Digital technology to drive evolving electricity markets

There is little doubt that the energy world is changing. This was reflected at the World Future Energy Summit in Abu Dhabi last month, where leaders from oil and gas rich nations in the Middle East spoke favorably as to the role solar and wind is likely to play in their economies in the future. […]

Cautious optimism

Sentiment in solar stocks improved on the better-than-expected China 2019 outlook. Year-to-date (YTD), the Guggenheim Solar ETF (TAN) increased 19% versus the S&P 500 and Dow that gained 5.3% and 5.4% respectively.

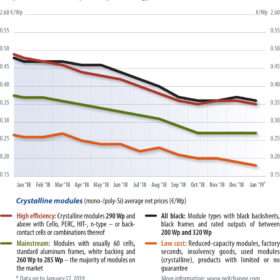

The snow keeps falling – module prices do not

After a uniquely pleasant but dry summer and autumn, it has been raining and snowing in central Europe for weeks with no sign of letting up. Judging by sheer volume, the god of precipitation apparently wants to make up for his neglect of last year.

2019: A year for critical adjustments

Since the PV module market has already witnessed intense industrial concentration over the past few years, the top 10 manufacturers didn’t change significantly as 2018 unfolded, writes PV InfoLink Chief Analyst Corrine Lin. On the cell side, the decline of Taiwanese cell makers has Chinese cell makers filling the top three spots this year.

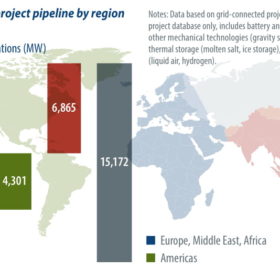

Global battery storage pipeline reaches 15 GW

As data drifts in, 2018 is shaping up to have been a record-breaking year for battery energy storage, writes IHS Markit senior analyst Julian Jansen. Especially for front-of-the-meter projects, which experienced rapid growth. This growth was led by significant activity in South Korea, the United Kingdom, the United States, Australia, and China, which together accounted for 78% of battery energy storage projects commissioned in 2018, according to the Q4 2018 edition of the IHS Markit “Energy Storage Company and Project Database.”

Gossip reigns in Dutch Solar-land

If the world of solar was a newspaper, it would be a tabloid. There is no sector where gossip spreads quite so quickly and ultimately does not contribute much. For an example, Good! New Energy’s Rolf Heynen looks back to 2013, when Europe introduced the Minimum Import Price on Chinese solar panels.

Nothing boring about Japan’s year of the boar

With tenders coming in for large-scale projects, and decade-old generous FIT programs being phased out, new opportunities and challenges are facing Japan’s PV players. Izumi Kaizuka from Tokyo-based analyst RTS Corporation sets out the major market trends for 2019.

Shifting to storage

To facilitate the growing share of renewables in the world’s energy mix, and the more distributed nature of generation, changes are needed to the way electricity is transmitted and distributed. Claudio Palmieri, CEO of CLS Energy Consultants looks to Dubai, where a robust, distributed system has helped local utility DEWA with the difficult task of securing a reliable water supply in a parched desert region. This system, he argues, could provide an example of how an electrical ‘grid of the future’ might work.

Zero energy, maximum support

As Japan’s solar appetite shrinks amid questions over everything from falling FIT rates, through the availability of suitable land, to the revival of nuclear generation, Japan’s Zero Energy Homes policies, requiring new buildings to be integrated with solar PV and various energy efficiency measures, could provide a significant boost to installations. pv magazine looks into Japan’s upcoming residential recovery.

A year for transition: Japan’s move beyond the big scale

For the past few years, Japan’s solar industry insiders have been eyeing 2019 as a year of transition in the residential rooftop market, as the original 10 year feed-in tariffs come to an end. So, what will this post-FIT landscape look like, and how are Japan’s leading PV suppliers preparing for the future? Hanwha Q Cells’ Japan Marketing Manager Junichi Katayama breaks down the main points.