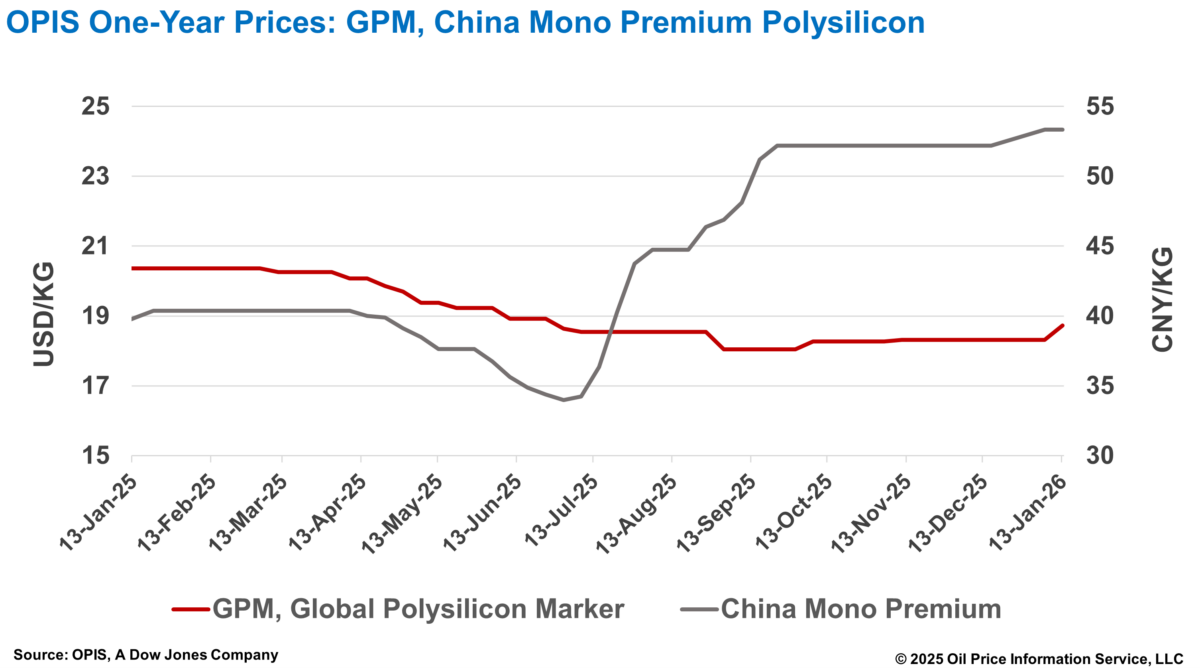

The Global Polysilicon Marker (GPM)—the OPIS benchmark for polysilicon produced outside China—was assessed at $18.728/kg, or $0.039/W, marking a 2.23% week-on-week increase, according to the OPIS Global Solar Markets Report released on January 13.

The current global polysilicon trade landscape remains characterized by a mix of long-term contracts at relatively stable prices and spot transactions exhibiting wide price dispersion. This week’s increase in assessed prices was driven primarily by a limited number of high-priced spot deals. Market participants said some buyers are willing to pay premiums for global polysilicon with secure and compliant supply chains to mitigate potential risks arising from the US Section 232 investigation and Foreign Entity of Concern (FEOC) regulations. Sources added that prices for such material are expected to rise further through 2026 as the scope and enforcement of Section 232 and FEOC rules become clearer.

Join us on Jan. 28 for pv magazine Webinar+ | The Solar Module Market Playbook: Managing pricing, risks, and other procurement challenges. We combine real-time market data, case studies, and an interactive Q&A to help EPCs, developers, investors, and distributors secure high-quality PV modules at competitive prices, thereby safeguarding project bankability. As 2026 progresses, the release of Section 232 investigation findings is approaching. Industry participants generally anticipate an announcement by the end of the first quarter, though some expect it as early as late January. Another source noted the investigation’s outcome may be affected by the Supreme Court ruling on the legality of tariffs imposed by the Trump administration under the International Emergency Economic Powers Act (IEEPA). Although a ruling was initially anticipated on January 9, the decision has been postponed. Separately, a new polysilicon manufacturing project in the Middle East has been confirmed by sources familiar with the matter to begin production in early February. The project adds further uncertainty to global polysilicon supply and pricing. Industry insiders noted that its eventual trade flows and downstream application markets will be key factors shaping global supply-demand dynamics and trade patterns in the polysilicon market.

The China Mono Premium—OPIS' assessment for mono-grade polysilicon used in n-type ingot production—was unchanged week-on-week at CNY 53.333 ($7.66)/kg or CNY 0.112/W. At a symposium convened by the State Administration for Market Regulation (SAMR), PV manufacturers and industry associations were urged to halt coordinated “anti-disorderly competition” and self-regulation measures involving production, sales, and pricing, citing antitrust risks. The China Photovoltaic Industry Association (CPIA) and relevant companies were instructed to review existing practices and submit corrective action plans to SAMR by Jan. 20. Industry sources said SAMR’s actions could directly lead to the suspension of the polysilicon consolidation plan. The operating entity established last month by leading polysilicon producers to acquire and permanently retire inefficient capacity—intended to help restore supply-demand balance—may be rendered ineffective. All seven entities summoned by SAMR, including the CPIA and six polysilicon producers, are shareholders of this platform, reinforcing expectations that the plan will no longer play an active role. Following the symposium, sources told OPIS that no polysilicon transactions have been observed, as the market adopted a wait-and-see stance ahead of the Jan. 20 submission deadline. Most market participants expect the recent rise in polysilicon prices to lose momentum under policy reset. However, industry sources emphasized that SAMR’s action is not aimed at dismantling industry self-discipline, but at ensuring that capacity, production, and pricing controls operate within a transparent and legally compliant framework. Sources broadly agree that a sharp price collapse is unlikely, as it would trigger severe negative spillovers across the value chain, and China’s Price Law already prohibits below-cost sales. Absent structural resolution of overcapacity, polysilicon prices are therefore expected to hover near breakeven, with averages potentially stabilizing around CNY 50/kg in the near term.

More cautious participants noted that recent transactions at up to CNY 56/kg were largely sentiment-driven, supported by anti-disorderly competition measures and consolidation expectations. Once these factors fade, and with over 500,000 MT of inventory likely carried into 2026, prices could retreat to the low CNY 30s/kg range. Overall, the policy shift is expected to increase short-term price volatility, with leading producers most exposed. Without clearer policy signals or effective capacity-clearing mechanisms, uncertainty around the sector’s 2026 earnings outlook is likely to rise. OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report. The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine. This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.