The MIBEL electricity market for Spain and Portugal was the highest in Europe this week, with an average value of €56.17/MWh between Monday and yesterday – an increase of 9.7% on the first four days of last week. Since the beginning of the week, every day the Iberian market daily average price was the highest in Europe, a situation that also occurred on May 19.

According to the analysis carried out by AleaSoft, the main cause of the rise in prices was a drop in Iberian wind energy production Monday to Wednesday of 65% compared with average values last week. This week, solar energy production in Spain – which includes photovoltaic and solar thermal plants – dropped by 2.8% compared to the average of last week. That, together with the fact there are two nuclear plants stopped for refuelling – Ascó II and Trillo – favored production with combined cycles and coal in Spain, that increased 29% and 87%, respectively, on a comparison between the average of the first three days of the week and the same period of last week.

Another interesting aspect of the MIBEL market, caused by the drop in wind energy production, was that since Tuesday the price valley has disappeared. Between Tuesday and Thursday the daily price range – the difference between the maximum and minimum daily prices – decreased by 62% compared to the same days of last week.

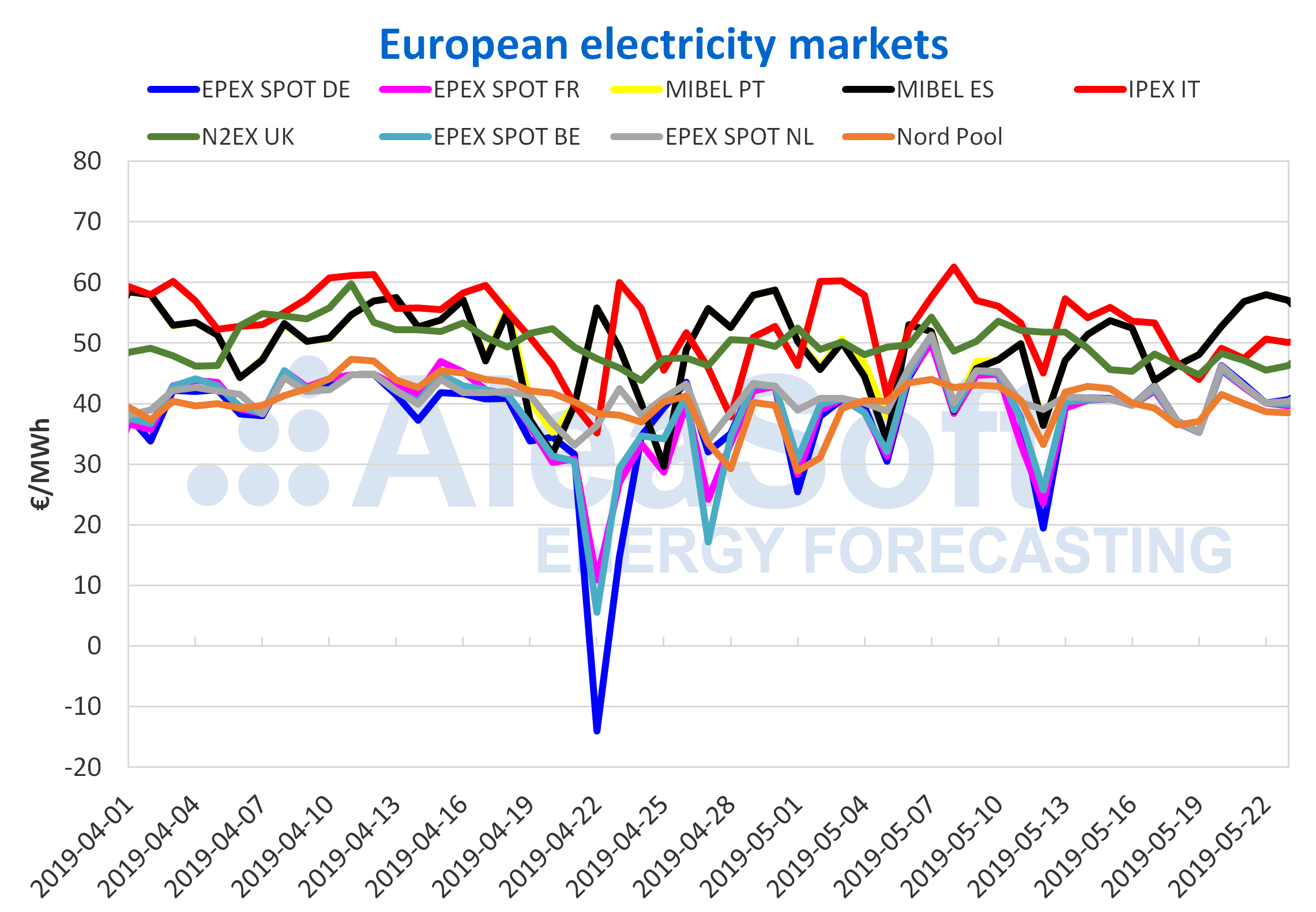

European electricity markets

In most of the analysed European electricity markets, prices have risen so far this week, compared with the first four days of last week, although the increases – of 4-6% for the EPEX SPOT markets of Germany, France, Belgium and the Netherlands – were not as high as those seen on MIBEL. In the case of the N2EX market of the U.K., the Nord Pool market of the Nordic countries and the IPEX market of Italy, prices fell 2.5%, 5.2% and 11%, respectively.

The MIBEL market saw daily average values of €50-60 €/MWh. The IPEX market had prices of around €50/MWh and the N2EX market had values of €45-50.

The Nord Pool had prices of around €40/MWh. The EPEX SPOT markets of Germany, France, Belgium and the Netherlands started the week a little above €45/MWh but in the last two days analysed returned to around €40.

