In mid-August, Duke Energy announced that it had acquired a 25 MW solar project on a former golf course on Long Island. The Shoreham Solar Commons marks Duke’s 63rd solar project, and the 15th state where it is building solar and wind projects. Not to be outdone, Duke Energy Florida, a utility subsidiary of the same parent company, announced that it would build 700 MW of solar and battery storage, as part of a deal to settle costs from an abandoned nuclear project.

And it is not only solar, wind, and batteries that Duke is installing. Last December the utility unveiled a plan to install 200 electric vehicle charging stations in North Carolina, and has invested in a fleet of electric vehicles for its own operations.

Duke is in many ways a typical large U.S. power company, with both competitive generation and regulated utility arms. The North Carolina power giant owns and operates more than two dozen coal and nuclear power plants, and such moves would have been odd 10 years ago, when it was focused largely on investments in fossil and nuclear generation.

But Duke isn’t building coal plants anymore, and has even backed away from some nuclear projects. August was also the month that Duke sought permission from North Carolina regulators to cancel the William States Lee 3 Nuclear Station, for which it had applied for a license a decade prior.

And Duke is far from alone. Instead, it is one of many U.S. utilities that is moving from brown to green power, and the changes at Duke show a lot about the way that utilities are approaching solar and clean energy.

Competing on price

For years, solar advocates spoke of grid parity, as though the moment when solar costs the same as retail electricity were a Holy Grail. But the truth is that retail prices are really only relevant for distributed solar. For utility-scale, the important thing is to be able to compete at the point of generation, which means competing with wholesale, not retail prices.

According to many experts, utility-scale solar has crossed a threshold where it is cheaper on a wholesale basis than conventional sources of power in many regions. In its latest benchmark report on costs, NREL found that utility-scale solar had fallen to a levelized cost of electricity of $44 – $66/MWh during Q1 2017, which is competitive with many forms of conventional generation.

And as prices continue to fall, prices for new contracts are even lower, with the low end able to compete even with the depressed cost of gas generation. Such price declines are not unique to the United States. Financial Advisory firm Lazard reported similar prices to NREL at $46 – $61 in its late 2016 report on the unsubsidized LCOE of various sources of energy. Globally, this puts utility-scale solar only a fraction behind wind as the cheapest form of electricity generation. It also adds to the inherent advantage that solar has of offering stable, predictable prices, as opposed to the fluctuating price of fossil fuel generation, which depends upon often volatile fuel markets.

Falling prices have not gone unnoticed

“It’s no secret that solar prices have gone down,” says Duke Energy Communications Manager Randy Wheeless. “It started to make sense to build [solar] in the regulated states – not only in the states that have renewable portfolio standards, but in states that don’t, like Florida and Kentucky.”

But it is not only utilities that have seen the light. U.S. President Donald Trump’s appointee to run the Office of Energy Efficiency and Renewable Energy, Daniel Simmons, was formerly VP of policy at the Institute for Energy Research, a policy research organization that describes itself as “free-market” but has been criticized as being a proponent of an expanded role for fossil fuels. While in the past Simmons expressed skepticism that solar could play much of a role in future energy systems, today his stance looks very different.

“Ten years ago, the energy landscape looked completely different than it does today,” Simmons told pv magazine in an interview during the Solar Power International trade show in Las Vegas. “I didn’t see the costs of solar and wind decreasing as fast as they have. One of the things that we have to understand is that technology is dynamic.”

Putting megawatts online

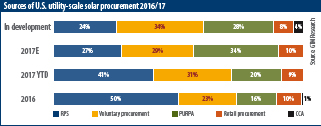

As the result of this cost advantage, utilities are increasingly either procuring large-scale solar from third-party developers, or building it themselves. GTM Research estimates that of the roughly 10 GW of utility-scale solar that came online last year in the United States, only half of it was driven by renewable energy mandates, while the other half was the result of other reasons, all of which boil down more or less to economics. This includes more than 2 GW which was the result of voluntary procurement by utilities – a sector which essentially did not exist just a few years ago.

In 2017 the balance of large-scale solar coming online has been driven by these other factors, and by the end of the year GTM Research estimates that 29% of all new solar will be the result of voluntary utility procurement. In terms of projects currently underway, GTM Research identifies voluntary procurement as the biggest single driver, responsible for over one third of capacity under development (see the graph above).

This category of voluntary procurement does not include situations where corporations are buying power from renewable energy projects, either directly or through “green tariff” arrangements with utilities. Such arrangements have become more popular as a way for utilities to keep the increasing number of corporations with 100% renewable energy goals as customers, and to avoid the defection seen in Las Vegas, when a number of casinos broke from NV Energy to procure renewables directly.

Voluntary procurement is not only happening in states with high levels of solar potential, such as Arizona and California, but also in regions such as the U.S. South and Midwest, where irradiation levels are lower. This can be seen clearly in the case of Southern Company, which started by investing in solar projects in states such as New Mexico and California roughly a decade ago. Pushed initially by the Georgia regulators, Southern began building solar in the service area of its utility subsidiary Georgia Power in 2010, and then voluntarily expanded the program and began building solar in its Mississippi and Alabama territories as well.

Such interest in solar is not limited to investor-owned utilities. Municipal utilities in Austin and San Antonio initiated the state’s current boom in big solar, and rural electric cooperatives in Wisconsin, Texas, and Georgia have announced substantial deals to buy power from multiple solar projects.

