pv magazine regularly produces features and special editions in collaboration with our trusted industry partners. On this page, you can download low-resolution PDFs of our Huawei specials, to be read online and on the go, at your convenience.

2022

This year Huawei's special edition looks at technical challenges to a power system mostly run by inverter-interfaced power sources. This editions leading topic: Smart PV and Storage – Anytime for Anyone, is achieved by a high degree of digitization, a new business division within the Huawei corporation and strong network of partners. View and download the edition here.

This year Huawei's special edition looks at technical challenges to a power system mostly run by inverter-interfaced power sources. This editions leading topic: Smart PV and Storage – Anytime for Anyone, is achieved by a high degree of digitization, a new business division within the Huawei corporation and strong network of partners. View and download the edition here.

2021

For the sixth time, pv magazine and Huawei partnered to produce a 2021 Special Edition. The focus this time is on powering a zero carbon future and power digitalization for a smart, green society.

For the sixth time, pv magazine and Huawei partnered to produce a 2021 Special Edition. The focus this time is on powering a zero carbon future and power digitalization for a smart, green society.

View and read the entire 2021 publication online.

2020

pv magazine has partnered with Huawei for the fifth consecutive year with our 2020 Special Edition. This year’s publication highlights the PV industry’s movement into the Era of Artificial Intelligence, which is quickly advancing through information and communication technologies (ICT).

pv magazine has partnered with Huawei for the fifth consecutive year with our 2020 Special Edition. This year’s publication highlights the PV industry’s movement into the Era of Artificial Intelligence, which is quickly advancing through information and communication technologies (ICT).

View and read below the entire 2020 publication online or download the PDF.

2019

Another year, and another Huawei special edition, ready for Intersolar Europe. View and download the entire 2019 pv magazine Huawei special here.

2018

Once again, we teamed up with Huawei to bring you a 44-page special edition, just in time for Intersolar Europe. View and download the 2018 pv magazine Huawei Special.

2017

This pv magazine special, developed in partnership with Huawei, made its debut at the Intersolar Europe exhibition on May 31. View and download the entire 40-page special edition.

Articles produced in partnership with Huawei for the pv magazine special publications

The evolution of solar intelligence

Artificial intelligence (AI) is already transforming a range of industries, from the automation of trading decisions in the financial sector to the deployment of smart robots in factories. In one 2017 study, PwC estimated that AI could contribute up to $15.7 trillion to the global economy by 2030. Solar has jumped on the AI bandwagon.

In the PV industry, AI is now being used to help push solar toward grid parity in markets throughout the world. The International Renewable Energy Agency (IRENA) asserts that such technologies are already playing a “transformative” role in pushing the global energy transition forward, even while acknowledging that some people may already view terms such as AI, big data, the Internet of things (IoT), cloud computing, and blockchain as hackneyed buzzwords.

However, these terms are part of the growing digitalization of electricity generation, distribution, and consumption. And in the world’s biggest solar market, China – where the authorities recently outlined a series of policies to expedite the development of subsidy-free solar projects – these technologies are rapidly driving further reductions in PV plant costs.

However, these terms are part of the growing digitalization of electricity generation, distribution, and consumption. And in the world’s biggest solar market, China – where the authorities recently outlined a series of policies to expedite the development of subsidy-free solar projects – these technologies are rapidly driving further reductions in PV plant costs.

Powerful potential

The potential of AI in energy has been known for years, and digitalization of the transmission sector is at an advanced stage, the International Renewable Energy Agency says in its report, Innovation Landscape for a Renewable-Powered Future.

Although sensors have been installed in solar arrays from almost day one, the digitalization of generation and consumption is still at a relatively early stage. The next step, IRENA argues, will be to modernize power plants and further automate control of the grid.

The role of AI in power systems is rapidly becoming a “necessity,” IRENA asserts, as it can help to more effectively integrate variable renewables into the grid by predicting generation and consumption patterns.

“Reductions in uncertainty in power production forecasts and power demand forecasts enable smarter operations,” agrees Elizabeth Traiger, senior researcher at energy consultancy DNV GL. “Unexpected curtailment can be reduced, and planned maintenance can be scheduled at optimal times.”

Investors in new solar projects can use sensor data to provide an accurate picture of the generation possibilities at proposed sites, opening up financing potential. Solar arrays provide enormous amounts of data that are already being used in meteorology applications.

“AI and machine learning algorithms are being proven in forecasting to improve the accuracy of short-term forecasts, up to 48 hours ahead,” explains Traiger. “By combining the wealth of meteorological ground station data, satellite weather data, and local cloud cover imagery, the irradiance, or available solar resource, can be more accurately estimated. The resulting reduction in uncertainty in solar power production helps to ensure a balanced and reliable electrical grid. Variability can be anticipated and alternate dispatch or adjustments to generation can be made more smoothly.”

Scratching the surface

Solar manufacturers are also starting to deploy AI in their factories to streamline production. JinkoSolar, for example, recently revealed plans to use AI at its 400 MW module factory in Florida, starting with electroluminescence inspections. However, the industry is still just scratching the surface of AI’s potential to push solar closer toward grid parity.

Image: Huawei

“The integration of AI will enhance the ability of solar to integrate in the dynamic energy mix,” says Traiger. “AI enables accurate, informed decisions in all data- heavy areas. For solar, this encompasses the entire value chain: feasibility, development, operations, and decommissioning. Making smart decisions ensures the best outcomes by adding reliability and reducing the variability inherent in renewable resources such as solar.”

That said, the solar industry still has a long way to go in more effectively exploiting data, she adds.

“AI and machine learning is based on data. As we gather more data, from historical sources, past weather and production patterns, different spatial resolutions of new satellites, as well as new data from increased ground sensor installations, the tools will evolve,” Traiger says.

Smarter storage

As the global cost of solar continues to fall, developers increasingly struggle to reduce risks and improve returns on distributed generation PV projects. The ongoing decline in the cost of energy storage provides a ray of hope, but in order to truly leverage the power of storage, project operators need to utilize AI to provide new sources of value. These value streams include lower demand charges and the provision of higher revenue from virtual power plants (VPPs).

California-based storage specialist Stem, for example, announced plans in late 2017 to install AI-backed storage solutions in Japan, a global hotbed for VPP deployment. Other recent AI-backed storage pilots noted by IRENA include French utility RTE’s Ringo Project, which aims to ease grid congestion without the need for new power lines, by using AI to facilitate dispatch.

The future potential of AI-driven solar+storage is huge, with IHS Markit recently predicting that more than 500 MWh of storage capacity will be paired with utility-scale PV projects this year in North America alone, in what the research firm describes as “the first meaningful volumes” to be deployed.

Image: Huawei

Intelligent inverters

IHS Markit expects an uptick in the use of AI in the solar sector this year, and it sees inverters as playing a “critical role” in this shift. It also expects 11 million PV inverters to be connected to the Internet of energy this year and characterizes the digitalization of the grid as a “mega-trend.”

PV system maintenance, in particular, is becoming more predictive thanks to the growing use of monitoring software, which helps system owners and O&M service providers identify problems before disrupting a solar array’s output. Sensors in inverters facilitate predictive maintenance, and many companies have taken notice of AI’s potential. Huawei, for example, has been exploring smart PV solutions for the past five years, as part of its efforts to accelerate grid parity with AI. Its inverters serve as smart sensors, providing the feedstock needed to continuously improve its AI algorithms, which are used to optimize O&M practices.

Huawei’s AI-driven FusionSolar 1500V Smart PV Solution also boasts a number of features aimed at supporting the push toward grid parity. Intelligent trackers and bifacial modules are backed by AI algorithms, while its Smart I-V Curve Diagnosis and AI recognition technologies facilitate automated O&M of PV projects.

Many companies have long used automated drones for inspections to identify defects in advance. But inverters show promise to provide faster, better intelligence.

