Commands often come in three stages: On your mark, get set, go; ready, aim, fire; and lights, camera, action. These are well-worn three-step rituals, designed to give competitors and performers appropriate time to prepare.

Trace the growth of the energy storage market the past few years and one might conclude that the industry has been stuck on that middle step for far too long. Storage has most definitely ‘gotten set’ with its technological advances; has ‘taken aim’ at widening portions of the energy market that are crying out for flexible and affordable power; and knows that the cameras are primed to capture the next Elon Musk press conference, head-turning acquisition, or dazzling product upgrade.

But turning this posturing into tangible action has proven more cumbersome than many – particularly impatient observers in the solar world – would have liked. Each year brings new trade show expansions where storage is no longer marketed as an add-on or a support act, but it often seems that way.

And yet 2017 feels different. At Intersolar Europe in Munich this year, the buzz emanating from the storage hall was deafening. The deluge of drinks and dancing that sprung forth from the booth parties of sonnen, Senec, Mercedes-Benz et al. was a sticky sight to behold. Trade shows can be accurate bellwethers of industry trends, and this year it felt like storage had finally raced out of the blocks.

A rather more sober assessment of storage growth comes via analysts IHS Markit, which expects the global energy storage market to reach 5 GW this year, rising to more than 52 GW by 2025 – up from an initial low base of 0.34 GW installed in 2012 and 2013. Underpinning this growth is the usual cocktail of suspects: Tumbling prices, reduced solar subsidies, and a growing public and government desire to embrace cleaner energies are all playing their part. Storage, it seems, really has found the accelerator pedal this year – which is an apt metaphor for an industry that owes a debt of gratitude to the automobile sector.

EVs and M&As

A Bloomberg New Energy Finance (BNEF) report published this summer readily admits that its growth projections for Electric Vehicle (EV) uptake published in 2016 are already way off the mark. Its latest report suggests that EVs will account for 54% of new car sales by 2040 (up from 35%), aided hugely by governments in the U.K., Norway, France, and the Netherlands (to name just a few).

BNEF also expects that EVs will offer lower lifetime costs and be cheaper to buy than internal combustion engine (ICE) cars in most countries by 2025-29. EV momentum can be traced to a number of sources. Most obviously, climate-based pressure to decarbonize road transport is having a huge push effect, but the sector is also being pulled by technological improvements and innovations that are shaping consumer preference.

AT A GLANCE

- By attracting large household names to the sector, energy storage can reap the benefits of improved brand perception.

- This will likely increase uptake, and as more storage is deployed, more investment in R&D will result.

- The role of electric vehicles will prove pivotal in catalyzing this uptake. Firms as large as Mercedes and Tesla can afford to even be loss-making in some storage markets and regions – their longer-term objectives are more important.

- The coupling of storage with solar will accelerate, creating a virtuous circle where more solar leads to more storage, which leads to lower costs all round.

- Prices for lithium-ion – the dominant technology – will tumble and could cross the $100/kWh threshold in just a few years.

In late July, Tesla unveiled its new Model 3 EV at a price point of $44,000 – less than half the launch cost of its Model S 100D, the only other Tesla vehicle able to match the Model 3’s 310 mile (499 km) range. Much cheaper, with better performance, the new Tesla EV is not only a marketable example of where the wider storage industry is headed, but also an example of what long-term, deep-pocket investment can do for the sector.

“For many larger players entering the industry, energy storage is seen as a strategic investment with significant long-term growth potential because storage will become a pivotal ingredient in our future energy mix,” Julian Jansen, Senior Market Analyst, Solar and Energy Storage at IHS Markit told pv magazine. “This is especially true for energy suppliers and utilities that see their traditional business model under threat. Energy storage development is part of a new strategy tying together a decentralized, digitalized, and flexible demand and generation infrastructure required for the future.”

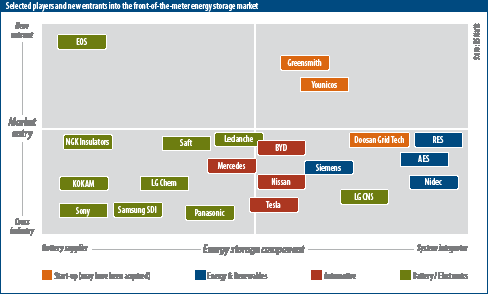

Those ‘larger players’ Jansen refers to could mean Finnish power giant Wärtsilä, which in May acquired U.S. storage integrators Greensmith; it could also refer to U.K. firm Aggreko snapping up German-U.S. storage specialist Younicos for GBP 40 million ($53 million); or Germany’s Innogy acquiring Belectric; or even French multinational utility Engie taking a major stake in Green Charge Networks.