Sources: Prepared by AleaSoft using data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

Brent, fuels and CO2

The Brent oil futures price for July in the ICE market remained on Monday and Tuesday around $72/bbl and settled on Wednesday at $70.99, decreasing almost $1/bbl with respect to the previous day and positioning itself as the lowest value in a week. That decrease came after a report by the U.S. Energy Information Administration which revealed an increase in crude inventories in the United States last week. Another factor pressing downward was the trade dispute between the U.S. and China. On the other hand, the market continues to be pressured by strong geopolitical tensions, together with cuts in the production in OPEC countries which Saudi Arabia wants to maintain in the second half of the year.

Futures of TTF gas for June in the ICE market continued their downward trend since April 9 and settled on Wednesday at €12.65/MWh.

API 2 coal futures for June in the ICE market continued settling at historic lows, positioning on Monday and Wednesday below $58/t.

The prices of CO2 emission rights futures in the EEX market for the reference contract of December 2019 continued to fluctuate between €24.70/t and €27.54, settling on Wednesday at €26.37. Prices are in this band from April 11, after it was confirmed Brexit had been postponed until October.

Electricity futures

Spain’s electricity futures on the OMIP and EEX markets – as well as those of Portugal in the OMIP – for the third quarter, fell this week from €54/MWh, maintaining the downward trend experienced since May 10. The electricity futures of Spain settled on Wednesday at around €53.40/MWh.

The France and Germany futures in the EEX market for the next quarter settled on Wednesday at €42.43/MWh and €41.70, respectively, representing an increase of close to €1/MWh on Tuesday, after falling on Monday and Tuesday compared to last week. Similarly, the futures for next year of those two countries during the first two days of the week had a decreasing trend but in the session on Wednesday they rose, above €52/MWh in the case of France and €48 for Germany.