“Algorithms that can give early warning of faults such as inverter failures, or indicate any deviations from normal operating behavior will be instrumental in maintaining even higher levels of reliability for long-term reliance on consistent solar production,” says Traiger.

Tip of the iceberg

But even with solar O&M, there is still a great deal of untapped potential. Data from sensors can help prospective investors with due diligence, while also contributing to certification of equipment, for example.

“AI can, and will, definitely change and improve solar O&M in many ways and we are only now seeing the tip of the iceberg of the applications that will be commonplace,” says Jaime Sureda, Director of Digital Transformation for Spanish O&M specialist Solarig. “Price reductions coming from the use of AI in the sector will definitely foster the use of solar energy all around the world.”

Solarig has serviced roughly 4.5 GW of solar capacity around the world, and is now in the process of digitally overhauling its operations, with important ramifications for its customized O&M management platform. A key aspect of this shift is the optimization of data collection, integration, and management. It collates data from its monitoring software and uses it to continuously improve its predictive maintenance algorithms. It says such technologies are contributing to significant reductions in global O&M costs, and it says it is using AI to “squeeze” data it collects from a range of sources.

“We are also paying particular attention to the use of cutting-edge technologies in those areas with the highest impact on direct or indirect costs, such as labor- intensive activities,” Sureda explains, noting that the company has long used thermographic camera-equipped drones to spot defects in arrays.

While companies such as Solarig have long used sensors to assess the impact of weather conditions on contractual performance requirements, Sureda argues that the challenge ahead is to further integrate such information with weather forecast- ing models to predict the output of PV plants.

“AI applied to this analysis is crucial and will definitely help to improve plant operations in the near future by increasing the reliability of electricity generation models,” Sureda says.

The growth of distributed-generation PV and technological advancements in AI have fuelled the proliferation of smart devices and demand-management services in recent years, contributing to significant changes in the global power sector, IRENA says. But the organization believes that developers need to launch more pilot projects in the years ahead to fully grasp the potential of digital solutions.

“The disruptive potential is only beginning to be understood,” IRENA concludes. “It is far from being fully exploited.”

Grid parity's hackathon

In October 2018, Huawei released its AI strategy and a full-stack, all-scenario AI portfolio solution. The company’s full-stack capabilities are based on a cloud-pipe-device strategy which connects enterprise intelligence, equipment, and intelligent terminals integrated with AI. Huawei has not only incorporated AI into its internal production, logistics, and processes, but has also joined with partners to promote the development of intelligent solutions across industries.

In the energy sector, Huawei has been working with its industry partners to explore digital practices for smart PV since 2014. Collectively, the companies are promoting artificial intelligence and digital technologies such as cloud computing, big data, Internet of things (IoT), and edge computing to work in synergy for further reduction in PV plant costs across the industry.

The PV industry is embracing grid parity globally. Regions particularly rich in solar irradiation resource such as India, Spain, Latin America, and the Middle East, have ushered in the new era. By 2020, most parts of the world will be able to achieve full grid parity. Advancing the global energy transition is crucial to addressing climate change, and bringing LCOE down for grid parity will be the key element and driving force to a clean energy future across all markets. And Huawei is turning to AI to accelerate grid parity.

Image: Huawei

Taking the lead

In the intelligent era, innovation has become the core competency among leading enterprises. According to IHS Markit, Huawei has been ranked number one in global PV inverter shipments for four consecutive years. The company attributes its successes to customer-oriented innovations that simplify complex problems through fully digital technologies in its electronics, chips, computing, and artificial intelligence.

“Each inverter of Huawei is a smart sensor. The massive amount of data collected by increasing numbers of sensors optimizes more machine learning algorithms and effectively and continuously trains AI models, thereby enhancing the AI capability exponentially,” says Jeff Yan, Senior Product Manager at Huawei. “This helps Huawei optimize and manage power generation and O&M in a refined manner, which radically changes the traditional management mode and brings a revolutionary impact to the new energy industry.”

Huawei’s FusionSolar 1500V Smart PV Solution has five particular characteristics that support the drive toward global grid parity.

Bifacial PV modules+smart trackers+multiple MPPTs

Huawei abandons traditional astronomical algorithms and adopts intelligent trackers and bifacial PV modules with AI algorithms to maximize energy yields by integrating tracker control, power supply, and communication. According to Huawei, a test conducted on a large PV plant in northwestern China demonstrated an energy yield more than 20% higher when using a bifacial modules+smart trackers+multiple MPPT solution, in comparison with monofacial PV modules+fixed trackers+central inverters solution. AI auto-learning enables trackers and bifacial modules to be optimized using the tracking algorithm, which can provide an additional 0.5 to more than 1% in energy gains, according to Huawei.

Informatization of PV devices for building smarter plants

By combining digital components with AI algorithm controls, the solution enables the collection of high-precision digital information to improve energy yields. PV strings can be monitored with the precision of 0.5%. Big data and AI algorithms are oriented to component-level monitoring and refine management to locate old and faulty devices.

AI recognition+Intelligent O&M

Huawei has further upgraded its Smart I-V Curve Diagnosis. The Smart I-V Curve Diagnosis and AI recognition enable the smart diagnosis for multiple components in various scenarios. Currently, the technology has been applied to more than 3 GW of PV plants worldwide. The application of AI enables automated O&M of PV plants. According to Huawei, one-click scanning of its Smart I-V Curve Diagnosis 3.0 ensures the scanning of all strings in a 100 MW PV plant in just 15 minutes.

Another powerful technology used for O&M is its discreteness analysis. In the past, faults were cleared manually, which was time-consuming. Some faults might be ignored completely. “With discreteness analysis, a PV plant in the Shanxi province of China accurately had 283 faults located in half a day. After more than 20 days, the PV plant cleared almost all faults with the performance ratio (PR) improved by 2.52%,” says Yan, “Traditional PV plants, however, take about two months or more to clear faults before feeding power to the mains power grid.”

Grid-tied stability of PV plants based on AI algorithm control Huawei has established a precise mathematical model for different types of grid- tied scenarios and PV plant designs, and imported related data by testing the power grid waveforms of steel mills and electrified railways into the model. The mass of data is used to train the optimal grid-tied control algorithm.

By doing this, Huawei ensures stable grid-tied power generation of inverters even if they have poor power grid waveforms. “The power quality meets or even outperforms standard requirements,” adds Yan.

Health check reports

Image: Huawei

Huawei offers PV plant health check reports with customized indicators for controlling the operating status of PV plants in a one-click manner. By analyzing the environment, energy yield benchmarking, loss caused by power rationing, and power loss, Huawei uses big data and intelligent analysis methods to perform a one-click health check and generate comprehensive evaluation reports for PV plants with O&M suggestions.

Operations and maintenance managers can quickly find the causes of low energy yields and laggard PV strings, thereby liberating personnel from time-consuming inspection and data analysis, thus reducing labor costs. “The magic of this feature lies in the perfect combination of expertise and AI,” says Yan.

How do these five characteristics benefit customers? “Based on comprehensive analysis and calculation, the AI-aided Huawei 1500V FusionSolar Smart PV Solution can effectively reduce the initial investment by more than $0.05/W and reduce the levelized cost of energy (LCOE) by more than 7% in China,” says Yan. “This is key for speeding up grid parity.”

In 2019, Huawei will use the AI-aided 1500V FusionSolar Smart PV Solution to continuously reduce LCOE and accelerate the grid parity process.

Next generation inverters optimize bifacial boost

Inverter makers are under pressure to upgrade performance to accurately measure and manage the boost from bifacial solar panels. Inverter improvements including greater granularity of maximum power point tracking (MPPT), the marriage of artificial intelligence with more capable algorithms, and string overload safety are ushering in the next generation of inverters redesigned for bifacial systems, according to the development team at Huawei Technologies’ Smart PV Business.

