, 12%, 9% and 8% for the month, respectively. Roth analyst Phil Shen indicated that mono PERC cell pricing could increase by a few RMB pennies/W near-term. Although there is caution around China demand in H1 2020 after an expected surge in H2 2019, selling price increases near term are expected to drive stocks higher.

China domestic multi grade polysilicon is $8.07/kg, which declined 4% from June. Mono grade poly is now $10.62/kg. Multi and mono wafers are $0.06/W and $0.09/W, multi and mono cell price is $0.11/W and $0.12/W, multi and mono module price is $0.22/W and $0.26/W.

Despite strong solar industry fundamentals, macro economic sentiment will drive the stock market. Namely decreased economic activity in the United States and globally, exacerbated by trade war with China. On 08/23, the Dow dropped more than 600 points after President Trump said U.S. companies must look for an “alternative to China”.

Roth is hosting its seventh Annual Solar & Storage Symposium at Solar Power International on September 24-25, 2019 in Salt Lake City, Utah. The Symposium will include meetings with management teams of public and private companies and a booth tour visiting a variety of distributors, developers and renewable asset owners. We will focus our symposium around four main topics: (1) What to expect ahead for the global supply/demand balance; (2) Outlook for U.S. solar, especially residential; (3) The evolving competitive landscape of the inverter market; and (4) The economics of the solar supply chain.

Jesse Pichel, ROTH Capital Partners

August 2019: Awaiting your demand

Solar stocks outperformed the broader market in July. The Guggenheim Solar ETF (TAN) gained 2.4% vs. the S&P 500 and Dow, which both increased ~0.5%. The top five performers in the U.S. stock market were Enphase (ENPH), Intevac (IVAC), Applied Materials (AMAT), TerraForm Power (TERP) and Azure Power (AZRE), with increases of 54%, 8%, 8%, 8%, and 5%, respectively.

Solar stocks outperformed the broader market in July. The Guggenheim Solar ETF (TAN) gained 2.4% vs. the S&P 500 and Dow, which both increased ~0.5%. The top five performers in the U.S. stock market were Enphase (ENPH), Intevac (IVAC), Applied Materials (AMAT), TerraForm Power (TERP) and Azure Power (AZRE), with increases of 54%, 8%, 8%, 8%, and 5%, respectively.

Solar stocks were driven higher in July by strong earnings posted by major companies and positive expectations for Chinese demand in the third quarter. The interest rate cut also helped shares of project developers TERP and AZRE, which give them access to cheaper capital.

The U.S. residential market is strong. Enphase and SolarEdge both reported solid results and positive Q3 forecasts, with 39% and 30% increases, respectively. Sunnova Energy (NOVA) also successfully raised $168 million through its IPO on the New York Stock Exchange.

The broader market, however, was depressed due to concerns about weaker economics, indicated by this first interest rate cut in 10 years. Trade negotiations between the United States and China have also entered a more difficult phase.

Although demand in China is expected to pick up in August or September, there is some downside pressure on pricing now. China’s domestic multi grade polysilicon is at $8.44/kg, down 3% from June. Mono-grade poly is now at $11.06/kg. Multi and mono wafers are $0.06/W and $0.09/W, multi and mono cell pricings are $0.11/W and $0.14/W, and multi and mono module prices are at $0.22/W and $0.27/W, respectively.

Daqo New Energy (DQ), Canadian Solar (CSIQ) and JinkoSolar (JKS) will announce earnings in the next three weeks. We expect management will provide clearer guidance on China’s Q3 demand and supply chain pricing. Looking ahead, we expect more volatility in stocks as companies report earnings and the trade war intensifies.

July 2019:Upwards spiralling

Solar stocks outperformed the broader market in June. Following SNEC — the largest solar conference in the world, in the largest solar market in the  world — the Guggenheim Solar ETF (TAN) gained 9.1% vs. the S&P 500 and Dow, which increased 7.2% and 7.7%, respectively.

world — the Guggenheim Solar ETF (TAN) gained 9.1% vs. the S&P 500 and Dow, which increased 7.2% and 7.7%, respectively.

The top five performers in the U.S. stock market are SunPower (SPWR), Sunrun (RUN), Enphase (ENPH), Canadian Solar (CSIQ) and Vivint Solar (VLSR). They increased 39%, 18%, 16%, 16% and 12%, respectively. Stocks were driven by expectation of a trade deal ahead of President Xi and Trump’s G20 meeting, the outlook for a dovish Fed, positive industry sentiment on healthier fundamentals, Section 201’s bifacial exclusion, and Huawei’s exit from the U.S. inverter market.

The outlook for international demand remains strong. While China may be a little slower than expected in the third quarter, industry participants believe the key to its installation size in 2019 will be the timing of the National Energy Administration’s release of the subsidized project list.

The latest forecasts from Roth analyst Phil Shen for China and the world are 35 GW and 105 GW in 2019, 50 GW and 135 GW in 2020, a year-on-year increase of 43% for China and 28% for the world in 2020. The other impression is that the industry is shifting rapidly to mono. Mono wafer capacity could reach 120 GW by year-end 2020. Both Longi and Zhonghuan have aggressive expansion plans and we learned from the trip that the latest entrant, Wuxi Shangji Automation Industry, has invested in a 5 GW mono wafer plan.

