Two startups are attempting to solve what has been a sticky challenge facing the solar industry: how to bring copper metallization into the mainstream of PV production as a replacement for costly and increasingly scarce silver. At the same time, the companies hope to tackle a major challenge as the industry scales towards the terawatt level.

PV2+ and SunDrive are the tiny outfits taking on the challenge and with innovative technology and an agile approach, they may play David to the Goliath-like problem of the solar industry’s unsustainable silver consumption. “People in the scientific community have realized for a very long time that silver is unsustainable,” commented SunDrive co-founder Vince Allen, at the time of announcing an impressive 26.41% efficiency result, achieved using its copper plating metallization technology on an M6, silicon heterojunction (HJT) cell.

However, both PV2+ and SunDrive will not only need to make technical progress to make their ambitions for copper in PV production a reality, sufficient funding is also required to bring their technology to scale and overcome market preconceptions regarding the suitability of copper metallization within the PV community.

Both startups have attracted substantial support from the public purse. Freiburg-based PV2+, which completed its spinoff from Fraunhofer ISE in mid-2022, is funded by the German Federal Ministry for Economic Affairs and Climate Action (BMWK). Sydney-based SunDrive has received the backing of Australia’s scientific commercialization body CSIRO, and the Clean Energy Finance Corporation.

SunDrive began its commercialization journey ahead of PV2+ and along with the public bodies, attracted support from private investors. They include tech-savvy former Australian prime minister Malcolm Turnbull, alongside climate activist investor and software billionaire Mike Cannon-Brookes, among others, in an AUD 21 million ($14.2 million) Series A round announced on Oct. 13.

Silver conundrum

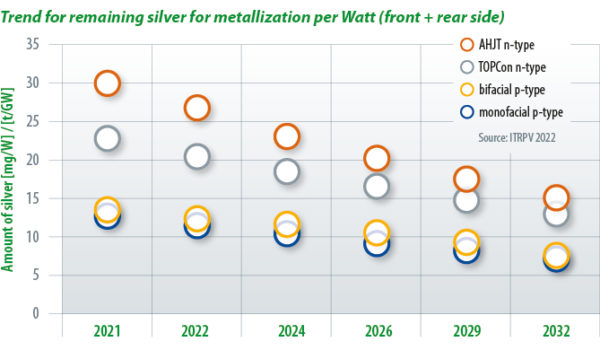

Replacing or significantly reducing silver usage in PV production is based on cost, sustainability, and outright necessity. Silver is regularly more than 100 times more expensive than copper, and considerably scarcer. While the PV industry today consumes around 15% of mined silver, that figure is expected to increase sharply as more silver-intensive high-efficiency technologies move into the mainstream. Demand for silver from the mobility sector and technologies such as 5G is expected to put further pressure on supply.

But the problem is not new. As far back as 2013, at the EUPVSEC scientific conference in Paris, veteran researcher Pierre Verlinden, the former chief scientist at Trina Solar and 2019 Becquerel Prize winner, warned that current levels of silver consumption by the solar industry would become unsustainable. He describes the challenge of material consumption in silver, indium, and bismuth, as “keeping me up at night” while solar manufacturing rapidly expands to the terawatt scale.

Expanding on the work of Verlinden and others, Brett Hallam, Associate Professor in UNSW’s School of Photovoltaic and Renewable Energy (SPREE), published a paper in 2021 highlighting that scaling up to the required terawatt-scale production of current and proposed solar technologies will rapidly exhaust global reserves of the three key minerals. Some suggest that Hallam’s work is the most comprehensive in addressing material scarcity in the PV industry to date.

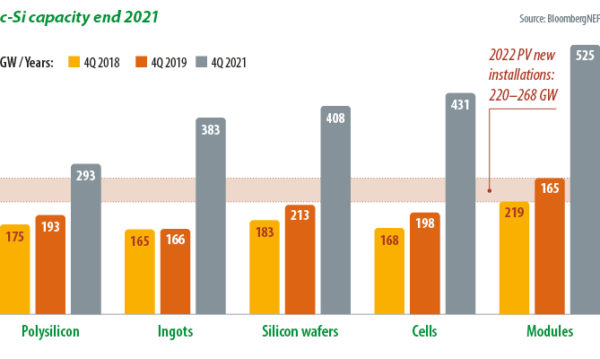

Hallam concludes that sustainability should be front of mind before pursuing research into new silver-heavy PV technologies – namely HJT and tunnel oxide passivated contact (TOPCon). Accepted figures are that the mainstream manufacturing of silicon HJT consumes 34 mg/W of silver, TOPCon 25 mg/W, and best-in-class PERC 15 mg/W. But it’s not just that supplies of these vital metals will run short, but that as the elements become more scarce and various industries compete for access to them, their price will increase.

Speaking at a Nov. 8 pv magazine webinar, Verlinden set out the worrying silver consumption numbers that would result from terawatt-scale PV manufacturing at current rates of consumption, noting, “At 1 TW production level, PERC technology would use 53% of the current global production of silver, TOPCon 88%, and HJT would use more than 100%.”