The complexity of matching inverters to bifacial panels arises from the dynamic and uneven light capture levels on the rear side of the panel over time. Different sources of reflected light on reflective surfaces with different albedos, or reflected light values, permutate to make bifacial light capture management no less than a symphonic performance for inverters. Huawei Technologies’ FusionSolar Smart PV Solution has refined inverter technology to address these issues, while providing substantial increases in bifacial system yields in the process.

The moving target of the energy yield gain from the rear of the bifacial module varies depending on the scenario, but the energy yield can increase anywhere from 5% to 39%, according to Huawei research. Beyond that base gain, the bifacial module can further increase the energy yield by 2% to 6% based on its performance in response to low light and low power loss under the working temperature, the researchers point out. Thus, the combined “ energy yield gains of a bifacial module can range from 7% to 45% when compared to a conventional monofacial poly-Si module, a goal the industry is eagerly pursuing.

Inverter load flexibility critical

Designing inverters for bifacial modules that are capable of managing a large and varying yield gain is a first basic task. If inverters are not upsized to efficiently match and adapt to the dynamically enhanced DC output from bifacial pan- els, then they will suffer from clipping and yield loss. Balancing the need for capability versus size is a delicate design problem.

Industry research on bifacial systems currently focuses on ray-tracing and view-factor models, based on 3D modeling, to narrow down the best targets for design optimization. While more details can be displayed by algorithms, computing is complex and time-consuming, which does not mesh well with improved inverter performance.

Huawei has simplified and optimized the two models and launched an industry- leading intelligent design tool for bifacial module systems based on the 2D physical model, according to Shawn Gu, the Chief Scientist for Huawei's Smart PV Business. Huawei Smart Design is the online design platform for the company’s Smart PV solution.

Smart Design is used to assist in plant system design, including component selection and energy yield assessment. The tool can determine the balance point between calculation speed and design details, quickly and accurately calculating the optimal configuration of a bifacial module system.

Huawei’s 2D modeling method increases the overall energy yield from a bifacial PV system by more than 3% com- pared with solutions provided by other standard design methods, says Gu. This further compounds the bifacial boost.

Resolving overcurrent issues

Secure and reliable protection design is another key attribute of the next-gen bifacial inverter. “Every two strings of the Huawei FusionSolar Smart PV Solution string inverter form one MPPT circuit and have a fuseless security protection solution. The design ensures that no risk will occur at overcurrent condition,” says Gu. At the same time, security risks, frequent fuse replacement, and energy yield loss caused by fuse faults are avoided.

Inverter anticipation of a fault is another key capability for bifacial system design. Since frameless and glass-glass module designs suffer from a higher risk of cracking than modules with frames, the inspection of module fault is a top- most priority for O&M. “The complexity of the I-V curve of the bifacial module makes the intelligent diagnosis of string faults easy to misjudge,” notes Gu. Huawei’s latest Smart I-V Curve Diagnosis V3.0 uses a new, intelligent string diagnosis algorithm with a built-in database. This combination enables optimization of the input and output feature curves of various manufacturers’ PV modules, automatically filtering out the data “noise” that causes misjudgment.

MPPT granularity

Another necessary tool for bifacial inverters is more granular and dedicated MPPT units, industry experts broadly agree. “To prevent current mismatch within a string, there is a crucial need for dedicated strings supported by higher MPP granularity. Ideally this should take place at the individual string level,” says Shashwat Kumaria, Director of Engineering at Sunpreme.

The multiple sources of reflected light on the rear side of a bifacial panel, in wide variance during the day, necessitate far more detailed sensing by the inverter. With the mismatch of the bifacial module high, its I-V curve is more complex than that of a monofacial module, and its power-voltage curve will generate multiple peak values over time. This poses higher requirements on the detection precision and MPPT of inverters.

Thus, using more MPPT units per string was a beginning requirement for Huawei’s redesign of the optimal inverter for bifacial systems. “Our string inverter has multiple MPPT units, which can precisely track the maximum power point of every one or two PV strings, releasing the maximum output power of each PV module. This greatly reduces PV string mismatch caused by distance and shade between modules, along with other issues,” Gu says.

The degree of granularity improvement required will depend on the bifaciality factor of a given panel. “Since the overall output power of the [combined sides of the] PV module is different, the current discrete rate of the module is more than five percent. So, the MPPT granularity of inverters needs to be finer,” explains Gu. “Based on the Monte Carlo statistical method, the mismatch loss of a bifacial panel yield caused by inverters with one MPPT circuit per two strings is 1.1% lower than the loss caused by common inverters in a bifacial module system,” he adds. “In practice, the environment is not as ideal as expected in the simulation and therefore an even lower mismatch loss can be achieved by the multi-MPPT feature with two strings in one MPPT.”

Image: Huawei

AI algorithms crunch big data

Another key tool for advanced inverters serving bifacial systems is the use of AI and algorithms for analyzing the bifacial data that more granular inverters are read- ing. “Bifacial strings inherently result in more complex I-V curves so there is a definite need for more robust MPP tracking algorithms tailored to accurate MPP identification under steady-state and dynamic [partially cloudy] irradiance conditions,” Kumaria points out.

Huawei is prominent among the inverter suppliers pushing the algorithm envelope for bifacial applications, Gu asserts. “This year, our FusionSolar Smart PV Solution has further applied AI technology to PV plants. We have updated the traditional astronomical algorithm to achieve the integration of tracker control, power supply, and communication, thus maximizing energy yields.”

With bifacial projects, maintenance is a more complicated issue than for mono- facial systems, given the relative value of the boost components. “Big data analysis plus AI algorithms are oriented toward more refined component-level monitoring and management,” says Gu. “This can proactively identify a low-performance unit, in a revolutionary switch from passive maintenance to active, predictive maintenance.”

Avoiding infinite calculations is a major contribution of AI, which eliminates much of the cumbersome rote method of data analysis.

“From the aspect of hardware, faster scanning of voltage and power must be supported, but frequent scanning of MPP will cause power loss. After introducing AI that includes high-speed memory and a tailored algorithm, the system gains the ‘experience’ to deal with all cases without frequently scanning,” Gu explains.

Such a melding of AI and algorithms can provide a system boost all of its own, a situation where the whole has more value than the sum of the parts alone.

“An intelligent design tool for bifacial systems integrates full-scenario, adaptive, and self-learning intelligent control algorithms to accurately enable an optimal design solution,” Gu explains. “This increases the energy yield by more than three percent compared with solutions provided by other standard design methods.”

Connecting intelligent power

Information and communications technology giant Huawei is on a mission to build a fully connected world. Operating in more than 170 countries and regions to serve more than three billion people globally, the company is well on its way. In this exclusive interview, pv magazine meets with Tony Xu, President of the Smart PV Business unit at Huawei, to discuss the technological breakthroughs, trends, and policies that have the company driving solar PV into the era of digitalization.

Image: Huawei

One year ago, you told pv magazine that your vision for 2018 would be to bring digitalization to every person, family, and organization to build a fully connected, intelligent world. What progress has Huawei made to this end over the last year?

The vision of Huawei is to bring digital to every person, home, and organization for a fully connected, intelligent world. We set up and repeat this vision during past years and now by including our inverter sector, the entire Huawei company is heading towards this future. The vision includes three levels or stages. All things sensed, all things connected, and all things intelligent. First, we try to modify and make things sensible, which means data and information can be sensed and collected from the environment. Then we use connection means, including wired or wireless, especially 5G technology, to connect all of them into the network, and onto the cloud. In October 2018, Huawei announced the Full Stack All Scenario AI Solution, and we now provide the AI functions and solutions from bottom chip level to industrial level.

Our target with AI is to set up a platform on which our partners can provide specific and customized AI applications for end users. We just provide the basic infrastructure service for AI developers, just like the power grid: You use electricity, but you don’t need to know where and how the electricity is generated.

