Through May, the corporate clean energy procurement market is on track for another record year in 2021. Companies have announced 8.3 GW of clean energy power purchase agreements (PPAs), up from 5.2 GW at the same point last year.

Despite the growth, considerable skepticism remains that the corporate clean energy procurement market isn’t sustainable over the long term. What happens as utilities continue to decarbonize and the grid becomes cleaner? Who is going to replace the Googles and Facebooks of the world once they are 100% renewable? Can the risk-averse buyer rely on the current PPA model? As more weather catastrophes arise, like the recent Texas freeze-out, should companies place their sustainability chips elsewhere?

These concerns look at corporations in a one-dimensional and somewhat outdated way. The corporate clean energy buyer of 2021 is a lot different than the buyer of 2017. Companies are now approaching decarbonization holistically, using it as a proactive growth strategy that benefits multiple stakeholders, rather than a reactive lever they can pull to keep investors happy. This pivot, spearheaded by net-zero and 24/7 carbon-free goals, has breathed new life into corporate clean energy buying, leaving us more optimistic than ever.

Race to net zero

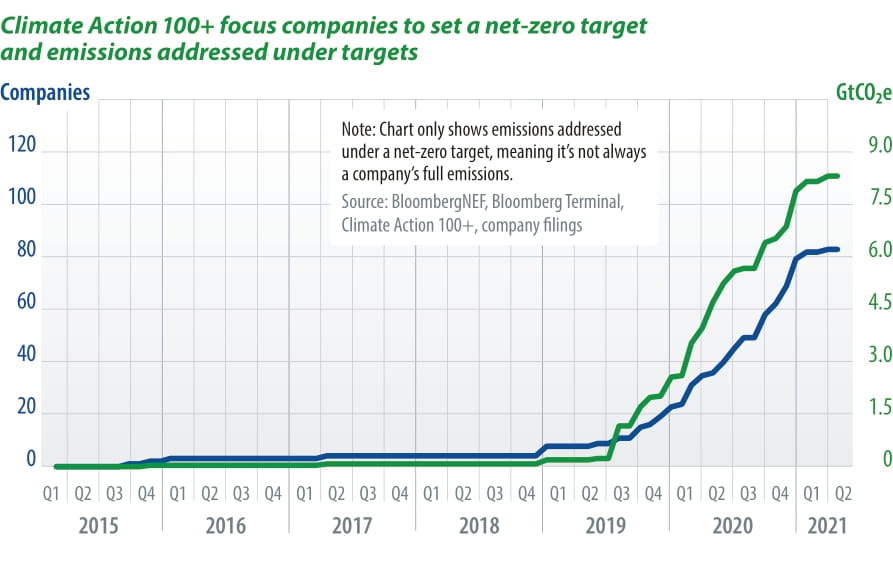

Corporate net-zero targets, which are surging in popularity, are driving significant newfound clean energy demand. By pledging to go net zero, companies commit to fully reducing and/or offsetting their emissions annually. Some 83 of the 167 “focus companies” in the Climate Action 100+ – deemed to be the world’s heaviest-emitting private sector players – have now set net-zero targets. If these companies were to all achieve their goals, it would result in annual emission reductions of 8.3 billion metric tons of carbon dioxide equivalent by 2050. This amounts to 20% of global emissions.

Strong net-zero targets carry a number of prevailing traits. They should be guided by strong, science-based, interim goals. They should be achieved earlier than 2050, calling for immediate action. But above all, net-zero targets must address emissions across the entire value chain.

Companies need to look outside of their four walls, addressing not just Scope 1 and Scope 2 emissions that come from their own operations and electricity consumption, but also Scope 3 emissions from their suppliers and customers. These are the most difficult emissions to reduce, yet they comprise the majority of a corporation’s carbon footprint.

Clean centerpiece

The leading companies have turned reducing their Scope 3 emissions into a new growth opportunity, with clean energy serving as the centerpiece of this strategy. Materials companies like Norsk Hydro and Alcoa Corp. are powering their steel and aluminum smelting operations with clean energy to market their products as sustainable. They can sell these materials for a premium and unlock new customers that are working toward their own sustainability targets, such as automakers producing carbon-neutral vehicles. Clean energy is their ticket to creating distinguishable products as they work towards their goal.

For the oil and gas sector, whose Scope 3 emissions exceed all other sectors, clean energy represents a new diversification opportunity on the road to net zero. Oil majors are now investing in clean energy to reduce emissions from the use of their products. Shell has gone on a shopping spree, acquiring electricity retailers, EV charging companies, and virtual power plant providers to pivot from being an oil company to a power company. These deals will prove essential as it works toward net-zero emissions by 2050.

Total, which has a goal of net-zero emissions for its European operations by 2050, has gone the route of directly acquiring solar and wind projects. In the past nine months, the company has acquired 5.5 GW of PV projects, consuming some of the power and selling the rest. This has quickly made it one of the largest corporate buyers of clean energy – placing it fourth after Amazon, Google, and Facebook – and one of the largest owners.

Carbon-free energy

A handful of companies are also taking their sustainability strategies to the next level by setting “24/7 carbon-free” goals. Instead of looking at the generation from their clean energy purchases at the end of the year and netting it out with annual electricity consumption, companies like Google and Iron Mountain are aiming to do this hourly.

A 24/7 goal requires companies to look past the standard region-agnostic, bilateral clean energy deal and combine various technologies to ensure more consistent generation profiles. Companies are employing a portfolio of technologies, including solar, wind, geothermal, hydro, nuclear, and batteries to make renewable generation and electricity consumption net-out hourly. This also creates an opportunity to work with retailers or utilities, which can tailor electricity delivery to a customer’s demand, creating a strong alternative to the PPA for risk-averse buyers. A slew of utilities and retailers globally offer these programs already.

A 24/7 strategy also requires a company to buy more clean energy than it needs. A solar deal might allow a company to be “100% renewable” at the end of the year, but only during certain hours of the day. Pairing that solar project with wind or batteries will ensure more consistent clean energy generation over the course of a day. As a result, a 24/7 strategy should in many ways be considered the next logical step after going 100% renewable, meaning a company’s clean energy buying days are just beginning.

Above all, a 24/7 goal benefits multiple stakeholders. By purchasing more electricity than it needs at any given hour, a company can help both replace dirtier generation sources and decarbonize the grid. A strong example of this is Google’s geothermal purchase in Nevada, announced in May. The deal brings Google closer to hourly carbon-free generation, but also adds a reliable new generation source to the Nevada grid. Future 24/7 strategies will provide similar benefits, all while driving additional sources of clean energy demand.

About the author

Kyle Harrison leads BNEF’s sustainability research team, which covers the private sector’s transition to a low-carbon economy. The team focuses on core areas such as environmental, social and governance (ESG) reporting, target-setting, low-carbon pathways, and sustainable finance. Harrison specializes in corporate clean energy procurement, net-zero targets, and voluntary carbon offsets.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.