Verlinden explains that PERC uses silver only on the front side of the cell and aluminum on the rear, with some silver on the bonding paths, TOPCon aluminum-silver contacts on the front with pure silver on the back, and with silicon HJT, silver is used on both sides. “And future tandem cells, like perovskite on silicon, also use silver contact on the front and the back.”

The metallization of solar cells with silver pastes may bring with it relatively high material costs but it is a stable, reliable, and relatively simple process. Screen printing, through which a silver paste is applied to the solar cell surface by forcing it through a screen using a squeegee, has proven effectiveness. Paste and equipment suppliers have also made great strides in reducing line thickness and silver consumption over the past decade.

Once the paste is applied, it is first dried and then fired, in a process called sintering, with temperatures reaching between 700 C to 800 C. Technologies such as HJT require lower temperature processes, not exceeding 250 C to ensure the integrity of the amorphous-silicon layer. The necessary low temperature pastes have an approximately 10% higher cost, through higher silver content and aspect ratio.

Enter copper

SunDrive co-founder Vince Allen first developed copper plating technology in his PhD work at UNSW in 2014, partnering with David Hu, a former banker. The story has been documented by the Australian Renewable Energy Agency (ARENA). Allen worked under the tutelage of UNSW solar luminaries and pioneering researchers including the late Stuart Wenham, who was one-time solar giant Suntech’s CTO, and Alison Lennon – who now serves as SunDrive’s chief scientist.

The technology became incorporated in a literal garage spinoff in the Sydney beachside suburb of Maroubra. Worldwide protection of SunDrive’s intellectual property (IP) was secured via patents in partnership with UNSW’s technology transfer vehicle, New South Innovations.

The SunDrive team are currently stepping back from public engagement, after a flurry of interest on the back of their recent funding and efficiency milestones. The small team is instead requiring “all hands on deck” to execute on its technology roadmap, the company says. However, details of its production processes for its potentially cheaper and higher-efficiency copper metallization can be gleaned from its patent, granted on Jan. 7, 2015.

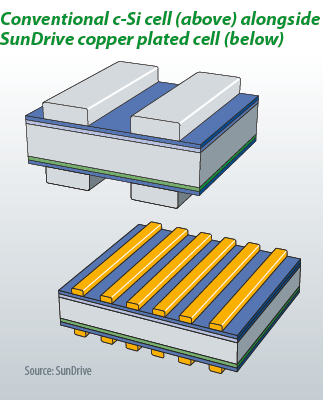

While a screen is used in silver paste screen printing, a masking process is required in copper plating to prevent the cell surfaces from being entirely electroplated by the copper. SunDrive appears to deposit a polymer material by a spray or rotating application process to the surface of the PV cell. It then uses a laser process in such a way that the polymer is or can be removed and the surface of the cell prepared in the pattern for the metallic fingers, or grid lines, where copper metallization will take place. A combination of thermal processes, plasma etching, and chemical baths are included in the SunDrive patent for the copper plating and subsequent removal of the polymer.

While a screen is used in silver paste screen printing, a masking process is required in copper plating to prevent the cell surfaces from being entirely electroplated by the copper. SunDrive appears to deposit a polymer material by a spray or rotating application process to the surface of the PV cell. It then uses a laser process in such a way that the polymer is or can be removed and the surface of the cell prepared in the pattern for the metallic fingers, or grid lines, where copper metallization will take place. A combination of thermal processes, plasma etching, and chemical baths are included in the SunDrive patent for the copper plating and subsequent removal of the polymer.

Speaking to pv magazine, PV2+ joint-CTO Thibaud Hatt reports that his company prepares the cell surface for plating by depositing both a seed and mask layer through physical vapor deposition (PVD) processes, utilizing equipment provided by German tool makers Von Ardenne, or Singulus. Hatt reveals that the company is currently pursuing a laser process for the subsequent patterning step, which is then followed by the copper plating. Metallized lines with a width of just 19 microns can be achieved though the approach.

PV2+ claims that by using a nanometer-thin aluminum mask, the metal can be etched off after the copper plating and recycled – an apparent advantage over the use of polymer masks. “We were able to adapt the process parameters and develop a special type of electrolyte which ensures that the aluminum’s extremely thin, native oxide layer can reliably fulfill its insulating function. This was an important milestone for the success of our research project,” said CEO Markus Glatthaar in a Fraunhofer ISE publication, announcing the PV2+ spinoff on Sept. 1.

That PVD can be used for the deposition of the aluminum mask alongside the transparent conductive oxide (TCO) layer, commonly needed in HJT cell production, is an additional advantage, claims Hatt. A longer PVD tool could be used for both processes without breaking vacuum. “The PVD tool is the same tool for the TCO layer, which is quite nice.”

Cautionary tales

While the progress being made by both SunDrive and PV2+ is encouraging, it is far from a foregone conclusion that copper plating will accelerate into the fast lane of high efficiency PV production. Copper metallization is not new, with buried contact, plated PV cells having been developed at UNSW. Attempts were made to commercialize variations of the technology by BP Solar with its Saturn technology, and Suntech with Pluto.