In June, the United States Trade Representative announced a Section 201 exemption for bifacial modules. Both JKS and CSIQ gained 2.8% and 2.5% after the announcement. The other big news is that Huawei shut down its U.S. inverter sales on June 21. Roth analyst Philip Shen called it the end of a chapter and it could be positive for other major inverter suppliers in the U.S.

Year to date, solar stocks significantly outperformed the broader market, with TAN increasing 51%, while the S&P 500 and Dow gained 18% and 15%. For Y2 2019 and 2020, the industry will be surrounded by noise from the trade war, while demand is there and a new upcycle expected.

Author

Jesse Pichel, Roth Capital Partners

June 2019: Demand outside of China

With market growth in a range of markets exceeding expectations, solar stocks are continuing to perform strongly. The Guggenheim Solar ETF (TAN) was up 2.7% from the previous index, while S&P 500 and Dow decreased.

With market growth in a range of markets exceeding expectations, solar stocks are continuing to perform strongly. The Guggenheim Solar ETF (TAN) was up 2.7% from the previous index, while S&P 500 and Dow decreased.

Solar stocks outperformed the broader market since our last publication. The Guggenheim Solar ETF (TAN) increased 2.7% vs. the S&P 500 and Dow, which decreased 0.8% and 1.7%, respectively. The top five performers in the U.S. stock market are Sunworks (SUNW), Enphase (ENPH), SolarEdge (SEDG), Vivint Solar (VLSR), and SunPower (SPWR), which increased 108%, 46%, 28%, 18%, and 10%, respectively.

Solar stocks have also been driven higher by strong earnings and management guidance. Global solar demand outside of China is strong.

In the past month, Roth research analyst Phil Shen increased his United States, European Union, India, and Vietnam 2020 forecast by a total of 8 GW to 22 GW, while he revised down his China 2019 estimate to 40 GW from 50 GW, due to the policy uncertainty following the Chinese National Energy Agency’s release of the winning projects for subsidies.

Trade disputes

In the short term, the stock market will still be driven by the trade negotiation between Washington and Beijing, which the solar industry has experienced for the past two years.

In the longer term through 2020, we believe the U.S. solar market will lead investors’ positive sentiment in solar stocks with California’s solar mandate for new homes built in 2020 and later, and the pull-in of demand driven by the step-down and phase-out of the Investment Tax Credit.

We continue to see module price strength in the United States, which supports companies’ stocks with more U.S. exposure.

With Intersolar Europe last month, and more Chinese solar companies having reporting earnings over two in May, more visibility from the industry is emerging as to where we are and how these companies position themselves in the upcycle.

May 2019: Residential drive

Solar stocks outperformed the broader market in April. Month-to-date, the Guggenheim Solar ETF (TAN) increased 6.7% versus the S&P 500 and Dow that gained 2.5% and 1.8% respectively.

Solar stocks outperformed the broader market in April. Month-to-date, the Guggenheim Solar ETF (TAN) increased 6.7% versus the S&P 500 and Dow that gained 2.5% and 1.8% respectively.

The top five performers in the U.S. stock market are Sunworks (SUNW), Sunpower (SPWR), First Solar (FSLR), Sunrun (RUN), and SolarEdge (SEDG), that increased 51%, 15%, 14%, 11%, and 10%, respectively. Stocks were driven by stronger than expected demand in the United States, especially in the residential sector. Post-ROTH annual March conference, ROTH research analyst Phil Shen increased his U.S. 2019 forecast from

11 GW to 12 GW, which represents 16% YoY growth in the U.S. market, and the incremental demand is mainly in the residential sector. We had two top 10 installers at the ROTH conference that see potential for them to grow more than 30% YoY in 2019. Sunpower (SPWR) hosted its first analyst day in a number of years, highlighting its restructured growth story, and echoed positive commentary around strong growth in the residential and C&I sectors in the United States.

Another driver is China’s National Energy Administration’s (NEA’s) affirmation on 2019 solar subsidy. The document was released on April 12, and Chinese company stocks reacted favorably to the news with DQ, JKS, and CSIQ closed up 5%, 3%, and 2% on that date. However, NEA also issued a document that gives higher priority to parity projects versus subsidized projects and encourages approved projects from 2018 or before to convert to parity projects. The critical factor to determine the volume of 2019 installations will likely be based on when the NEA announces its approved list of winning projects for the subsidy. Before the industry gets more clarity on that, we believe pricing softness may continue into Q3. As of this week, most of the upstream pricing has been flat compared with that in the first week of April while multi-grade poly decreased 3.3% to $8.60/kg and multi wafer decreased 2.6% to $0.06/W.

New gigawatt markets are rising: Taiwan, Vietnam, Pakistan, and others all announced new targets that are creating meaningful new pockets of longer-term demand.

Jesse Pichel, ROTH Capital Partners

April 2019: Flat or falling

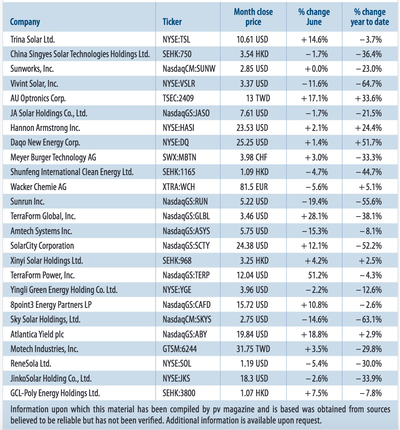

Table: pv magazine

Solar stocks underperformed the broader market in March. MTD, the Guggenheim Solar ETF (TAN) decreased 1.6% vs. the S&P 500 and Dow, which gained 1.7% and were flat respectively.

