In the heart of Oregons high tech manufacturing cluster known as the Silicon Forest, the largest PV production facility in the United States and the entire Western Hemisphere, for that matter is growing once again.

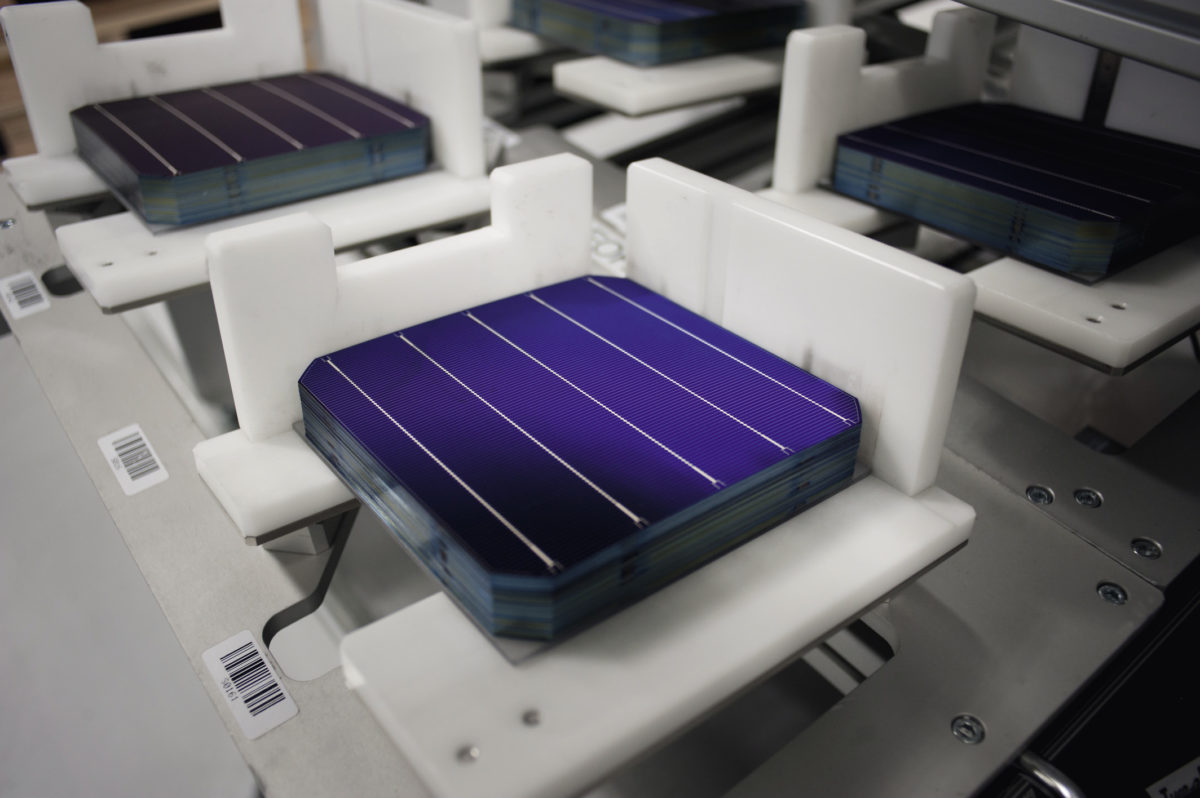

SolarWorld Americas this year plans to expand the crystalline silicon module manufacturing capacity at its factory in Hillsboro from 380 MW to 530 MW, while also boosting its capacity for producing monocrystalline cells by 100 MW to 435 MW.

The U.S. subsidiary of Germanys SolarWorld AG plans to invest $10 million into the expansion, creating about 200 new full-time jobs by summer and expanding SolarWorlds workforce in Hillsboro to 900. Further growth to 650 MW of module capacity could happen in the near future, confirms Mukesh Dulani, President of SolarWorld Americas.

With the growth of the market, the opportunity is very good for American solar manufacturing, Dulani told pv magazine. Customers are coming to us, sincerely asking to buy American-manufactured solar modules. Growth for us is related to our quality. SolarWorlds investment in the Silicon Forest is far from the only sign of resurgence in U.S. PV manufacturing following several years of contraction, job losses, high-profile bankruptcies and international trade disputes.

Finally, new PV manufacturing is taking root across the country.

In the Rust Belt, for instance, monocrystalline PV cell and module producer Suniva is building a 200 MW factory in Michigan, while leading thin film module manufacturer First Solar is adding two new production lines at its existing plant in Ohio. In Mississippi, thin film competitor Stion says it is expanding its factory this year, while thin film startup Siva Power has an eye on 2016 to build its first production facility. In upstate New York, SolarCity, the nations largest solar installer, has broken ground on a massive factory that company executives say has a targeted capacity greater than 1 GW within the next two years. The factory will feature crystalline technology acquired last year through SolarCitys purchase of startup company Sivelo.