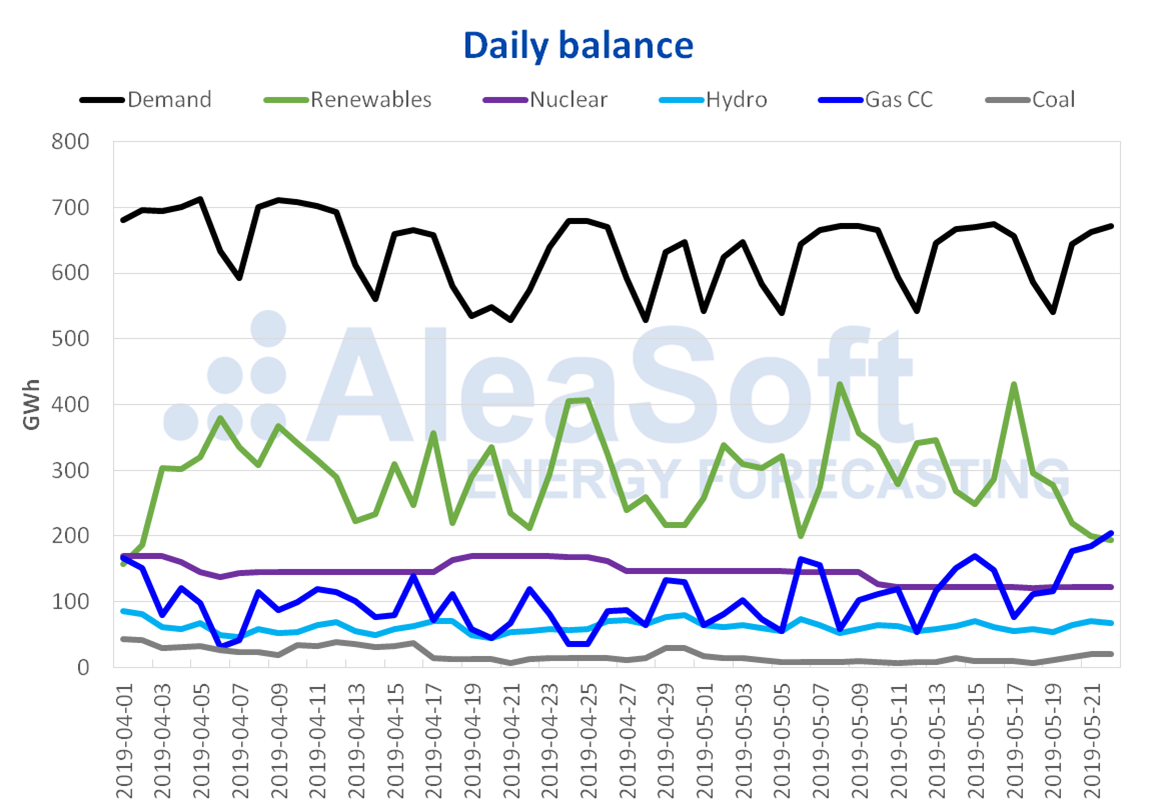

Mainland Spain, wind and photovoltaic energy production

Electricity demand in mainland Spain in the first three days of the week was similar to that of the same days last week, with a slight decrease of 0.2%. Next week demand is expected to have values similar to this week, albeit with a slight increase.

From Monday to Wednesday, wind energy production in Spain fell back just as it had in the previous week. This time it had a decrease of 65% compared to the average values of last week. However, it is expected to be significantly restored by next week.

So far this week, the solar energy production of Spain decreased 2.8% on the daily average values of the previous week. According to AleaSoft analysis, production is expected to slightly recover next week until reaching levels similar to those of last week.

Nuclear energy production maintained values similar to those of last week, due to the fact there were no changes in the state of operation of the Spanish plants. The Ascó II and Trillo nuclear power plants continued a planned shutdown for refueling. The expected date for resumption of operations is May 31 for Ascó II and June 9 for Trillo.

From Monday to Wednesday, hydroelectric energy production surpassed by 6.3% the average values of the same days a week earlier.

Sources: Prepared by AleaSoft using data from REE.

The growing behavior of the hydroelectric reserves that began in the second week of April was maintained this week, with an increase of 92 GWh compared to the previous week. Current capacity is 12,424 GWh, representing 53% of total capacity and 80% of what was available a year ago, according to the latest Hydrological Bulletin from the Ministry for the Ecological Transition.