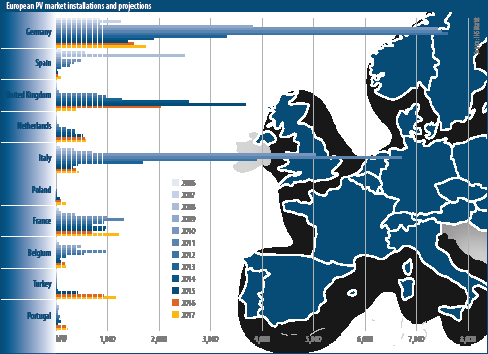

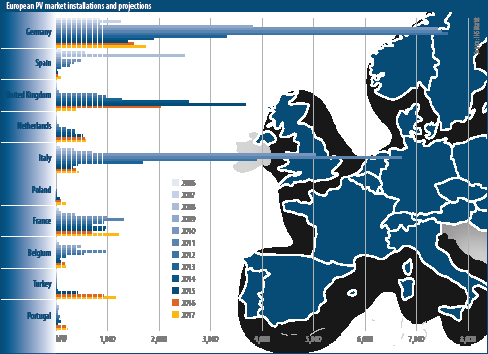

Europe turns to the rooftop

Stay informed

pv magazine is the leading trade media platform covering the global solar photovoltaics industry. Log in or purchase a digital or print version of this issue to read this article in full.

This website uses cookies to anonymously count visitor numbers. View our privacy policy.

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.