Our sources indicated flat / slight reduction in supply chain pricings for March, which could be driving the sector stocks down in this period. In China, domestic multicrystalline grade polysilicon was priced at $10.43/kg, down 4% compared with the February average of $10.89/kg.

Monocrystalline grade polysilicon is now priced at $11.92/kg, multi & mono wafer pricings are at $0.07/W and $0.10/W, multi & mono cell pricings are at $0.13/W and $0.15/W, multi and mono module pricings are at $0.28/W and $0.28/W, respectively.

Takeaways from ROTH conference

We held our 31st annual conference in Dana Point, California from 17-19 March, with over 80 cleantech companies participating, of which nine are solar companies including Daqo, Enphase, PetersenDean, ReneSola, SolarEdge, Sunnova, Sunrun, Sunworks, and Vivint Solar.

Despite flat / slight reductions in supply chain pricing, our meetings from the conference suggest tighter supply through 2019, driven by strong demand in the U.S. residential sector. According to ROTH research analyst Phil Shen, the United States is expected to install 11 GW of solar in 2019, representing 9% YoY growth, while we have two top 10 residential installers that see potential for them to grow more than 30% YoY in 2019. With limited module production capacity in the United States, residential installers that could secure module supply, especially the supply of monocrystalline silicon products, may be able to win more market share. The inverter companies with more U.S. residential exposure will also benefit from the strong growth in the sector.

On the polysilicon side, capacity expansion from China may be later than expected. It will be interesting to see what type of trade settlement would be reached between the United States and Chinese governments in April.

Jesse Pichel, ROTH Capital Partners

March 2019: PV feeling the spring fever

The investor sentiment in the solar sector was very strong in February. Month-to-date (MTD), the Guggenheim Solar ETF (TAN) increased 4.7% versus the S&P 500 and Dow that gained 2.6% and 3.4% respectively. The sector outperformance was mainly driven by China’s potential new solar policy which reintroduces PV subsidies at the national level, and also the strong expectations for PV demand in the USA for 2019/2020. The top performing solar stocks in the U.S. market MTD are Sunworks (up 44%), Sunrun (up 17%), Vivint Solar (up 15%), SunPower (up 12%), and JinkoSolar (up 10%).

In early February, ROTH research analyst Phil Shen increased the China demand forecast to 50 GW for 2019, an increase from the prior forecast of 45 GW for 2019 and China’s 2018 installation volume of 44 GW. Outside of China, we have seen pricing through the upstream and midstream solar supply chain improve meaningfully with mono wafer ASPs up 6.6% YTD, multi high-efficiency ASPs up 7.3% YTD, mono cell ASPs up 4.7% YTD, and multi wafer ASPs up 2.2% YTD.

We are hearing some industry concerns of a possible shortage of U.S. modules (compliant/tariff-free) which dovetails with large growth expectations for the USA. Despite the growth in the USA, there are some uncertainties around utility-scale power purchase agreements (PPAs) following PG&E’s filing for bankruptcy last month. The New York Times is reporting that the bankruptcy will allow PG&E to revoke or renegotiate solar PPA contracts lower. This could hurt downstream project owners that borrow money based on higher priced PPAs. (The New York Times, 01/17/2019). ROTH anticipates USA market demand of 11.3 GW in 2019 and 14.6 GW in 2020.

Earnings season for solar companies has now begun and investors will gain some market volume and price clarity with public company guidance and news emanating from PV Expo in Tokyo. We anticipate stock volatility will ensue.

Jesse Pichel, ROTH Capital Partners

February 2019: Cautious optimism

Sentiment in solar stocks improved on the better-than-expected China 2019 outlook. Year-to-date (YTD), the Guggenheim Solar ETF (TAN) increased 19% versus the S&P 500 and Dow that gained 5.3% and 5.4% respectively.

The solar sector’s outperformance was mainly driven by China’s potential new solar policy which reintroduces PV subsidies at the national level. To recall, on May 31, 2018, China announced that traditional utility-scale projects won’t be eligible for the 2018 FIT until an update is provided, and 2018 distributed generation demand would be capped at 10 GW. The announcement was a major shock to the industry and institutional investors.

Demand destruction

The major impact of the demand destruction in China has been the collapse of Chinese PV demand, as well as the collapse of upstream pricing – 2018 solar installations in China were only around 40 GW, down 25% compared with 2017’s installation of 53 GW.

In the stock market, the TAN declined 26% over 2018 as a result of the demand destruction. With the potential reintroduction of the national subsidy, the new solar policy, if implemented, could drive an increase in Chinese demand to around 50 GW for the full year 2019, according to ROTH research.

Upstream issues

Upstream pricing, on the other hand, has remained flat since the release of the new draft policy. As of January 25, the pricing of polysilicon is at $9/kg, mono wafers at $0.08/W, multi wafers at $0.06/W, mono cells at $0.13/W, multi cells at $0.11/W, mono modules at $0.25/W, and multi modules at $0.23/W.

The other key questions from investors would be: 1) How will the new subsidies be funded, given the huge deficit and delay in PV subsidy payments? 2) And what quota could be included in the final policy, given its transition in focus from subsidy to competition?

