Solar PV is scaling, fast. On track to terawatt scale – Fraunhofer ISE estimates around 12 TW will be installed by 2030, while PV consultancy Amrock puts the 2050 figure at 70 TW to 80 TW – it is a disruptive, low-cost, clean energy source.

Growth poses lucrative opportunities, particularly for manufacturers; yet, a dark cloud lingers. As Pierre Verlinden, Amrock MD, said during pv magazine’s recent Virtual Roundtable (see p. 58), at 1 TW, the industry accounts for 94% of today’s silver market, 35% of copper, and 32% of MG silicon. Even at today’s GW level, waste is worrisome, toxic materials integral, and raw materials finite.

The World Economic Forum’s 2020 Risk Report confirms such issues are not confined to the few, but rather represent disruption for the many.

Heightened activity

In response, multilateral global partnerships are forming to investigate how circular manufacturing models can play a revolutionary role. The goal is not just avoiding environmental destruction; equally, innovative business models, new revenue streams, resiliency and long-term economic stability are targeted.

Global thinktank SustainAbility wrote in its 2020 annual trends report: “From food and fashion to electronics and the built environment, circular thinking – keeping resources in use for as long as possible to extract the maximum value – will continue to gain momentum in 2020.”

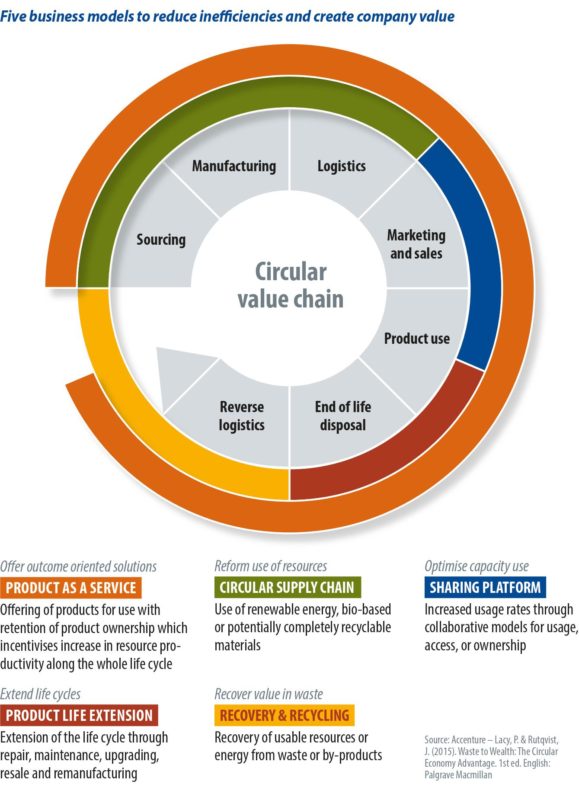

In Europe, the unveiling of the European Green Deal and associated Circular Economy Action Plan this March has seen heightened sustainability activity. For example, Sitra, Technology Industries of Finland and Accenture released a playbook, “Circular business models for the manufacturing industry”, in May. In it Sitra states: “Circular economy … offers companies the opportunity to turn inefficiencies in linear value chains into business value. These inefficiencies look beyond production waste, focusing on underutilised capacities, premature product lives, unsustainable materials, wasted end-of-life value and unexploited customer engagements.”

Reviewing a number of globally established businesses, the playbook identifies proven circular business results. These include Wärtsilä achieving a 45% reduction in production development expenses and a 50% reduction in assembly time using modular engine architecture, and Caterpillar reaping 50% higher gross profits from selling remanufactured products at a 20% discount. Ford has also cut costs by around 20% by swapping aluminum for steel, while Michelin is selling tires-as-a-service, with a revenue potential of €3 billion in 10 years.

Overall, five working circular manufacturing business models are identified to achieve such results (see chart to the left). Work on circular projects in the PV and storage sectors is also underway, including three Horizon 2020 European Commission funded projects – Circusol, Cabriss and Super PV – and Fraunhofer ISE’s Green Manufacturing Consortium. As discussed below, similarities between the industries and business models mentioned above can be drawn, and knowledge transferred.

Powerful potential

With €8.25 million in funding, Circusol – or Circular Business Models for the Solar Power Industry – aims to formalize reuse, repair and refurbishment value chains for PV and storage. It also demonstrates the potential of Product Service System (PSS) business models over a four-year period.

Its report calculates there will be 8 million tons of PV waste, 13 GW of EU solar power that second-life PV could serve, and 25 GWh of second-life batteries by 2030. These “resources” could reap benefits if changes are made, like user not owner business models, economic stimulus and facilitation packages, rather than regulation, and transition from a few global, to many regional players. Key are reuse, repair, remanufacturing, repurposing and recycling.