“Aggreko’s purchase of Younicos was the seventh major acquisition of a large storage company since the end of 2015,” Logan Goldie-Scot, a storage analyst at BNEF, told pv magazine. “We have also seen utilities such as Enel and Engie expanding their interest in energy storage, snapping up relatively small companies and integrating them into their wider utility strategy.” Their motives, Goldie-Scot adds, are often rooted in gaining greater understanding of optimizing power networks and management of systems, and their impact is likely to be one of accelerated cost decline.

“Pretty much every major utility is heavily looking at storage to the extent where many are acquiring storage firms,” said Younicos CCO Jayesh Goyal. “This is happening because fundamentally we are seeing a real shift in the way that energy is delivered – moving towards a much more decentralized and digital model where the focus is increasingly on how to gather customer data, and how to use those data to dynamically decide when to modify load, for example.”

Absorbing costs

Tesla has enjoyed – indeed, created – an unrivalled surge to the center of the public’s consciousness regarding battery storage. Since the launch of its first Powerwall home battery in 2015 to the announcement this summer that the company will build the largest battery project in the world in Australia, the firm has adopted a brand-led approach that instills confidence first, and invites questions later.

Now, however, Elon Musk may find the view from the top obscured by that most recognizable of brands – the Mercedes-Benz logo.

The German car giant has rolled confidently into storage in the past few months, unveiling in May its new home battery and announcing a partnership with number two U.S. solar installer Vivint Solar. It has done so under the leadership of Boris von Bormann, the former sonnen CEO Inc. who remarked: “As Mercedes-Benz electrifies its vehicle fleet, solar-plus-storage is essential to enable those vehicles to be powered by clean energy.”

In one sentence, solar, storage, and Mercedes-Benz converge – a rather attractive triumvirate that is likely to turn the heads of previously reluctant homeowners, some experts say.

“Persuading consumers to invest a few thousand dollars into a stationary storage system can indeed be done with brand perception,” mused BNEF’s Goldie-Scot. “For residential storage to become more commonplace, the industry will need more household names like Mercedes-Benz and Tesla, and that may end up creating a positive effect and supporting smaller companies that don’t have that.”

The maneuverings of companies as large as Mercedes-Benz and Tesla within this space are anticipated to accelerate cost reduction of battery technology, bringing down the price of lithium-ion to more attractive levels. “Some of the costs for storage at the lower end of the industry look achievable when manufacturing at scale, and as manufacturing capacity comes online we see lots of room for profit in the industry,” said Goldie-Scot. “For Tesla, Mercedes-Benz, or some of the large stationary players such as AES, they are all able to achieve significant cost reductions compared to smaller players because of economies of scale and the relationships they have with manufacturers.” Tesla, for example, works with Panasonic at its Gigafactory in the U.S., while China’s BYD – which makes EVs, batteries, and solar modules – has a longstanding partnership with Samsung SDI.

“With Mercedes-Benz and Tesla, but also in various ways such as second-life battery players like BMW and Nissan entering the storage market, these large companies give investors and customers certainty as they can guarantee that they will still be there to satisfy warranties and help make projects bankable,” said IHS Markit’s Jansen. “In the C&I and grid-scale segments no customer would forego a proper cost analysis because of a big name, but they will be more likely to trust that these companies will be able to deliver the project to specification and on time, while satisfying warranty and O&M claims.”

In the smaller residential market, it would appear that Tesla has few advantages over pure-play battery makers such as sonnen or LG Chem, although larger corporations are inherently more able to take risks on uncertain revenue streams in large utility-scale energy storage projects.

Speculate to accumulate

Another compelling argument in favor of the benefits huge companies can bring to storage lies in their ability to drive down technology costs, even if it could mean short-term industry consolidation. A recent study by the University of California and TU Munich in Germany has revealed that long-term R&D spending in storage is playing a crucial role in reducing costs. The study found that battery storage prices are now falling more quickly than solar PV and wind technologies – largely because the presence of bigger players in the sector naturally leads to increased R&D expenditure, which creates a virtuous circle of lower costs and wider deployment.

