Vietnam is no doubt one of the hottest renewable energy market in this world. One year ago, an incentive-driven commission rush of 5GW solar projects has put Vietnam on the stage of the world's most active market.

The reason why commission rush happened is because Vietnam's energy demand keeps a steady annual growth rate around 8.5% and it will exceed supply in 2021 by 6.6TWh and 15TWh in 2023, which indicates that a serious and frequently blackout would be happening there if no any effective measures are going to be taken. For that reason, the Vietnamese government decided to promote renewable energy power as one of its scenarios to address the challenge through a series of attractive incentives. However, its weak grid condition doesn’t allow such a large amount of RE project which connected to the grid in a very short period of time to fully generate power. Currently, there are around 60% of utility-scale and subsided projects suffering power curtailment. While with the latest decision 13 released, all attention has been moved from utility-scale projects to the rooftop solar market.

In yesterday’s webinar, The Future Landscape of The Vietnam Rooftop Solar Market, organized by PVBOX, supported by Vector Energy Advisory and sponsored by Goodwe, Nguyen Hai Duc, renewable energy advisor of USAID V-leep, pointed out some most important updates among the decision in his presentation.

Firstly, the decision updated the definition for the rooftop solar (RTS) as a solar power system with photovoltaic panels installed on the roofs of civil works or industrial works and has a capacity of less than or equal to 1MWp and directly or indirectly connected to the electricity purchaser with the line of 35kV or less. Secondly and also the most dramatic change is that the off-taker and generator now can be an organization and an individual person, which means that power transaction now allows no EVN the local power authority interfere, and be more specific, private PPA is legitimate now.

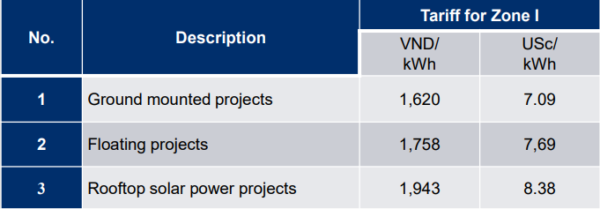

In addition, the decision also canceled the zone-based FIT policy in which FIT is varied from zone to zone. Replaced it, one unified tariff, also known as FIT2, is implementing where the FIT is only varied from ground-mounted project with USc 7.09/kWh, floating project with USc 7.69/kWh and USc 8.38/kWh.

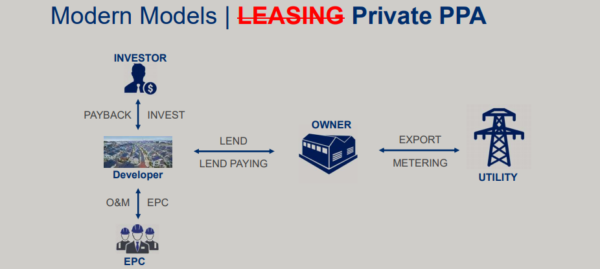

In addition, Duc also explains another two most popular rooftop solar development models in Vietnam except the conventional model that rooftop owner builds system on their own rooftop. One of which is the Roof Leasing Model by which the roof owner leases the roof to RTS developer and receives monthly payment and the RTS investor is to invest, install and do O&M for the system and sell all generated electricity to EVN. Another one of which is the private PPA model. Under this model, the RTS investor is to invest, install and do O&M for the system and sell all or part of generated power to the roof owner, and the remaining power, if there do have, will be sold to EVN through a standardized PPA.

After almost 9 months of endeavor from both EVN, MOIT, and also players in the Vietnamese RE industry, 27,845 systems with 573MW installed capacity have been added. Of these, 56% of the capacity is contributed by industry roof, followed by a residential roof(28%), commercial roof(11%), and administrative roof(5%). And top installed capacity by cities in follow is HCMC (84MWp), Ninh Thuan(58MWp), Dak Lak(43MWp), Binh Duong(41MWp), Dong Nai(34MWp), Khanh Hoa(30MWp), Long An(28MWp), Dak Nong(28MWp).

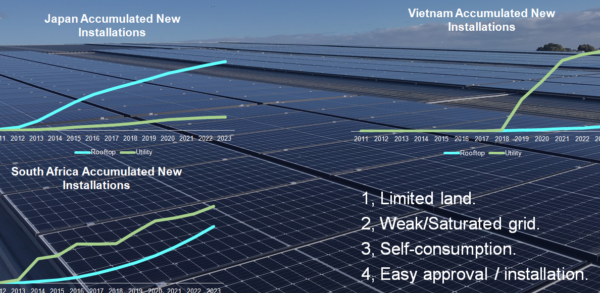

Mr.Rong Shen, vice president of sales and service at Goodwe, also shared his positive attitude towards the Vietnamese RTS market by analyzing the benefits for developing RTS from power supply and demand, FIT2, and market comparison.

Milan Koev, CEO and funder of Hexagon Peak, said that it’s difficult to complete a project and put it into operation during the timeline included in the FIT2, and now COVID-19 worsens it. With the manufacturing hub gradually transferring from China to South Asia, there are an increasing amount of foreign investors entering Vietnam, which is a very positive sign for the DPPA model RTS development.

Gavin Adda, CEO for Total Solar Distributed Generation Asia, introduced Total’s view and strategy for RTS development. The behemoth adopts a model called solar saving model, Gavin explained, the model is different from the roof leasing model which pays owner lease fee monthly, etc. Under the solar saving model, Total provides the customer or the owner with a specific scheme including system size, foreseeing interests and so on, if the customer agrees with the scheme, Total will install the system on its roof and sell part or all generated electricity to the customer with a substantial discount price (>5% to grid tariff) through a 20 year private PPA. It will be lucrative from customer respect, especially industrial users, Gavin pointed out that the average electricity prices keep around 4.9% annual growth rate from 2006 to 2018, and it will grow faster in the future. When the contract expired, Total will leave the system with the customer instead of giving it to EVN, which is the key difference compared to the leasing roof model. Normally, a system life is 35 years. Taking a 2MW around the solar system for an example, Gavin explained that it will help customer saving totally around USD3.2 mln during the contract (20 years), and saving around 14 mln cumulatively during the system life(35 years).

Recording please refer : https://www.youtube.com/watch?v=k3WNx_b6H60&t=4269s

About PVBOX & EnergyBox

PVBOX & Energy Box is a vertical media company dedicated to the renewable energy. Enrooted in China, we are one of the TOP3 most influential media in our domestic market.

To enhance the business cooperation across the land and inland and to promote green energy, PV BOX EVENTS are held around the world span Europe, South Africa, and South Asia. Up to date, we have 12 events in record across the world.

Besides, we provide professional and customized promotion plan for our clients, and help them achieve their goal by our networking such as publications, online platform, international conference and forum, etc.