We follow the general Huawei company strategy for our Smart PV Business Unit. Our latest FusionSolar Smart PV Solution is pre-equipped with AI, cloud computing, and big data technologies. These features can help our customers to achieve higher yields with optimal LCOE, locate problems quicker, and achieve better performance. With Huawei’s FusionSolar platform, we already help customers to operate and maintain more than 30 GW of solar PV projects. And we will continue in our devotion to this sector.

Are there regulatory burdens to overcome in certain markets?

We know people are curious about this question of Huawei, especially under the current China-U.S. trade war, in which Huawei was named by the U.S. several times. Honestly speaking, we have not experienced such kind of obstacles in Europe when marketing our inverter products. We have very good relationships and cooperation with our European customers, and we will continue to serve them and follow our customer centric principle.

The inverter market segment is very dynamic. What are the big trends of the inverter landscape this year?

Because of the spread and popularity of bifacial modules, which we believe is an obvious market trend, it will be important in the future to better connect inverters with high-efficiency bifacial modules, tracker support structure, and multi-MPPT. I think this will influence the investment and the future of inverters greatly. If this is correct, the future prospect of large centralized inverters is dim.

We have worked and cooperated with several key partners including tracker support structure providers, module suppliers, and EPCs to observe the actual performance. Of course, we have identified some problems that need to be resolved. We believe there is still a process before this becomes mature, and we are working with our partners to push it.

For four years, Huawei has continuously ranked number one in inverter shipments. What is key to Huawei’s success?

First, it is because of the platform of Huawei Company. The platform attracted talented people, and talented people make the business successful. Second, it is because of the brand of Huawei. For a product that needs 25 years of service life, the manufacturer should survive that long to serve its customers. And the core factor is that we provide good products and solutions.

At Huawei, our smart employees have devoted themselves to this inverter product, bringing their experience and quality control expertise from ICT products with higher requirements. We have found that our customers, especially from Japan and Europe, are most concerned with stability, which is exactly what we are good at – based on the system of Huawei.

What will be the main themes for Huawei's marketing of inverters in 2019? And what does Huawei predict for the market in the future?

In 2019, our market focus is still on products and solutions for lowering LCOE. We face challenges from our competitors and the market. We are concerned with market trends, but no matter how markets change, we will focus on providing the lowest LCOE in the inverter sector for our customers. We believe this is the key factor that makes Huawei’s inverter irreplaceable.

We shipped over 90 GW of FusionSolar globally through December 2018. Our over- seas shipments recorded at 48% of total in 2018, with 52% domestic. With the rapid growth of overseas markets, we estimate the growth could be 100% over 2018 this year. In Q1, we had a 140% increase in our overseas sales. In 2019, overseas shipments may increase to 70% of our total business.

In the future, we will try to control the number of customers which we directly do business with to less than 100 and establish a distributor system to handle all other customers. This means a shift from previous direct sales to a distributor system, and we’ll cut our costs in sales and marketing.

People in the industry are watching closely as China’s next policy move is expected. How do you think your domestic market will play out in 2019?

Yes, lots of people including myself are watching and waiting for the policy. From the news released so far, personally I believe it will be a positive policy for China’s PV industry.

First, due to the international rules which you will face outside of China. Second, the new policy will benefit those manufacturers that produce at high quality and eliminate low quality products. A really good policy will drive the industry to grow even stronger. We are working to understand the policy to try and figure out how to match the policy to our product, human resources, marketing, and even structure.

Do you think Huawei has met or is going to meet some kind of bottleneck in growth?

Presently, solar PV accounts for around two percent of total power generation globally. I think in future solar with storage will very probably be the most promising renewable energy. If I am right, the total installation capacity will be tremendous compared to its current size. The market is just at its beginning stage. Actually, all the major energy giants including State Power Investment Corporation (SPIC), Huaneng Power, Électricité de France (EDF), and others are just getting started in their transformation from traditional power to renewable energy.

Because of declining costs, solar PV energy is now the cheapest power source in many places. This will terminate investment in traditional energy. The future market of solar PV will be ten or even a hundred times its current size.

Taiwan’s rapidly developing PV market

Taiwan became a gigawatt solar market last year and capacity is expected to grow even further in 2019. Chen JuiHsin is the Vice President of Chailease Holding, the largest EPC and PV solar plant owner in Taiwan.

Due to significant declines in pricing for solar PV products including cells, modules, and other parts in 2018, grid parity is becoming more and more widespread. What is Chailease’s perspective on the future of Taiwan and Southeast Asian PV markets?

Currently, Taiwan still has a good feed-in tariff (FIT). Even though it’s not as significant as that of mainland China, the profit margins are considerable given declining costs. We take several factors into consideration when assessing investment in PV projects and markets. Taiwan has limited political and financial risks, and solar resources are also pretty good. There are climatic disasters, especially typhoons in the summer, which pose threats for PV projects. But generally speaking, we see a strong prospective PV market for Taiwan [through] 2025.

For Southeast Asia, there are significant differences between each country. Thailand is the best market for our company due to energy costs, sufficient solar resource, and the key: a stable political environment. We have been in the market for a long time, and have strong relationships established with local partners. Malaysia is also a strong market, but energy costs are quite low compared to Thailand due to its richness in oil resources, and it also has a lot of natural disasters.

Vietnam and Cambodia are both potential future markets, but in the current situation, insufficient infrastructure negatively impacts PV investment. We believe that the political and financial risk is pretty high in both the Philippines and Indonesia, so we are very cautious in entering into these markets to do local business. Chailease Energy’s market strategy differs in the various ASEAN countries.

With the rapid growth of Taiwan’s PV industry, can you tell us about the size and scope of the projects that Chailease is developing in the market?

I have to say that as an EPC (engineering, procurement, and construction) provider, Chailease Energy is quite different from other players in the market. Our PV business initiated from our small and [medium-sized] enterprises (SMEs) leasing business which shaped Chailease Group. We don’t have iconic projects to show as other EPCs typically do. Each project we have done is quite small, though not at a residential scale, and dispersed geographically. Dispersing projects helps reduce risk, particularly with climatic factors such as typhoons in Taiwan.

What is your current installed capacity? And in the future, what is the primary target sector for Chailease solar projects?

At the end of 2018, we had a total of 370 MW of PV capacity installed across more than 1,200 projects. This year, we anticipate completing another 400 to 500 projects for an additional 150 to 200 MW of capacity, which will represent a significant increase for us. In the future, we will consider moving toward working on more utility-scale PV projects. We have a lot of experience in developing PV projects, and we believe we can go bigger and better.

We know Chailease’s FinMart project has been focused on providing investors with a long-term stable return on investment. This kind of project requires a higher degree of quality for all system components. Can you describe Chailease’s quality requirements for components and the inverter?

Since we provide investors a guaranteed return of 20 years, we have very strict requirements about the components used for our PV projects. The most important factor for us is to have a high degree of confidence that the manufacturer will survive for the next 20 years, so that it can continuously serve our projects and investors. Beyond that, we have two other quality requirements that we are looking at.

First, considering the harsh environmental conditions of Taiwan, such as high temperatures, rainstorms and lightning, and typhoons, we want to keep maintenance costs low and need the parts to have the lowest failure rate possible. Second, the efficiency rate should be high and stable.

Chailease has built a number of solar projects and accumulated extensive experience. How does your company go about choosing inverters?

Usually, we have two or three vendors for each component. For example, we team up with inverter manufacturers like Huawei, Delta, and Schneider. We chose Huawei inverters initially for their fanless design. We had many poultry farm projects, and if the inverter had a fan cooling system, this would often get jammed with chicken and duck feathers and particles. Maintenance would be difficult and costly with fans, and there was high risk for the inverter to accumulate heat and burn out. We tested Huawei’s inverters for quite some time and found that their product is extremely suitable for the conditions of PV projects in Taiwan.