Although prices have not increased, there is increased chatter about tight supply in the second half of the year in the United States, at a time when new project construction is surging.

Jesse Pichel, ROTH Capital Partners

January 2019: Tariffs ringing in 2019

Last year was obviously an extremely difficult year for solar stocks, but it could have been worse. Solar stocks were driven by three themes this year: China’s policy shift; strong U.S. demand; and the unfolding U.S.-China trade war.

Last year was obviously an extremely difficult year for solar stocks, but it could have been worse. Solar stocks were driven by three themes this year: China’s policy shift; strong U.S. demand; and the unfolding U.S.-China trade war.

The Guggenheim Solar ETF (TAN) decreased 20% YTD versus the S&P 500 and Dow that declined 2.8% and 2.5% respectively. Best performers in the U.S. YTD are Enphase (ENPH), Sunrun (RUN), Hanwha (HQCL), Vivint Solar (VSLR), and SolarEdge (SEDG) up 136%, 121%, 39%, 13%, and 2.1% respectively.

YTD, polysilicon dropped 44% to $9.50/kg in December; mono and multi wafers are now at $0.08 and $0.06/W, a 48% and 56% YTD decline; mono and multi cell prices are $0.13 and $0.11/W, a 40% and 47% YTD decline. Module prices are $0.25 and $0.23/W.

Polysilicon stocks (REC, DQ, Wacker, and GCL-Poly) decreased 57% on average. Both Longi and Tongwei fell 28% in the Chinese market, Canadian Solar and JinkoSolar dropped 1.2% and 53% respectively.

Canadian Solar held up better due to earlier planned privatization and stability from downstream projects in the West and Japan.

U.S. solar continues to grow, thanks in part to the China shift and resulting oversupply. Projects for 2019 and 2020 are penciling out at or near natural gas prices and utilities and corporations continue to secure solar. Demand is driven by 100% clean energy goals for California and others, energy storage, endless demand from data centers, and solar requirements for new homes.

Sunrun and Vivint Solar gained 121% and 13% YTD respectively. According to Roth analyst Phil Shen, 2019 U.S. solar installation is expected to increase 28% YoY to 12 GW from 9.5 GW in 2018, driven by a rush to install ahead of ITC subsidy reductions.

Solar was one of the first industries impacted by tariffs, starting from Section 201 and followed by Section 301. President Trump met with China’s President Xi in Argentina and agreed to work on negotiating a trade agreement between the nations. As Section 301 tariffs were slated to increase from 10% to 25% on January 1, 2019, the result of this negotiation would be the main driver for the stocks in the remainder of 2018 through H1 2019.

Jesse Pichel, ROTH Capital Partners

December 2018: Moment in the sun

Solar stocks have outperformed the broader market since our last publication on October 16.

The Guggenheim Solar ETF (TAN) increased 6.5% versus the S&P 500 and Dow that declined 2.8% and 1.7% respectively. Despite the global stock sell-off, solar stocks have had one of their best months in H2 2018 since the China solar policy change.

On November 2, the National Energy Administration (NEA) of China held its mid-term review meeting for the country’s 13th Five-Year Plan (2016-2020). During the meeting, solar policymakers set a positive tone around new installation targets. Some expect a new 2019 target of ~45-50 GW, and see the potential for demand to exceed this target.

As a result of the NEA meeting, Jinko (JKS), Canadian Solar (CSIQ), and Daqo New Energy (DQ) gained 3%, 2%, and 6% respectively on the day the news was released. In the Chinese market, Longi and Tongwei increased 10% and 7% on that day. However, the solar subsidy deficit in China remains the key concern for investors. Reportedly, the deficit for the FIT is CNY 120 billion ($17.4 billion) and payments for more than 20 GW of completed projects remain delayed.

2019 Market flood

The gap between polysilicon supply and demand is widening. Tongwei recently opened a new 25,000 metric ton polysilicon production facility in Inner Mongolia. Additionally, Chinese antidumping tariffs on U.S. polysilicon are expected to expire in January 2019.

If allowed to expire, companies like OCI, Hemlock, REC Silicon, and Wacker Chemie U.S. may gain access to the Chinese market, thereby flooding it. As of 15/11, the Chinese polysilicon domestic price is $10.22/kg, down from $12/kg at Intersolar North America in July. For wafers, multi and mono wafers are at $0.06/W and $0.08/W, down from $0.07 and $0.09 in July. Multi and mono c-Si cells are at $0.11/W and $0.13/W, down from $0.14 and $0.15 in July. Module prices have also dropped to $0.22/W, down from $0.26 in July

Jesse Pichel, ROTH Capital Partners

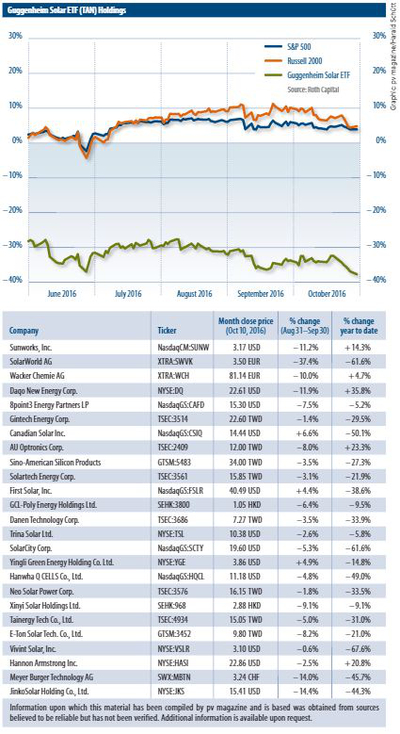

November 2018: Positive currents from SPI

Sentiment from downstream utility and residential solar companies at SPI was extremely positive. One would never know that China’s demand imploded and the U.S. imposed solar trade tariffs.

