Terawatt scale by 2022

The solar sector is no stranger to breaking records. Perhaps the most impressive figure to emerge from SolarPower Europe’s new ‘Global Market Outlook’ is that the global solar sector will reach terawatt scale by 2022 – just four years after the 500 GW milestone was reached. Michael Schmela from SolarPower Europe sets out the reasoning behind this and other key findings in the report.

As countries reopen, market recovery begins

As the Covid-19 pandemic gradually eases, countries around the world have slowly begun to relax lockdown measures. Some countries have also launched varying types of economic stimulus to support the solar sector. In contrast to others, the Chinese market is stable, as the country has had some success in controlling the virus.

Universal energy access just got harder

This year marks a uniquely critical juncture on the road to universal access to affordable, reliable, sustainable, and modern energy. The massive disruption caused by Covid-19 complicates the outlook to 2030, which is the target date for reaching UN Sustainable Development Goal (SDG) 7, writes Rohit Khanna, manager of the World Bank’s Energy Sector Management Assistance Program.

Emerging markets and innovation: Twin pillars of the solar tracker market

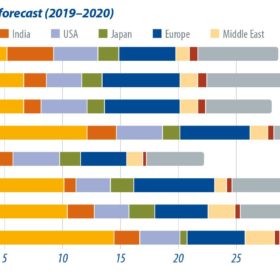

Global solar tracker shipments reached new record levels in 2019, exceeding 31 GW, up 55% year on year. Exceptional demand in the United States – as well as multiple gigawatt markets in Brazil, Mexico, Chile, Spain and Australia – helped propel the market to new heights, writes Cormac Gilligan, associate director at IHS Markit.

Green electricity tariffs, 1 GW solar tender ‘light at the end of the tunnel’ for Turkish PV

The new 1 GW Yeka tender in Turkey is more than welcome, says KRC Consulting’s Hakki Karacaoglan and Life Enerji’s Ramazan Aslan. Regulations to enable “green electricity” tariffs, also announced this month, add further momentum to the country’s solar sector – allowing Turkish consumers choose renewable energy for their power supply.

Beware of zombies: PV thriving after chaos

In times of crisis, a population usually divides itself into two opinion groups. On the one hand, there are those who believe the storm will pass and things will return to business as usual. And on the other, there are those who took the time to embrace the new reality, accepted it, and now swear that the old world has disappeared and won’t ever come back. In general, writes Becquerel Institute’s Gaëtan Masson, reality splits between the two and makes everyone wrong. And this is what might be about to happen in the solar PV sector.

Module prices plunge as Covid-19 hammers demand

Some European countries and emerging markets are now showing signs of slow recovery, as the Covid-19 pandemic brought overseas markets to a shuddering halt in late March. However, demand is expected to remain weak through the beginning of the third quarter, writes PV InfoLink’s Amy Fang, as it will take time for overseas markets to snap back. Meanwhile, the Chinese market is again busy with the June 30 installation rush, as the government has left tariff timelines unchanged up to the middle of May.

Does corona pave the way for a real Green Deal revolution?

Germany will assume the Presidency of the Council of the European Union on July 1 and will be responsible for progressing EU legislation over the next six months.

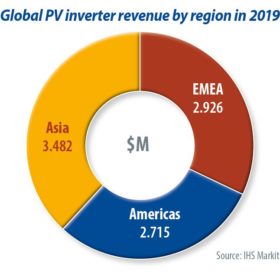

Record shipments push global solar PV inverter market past $9 billion in 2019

The PV inverter market achieved record shipments in 2019, writes IHS Markit’s Miguel de Jesus, driven by booming shipments in key markets such as the United States, Spain, Latin America, Ukraine and Vietnam. Revenue rose rapidly, surpassing the $9 billion mark in 2019 for the first time.

Climate-neutral EU before 2050

The European Commission has positioned the Green Deal at the center of its policy priorities. The goals have been set: climate-neutrality, zero greenhouse gas emissions, and the complete decarbonization of the energy sector by 2050. The stakes are high, writes SolarPower Europe CEO Walburga Hemetsberger, but thus far Commission President Ursula von der Leyen has made good on her promises.