Over the last two years working in cooperation with Huawei, we have found that they’re a strong, quality vendor. They produce high quality inverters. Beyond that, they have a great service attitude and are quick to respond. We feel their respect, and that they really understand customer needs.

Has Vietnam’s moment in the sun finally arrived?

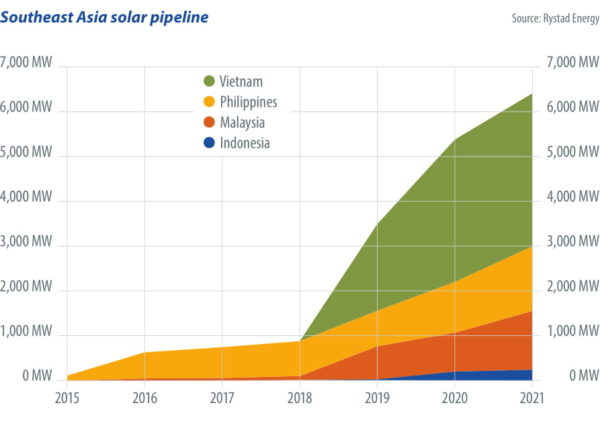

New solar PV installations soared for Vietnam in 2018 — at least in relative terms, they did. The nation’s cumulative installed PV capacity stood at just 106 MW by the end of 2018, according to statistics from the International Renewable Energy Agency (IRENA). That number looks paltry when stacked against regional rivals such as Thailand and the Philippines, but represents a huge jump from just 8 MW a year earlier — the approximate level at which the country’s total PV installations had languished for much of the past decade.

A recent series of policy announcements — and looming revisions to Vietnam’s feed-in tariff (FIT) program — have left many investors hopeful that the Southeast Asian country is finally poised to unlock its PV potential in both the utility-scale and commercial rooftop segments.

“Under the current FIT, there is tremendous developer activity going on right now. Almost purely in the utility-scale segment,” says Josefin Berg, Research and Analysis Manager for IHS Markit.

The Vietnamese government is expected to officially publicize its new solar FIT rates before the end of the first half of this year, as current rates are set to expire on June 30, 2019. Proposed FIT rates for ground-mounted projects range from VND 1,525 ($0.065) to VND 2,102

($0.09), depending on the region. Suggested rates for floating PV systems — a key government policy priority in land-scarce Vietnam — have ranged from VND 1,566 to VND 2,159. Solar+storage installations, meanwhile, could receive rates of VND 1,994 in the country’s southern provinces or VND 1,196 in the central highlands.

Berg expects solar developers to install as much as 2 GW of utility-scale PV capacity in Vietnam in 2019, primarily in the first half of the year.

Berg expects solar developers to install as much as 2 GW of utility-scale PV capacity in Vietnam in 2019, primarily in the first half of the year.

“The boom doesn’t stop here. As there have been extensions to the FIT in some zones, we project more than 2 GW of utility-scale PV also in 2020,” she adds.“Then the new proposed FIT would be likely to trigger another 2 GW in 2021, but with development shifting to the north.”

Looking ahead, it remains to be seen how long the revised FIT regime will remain in place, says Berg, noting how other solar FIT markets throughout the world have come to abrupt ends in the past. “The big question is how [state-owned power company] EVN will react to this amount of capacity and the related costs,” she explains.

Measured approach

Oliver Massmann, a Vietnam-based lawyer for Duane Morris LLP, says the proposed revisions to the FIT rates suggest that the Vietnamese government is taking a measured approach to solar development.

“Vietnam does not want to develop solar power projects at any cost,” says Massman, explaining that the government has put strict caps on project capacities.

Massmann’s 2019 installation forecast is considerably more conservative than that of IHS Markit, at just 854 MW. Although 2.24 GW of PV capacity was under construction by June 2018, he believes that many of the developers of those projects will likely miss their commercial operation deadlines to claim the FIT rates currently offered.

The newly proposed FIT rates, he argues, appear designed to strike a balance in order to facilitate significant PV build-out, but at prices that state-owned utility Vietnam Electricity (EVN) will be able to stomach. However, there are other potential obstacles to future solar development looming on the horizon.

“In general, the network is underdeveloped,” says Massmann, arguing that the national grid may not be able to handle the modest 2020 target of 850 MW that the government presented in its seventh Power Development Plan — to say nothing of its long-term targets of 4 GW by 2025 and 12 GW by 2030. It also remains to be seen what will happen to the 8.1 GW of solar capacity that has already been approved for development through the end of the current decade, accord- ing to the Ministry of Industry and Trade (MOIT).

“Coal thermal power projects have covered 70% of the total installed capacity, and that limits the available infrastructure, location, and capacity for development of further solar power projects,” Massmann explains. “For example, it is very challenging to find locations near the grid for the development of solar power projects.”

Grid limitations

The limitations of the Vietnamese national grid also make it “very challenging” for solar developers to hit their commercial operation deadlines, Massmann adds. Another issue for utility-scale solar is the Vietnamese government’s draft PPA template. While authorities are now working to revise the template to make it more acceptable to domestic and foreign financial institutions, Massmann says that the draft PPA is not particularly bankable for a number of reasons. For one, the template does not clearly delineate risks for the government and the private sector. It also lacks foreign exchange guarantees, and it remains unclear whether the PPA template is a “take or pay” agreement, according to Massmann. Additionally, PPA negotiations still take an inordinate amount of time and the process is still not sufficiently transparent for foreign investors.

Despite these lingering concerns, the Vietnamese solar market nonetheless offers enormous potential. “There are still many broad opportunities for foreign investors, developers, consultants, and equipment suppliers,” says Massmann, noting that cumulative PV installations remain negligible, with the Vietnamese market still in its infancy.

One encouraging development is that the government plans to introduce a direct PPA for large-scale renewable projects at some point this year. This would allow renewable power generators to sell their electricity directly to corporate consumers. “We believe that foreign expertise in direct power purchase agreement projects is most needed at this point since the pilot direct PPA will be implemented soon,” Massmann says.

Promising C&I outlook

In Vietnam’s fledgling commercial and industrial (C&I) rooftop solar sector, where Massmann expects 19 MW of new capacity to be built this year, the outlook for PPAs is considerably more promising.

In March, the MOIT replaced the old PPA model for rooftop PV and extended the FITs to all C&I projects, effective April 25, 2019. The new version of the PPA features a number of notable improvements, including the clarity that the FIT will be applicable for 20 years from a project’s commercial operation date. The new model PPA also includes a detailed but simple formula to calculate power generation and the price that is to be paid to generators, and separate payment and invoice procedures for companies and households.

“The new model PPA has been simplified for the sale of solar power from the rooftop solar generators to EVN/power purchasers,” Massmann explains, noting that it drops the previous net metering structure which mixed the sale and purchase of power between parties. “[This] is expected to address all outstanding issues of rooftop solar power projects.”

German solar specialist Conergy is similarly upbeat about the potential of Vietnam’s C&I solar space. CEO Alexander Lenz says the country could install more than 1 GW of C&I rooftop PV capacity over the next four to five years. He says that Conergy is therefore “very optimistic” about the country’s potential.

Lingering issues

However, Lenz acknowledges that a number of pressing issues still need to be definitively resolved, such as the 1 MW cap that the government has placed on rooftop PV projects, which reduces the potential benefits that can be achieved through economies of scale. A number of other related laws and regulations also need to be clarified, he argues.

“[A recent solar policy document] defines four business models for solar rooftop investments, but the exact procedures on how to implement these models are not clear. We are assuming that more detailed procedures will follow,” Lenz explains. “The policies in general are supportive of rooftop solar development. [But] the laws and regulations need to be improved to provide more details and clear guidance, not only for the developers/investors, but also for the local government authorities who are responsible for executing the policies.”

