Module prices continue to slide

After China’s National Day holiday, demand started picking up at a slow pace, but the anticipated installation rush did not occur as expected, due to land and financing issues, as well as the return of winter. These factors will also delay the timing of more than 6 GW of capacity to the first half of next year. PV InfoLink has thus downwardly revised its estimates for installed capacity in the fourth quarter to 11.3 GW in China and 30 GW globally, bringing this year’s global demand forecast to below 120 GW.

Is the EU solarizing its digitized economy sans an environmental tax policy?

The EU is solarizing its digital economy at a fast pace. The factors behind this paradigm shift in energy – when renewable energy is projected comprise 90% of the electricity mix in Europe by 2040 – include technical, economic, environmental.

A record year for trackers

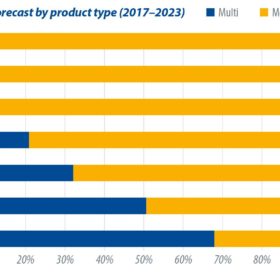

It was a record year for global shipments of single-axis solar photovoltaic (PV) trackers in 2018, as they increased by more than 40%, surpassing 20 GW globally for the first time, writes IHS Markit senior analyst Camron Barati. While the United States continued to be the largest individual market for single-axis trackers last year, shipments also increased in Mexico, Australia, Egypt, Spain, and other large utility-scale markets.

Solar will power ahead to offer 20% more output for 25% lower module costs within 15 months

PV industry veteran Karl-Heinz Remmers recalls the trajectory of solar power this decade and predicts stronger than expected development for the ten years ahead.

Powering the investment case for battery storage

The U.K. government was the first major economy in the world to pass laws to end its contribution to global warming by 2050. But to achieve this ambition is going to take some major changes – not least of which to the U.K.’s power network.

Europe: The time for large-scale PV is now

The past year has marked a watershed moment in the global energy transition, driven primarily by the fact that public awareness of the challenges posed by climate change has skyrocketed.

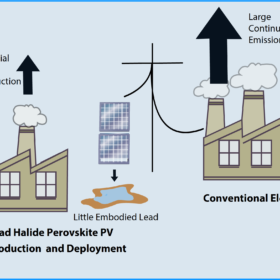

Benefits and risks of lead halide perovskite photovoltaics

Lead halide perovskite PVs (LHP-PV) have rapidly emerged over the last decade as a potentially viable thin film PV technology, because of their high efficiency and potential for low manufacturing costs. However, concerns remain over potential impacts to the environment and human health arising from the use of toxic lead in LHP-PVs.

Can Nam Ngum solar replace Mekong hydro in Laos?

The Lancang-Mekong River is being decimated by hundreds of tributary and mainstream hydroelectric projects from the Tibetan Plateau in China to Lower Sesan in Cambodia. On the Mekong, the Laos Government has constructed the majority of these projects and it is planning even more. But why does it only focus on hydroelectric power plants (HPP’s)? What about other renewable energy sources? Can Nam Ngum solar replace Mekong hydro?

COP, climate, class struggle?

The World Climate Summit in Santiago de Chile, set to be held in just a few weeks, has just been cancelled. Against a background of social protests in the country, concerns have recently grown as to whether logistics and security could be guaranteed for the event. Nevertheless, social problems and environmental protection must not be played off against each other: Both are closely linked to the economic paradigms of recent decades.

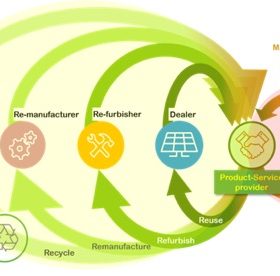

Towards circular business models for the PV sector

With solar energy about to reach the iconic terawatt (TW) milestone of globally installed PV capacity, waste handling and end-of-life (EoL) scenarios become a pressing matter.