Tracking the impacts

In the month of August, the Invesco Solar ETF underperformed relative to the S&P 500 and Dow Jones Industrial. Jesse Pichel of ROTH Capital Partners attributes this to uncertainty over the allocation of tariffs outlined in the US Inflation Reduction Act.

Who gets what?

The Invesco Solar ETF, an exchange-traded fund that tracks the MAC Global Solar Energy Index, outperformed relative to the S&P 500 and Dow Jones Industrial in September. Jesse Pichel of ROTH Capital Partners puts this down to continued expectations of support linked to the US Inflation Reduction Act.

Rising costs increase risk

The Invesco Solar ETF, an exchange-traded fund that tracks the MAC Global Solar Energy Index, underperformed relative to the S&P 500 and Dow Jones Industrial in October. Roth Capital’s Jesse Pichel attributes this to fear over cost increases, and a surge in the broader markets.

Confidence boost

The Invesco Solar ETF, an exchange-traded fund that tracks the MAC Global Solar Energy Index, outperformed the S&P 500 and Dow Jones Industrial Average in November. Roth Capital’s Jesse Pichel attributes this to strong earnings and confidence due to the US Inflation Reduction Act.

Out with the old, in with the new

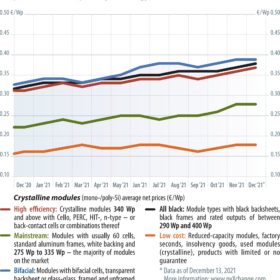

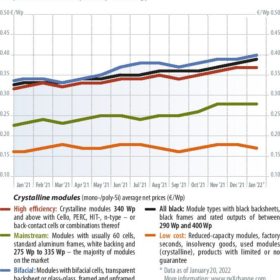

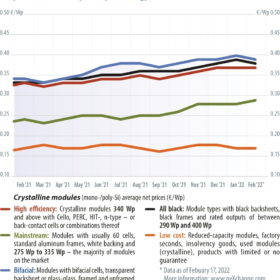

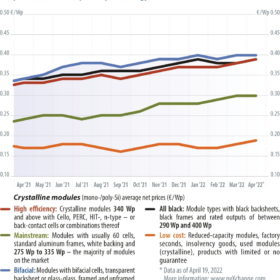

When module and balance of system prices are high, new installations become less profitable and the focus shifts back to renovating and optimizing existing arrays. Although there are signs that the upward price trend is slowing, Martin Schachinger and Falko Krause say there is still no evidence that prices are stabilizing or falling.

Scarcity is the new norm

Scarce goods, delays, organizing, improvising – our fellow citizens from the former eastern bloc know these terms all too well. The centrally planned socialist economies were characterized by shortages of almost everything. Not until the fall of the Berlin Wall at the end of the 1980s did citizens of the bloc get a new perspective. Suddenly, everything was supposed to be available in abundance. As a result, the values of thrift, stockpiling and repairing, instead of buying new things, were increasingly abandoned. With PV modules in short supply, these values may need to make a comeback, writes Martin Schachinger of pvXchange.

Time for a rethink, and a sunny future

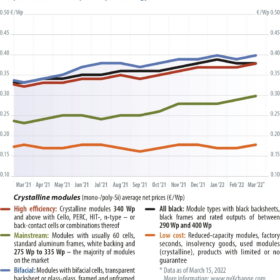

The three-year peak in module prices now seems to have subsided. Prices are again in a slow but steady decline, particularly for project modules. For larger order quantities, panels in the 400W class and above can occasionally be ordered again at prices below the €0.26/W mark, with a delivery date of April or May at the earliest.

Permanent crisis mode

It seems that one global emergency is not enough for us to deal with – as if we needed two or three crises at the same time. The impending climate catastrophe was already enough of a challenge, and the Covid-19 crisis still has us firmly in its grip. And now, a new global problem in Ukraine is affecting our everyday lives and international markets.

An ounce of prevention

The causes of performance issues and safety problems in PV plants are diverse, as Martin Schachinger of pvXchange and Falko Krause of GME clean power outlined earlier this year (see pv magazine 01/2022, p.11). For plant operators, it is not only important to keep an eye on yields, but also to identify changes in installed components quickly – especially those that can lead to serious safety and operator risks.

The times, they are a changing

In borrowing a headline from Bob Dylan, what we really want to express is the introduction of a “remade” price index based on new price categories. Continued advances in cell technology and format, particularly when it comes to steadily rising efficiencies, have necessitated some reshuffling so that specific price developments can be more accurately reflected in the index – but more about that later. First, Martin Schachinger of pvXchange will shed some light on the dramatic overall market situation for modules, and even more so for inverters and storage systems.