Long-standing grid constraints are another issue that solar developers also need to consider when selecting potential project sites, in order to limit dispatch-related risks, according to Lenz. Despite such lingering concerns, the outlook for rooftop PV is extremely positive in Vietnam. With average annual GDP growth rates of about 5-8% over the past 10 years, the country’s electricity demand is expected to outpace the growth of power generating capacity through the middle of the next decade.

A tale of dust and heat

Keeping it cool even in the toughest conditions is a point of concern for many plant owners and EPCs. The trick is striking a balance between ensuring safe and efficient plant operations while keeping the associated costs to a minimum. Reducing the number of moving parts is one way to keep the O&M bill low.

Image: Huawei

The insulated-gate bipolar transistor (IGBT) is an inverter’s ‘heart,’ and a component which produces a considerable amount of heat while switching. However, IGBTs, printed circuit boards, and other electrical equipment start operating at lower efficiency levels when they reach a certain temperature. An increase of just 1-2 degrees above the maximum operating temperature – usually 90-110°C – can cut equipment lifetime in half.

Inverters lower their power output through a process called derating to avoid damaging themselves by overheating. Derating, however, has significant effects on a plant’s levelized cost of electricity (LCOE). The more efficient an inverter’s cooling mechanism, the later derating occurs. A quick look at inverter data sheets shows that most inverters can maintain operations at a maximum ambient temperature of around 60°C, but start derating at slightly above 40°C. Not all suppliers provide data on different outputs under different ambient temperature scenarios, but those who do, admit power losses of between 5% and 10% at an ambient temperature of 50-55°C, when com- pared to 30°C.

The switch from two to three-level architecture has allowed for more efficient high frequency switching without having to use higher voltage or IGBTs that could resist higher heat levels. In the past, many inverters had less than 96% efficiency, and most losses dissipated into heat inside the inverter cabin. Less heat is dissipated today, with efficiency rates beyond 98.7%. In making this step, manufacturers offset the effect of more efficient switching by increasing the power density of the inverters – making cooling an issue yet again.

If a project is located in the scorching heat of a desert, the point at which derating sets in is routinely surpassed. Plant owners then have to accept repeated low falls in production output, with adverse impacts to their LCOE. Installing a fan to more efficiently draw the heat from the inverter cabinet may seem an attractive solution, but dusty desert conditions and the ingress of small particles interfere with the functionality of the delicate electronics.

Huawei says it has found solutions to both of these desert challenges: using natural convection flows without fans to sufficiently dissipate heat. The system would work even with high-power inverters, such as its SUN2000-100KTL-H1 100 kW product. Via natural convection flows of hot air, heat dissipates through heat pipes onto a heat sink on the outside of the inverter. Huawei places heat generating components and sensitive parts in different compartments in combination with various thermal insulation strategies so that the build-up of hot spots in sensitive areas can be avoided. The smart PV technology giant says that because there are no air inlets, the solution is better for dust protection.

The innovative solution shows promise to utility-scale investors, particularly those with their eyes on the Middle East region. A system that works well under the scorching sun, without the cooling breeze of a fan, could have positive impacts on both market expansion and LCOE.

Gaining the most with multi-MPPT inverters

The role of smart technologies in improving solar project costs and yields in India

Sunil Jain is the CEO and Executive Director of Hero Future Energies (HFE), an independent power producer that has an installed capacity of 1.2 GW and is striving to cross 3.5 GW by 2022.

Image: Hero Future Energies

As India’s leading independent power producer with an established global presence, what are your continued plans for growing renewable energy over the next three years?

Hero is presently operating approximately 1,500 MW of wind and solar assets, and has around 1,000 MW under construction, with another 1,000 MW under development. We plan to reach a capacity of 5 GW of solar in the next three to four years. Hero will also go for a lot of innovative projects, like hybrid or tribrid with wind and storage in the coming years.

How would you describe the evolution of India’s energy sector thus far?

The Indian energy sector continues to grow at 6-7% annually. It is evolving to include a large mix of renewable energy and also adopting new technologies to get 30% renewables onto the grid by 2022. I believe then that our energy sector will gradually move to low carbon as renewables will become mainstream in the energy mix.

What role are cutting-edge digital technologies, such as machine-to-machine learn- ing and Internet of Things (IoT), playing in this evolution?

Huge! There are three stages of solar and wind power plants: design, execution, and operation. At the design stage, the use of drones, in conjunction with differential GPS, for land-based topography with artificial intelligence is immensely helpful in plant lay- out design, drainage design, earth-work assessment, etc. This is creating much more accuracy and speed.

At the execution stage, piling and ramming using GPS-based machines ensure automated location of pile coordinates. Even drone-based plant monitoring and process data generation through AI and machine learning is possible. At the operation stage, state- of-the-art robotic cleaning systems, mounted with wind sensors, pyranometers, and IoT-based data analytics, can govern the smart cleaning of modules to ensure higher [power] generation.

The use of drones laded with thermal camera and GPS enables perfect monitoring of module behavior, and defects are diagnosed through machine learning and AI-based data analytics. With string-level monitoring features, it is now possible to communicate string data through IoT, leading to error-free data for accurate assessment. With multi- MPPT (maximum power point tracking) string inverters using high-end algorithms, it is possible to assess the behavior of each string, including the I-V curve. This can effectively prevent technical issues, improve O&M efficiency, and reduce O&M costs.

Power electronics can be the cause of failures in solar installations. In India, what are the specific requirements that inverters must meet?

Reliability and performance of power electronics-based devices are critically dependent on the ambient temperature, humidity, and presence of vermin, etc. Tropical countries like India are characterized by high temperatures and levels of humidity, and also have the presence of lizards, rodents, and snakes. The inverters must be designed to have protection from such extremes.

What made you choose Huawei as your preferred inverter partner?

Huawei is one of the largest R&D-oriented organizations, with their products using state-of-the-art technology. The company manufactures high-efficiency string inverters, with greater than 99% efficiency and the multi-MPPT feature, unlike central inverters which carry efficiencies of approximately 98.3% and single MPPT. Multi-MPPT is extremely advantageous for installing PV systems on any land profile, including high sand dunes or mountainous zones. Due to Huawei’s high-end technology, it is possible to load such inverters beyond 200% DC. There is an observable gain of more than 3% vis-à-vis central inverters. With the inverters being distributed in nature, their mean time to repair is also very low.

Due to falling tariffs, does the thinning of profit margins mean compromises on the quality of the projects?

The solar PV sector has gone through an immense innovation phase and a great learning curve. Initially, the balance of system design was drawn in equivalence with thermal plants, which run at 100% capacity, 24/7. Designers have gradually unlearned that, and adapted to the behavior of solar PV plants. This has led to innovations and optimizations without compromising quality.

For large-scale PV plants, better data analytics and smart monitoring of the plant are possible, which can ensure better preemptive maintenance and improved generation. Tariffs have fallen due to the aforementioned points, and the immense price reductions in modules. It is therefore believed that there need be no compromise in the quality.

How can O&M costs be minimized over the life cycle of a project?

More and more usage of smart technologies such as robotic cleaning, soiling loss measurement kits, drone-based thermography, smart inferences through machine learn- ing from SCADA data analytics, automated grass-cutting machines, and inverter and transformer health diagnostics through machine learning can minimize O&M costs without any compromise, and even with better generation.

Six trends of inverters accelerating PV grid parity

The United States, Europe, India, Latin America, the Middle East, and other regions of the world are rapidly ushering in a new era of PV grid parity. China is expected to gradually embrace grid parity in 2020. As the ‘brain’ of a PV plant, inverters play a key role. Six trends of inverters will arguably speed up the progress of grid parity.