Both technologies embraced planetary branding and involved a selective emitter process based on phosphorous spray and laser doping. Alongside material cost reductions when compared to screen printing with silver, thinner fingers and less shading of the cell surface delivers higher efficiency – a performance advantage common to copper plating solar cell metallization.

“We used to use a laser to blast through an oxide on a wafer that had been defused, so it went through the diffusion and then we did a second diffusion using that oxide as a mask, and then the oxide got used as a plating mask – so you plated the copper in the groove,” explains UNSW Scientia Professor Martin Green. “So, it was keyed in very strongly by the groove. That meant that there weren’t any issues with the delamination of the plated contact.”

Yet, at the same time as this approach was being commercialized, interest in copper plating waned. Silver paste suppliers were very effective in reducing silver consumption, effectively diminishing some of copper’s value proposition.

German production equipment supplier Schmid reports that it delivered around 1.2 GW of copper plating equipment to PV manufacturers between 2005 and 2009. Christian Buchner, the long-standing head of the PV business unit at the Schmid Group notes on the back of advancements achieved by silver paste and screen printing equipment suppliers, copper plating was left out in the cold. “The process was not sexy any more,” says Buchner, “and the cost of ownership became too expensive in terms of chemistry and waste.”

Copper plating itself is mature and commonplace in the semiconductor industry for printed circuit board production. However, modern consumer products such as computers and smartphones have a useful lifetime of three to five years. PV modules must survive 25-plus years – in the sun, rain, hail, and snow. “Fears of early cell degradation are dominant, I suppose,” says Buchner.

Silver consumption by technology at current consumption levels

| Silver (mg/cell) 166 mm | Efficiency (%) | Percentage of global silver supply for 1 TW | |

| PERC | 96 | 22.8 | 15.4 |

| TOPCon | 163 | 23.2 | 25.6 |

| HJT | 21.8 | 23.5 | 117 |

Suntech to SunDrive

The copper-plating universe is small and interconnected. Take prominent UNSW alumni and Suntech founder Zhengrong Shi, who played an important role in attracting early-stage investment and PV manufacturing interest for Australia’s SunDrive. “Shi was perhaps the best person to provide the first external investment in SunDrive,” notes ARENA in a 2020 publication. “Not only did he understand the solar industry and market opportunity, but he was also acutely aware of the technical challenges that SunDrive’s technology was addressing.”

Both Shi and then Suntech CTO Stuart Wenham had first-hand experience in the challenges facing copper plating at Suntech, through the mottled history of the company’s Pluto technology. Suntech, the world’s largest PV producer in 2010 and 2011, experienced difficulties in scaling the production of modules utilizing copper plating. Suntech commenced sales of its Pluto modules in 2009, which deployed copper grid contacts with a width of 30 microns.

In 2009, Suntech targeted 50 MW of Pluto production, increasing that ambition to between 150 MW to 180 MW in 2010. However, in June 2010 it noted that problems arising during ramp resulted in it maintaining a 4 MW a month output, or 48 MW a year. In October of that year, Wenham told pv magazine that monthly output stood at 6 MW, or slightly less than 100 MW a year. “The alternative approach, which we have implemented in production at the moment, is a Pluto technology that has all these fine metal lines very closely spaced to each other to make the cell interconnect,” said Wenham at the time. “It’s a good way of doing it, provided you do the interconnect in the right sort of way.”

In its fourth-quarter and full-year 2011 financial results, Suntech reported that it achieved 120 MW of Pluto shipments and was targeting 800 MW sales of the technology in 2012. However, the operation and exact technical failings of the Pluto lines are difficult to ascertain. After this time, as its public statements regarding the technology ceased, and as quarterly losses mounted, the company descended into bankruptcy.

Despite Suntech achieving a verified world record cell efficiency with the technology of 20.3% in March 2012, the pursuit of copper metallization was not a success. Subsequent research into production processes similar to those deployed in the Pluto technology point to poor contact adhesion – although if Suntech had not collapsed, Wenham and Suntech production engineers may well have overcome the challenge. Likely, the tale has become a cautionary one for PV manufacturers.

“I first heard from one of the original Pluto team that there had been extensive failures due to adhesion,” says George Touloupas, the senior director of technology at quality assurance provider Clean Energy Associates (CEA). “It was an R&D effort and quality issue, that could have probably been resolved in the long run, but Suntech had other, much bigger headaches at the time.”

Issues relating to inadequate contact adhesion were investigated in research published by Fraunhofer ISE and, over time, countered by Wenham and others at UNSW. The competition between PV2+ and SunDrive, spinoffs from solar research centers, appear to be a case of history repeating – although with newer variations on the copper plating technology. It may have been a case of earlier copper plating technologies like Pluto having been ahead of their time. And with silver consumption the subject of more intense focus, perhaps copper’s time has come.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.