Despite fears that tariffs would decimate the U.S. solar industry, the industry continues to grow, thanks in part to the China 31/5 policy shift and resulting massive oversupply.

Solar projects for 2019 and 2020 are penciling out at or near natural gas prices and utilities and major corporations continue to secure solar. U.S. demand drivers widely discussed are 100% clean energy goals for California and other places, energy storage, endless energy demand from data centers, and solar requirements for new homes. The ITC is plentiful again, and tax equity returns are now 6-7% for utility-scale, and may be headed lower. Despite this good news, stocks have traded poorly given the U.S.-China trade war and rising interest rates which affect all stocks.

Since Solar Power International (SPI), the Guggenheim Solar ETF (TAN) declined 8.3%, underperforming the broader market, which saw the S&P 500 and Dow fall 4.1% and 3.5% respectively. Year-to-date (YTD), the TAN index declined 21%, compared with the S&P 500 and Dow that were up 5.1% and 4.4% respectively.

Just a week before SPI, SunPower (SPWR) was granted an exclusion from the 30% section 201 import tariffs for its IBC cells and modules. The stock closed up 14% when the news came out on September 19. As Enphase’s (ENPH) micro-inverter is considered a component within SPWR’s AC modules, ENPH has been one of the best performing stocks since SPI (up 11%). Looking at the demand indicator, poly pricing, China domestic strike price is at $11/kg. On October 15, DQ announced it has begun pilot production at its new Phase 3B polysilicon facility which expands its capacity to 30,000 mt at full ramp by the end of Q1 2019. With more production capacity resumed, we believe near-term pricing would still be under pressure but hopefully supported by stronger demand in China in Q4. YTD, polysilicon stocks have declined over 56% on average. (Shares of GCL-Poly: -67%; REC: -62%; DQ: -53%; Wacker: -42%)

October 2018:

Silicon and inverters slip

Month-to-date (MTD), the Guggenheim Solar ETF (TAN) was down 3.5%, underperforming the broader market, which saw the S&P 500 and Dow up 0.1% and 1.1% respectively.

While all solar sectors dropped ahead of SPI Anaheim on September 25, inverter and polysilicon stocks were hit hardest by a new round of tariffs and the weakness in polysilicon prices, which fell 10% and 9% on average, respectively.

On Friday September 14, U.S. President Trump approved tariffs on the $200 billion list of imports from China, which includes inverters. The initial tariffs will be 10% and raised to 25% at the end of the year. SolarEdge (SEDG), Enphase (ENPH), and SMA (S92) have dropped 12%, 11%, and 8% MTD. In contrast, on September 18, the U.S. granted Sunpower (SPWR) an exclusion from the 30% Section 201 tariffs for its IBC cells and modules, which made SPWR one of only two tariff-free module importers to the U.S. market. SPWR stock closed up 15% after the announcement. On the polysilicon side, pricing resumed its WoW decline to approximately $11.68/kg in the China domestic market due to weaker than expected wafer demand. MTD, Daqo (DQ), REC Silicon (REC), and Wacker (WCH) stocks have dropped 17%, 10%, and 9%.

Year-to-date, the Guggenheim Solar ETF (TAN) was down 16.2% versus the S&P 500 and Dow up 8.6% and 6.2% respectively. Within solar, on average, polysilicon stocks (Daqo GCL-Poly, REC, and Wacker) have dropped 49%, module manufacturers (Canadian Solar, First Solar, Hanwha, JinkoSolar, and SunPower) have decreased 15%, and equipment manufacturers (Amtech, centrotherm, Intevac, Manz, Meyer Burger, and PVA) have experienced a decrease of 17%.

At the 6th Annual ROTH Solar & Storage Symposium in Anaheim (September 25-26) we will host meetings with solar and storage firms, in addition to a booth tour at SPI and networking reception. We believe our events keep investors ahead of the curve on what to expect for the global supply/demand balance, given the 31/5 policy shock, outlook for U.S. solar, future competitive landscape of the inverter market, and economics of the solar supply chain.

Jesse Pichel, ROTH Capital Partners

Table: Guggenheim Solar

September 2018:

Solar stocks slipping

Solar stocks underperformed the broader market last month (7/30-8/24): The Guggenheim Solar ETF (TAN) dropped 3.8% versus the S&P 500 and Dow up 2.0% and 1.3%, respectively. Year-to-date (YTD), TAN has substan- tially underperformed the market, drop- ping 12.9%, compared with the S&P 500 and Dow up 7.5% and 4.3%. Within solar, the only two performing sectors YTD are residential installers (Vivint Solar, Sun- run, and Sunworks), and inverter manu- facturers (SolarEdge, Enphase, and SMA), which increased 45% and 40% on average. Equipment manufacturers, polysilicon producers, ingot/wafer/cell manufactur- ers, module manufacturers, and down- stream IPP/yieldco stocks were adversely impacted by negative sentiment from the

31/5 policy. On average these sectors have dropped 12%, 42%, 32%, 17%, and 4% YTD, respectively. In August, the top two performing sectors were module manu- facturers and IPP/yieldco, which had an average increase of 5.5% and 1.0%. We believe strength in these two sectors is driven by two key factors: (1) The EU is set to end Chinese module import control in September; and (2) strong earnings results posted by IPP/yieldco firms. Meanwhile, polysilicon prices have been flat and sta- ble at ~$12/kg since China revised its solar subsidy policy. Multiple polysilicon plants remain shuttered for maintenance.