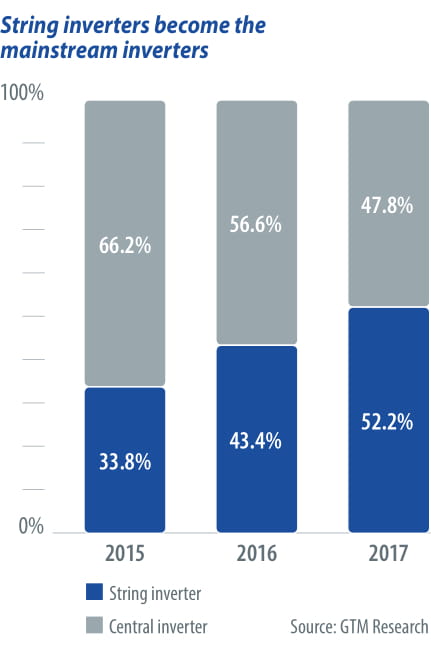

String inverters become the mainstream

According to IHS Markit, Wood Mackenzie, and other leading market researchers, the global market share of string inverters over central solutions continues to increase, and surpassed that of central inverters for the first time in 2017. Smart string inverters provide high efficiency, high availability, and multiple maximum  power point trackers (MPPTs) to bring in higher energy yields. Without vulnerable parts or fuses, string inverters can reduce the initial investment and opex while simultaneously increasing PV system reliability. Huawei says that BOS costs can be reduced by 4.5 cents per watt.

power point trackers (MPPTs) to bring in higher energy yields. Without vulnerable parts or fuses, string inverters can reduce the initial investment and opex while simultaneously increasing PV system reliability. Huawei says that BOS costs can be reduced by 4.5 cents per watt.

1500 V as standard

With lower costs and higher efficiency, the 1500 V system is becoming a mainstream solution for large-scale, ground-mounted PV plants, particularly in emerging markets. According to data from IHS Markit, the shipment of 1500 V solutions for large scale, ground-mounted PV plants in 2018 (excluding China) reached a 62% market share.

The 1500 V inverter solution is used for global low electricity price markets and non-subsidized PV projects, and has been widely adopted in India, the Middle East, and Latin America. Compared with the 1100 V system, the 1500 V system has a higher voltage and longer string length, reducing the equipment, cable, and construction costs. A project’s BOS costs can again be reduced by approximately five cents per watt, according to Jeff Yan, senior product manager at Huawei.

“The 1500 V devices, including inverters, have been delivered on a large scale in 2018 as the first choice for utility-scale, ground-mounted PV plants,” says Yan. “After seven years of the concept period, new product period, and verification period, we are achieving grid parity.”

Bifacial module+string inverter+tracker

With the popularization and application of bifacial PV modules in combination with trackers, the upgrade of support- ing inverters becomes inevitable. “Smart string inverters reduce the loss of string mismatch and integrate support control, power supply, and communication management at the same time, which greatly improves the energy yield of the system,” says Yan. He also gives an example, explaining that the measured data of a PV plant in Qinghai, China shows that the energy yield of a PV plant using the bifacial PV modules+trackers+Huawei smart string inverters solution is increased by more than 20%.

PV+storage systems

Energy storage is of great importance to the global energy transition. Due to cost factors, the industrialization of PV+storage is still in the stage of subsidy-driven development. However, the pace of marketization of PV+storage is accelerating. The application of the PV storage systems will further drive the evolution of the inverters to be the energy management center for PV plants.

Proactive safety protection

There is no doubt that a PV plant’s value is strongly influenced by its safety features, particularly when it comes to the rooftop segment. Inverters, with functions such as DC arcing detection and safety shutdown of PV modules, evolve the safety protection of PV plants from passive to active.

Digitalization, intelligence, and AI

In the high-speed development of solar PV globally, the effect of reducing costs using traditional methods has reached its limit. The digital transformation of the PV industry has become a trend. In the future, the PV industry will be digitalized.

With the development of technologies such as big data, cloud computing, Internet of Things (IoT), and mobile interconnection, the PV industry will achieve visualized management and high O&M efficiency.

The PV system will be inverter-oriented, and its digitalization and intelligence will continue to improve. In addition to energy yield and O&M efficiency gains, the ultimate platform for future comprehensive energy services is emerging.

Smart I-V curve diagnosis

While AI technology will be gradually integrated into PV solutions, Huawei is “ already driving this intelligence forward with its extensive Smart I-V Curve Diagnosis, which is able to carry out online analysis of entire strings with advanced diagnosis algorithms.

On-site inspection becomes unnecessary, with the ability to perform remote diagnosis in one-click mode. According to the company, a comprehensive diagnosis report for a 100 MW PV plant can be generated in 15 minutes.

These six major trends of inverter technology today are vitally interrelated with the PV industry’s core objectives of cost reduction, efficiency improvement, and intelligent upgrades – all of which provide the opportunity to lower the LCOE and accelerate grid parity.

“It’s all about bankability, and string inverters are here to stay”

Alvaro García Borbolla is the Director of International Business at Prodiel, a global EPC that has been operating for more than 20 years, with 5 GW of solar PV capacity installed. Borbolla speaks to pv magazine about how his company has remained successful in a competitive market, its global expansion, and the growth of string inverters.

Image: Prodiel

Prodiel has been operating in the PV sector since 1994, in the early stages of development for solar energy. How has the company most changed since then?

Solar technology has advanced significantly, and the capex of the technology has changed a lot since we got started. In terms of scope, a 2 MW project was a big project in 2005. Today, our projects could be 100 MW and up. Most changes for our company from early-on projects have been in the logistics and the engineering.

Prodiel has continued to expand outside of Spain, with subsidiary locations in Chile, Colombia, Peru, Brazil, Mexico, Panama, Morocco, Kuwait, Guatemala, and Argentina. Can you talk more about your expansion in Africa?

We are all over Africa looking for opportunity. Prodiel is a company focused on large utility-scale projects – we are not doing projects below 15 or 25 MW. Right now, we are looking at Ethiopia with upcoming tenders. Senegal is always the hope, but the market hasn’t taken off yet. The Middle East is now proving to be a core market for us. With significant tendering in Saudi Arabia, the United Arab Emirates, Oman, and Kuwait, we are putting a lot of focus on these markets.

Are Latin America and Spain still the most important markets? What is next for continued expansion?

In terms of sales, yes. Spain is a market that is booming with large-scale projects, which is very exciting. For the next five years, we foresee five gigawatts being installed each year. Italy is also very promising right now. In Latin America, Mexico is significant, and accounted for about 40% of our sales last year. While things have changed, we believe that in the mid-term Mexico will be still be a strong market for us. Over the next two years, we still expect Chile to grow as well. While the Middle East will not be similar in terms of the sales that will be seeing in LatAm and Europe, we are very focused on the region. Australia will also soon be a new market where we will be actively working with industry partners.

Planning and building a large-scale solar plant is becoming an increasingly challenging business. How has your company continued to succeed through market challenges?

Prodiel has continuously focused on growing and expanding our internal expertise across all departments, from our engineering to tendering. Right now, we are staying on the cutting-edge of machine learning and digital technologies. We have remained at the forefront of technologies and markets, and then of course, maintain close partnerships with suppliers.

Can you speak to the level that your network of partners plays to ensure the bankability of a project?

This is definitely one of the main strengths of Prodiel. From 2008 to 2019, this industry has grown enormously, and our company has grown with the technology. We have long established, strong partnerships with the main equipment suppliers and industry stakeholders. It is crucial to work in collaboration with other partners and vendors to have the best equipment offering for investors. From concept to completion, projects create a long-term collaborative relationship that exists well after the installation is complete. We all have to work together as members of a team in order to develop excellent work.

How much does Prodiel rely on string inverters for your utility-scale PV plants?

We typically use string inverters for project plants with unique characteristics or challenging installation requirements. In previous years, we have installed more than 200 MW of PV projects using string inverters. In our pipeline, we have more than 300 MW of project capacity planned [utilizing] string inverters. We specify Huawei for string inverter projects.

What advantages has Prodiel found in using Huawei string inverters? In which markets are they used?