Value chains

To realize a vision, barriers must be understood. Circusol has identified 48 of these in R&D, design, technology, grid, collaboration, recycling, regulatory and market. These could be addressed via short- and long-term actions, as outlined in the table to the right.

In addition to value chains, Circusol investigates how circular PSSs could support change. Specifically, it wants to catalyze markets for second-life PV modules (see pp. 68-69), and the remanufacturing of disused EV batteries for stationary PV systems (watch out for pv magazine 08/2020). It sees further potential in novel product technologies with lower environmental footprints, like mounting structures comprising renewable materials.

“The intended role of a service-based business model approach is to enable coordinated product management (collection, sorting, refurbishment, testing, certification) and mitigate user concerns about the reliability, performance and lifetime of second-life PV products,” writes Nancy Bocken and Lars Strupeit of Delft University of Technology, in a 2019 paper titled “Towards a Circular Photovoltaic Economy: The Role of Service-based Business Models”.

For example, opportunities exist in sharing excess electricity with other users through microgrids, aggregation services, and trading platforms, and enabling sharing of electric storage capacity at the community level. “Delivery of these actions would require the coordination of responsibilities across several partners of the value chain, a role that a solar service firm potentially can adopt,” they say.

Circusol divides cPSS into three categories: product, use, and result oriented. The first, pPSS involves selling products combined with services in the use phase, such as a product and after-sales repair. With uPSS models, the use of, or access to, products is central, like renting/leasing products; while the rPSS model focuses on services, not products, which could be a fee for service.

“A benefit of service-based business models is the opportunity to gather valuable data on performance and service needs on a large number of systems, thereby enabling incremental optimization of system design and operation,” say Bocken and Strupeit. They also allow for easier repair, reuse and recycling, among other benefits. See pv magazine 06/2020 and listen to our Virtual Roundtable Sustainability Session to learn more about Circusol, and partners imec and PV Cycle.

Promising innovations

Complementing Circusol is the Super-PV project, which aims to reduce PV module LCOE by 26% to 37% via innovation in electronics, and module and solar system design. With a budget of €11.6 million, it is focusing on areas like Module Level Power Electronics (MLPE) developments ensuring higher power output, performance monitoring and data collection on the string level, and nano-coatings for modules, which are anti-soiling, easy-to-clean and anti-reflective. “These innovations are already showing promising results after the first tests. It is the second year of the Super PV project out of a total of four years,” Tadas Radavičius, project manager at Lithuanian-based Solitek told pv magazine. Work will now focus on demonstration of these innovations in desert, tropical, and cold climates.

The Lithuanian module maker is also looking into circular business models for second-life panels and refurbished batteries, while investigating alternative non-toxic materials like lead (pv magazine 09/2020 will cover circular materials), new panel designs, and integrating radio-frequency identification (RFID) technology. This latter issue ties into Circusol’s short-term action 1, and long-term action 3, and the creation of a central digital repository of information.

As Radavičius explains, RFID tags could contain information useful for installers and recycling companies, like technical parameters and material composition. Another option RFID unlocks is the creation of an online database documenting information on each panel or PV system, which could be accessible to a number of stakeholders like manufacturers, installers, recycling companies, and researchers.

Ecological efficiency

A third Horizon 2020-funded project is Cabriss, or the implementation of a circular economy based on recycled, reused and recovered indium, silicon and silver materials for PV and other applications. The aim of the group, which includes 16 European companies and research institutes, and has access to €9.26 million in funding, is to develop a circular economy based on PV waste manufacturing and end-of-life modules. It is focusing on technologies to recover secondary materials from modules and production waste; and to manufacture modules from these.

“We managed to develop all technologies required to separate, purify and recycle PV waste manufacturing and end-of-life modules,” Luc Federzoni of France-based research institute CEA and David Pelletier, project manager at French solar energy institute CEA-INES, told pv magazine. This involves opening the modules via non-thermal processes to recover over 95% of materials like silicon, aluminum, silver and indium, and the EVA. However, they say it is currently “difficult” to find profitable business models while recycling volumes are still small.

Several “innovative, resource-saving” production technologies for wafers and cells are concurrently being investigated. These mainly involve Si-kerf – waste from PV manufacturing – to produce low-cost silicon substrates, including ingots made from recycled Si via a hot-pressing process, say Federzoni and Pelletier. PV cells and modules with an efficiency of 18.5% and containing 100%-recycled silicon have reportedly been produced. This is a “promising technology” and the process is said to be ready for industrialization.

New cell technology using epitaxial deposition of silicon directly from silane, which avoids energy intensive processes and eliminates kerf loss, is another area of development. “Further R&D is still needed but feasibility has been demonstrated on small solar cells,” they say.

Protocols measuring the quality of recycled material and its suitability for making new solar cells tie into this work, although a standard for remanufacturing cells with recycled materials is said to be lacking. “What we precisely managed to industrialize was the re-use of the materials for other sectorial applications. This is the case for Si and In.”