The study’s lead author, Noah Kittner of the University of California, told pv magazine that they have witnessed “dramatic cost reductions” in storage as companies try to become more efficient by investing on a larger scale. “Storage is wide open,” he said. “Due to the diversity of emerging battery chemistries and services that different storage technologies can provide, there will be new competitors for different niche categories. “For EVs, Mercedes-Benz and Tesla may be the early players, but there will likely be new innovative vehicles utilizing different types of lithium-ion batteries. Vehicles are key to the introduction of widespread storage, and they would enable new entrants to make grid-scale applications more affordable. Mercedes-Benz and Tesla are investing because they want to get ahead of the curve, and other companies will likely jump in as well.”

Published in Nature Energy, the UC/TU study posits a scenario whereby the cost of a lithium-ion battery could fall to just $100/kWh by 2019, down from the current average of around $450/kWh. “R&D investments in storage are lagging behind where they should be for deep decarbonization and low-cost storage,” Kittner said. “Breaking $100/kWh for lithium-ion storage is technically feasible within the next year or two depending on the levels of investment.”

The researcher pointed out that a two-pronged approach of greater R&D and deployment would serve as an accelerant to cost reduction. “Deployment alone may be costly, so Telsa and other large companies may well be subsidizing their own efforts to corner the market for the future. And they will likely succeed as costs within the past year alone have fallen dramatically. Tesla also has capital and realizes that they will benefit from the early adoption experience as they can also forecast where the prices are headed, which is profitable when combined with low-cost solar PV and wind. They are all mutually reinforcing efforts,” Kittner added.

BNEF’s Goldie-Scot agrees. “Increasing R&D will result in improvements not just in terms of battery costs but also manufacturing costs, energy density, and broader performance.” He added that it is hard to look beyond lithium-ion at this moment because it is the most dynamic and addressable technology on the market.

Impact on solar

As growing amounts of capital are generated from increased storage deployment, and that capital is steered back into the vast R&D departments of leading battery companies, global deployment of lithium-ion batteries in the EV sector alone could reach 1.3 terawatt hours (TWh) by 2030, up from 21 GWh in 2016, finds a recent BNEF EV Outlook report.

This expansion will not happen in isolation, however. “Sector coupling between automotive and energy will be a necessity as EV markets will grow and have a significant impact on the power system, as well as enabling new business models that can include stationary storage as well,” said Jansen.

The convergence of solar and storage is already well advanced in the U.S. residential space, where each of the three leading installers have recently cozied up with a battery partner: Vivint Solar with Mercedes, Sunrun with LG Chem, and of course SolarCity with Tesla. “The way solar is sold and installed is very different in the U.S. to Europe, for example,” said Jansen. “On a smaller level the same trends are happening in Europe, it is just that there, small PV and electrical installation companies are looking to sell storage alongside residential solar.” A recent example of large brands moving into residential storage in Europe was seen in early August following the announcement that IKEA will begin selling home batteries – either as part of a solar+storage package or a standalone solution – via a partnership with British solar developer Solarcentury.

Whichever way these relationships take root, they are going to be mutually beneficial for both industries. Analysis by Deutsche Bank’s solar expert Vishal Shah has forecast that current solar growth rates could be doubled if there is an – as expected – rapid uptake in EVs. Solar demand is currently on course to grow by 10% a year out to 2022, reaching 140 GW annually by that point, Shah says.

This figure has the potential to reach 250 GW per year 2022 if EV adoption rates continue and storage reaches cost parity with solar, the analyst calculates. Global peak electricity demand is expected to rise by between 2% and 3.5% as EVs become more commonplace – and it is solar that is going to meet at least half of that incremental peak power capacity, believes Shah.

In this case, solar costs will tumble by a further 20% between now and 2022, aided by a further 20% cost reduction achieved with improvements in BOS. “At these price points,” Shah said, “solar would be cheaper than coal in more markets globally representing 5,000 GW of available market potential. Both utility-scale and distributed solar has the potential to represent over 50% of new global capacity additions over the next five years, representing $1 trillion in cumulative investment opportunity.”

The clean energy industry will always have Paris. But what is really pushing the decarbonization drive of society is cost. Consumers used to need incentives to adopt solar; these incentives were effective in boosting deployment and leading to lower costs.

Now it is the turn of storage – and the early signs are that there are already enough economic drivers in place or in the works to support wide, sustained and enthusiastic uptake

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.