ROTH hosts its sixth annual Solar & Storage Symposium on Tuesday, Septem- ber 25 and booth tour on Wednesday, Sep- tember 26 at Solar Power International, with 17 companies confirmed. Solar firms include ASYS, AZRE, CSIQ, DQ, ENPH, JKS, LONGi, RUN, SEDG, SOL, SUNW, and VSLR. Storage firms include AMRC, MXWL, Primus Power, sonnen, and WLDN. Our focus will be on four issues: (1) current state of global supply/demand imbalance given the 31/5 policy shock; (2) Outlook for the U.S. solar market, espe- cially residential; (3) the future competi- tive landscape of the inverter market; and (4) economics of the solar supply chain.

Jesse Pichel, ROTH Capital Partners

August 2018: Upstream down, downstream up

Stock price index: The major impact of demand destruction in China has been the collapse of upstream pricing. Polysilicon prices fell from $17 to $12 despite most major plants shutting down for “annual maintenance” ahead of schedule. Wafer prices have been reduced from CNY 4.80 to 3.30, and module cost will reach low $0.20s ahead of schedule, allowing a mid to high $0.20s module price for major markets. Year-to-date, the stocks of Daqo New Energy (DQ), Wacker, REC Silicon, GCL-Poly, LONGi, Tongwei, Canadian Solar, and JinkoSolar have dropped 35%, 25%, 45%, 49%, 40%, 42%, 21%, and 41% respectively.

Next year is expected to be a tremendous one for U.S. projects, driven by low costs and a pull in of demand ahead of ITC phased reductions. Year-to-date, Vivint Solar and Sunrun stocks have increased 46% and 156%. For July, the Guggenheim Solar ETF (TAN) increased 1.7% versus the S&P 500 and Dow each up 4.7%. The top five performing stocks in the U.S. are SolarEdge (SEDG), Vivint Solar (VSLR), Sunrun (RUN), Canadian Solar (CSIQ), and DQ, which gained, 21%, 19%, 15%, 9.3%, and 8.5% respectively. Downstream company stocks keep performing due to the lower module price and pull-in of demand. Upstream manufacturer stocks slightly recovered due to short-term price stabilization caused by the shutdown of capacity.

On July 25, the China Photovoltaic Industry Association (CPIA) issued its H1 2018 statistics and H2 2018 forecast. It forecast 2018 China demand of 35 GW+, indicating 10 GW+ in the second half (China installed 24 GW in H1). According to CPIA, China produced 140 MT of poly, 50 GW wafer, 39 GW cell, and 42 GW module in H1, year-on-year growth of 24%, 39%, 22%, and 24% respectively. For 2018, it estimates the utilization rate across wafer, cell, and module could drop to 67%, 58%, and 48%.

In the U.S. it will be interesting to see how domestic manufacturers react to the new policy in China and its effects on the U.S. market.

Jesse Pichel, ROTH Capital Partners

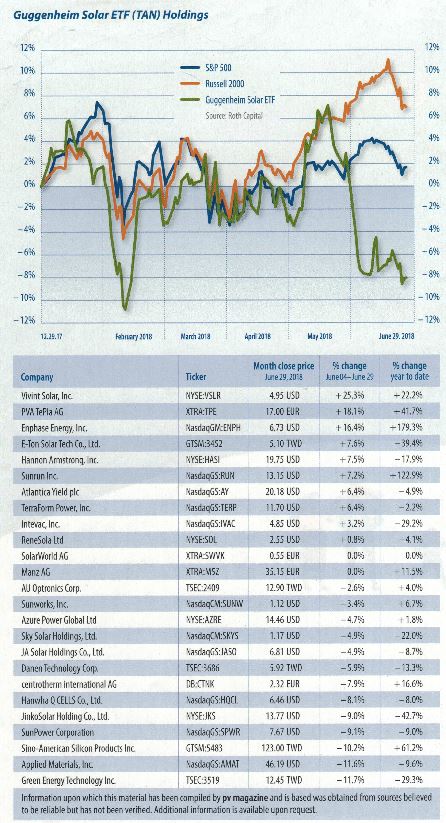

July 2018: Solar Stocks Slipping

Stock price index: Solar stocks significantly underperformed the broader market in June. The Guggenheim Solar ETF (TAN) decreased 8.2% vs. the S&P 500 and Dow down 0.6% and 1.5%, respectively. The general investor sentiment around the solar industry is very negative due to the shocking policy change in China. Pricing is on the decline. Polysilicon pricing appears to have hit $12/kg which represents a drop of >40% YTD. Correspondingly, GCL-Poly, Daqo, and Wacker stocks dropped 15%, 22%, and 33% in June, respectively. The wafer pricing has dropped to RMB3.3/wafer from RMB4.2/wafer at SNEC in late May. Jinko, FirstSolar, Canadian Solar and LONGi dropped 9%, 20%, 22%, and 25% in June, respectively. On the inverter side, Enphase increased 16% due to its acquisition of SunPower’s microinverter business, SolarEdge and SMA stocks dropped 13% and 32%.

