Thai commercial solar gets a $50m uplift

Bangkok-based solar developer Constant Energy has secured a THB1.5 billion loan from TMB Bank to finance its commercial and industrial operations.

Solar among the options as Moldova gets €5m credit line

The loan will be supplied by the EBRD and includes €1.25 million of concessional lending provided by the global Green Climate Fund.

World Bank lends $200m for South African renewables

The private sector arm of the multilateral development bank has offered a $200 million credit line to Nedbank, the first commercial bank in South Africa to offer a green bond, which it did on the Johannesburg Stock Exchange in 2019.

GCL concern over senior notes due January 30

Investors sitting on three-year notes worth $500 million have been asked to postpone settlement for another three years and to sign away their rights to oppose the debt restructure plan which would be needed if the company defaults on the commitment, triggering a cross default.

Bangladeshi apparel makers opt for rooftop solar

More than 500 factories have registered to make their manufacturing facilities more eco friendly in the garment exporting powerhouse and the nation’s net metering rules offer an obvious step in the right direction.

Consultant plays down Chinese solar fever

The nation is set to have added 40 GW of solar in 2020 and that figure will rise again this year, to 45-50 GW, according to one of the year’s first industry predictions.

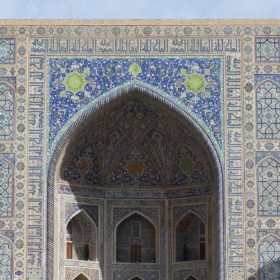

Uzbekistan announces second phase of 500 MW solar tender

Uzbekistan’s Ministry of Energy has revealed plans to launch a new solar tender in early 2021. Separately, the Asian Development Bank signed a deal last week to provide up to $175 million in loans to back the development of another 100 MW solar project in the country.

Sonnedix closes €160m of financing in Italy

Sonnedix has secured €160 million of non-recourse financing for solar PV projects in Italy.

PV trends of 2020: Part 2

Despite much of the world being on lockdown for a big chunk of 2020, there are few who could say it has been an uneventful year. And while the ongoing Covid-19 pandemic will be what defines 2020 for many, in the solar industry there’s plenty more to shout about, from the rapid rollout of high-powered modules to a drastic increase in carbon-neutral pledges from companies and governments around the world. Across five installments, pv magazine takes a look back at the year in solar. First up were the U.S. election and carbon neutral pledges. Today, we’re talking about auctions and green bonds.

The weekend read: New EU financing mechanism set to boost PV investments

A new EU framework designed to incentivize cross-border renewables financing could help accelerate the roll-out of solar PV projects across Europe. However, investors are awaiting more clarity about how the system will work in practice.