Israel’s N2OFF enters solar business

Agri-food tech specialist N2OFF says it has entered the PV business by lending €375,000 ($407,000) to Israeli PV developer Solterra Renewable Energy. The loan is part of a larger €500,000 agreement, with the remaining €125,000 to come from other parties.

IEA-PVPS identifies 456 patents in PV module recycling

The IEA Photovoltaic Power Systems Programme’s (IEA-PVPS) latest report on solar panel recycling offers a comprehensive review of all existing technologies in this market segment, from pure mechanical recycling to innovative techniques such as as light pulse treatment, water-jet cleaning, pyrolysis, and chemical treatments.

EDF invests in Israeli robotic agrivoltaics startup

AgRE.tech, which is developing a robotic operating system for existing photovoltaic infrastructure, has raised $2 million from EDF and Zemach Regional Industries. The company says it will soon set up commercial fields.

UP: Bringing everyone on board

With Europe’s grids ripe for upgrade and expansion, pv magazine’s Carrie Hampel examines community acceptance of energy infrastructure projects and some of the issues involved. Communication between communities and stakeholders is a two-way street.

Photovoltaics for hydroponic greenhouses

Researchers in Iran have investigated the operation of a real solar-powered greenhouse in the Alborz province and have found that only 4% of the greenhouse’s roof needs to be covered with PV modules to meet demand for lighting and pumping water.

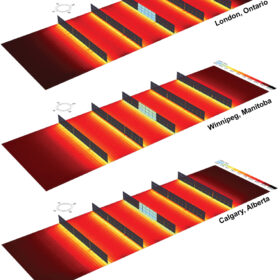

What crops fit with vertical agrivoltaics?

Research at three Canadian locations tried to identify which crops can grow between differently spaced rows of vertical agrivoltaic systems. The scientists concluded that all traditional corps could be grown at the research sites, including arugula, beets, bok choy, celery, coriander, collards, fava beans, kale, lettuce, parsley, parsnips, peas, swiss chard, and thyme.

Woltair expands online heat pump, solar PV platform

After finding growth in its home market and Poland, Czech Republic-based Woltair raised venture capital to expand its heat pump and solar PV software platform, used by both installers and homeowners, into Germany and Italy.

Component sizing key for upscaling high-temperature heat pumps

A group of researchers has investigated how high temperature heat pumps may be upscaled for industrial applications and has found that larger setups promise higher efficiency. They also found that smaller setups show a better coefficient of performance resulting from design effects.

Rooftop PV reduces building retrofitting costs by up to 50%

Cambridge researchers have analyzed the benefits of installing a PV system on the roof of an apartment building in addition to energy refurbishment and have found that photovoltaics, especially if combined with heat pumps, makes retrofit projects more affordable.

Intersolar 2024: Day 3: Tecloman unveils Cubox mobile storage platform

Our pv magazine newshounds will be walking the floors for one last time in Munich today as Intersolar Europe 2024 winds down for another year.