The main advantage is the production. Their reliability and strong performance in intense and unique environments has been extremely beneficial. We use Huawei inverters a lot in high desert areas. Having the ability to easily change the inverter if it is broken increases the reliability of the plant enormously. We have used Huawei inverters in Spain, the Middle East, and now Mexico. I think that the market will strengthen in coming years, and a higher percentage of projects will use string inverters. It’s all about bankability, and string inverters are here to stay.

French solar explorers acquire taste for Huawei inverters

After streamlining construction of photovoltaic arrays as far abroad as New Caledonia and Zambia, French developers are starting to roll out a new generation of inverters across their home market.

Image: Vincent Blocuquax

France is gently warming to the utility-scale projects that have come to dominate global photovoltaic installations, but according to Guirec Dufour, CTO of green energy producer Quadran, the French solar sector remains beset by regulation. He says that lengthy processes to obtain building authorizations, restrictions on the use of farmland, and exceptionally demanding national construction codes are typical French syndromes.

“European rules are not even good enough for us,” says Dufour. “We have to make up our own that are even more constraining.”

Over the past decade, Dufour has made a career of solving technical holdups on renewable energy construction sites. His efforts have been met with success. When he joined Quadran in 2008, he was one of just four workers. Following a period of brutal market consolidation, the firm has emerged with 250 employees, operating some 250 MW of solar plants, 500 MW of wind farms, and 20 MW of hydroelectric and biogas recovery units. Its achievements have attracted two acquisitions in the past two years, the latest from oil giant Total.

Quadran attributes its growth to the company’s agility in reaching new markets and implementing new solutions. The company has learned tricks in solving offbeat challenges that have given it a competitive edge in its core market. Two years ago, Dufour put this resourcefulness to the test when he set out to design the first 11 MW solar farm in New Caledonia, a French territory located in the South Pacific, 1,200 kilometers east of Australia – and about as far removed as geographically possible from Quadran’s offices in Béziers, France.

Further and smaller

“The time difference between headquarters and New Caledonia is nine hours,” Dufour says. “If you need to call someone in Europe, it is simply impossible.” That proved problematic. Conducting maintenance tasks on key components such as centralized inverters would typically require specialized technicians and heavy equipment that was unavailable on location and expensive to import.

“PV in New Caledonia basically did not exist two years ago when we started build- ing the plant. You couldn’t find trained personnel to maintain centralized inverters,” says Dufour, “And if you trained workers yourself, they were likely to go work for the competition in the following 15 days, leaving you constantly training new staff.”

Instead of meeting the human resource challenge head on, Dufour shifted construction of Quadran’s New Caledonia solar park to string inverters, which were lighter and easier to install than centralized. He connected all 43,000 solar panels of the project to the grid using 300 Huawei FusionSolar string inverters, each with a capacity of 33 kW.

“In the past, large projects had to adopt central inverters because decentralized inverters were not powerful enough,” explains Dufour. “Now, Huawei products can reach power outputs of up to 100 kW, so we can use string inverters on large plants too.”

Image: Quadran

Smaller and simpler

In terms of maintenance, decentralized string inverters offer an advantage over central in that they require no specialized engineers or lifting equipment to install. Three workers can transport the hardware on-site by hand, and connect it without risk. If an inverter malfunctions, instead of flying in heavy equipment or representatives from its manufacturer to repair the device, local workers can simply unplug it and install a replacement.

“We just simplified everything in our solar plants using these inverters,” says Dufour, explaining that the entire fleet of Huawei products in New Caledonia have only recorded two faults since their installation. “They are much more reliable and require absolutely no maintenance. If we have a fault, we just swap the component.”

It is still early to quantify these benefits, but he expects that the string inverters in the project are drastically reducing its maintenance costs.

Since its experience in New Caledonia, Quadran has commissioned Huawei inverters to connect close to another 100 MW of installations both at remote sites and in mainland France. Among the technology’s perks, Dufour says that Huawei is the only supplier he knows of that embeds ICT in its inverter hardware to supervise plant operation. The product offers voltage of 800 VAC, reaches energy conversion efficiencies of 99%, and has helped meet French construction codes for stringing PV modules in parallel.

“Because you only have two strings per entry point, you don’t need to use fuses on the DC side. That makes the installation more reliable,” says Dufour, adding that higher AC voltages allow for lower losses on the connection to the transformer, avoiding the use of AC combiner boxes, and that the in-built ICT supervises the system with no need for additional monitoring equipment. “We just have an inverter and cables – that is it. That means less equipment, and less equipment means fewer faults.”

Simpler and safer

Xavier Barbaro, President of Neoen, France’s leading independent renew- able energy developer, agrees that the downtime of a PV plant is substantially reduced when using string inverters. To date, his company has brought 2 GW of solar into construction across four continents. For bankability purposes, Neoen signs turnkey engineering, procurement, and construction (EPC) contracts with its subcontractors, but it still specifies the subcomponents that it wants installed.

The company placed its first order with Huawei in 2016 after winning a 50 MW photovoltaic project in Zambia as a pioneer of the Scaling Solar program run by the World Bank. Treading new ground, Neoen wanted to anticipate logistical challenges by supplying the landlocked country with small and easy-to-deploy inverters.

“We paid a visit to Huawei in Shenzhen, China, not really knowing what to expect,” says Barbaro. “But we liked what we saw. In terms of manufacturing, it was really world class.” He initially valued the small scale of the FusionSolar inverter for the project in Zambia, and has since grown fond of its convenience and performance as well.

“Huawei has proven a reliable supplier with a very convincing product,” he says. “So far, we have had no issues with any of the Huawei inverters that we have installed.” Since 2016, Neoen has ordered FusionSolar inverters for some 300 MW of photovoltaic plants across Zambia, Argentina, and the largest carport installation in France, which it inaugurated in April 2019.

Safer and cheaper

Image: Neoen

Barbaro says that simplicity offers advantages beyond construction sites, as lenders for Neoen’s renewable energy projects are cautious about the industrial choices that his company makes. He says that Huawei products have proven bankable, reassuring financial backers, and bringing down the overall cost of projects. “What we value is experience and expertise,” says Barbaro. “If you have dozens of gigawatts of installed capacity, you have a lot of experience covering a lot of different situations.”

Neoen is notably building a 200 MW solar plant in Argentina, located 4,000 meters above sea level. Not all inverters work at this altitude, but Huawei products have been deployed successfully under similar conditions in China.

“We tend to go with suppliers that can prove their point when they argue that their product offers the right choice for a situation that we face,” says Barbaro. “That is something that we have with Huawei.”

In today’s competitive market, Barbaro says that even curtailing financial provisions for inverters can have a decisive impact on the operation and maintenance budget of a photovoltaic project.

“Solar is now reaching prices under $20 per MWh, and that is really a game changer,” he says. “Every step in the project has been a part of that achievement, including the inverters. They represent 6-7% of a PV installation’s capital expenditure and play an even bigger role in its operating costs.”

Whereas capex optimization has dominated LCOE improvements over the past five years, Barbaro argues that “The next frontier is probably opex optimization, and there is a lot to gain from inverters in this area.”

“That is how we decided to also use Huawei inverters in France,” says Barbaro. “Of course, logistics in France is easier than in Zambia, but the product remains relevant.” He explains that FusionSolar is low-risk, user-friendly, and increasingly geared towards interoperability, concluding that “Huawei wants to make sure that their product is easy to package with substations and hardware coming from other suppliers,” and he concludes: “That is something that we like.”

European distribution insights

Wattkraft is a supplier and distributor serving EPCs and project developers. Francisco Pérez Spiess, Director of Technical Solutions and Sales at Wattkraft, talks about the European market and the company’s decision to exclusively offer Huawei for their inverter product offering.

Which markets have performed most strongly for you over the last year – Germany, the U.K., Italy, the Netherlands, or Spain?

Our home market is Germany, where our headquarters and our two German support offices are located. Consequently, we are much stronger in this market.