This latter issue touches on industrial symbiosis – where waste or by‐products of one industrial process become raw materials for another – key to a circular economy. In solar, benefits could be reaped by collaboration with TV manufacturers, for example. The full interview with Federzoni and Pelletier is available at pv-magazine.com.

Green manufacturing

Stating that now is the time to reinvest in the European manufacturing industry and take advantage of the TW-scale opportunities ahead, Germany’s Fraunhofer ISE established the Green Manufacturing Consortium in 2019. It is a German publicly funded project, comprising 20 industrial partners, four institutes and two industry associations, including First Solar, Meyer Burger, Total, Wacker, VDMA, Oxford PV and Von Ardenne.

The goal is to develop an economic-ecological evaluation methodology for a sustainable future factory – 10 GW in size and easily scalable beyond that – for the production of innovative PV modules. “Via a comprehensive energy and material flow model of scaled and vertically integrated PV fabs we will simulate changes in production capacity, factory layout, supply systems, production facilities and processes as well as recycling of materials through recycling processes and other value-added stages,” explained Jochen Rentsch, head of Department Production Technology Division Photovoltaics.

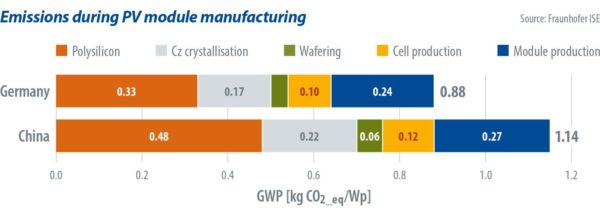

In a recent report, Fraunhofer calculated that €1.9 billion investment would be required for such a 10 GW factory, covering an area of 500,000m2 and creating up to 7,500 jobs. Director Andreas Bett said reestablishing a European PV manufacturing market represents a “big opportunity” to ensure energy security by reducing dependency on imports, lowering costs and addressing sustainability. “Why transport large and heavy PV modules the long distance from Asia and cause CO2 emissions and added cost? For example, module costs of €0.20/W can be soon realized, and transport costs from China to Europe can be up to €0.025/W,” he wrote. As the chart here shows, the emissions of manufacturing modules in Germany are also much lower than in China, because of the stricter environmental controls in place.

Fraunhofer gives a further nod to Europe’s R&D centers, which are working on sustainable solar technologies like those mentioned in Cabriss, including kerfless wafers and high efficiency solar cells using tandem structures.

Responding to fears that sustainability could mean more expense, the report’s authors say reducing and reusing materials, combined with higher efficiencies, and longer module lifetimes means end products should not be more expensive.

Strengthening this argument, the authors point to significant decreases in Capex costs and the replacement of traditional Al-BSF cells by PERC cells in industrial production. “The already significant cost reduction and the prospect of even further reducing the cost in PV production leads to the conclusion that local production can bring cost advantages. This is a new development.”

Bold

The year is 2050. Solar PV has reached terawatt-scale, with legislation on air pollution and waste. Caps on carbon have been filed away, digital dust stacked high upon their long-forgotten folders. Breaking news flashes detailing toxic spills and unjust labor conditions are inconceivable to today’s generation. Landfills have been eradicated; just as in nature, the concept of waste does not exist.

Every particle entering and leaving factories is beneficial to businesses, their employees and the environment, all of which are thriving. Everything fits into a continual technological or biological loop – maximum value extracted to the benefit of all societal and environmental stakeholders. This is a bold vision, yet with cooperation and innovation, it is achievable. The groundwork is now already being laid.

| Circusol’s suggested actions to overcome barriers | |

| Short term | Asset management data platform to record production, installation, and usage data of PV modules and batteries to allow for easy repair, reuse, refurbishment and recycling. |

| Code of practice to determine residual performance of second-life batteries. | |

| Labeling to provide a benchmark for secondhand products and materials. | |

| A coordinated R&D program to improve energy efficiency and circularity, including end-of-life recovery. | |

| Public procurement to initiate a service-based market by placing a required performance level on energy efficiency and circularity. | |

| Targeting financial and business incentives towards middle class end users to lease, rent or share solar power systems, rather than buying them. Most circular opportunities are said to be in the product use phase, meaning collaboration with customers is crucial. | |

| Revising the EU Waste Directive to take the circular economy into account. | |

| Investing in new collection centers and recycling points. | |

| Developing circular design directives to reduce the number of components. | |

| Long term | Establishing a zero fossil fuel policy. |

| Establishing integrated companies. | |

| Digitally monitoring new and second life solar power systems, from production to remanufacturing/reuse/recycling. | |

| Enforcing a circular economy policy on an EU level. | |

| Redesigning and manufacturing solar and storage products and solutions for circularity. According to the European Commission, more than 80% of a product’s environmental impact is determined at the design stage. | |

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.