We have seen several announcements from Heliene, Itek Energy, Mission Solar, Seraphim, Solaria, SolarTech Universal, Sunpower, Suniva, SunSpark and Tesla/Panasonic.

JinkoSolar (JKS) was the first mover among Asian solar manufacturers to announce a new USA plant. Most recently, Hanwha Q Cells Korea Corporation announced that it will build a solar PV module manufacturing facility in Whitfield County, Georgia.

Construction will commence in 2018, and the facility is scheduled to be completed in 2019. However, given the steep price decline of poly and wafer in China, it may be cheaper to pay the tariff than build the manufacturing in the USA.

With the JunQ earnings season coming, we expect more company announcements on how strategy will alter with the policy change in China.

Jesse Pichel, Roth Capital Partners

June 2018: Choppy waters ahead!

June 2018: Choppy waters ahead!

Stock price index: Solar stocks may be stuck in a malaise for the short term as demand in China wains, however, the higher efficiency transition will be the key driver of the industry longer term.Solar stocks outperformed the broader market last month (5/7-6/1), the Guggenheim Solar ETF (TAN) rose 3.8% vs. the S&P 500 and Dow up 2.7% and 1.5%, respectively. Despite this, we expect volatility due to the new policy in China. On 5/31, China’s NEA released its ‘Solar Management Plan’, the update is more severe than expected. It appears traditional utility scale projects will not be eligible for the 2018 FIT until an update is provided, and 2018 DG demand will be capped at 10 GW. Additionally, the 2018 FITs for utility scale projects and fully grid-connected DG projects were lowered by ~6-9%.

Canadian Solar (CSIQ), Jinko Solar (JKS) and Daqo New Energy (DQ) in the U.S. stock market dropped 5.5%, 14%, and 8.6% after the announcement. LONGi (SH601012), Tongwei (SH600438), and GCL-Poly (HK3800) in the Asian market dropped 10%, 10%, and 9.2% on the first day trading after the release.

Other takeaways from SNEC include: High efficiency is driving demand and transition to mono. There is some debate on the future of multi. Tier 1 suppliers may find themselves becoming obsolete as new entrants ramp higher efficiency, with lower capex /W.

Poly and cell: capacity is expected to rise significantly in 2018, as a result, pricing is expected to decline. The pricing for mono wafer, which has been tight, is now CNY4.2/pc from Longi and expected to be CNY3.80 by the end of the year.

Module: Some OEMs see pricing nearing $20c/W by 2020, while this is certainly grid parity, storage prices are still too high. If storage can mirror the capital formation witnessed in PV over the past 12 years, grid parity (PV + Storage) is just a matter of time.

Inverter: Despite noise, we have not seen any real volume of Chinese inverters penetrating the U.S. markets for smaller systems like MLPE. However, utility and C&I companies in the U.S. are using Chinese inverters. Trade conflicts are likely to hinder inverter exports near term.

Jesse Pichel, Roth Capital Partners

April 2018: Conference findings

Stock price index: A vibrant ROTH conference saw brisk interest in the solar inverter investment space, while storage backers are in it for the long game.

Last week, ROTH Capital held its 30th Annual ROTH conference with 94 Cleantech firms joining, including 28 solar and storage companies. Despite the noisy and dramatic nature of the solar industry, investors remain very interested in solar, especially inverter investments.

The investor outlook for SolarEdge and Enphase remains quite positive with better pricing and more feature-sets vs. Huawei and other new competitors. The worst-case fears have been alleviated. The Section 201-related solar downturn in the U.S. during the second half of 2017 appears to be over. Downstream growth is resuming, however, with many of the large developers sitting on ample module inventory. Storage remains a key interest to investors, and the consensus view is that it will become much more prevalent with lower cost and better battery performance over the mid-term.

Solar stocks outperformed the broader market in March. The Guggenheim Solar ETF (TAN) increased 1.2% vs. the S&P 500 and Dow up 0.2% and down 1.4%, respectively. The inverter stocks remained strong for the period with Enphase, SMA, and SolarEdge gaining 91%, 17%, and 9%, respectively. This is in line with our observation at the ROTH conference. Huawei’s higher pricing and limited product feature-set seen in Europe alleviated investors’ fears about the competition.

The polysilicon stocks declined in the last few weeks of March, with Daqo and GCL-Poly dropping 20% and 12% since our last publication, respectively. Although Daqo delivered a strong Q4 in 2017 and better-than-expected Q1 2018 guidance, the stock still declined on weaker industry ASP outlook.

According to our analysis, more than 125K MT of polysilicon capacity announced in 2017 is expected to come online in 2018. This has negatively impacted investors’ sentiment in the poly stocks. China’s domestic poly price had dropped to $16.1/kg by the end of March, down from $20.4/kg in January 2018.

Jesse Pichel, ROTH Capital Partners

March 2018: Solar stocks on top

Stock price index: A better than expected outcome to the Section 201 case kept solar ahead in February. However, there are surely more strategy changes to be announced as a result.

