GCL shareholders to vote on further 670 MW of project sales

Shareholders will vote on whether to approve the sale of ten solar farms to generate $320 million towards paying down its heavy debt pile.

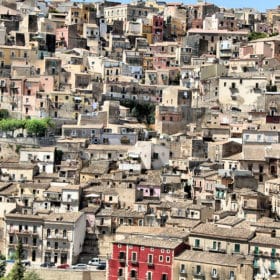

Axpo Italy chief says country is catching up with European private-PPA peers

Two PV farms planned in Sicily by Canadian Solar, with a total 12 MWp generation capacity, will sell the electricity they produce to Axpo Italia under a ten-year PPA at a fixed rate which the Chinese-Canadian company did not reveal.

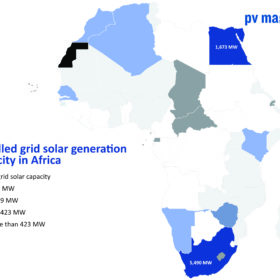

Solar dried up in North Africa during 2020

Politicians across the continent will have to decide between their heavily-indebted state utilities or embracing the energy transition, according to one energy analyst.

GCL reveals it lost 865 million shares in New Energy business over loan disagreement

The Chinese polysilicon manufacturer said it only discovered this month that the stock in its solar project division – which it had pledged to secure a $60 million loan which GCL says was never delivered – had been claimed by the lender a year ago, on the grounds the finance agreement had been breached.

GCL auditor resigns over silicon project pre-payment probe

Deloitte has walked away from the polysilicon manufacturer, despite the latter having followed the accountant’s recommendation to appoint a third party to investigate why a near-$80 million payment was made in September 2019. Apparently the parties could not agree the detail of the investigation to be carried out.

Canadian Solar invests in British ‘merchant battery’ AI company

Oxford-based Habitat Energy uses machine learning algorithms, artificial intelligence (AI) and its own trading platform and software to maximize profits from utility scale storage facilities. A Canadian Solar statement about the arrangement, issued today, contained no financial details about the co-operation.

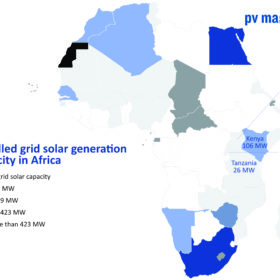

West African commercial solar installer looks east

Nigeria and Ghana-based Starsight Energy has spent an undisclosed amount to acquire a half stake in the Kenyan subsidiary of East African peer Premier Solar Group.

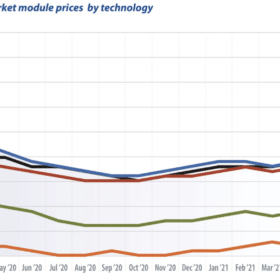

EU spot market module prices: Is sustainable market development possible?

Module manufacturers have once again adjusted their prices upwards. This is already the third or fourth price increase in the last six months, and there is no end in sight, writes Martin Schachinger of pvXchange. But why is it so hard to achieve long-term, sustainable development in the global solar market, at least on the part of manufacturers? Few other industries are so turbulent, with constant swings between excess supply and bottlenecks, between price collapses and price rises – and always to the breaking point of the market. Yet again, planning security is out the window.

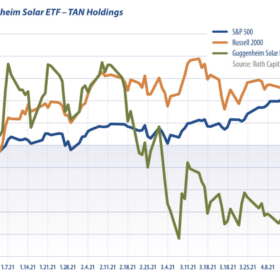

Guggenheim Solar Index: PV stocks slip on short supply

Supply shortages and price increases slowed solar stocks in April, writes Jesse Pichel of ROTH Capital Partners. In the United States, however, new policies promise to foster growth in the second half of the year.

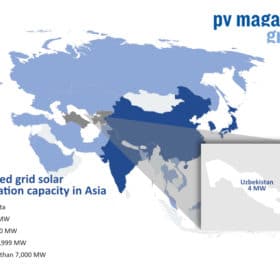

EU finances 100 MW solar plant in Uzbekistan

French energy company Total is developing the solar field near Samarkand, which will sell power to National Electric Networks of Uzbekistan under a 25-year power purchase agreement.