Year-to-year solar variability peaks in Europe, Australia, Argentina, and China

In a new weekly update for pv magazine, Solcast, a DNV company, reports that the regions with the highest year-to-year variability in irradiance include Central and Northern Europe, East Coast Australia, Northern Argentina, and China, with Africa exhibiting the most stable irradiance year-on-year.

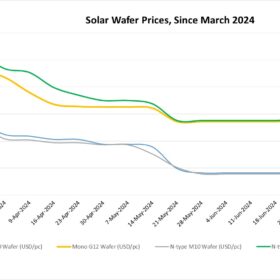

Wafer prices near bottom, size evolution and capacity globalization continue

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

How long do residential solar inverters last?

Multiple factors affect the productive lifespan of a residential solar inverter. In Part 2 of our series, we look at solar inverters.

Sinovoltaics shuffles PV module manufacturer financial stability ranking

The third edition of the Sinovoltaics financial stability report ranking lists India-based Abhishek Corp, Insolartion Energy, Waaree Renewable Technologies, and Solex Energy, all based in India, followed by U.S.-based First Solar as the top five. Six additional manufacturers entered the global ranking.

China’s solar dominance not an issue

In a new monthly column for pv magazine, the International Solar Energy Society (ISES) explains why potential trade disruptions in the global PV supply chain are substantially different from those related to coal, oil and gas.

The Hydrogen Stream: New way to make hydrogen, fertilizer from ammonia

German researchers have developed a new way to liberate hydrogen from ammonia, while a new MIT study shows the need for stringent emissions regulations on ammonia combustion for maritime mobility.

How long do residential solar panels last?

Multiple factors affect the productive lifespan of a residential solar panel. In the first part of this series, we look at the solar panels themselves.

WTO accuses China of low transparency on state subsidies, including solar

The World Trade Organization (WTO) Secretariat has criticized China for an alleged lack of transparency in its state support framework and has urged the nation to improve its subsidy notification process.

DAH Solar’s Full-Screen technology demonstrates 11% energy gain for solar PV modules

As frameless PV modules are gradually becoming a mainstream trend in the industry, DAH Solar’s R&D Director, Dr. Jiang Chengyin, says the company’s design for its 3.0 Full-Screen product version further improves energy yield while lowering costs and reducing the likelihood of fractures.

Weak demand continues to exert downward pressure on solar module prices

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.