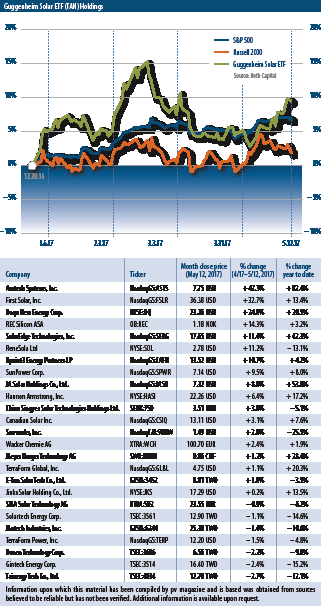

Solar stocks outperformed the broader market in February (29/01/2018–23/02/2018). The Guggenheim Solar ETF (TAN) dropped a mere 2.4% versus the S&P 500, Dow, and Russell 2000 down 4.4%, 4.9%, and 3.7% respectively.

We believe the outperformance of the solar sector compared with broader markets was due to consensus views that the final 201 tariff was fairly benign, and the best possible outcome for the industry at the present stage.

JinkoSolar (JKS) was the first mover among Chinese solar manufacturers to announce a new USA-based production facility. The stock gained 2.5% on

January 29 after they announced the plant. However, the stock dropped 21% in this period as it closed a ~$110 million follow-on offering at an ~11% discount. JKS intends to use the proceeds for its capacity expansion and upgrade including the construction and operation of its manufacturing facility in the U.S.

The best two performers in February were SolarEdge (SEDG) and REC Silicon (REC). SEDG gained 36% as it delivered a strong Q4 beat and an impressive Q1 guide.

The market has been worried about the competition from Asian players, but the Huawei higher pricing and limited product feature set seen in Europe alleviated those fears. REC gained 23% in this period on the heels of its Q4 results. REC was cash flow positive – the first time in three years.

With the DecQ earnings season coming, we expect stock volatility and more company announcements on how strategy will alter with the 201 result. In addition, ROTH is hosting its annual March conference with 94 Cleantech & Industrial Growth companies joining, including more than 28 solar and storage companies. We will have takeaways from the conference in our next issue. S

Jesse Pichel, ROTH Capital Partners

February 2018: An end to hyperbole

Stock price index: If the Section 201 ruling has taught the solar industry anything, it is that reason and nuance trump scaremongering every time.

Solar stocks underperformed the broader market in January. The Guggenheim Solar ETF (TAN) increased 1.8% versus the S&P 500, while against the Dow it was up 6 .7%, and 7.7% against the Russell 2000. Investors are still scratching their heads on what the final Section 201 tariffs and tax reform could mean for global solar demand. Consensus is that the U.S. market may be somewhat smaller as a result of the trade action, but there is also an acceptance that the impact is likely to be more benign than first feared. Meanwhile, China continues to expand strongly, especially the nation’s distributed generation (DG) and rooftop markets.

Trump chose a tariff level (30%) at the bottom of the bipartisan ITC recommended range. Many observers question if the tariff would increase U.S. manufacturing: the JinkoSolar 1.5 GW plant announcement did not take long to materialize, and we are aware of others in the early planning stages.

We have now seen several solar trade issues globally. In Roth Capital Partners’ opinion, trade issues are unlikely to go away until there is viable solar manufacturing in the U.S. Our recommendation is that we should abandon the sky-is-falling and phantom job loss tactic, and lobby the administration with several “asks,” that could include: MLP/REIT status for solar companies; fast-track permitting; reducing environmental studies; tax-free manufacturing zones in the interest of U.S. national security and to revitalize certain cities; a revision of accounting rules that penalize solar project owners; federal policy allowing net metering for homeowners and community solar projects; including solar in the upcoming infrastructure spending bill; and finally increased PV deployment on federal buildings.

We find that these suggestions are more rational given the administration’s avowed support for U.S. employment and economic growth.

Jesse Pichel, ROTH Capital Partners

January 2018: Taking stock of 2017

Stock price index: A look back over solar stocks’ performance across 2017 finds three key themes: Chinese strength, a capacity upgrade cycle, and the U.S. Section 201 case.

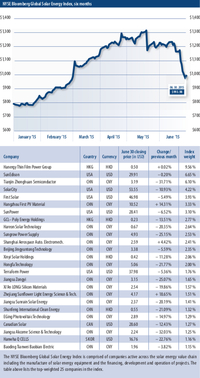

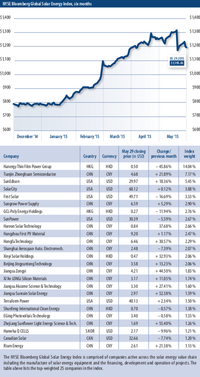

Solar stocks significantly outperformed the broader market in 2017. For the year of 2017, the Guggenheim Solar ETF (TAN) increased 51.7% versus the S&P 500, Dow, and Russell 2000 up 19.4%, 25.1%, and 13.1%, respectively. The top five solar stocks in the U.S. stock market were Daqo New Energy (DQ), SolarEdge (SEDG), Enphase (ENPH), Amtech System (ASYS), and First Solar (FSLR), which gained 208%, 203%, 139%, 137%, and 110%, respectively.

There were three key factors that drove the solar stocks and investor’s sentiment throughout 2017: 1) Strong China solar market demand; 2) A technology driven capacity upgrade cycle; and 3) The Section 201. We discussed these three factors below.