PURPA – a dirty word

But just because utilities are warming to large-scale solar does not mean that they like all mechanisms of procurement. As it has gone from obscurity to becoming a big driver of utility-scale solar, the Public Utilities Regulatory Power Act of 1978 (PURPA) has inspired particularly heated resistance.

This is particularly true in the Mountain West, where Idaho and Montana regulators have slashed contract lengths and payment levels under PURPA contracts. But North Carolina has also recently moved away from PURPA to an auction system for larger projects, in a compromise between Duke Energy and the solar industry.

Utility arguments against PURPA have centered on cost, with Duke in particular noting that previous estimates of “avoided cost” missed the fall in power prices, and alleging that it was overpaying. Meanwhile, Idaho regulators expressed concern about their utilities being forced to buy large amounts of power which they say they don’t need.

DG solar: the war rages on

While utilities are increasingly embracing large-scale solar, they still routinely resist distributed generation (DG). In a July blog post, Sunrun CEO Lynn Jurich complained of utility lobbyists “fighting tooth and nail to undercut competition and consumer choice.”

An examination of rate proposals supports the assertion that utilities have not slowed down in this regard. The latest edition of North Carolina Clean Energy Technology Center’s 50 States of Solar report showed utilities in 25 states attempting to increase fixed charges or minimum bills, and 24 states considering changes to net metering policies.

And it is not only investor-owned utilities that have tried, and in some cases succeeded, in sticking it to rooftop solar. Member-owned cooperative Salt River Project has implemented the only demand charge on residential customers known to pv magazine, which killed off the rooftop market in its service area.

Many utilities also continue to use the “cost-shift” argument to defend anti-rooftop solar policies. This is despite it being demonstrated in more than a dozen studies that net metered solar is a net benefit to other ratepayers at current penetration levels, and that no cost shift occurs until the penetration of solar reaches around 10% of demand. This is also despite a study by Lawrence Berkeley National Laboratories which shows that the actual volume of any cost shift is negligible.

Some of this can be traced back to the influence of utility trade group Edison Electric Institute, which has championed the cost shift myth, after warning members that broad adoption of rooftop solar could lead to a “utility death spiral.”

However, the war that utilities are waging against customer-sited solar tends to be something they don’t want to discuss. When confronted with anti-DG rate design, many will instead stress their large-scale solar portfolios. Many will also point to the fact that large-scale solar is less expensive at the point of generation – while routinely ignoring or under-counting the value of DG to the grid.

Utility DG and community solar

There is one type of customer-sited solar that utilities like: the kind they own. In fact, utilities as geographically distinct as Tucson Electric Power and Georgia Power have sought to expand programs that allow them to own rooftop solar and deploy it on their customer’s homes. There are reasons for this. Not only does it keep utilities in the game, economically speaking, it also allows them to design systems that provide greater visibility into grid operations, which they often cannot do with customer-owned solar.

The great compromise between utilities and customers who want solar is community solar. Community solar is everything to everyone: It offers cheap power due to economies of scale, it allows renters and homeowners who do not have suitable roofs to contract with power from solar, and it gives utilities a way to have skin in the game while providing their customers with what that they want.

And while it has been more hype than reality for several years, community solar is finally taking off in the United States. GTM Research estimates that there is now 436 MW of community solar installed in 36 states. However, the majority of this is in only three states: Colorado, Massachusetts, and Minnesota, although Maryland and New York have considerable project pipelines.

A system based on renewables

With the increasing deployment of wind and solar generation due to falling prices, we are moving to a system where these are no longer “alternative energy.” Solar is already meeting more than 10% of electricity demand in California, and wind is meeting 20% or more of demand in half a dozen states, including Texas.

Michael Liebreich, the founder of Bloomberg New Energy Finance, describes future energy systems as being centered around “base cost” renewables, complemented by other resources that adapt to both fluctuations in demand and the variable nature of these generators.

This is very different to 20th century power systems, which were centered on “base load” coal, hydro, and nuclear power plants, and both utilities and regulators are struggling to adapt to the new realities. And as the penetration levels of solar and wind increase, so do the technical challenges and the need to rethink the operation of the grid.

Solar Electric Power Association (SEPA) saw that it needed to change its role to help utilities adapt, and as part of a changing mission it has re-branded itself as the Smart Electric Power Alliance (without changing the associated acronym). SEPA’s new role is focused sharply on grid integration.

“It’s about really evolving how we operate and maintain the grid, really making sure that the grid is a platform that is able to process all of these new technologies,” explains SEPA CEO Julia Hamm. And this means not only solar, but also energy storage, which is one of the key technologies that promises to enable high penetrations of wind and solar.

Utilities are often quicker to embrace energy storage than solar, as it can solve multiple problems including supplying a host of ancillary services. But the same issues remain with solar, in terms of the inherent conflict over who will own and operate these resources.

Settling in

Despite fear-mongering regarding the “death spiral,” utilities aren’t going anywhere anytime soon. Despite falling costs for batteries, grid defection is still not cost effective, and utilities are needed, if for no other reason than that someone has to maintain the lines, wires, and other infrastructure of the grid.

As utilities begin to embrace solar, the problems and the questions become more complicated. Chief among these is who will own the solar that is deployed. Vertically integrated utilities want to maintain this role, and all utilities want a stake in the financial relationship. Additionally, as part of their role in maintaining the power grid, they want to be able to sense and control what sources are feeding in electricity.

While U.S. utilities are still resisting distributed solar, it is not enough to see them merely as enemies of an inevitable energy transition. It is more that the relationships are changing, and that utilities are struggling to keep up with a transformation that is more fundamental than any they have had to face since they first came into existence. S

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.