Chinese module prices rise 10% above forecast, causing problems for India

Growth in the booming Indian solar market, heavily reliant on Chinese modules, could slow as strong Q3 demand for panels in China and the U.S. push up prices and impact Indian firms’ financial modelling.

Uncertainty in 2018

As revealed in testimony against proposed trade action yesterday, the U.S. International Trade Commission’s Section 201 investigation is already having effects.

U.S. legislators pressure ITC to reject trade petition

A bipartisan group of congressmen cite the possibility of devastating job losses as a reason to reject the Suniva/SolarWorld Section 201 trade case, one day before the commission hears testimony.

Shunfeng issues H1 profit warning

The Chinese clean energy giant is expecting losses over the first half of this year to amount to around $49 million following a difficult 2016 and further squeezing of the firm’s activities in 2017.

SolarWorld Americas receives $6m cash lifeline

The U.S. arm of the troubled solar power company can expect to receive a $6 million infusion of cash from its lenders, which have also permitted the sale of non-operational assets.

Report: Global corporate funding of solar reached $4.6 billion in first half of 2017

Despite a robust first quarter, Mercom CEO Raj Prabhu says the uncertainty surrounding the Suniva trade case caused a dip in the second quarter and could have devastating effects going forward.

Suniva demands GTM Research retract ‘inaccurate report’

The company says the central assumption of the report – a $1.18 per watt floor price – is wrong and that the headlines resulting from the report could harm its trade case.

US solar industry could contract 60% if Suniva case succeeds: report

GTM Research’s latest report predicts a 50% to 60% overall reduction to solar installations if trade action is taken, with the utility-scale sector taking the most significant hit.

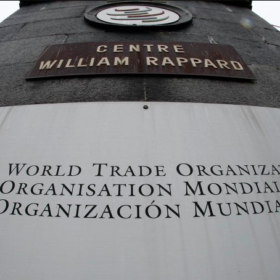

United States informs WTO of trade petition investigation (ITC notification embedded)

The U.S. International Trade Commission has informed the WTO that it is moving forward with its investigation into whether Suniva and SolarWorld deserve “global safeguard” protection from their competitors.

SolarWorld Americas joins Suniva’s trade petition

After originally being cool to Suniva’s petition to the U.S. International Trade Commission for protection from its Chinese competitors, SolarWorld Americas has reversed its stance and joined the complaint as a co-petitioner.