In San Antonio, Texas, Mission Solar Energy, a subsidiary of Korean polysilicon producer OCI, is this year doubling the size of its crystalline module plant to 200 MW, creating 400 new jobs. The company is contracted to supply domestically sourced solar systems to local utility CPS Energy. In Georgia, Suniva is considering expanding the 160 MW manufacturing footprint at its existing factory.Further up the PV manufacturing value chain, Massachusetts-based 1366 Technologies is currently evaluating several sites in the U.S. for a planned 250 MW wafer production facility. In the state of Washington, REC Silicon recently announced plans to add 3,000 metric tons of polysilicon production capacity in Moses Lake in 2016. Germany's Wacker Chemie, meanwhile, is building a $2.4 billion polysilicon plant in Charleston, Tennessee, that is expected to begin operations in mid-2015 and create 650 new jobs.

Shaking things up or shaking out?

These expansion initiatives are much more than wishful thinking: Most already are well underway.

But despite the recent surge in manufacturing investments, there is surprisingly little consensus over whether such large-scale capital commitments are short-term measures aimed at addressing Americas immediate market opportunity or true reflections of the long-term future for U.S. solar manufacturing.

A Congressional Research Service report on U.S. PV manufacturing trends, published in late January, takes a distinctly bearish view.

It concludes, Solar manufacturing continues to go through a shakeout, with manufacturers closing U.S. plants because of difficult global business conditions, stiff competition particularly from Chinese companies, and falling prices for solar panels. There is some evidence of ongoing disruption to support this conclusion. Polysilicon producer Hemlock Semiconductor, for example, in December shuttered its factory in Clarksville, Tennessee, citing Sustained adverse market conditions created by industry oversupply and ongoing challenges presented by global trade disputes. The latter comment was in reference toxAdvertisementtrade tariffs on U.S. polysilicon exports to China that were imposed in retaliation to punitive U.S. tariffs on Chinese-made crystalline PV cells and modules.

However, most of the data in the report is from 2012 and 2013, and does not necessarily accurately reflect the situation in 2014 let alone 2015. Prices, for instance, no longer appear to be falling. According to data published by the Solar Energy Industry Association (SEIA) and GTM Research, PV materials and component prices in the U.S. largely stabilized last year, from polysilicon feedstock down to modules. U.S. solar manufacturing employment trends reflect the segments return to growth.

According to a recent industry jobs census conducted by The Solar Foundation and BW Research Partnership, a recovery in U.S. solar manufacturing started in 2014 and will accelerate this year.

The census finds U.S. manufacturers added 2,639 new positions in 2014 which was good enough for nearly 9% annual growth, boosting the solar manufacturing workforce to 32,490.

Based in large part on expansions at cell and module factories in Oregon, Michigan, Ohio, New York and Texas, the census forecasts 14.5% employment growth this year, with an additional 4,700 jobs. The resulting 37,194 solar manufacturing jobs at the end of 2015 would represent the most since 2011.

DOE: strong revival

U.S. solar manufacturing, I think, has had a strong revival, Lidija Sekaric, Manager of the Technology-to-Market Initiative within the DOEs Sunshot program, told pv magazine . And with a strong market in the U.S., manufacturing is going to remain strong. In addition to the Sunshot programs goal of enabling PV power at $0.06 per kWh by 2020 without subsidies reaching parity with conventional grid power across much of the country the DOE has a goal for U.S. PV producers to reach a production capacity equal to the domestic markets size.

That may seem like a long way off, especially considering that domestic module production capacity stagnated in 2014 at approximately 1.6 GW and remained below the approximately 2 GW of equipment in place from 2010 2012 while the market grew 36% to 6.5 GW.

But announced capacity additions through 2018 to date already will push that to nearly 4 GW, says the DOE.

Despite the low share of U.S. module production compared to global panel output at only around 2 3% Sekaric doesnt see why the U.S. cannot produce more of its own modules.

Modules really are one part of the supply chain that make sense to be assembled close to the end market, she says.

U.S. module makers all of which have leveraged DOE research and development support at some point emphatically agree. Currently they are shipping the vast majority of their output to domestic projects, with the rest going to other markets in the Americas, such as Canada, Mexico and Chile.

There's an environmental and economic benefit to being closer to our customers, says Matt Card, the Vice President of Global Sales and Marketing for Suniva. The biggest change we have seen in the market in the last 18 months is the maturation of the buyer, he adds. Our customers are willing to pay a rational premium for a higher powered, higher quality, and yes, marginally higher priced product.Thats essential for all American manufactures. Chinese modules, even though burdened by trade tariffs imposed by the U.S. government, maintained their price advantage over U.S.-made panels as well as modules made in other Asian countries in 2014, according to SEIA and GTM Research. In the third quarter of 2014, pricing for Chinese panels was $0.73 per watt compared to more than $0.80 per watt for modules made in America and other Asian countries.

Certainly there is a price delta between what Chinese manufacturers are selling product for here today and what we are selling product for here today, says Card. But we are operating at a responsible level for us and we are having no trouble finding buyers.

We have to control what we can control

Card says import tariffs on Chinese-made modules, first levied in late 2012, havent played into Sunivas expansion plans or even impacted the U.S. market much as evidenced by continued market growth. If you look at the two large tariff actions and view them holistically, there has been a significant amount of theater, but Im not sure there has been a significant amount of impact. Whether its import tariffs or the looming expiration of the U.S. solar markets lucrative 30% Investment Tax Credit at the end of next year, Card says Sunivas approach is: We have to control what we can control and not rely on others. I dont want to be in an industry that is completely propped up by government as the Chinese industries are. It may not be a level playing field. But we are still here and we still have to compete. Its America, after all, and thats the name of the game.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.