Many battery manufacturers are reducing cobalt content or exploring other battery chemistries, but demand for the rare metal from the battery industry is expected to increase.

Battery-based demand for cobalt has skyrocketed in recent years, even as many companies actively adopt strategies to hedge against the turbulent, controversial market. On top of ethical concerns about human rights violation and child labor in artisanal mines in the Democratic Republic of Congo (DRC), the cost of cobalt and its price fluctuations have been major reasons behind this push. And supply chain bottlenecks, caused by almost 75% of the world’s cobalt being mined in the DRC, and over 70% processed in China, have made the case for eliminating or reducing the cobalt content in batteries even stronger. As a result, once dominant cobalt-containing chemistries are starting to lose their market share, but commodity prices remain under the influence of short-term market dynamics.

“After the cobalt metal price surged over 90% in early May 2022 from early June 2021 mainly at the back of logistics disruptions of the cobalt feedstock, the price plunged by nearly 40% in recent three months, before it slightly rebounded in late August amid pent-up inquiries over the summer,” says Susan Zou, senior analyst at Norwegian consultancy Rystad Energy. “However, despite the positive outlook of batteries used in electric vehicles, the overall market rhetoric of cobalt remains weak in near-to-medium term given sluggish consumption of lithium cobalt oxide (LCO) batteries for consumer electronics amid global macroeconomic headwinds.”

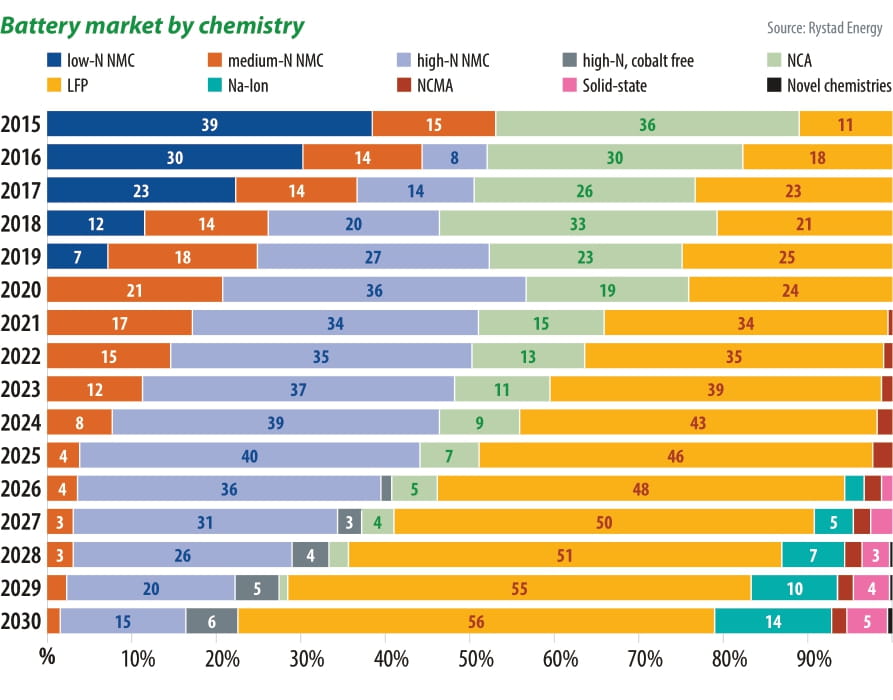

Rystad predicts that cobalt-free lithium-iron phosphate (LFP) will become the dominant chemistry in the medium term. It also sees cobalt being increasingly pushed out of nickel-based cells, with the share of nickel continuously increased until cobalt is completely removed. “The resurgence of LFP batteries in China, and overall attempts to use nickel-rich ternary batteries, which have higher energy density and therefore enable EVs to have longer driving range, has reduced the consumption of cobalt per battery cell. However, given the rapid adoption of EVs, it is estimated the total demand for cobalt from EV and ESS battery sectors will climb up by 360% in 2026 from 2021,” Zou says.

Other industry observers are less bullish on cobalt-free and low-cobalt chemistries. According to London-based consultants Benchmark Mineral Intelligence, in 2021, nickel cobalt manganese (NCM) and nickel cobalt oxide (NCA) battery demand accounted for almost 60% of the market. LFP demand made up about 25% and the remaining share and was primarily attributed to LCO demand from consumer electronics. “Although LFP production in China has outpaced NCM/NCA production recently, the chemistries’ global market shares are not forecast to change dramatically in the coming years,” says Cameron Hughes, analyst at Benchmark.

“LFP is expected to increase its market share to over 30% by 2026 but will remain at this level through to 2031. NCM/NCA demand is forecast to remain at roughly 60% of the market share through to the end of the decade.” Nonetheless, Benchmark also expects cobalt demand to accelerate amid EV expansion and grow by 170% from 2021 to 2031. “Whilst cobalt use on a capacity basis will continue to fall over that timeframe, fundamentally cobalt plays an important role in both safety and lifecycle in the battery and it is very hard to remove it all together,” Hughes adds.

New wave

Engineering cobalt out of the equation is no easy business, but diverse and exciting developments are underway. And as per usual, cost is king. “Reducing cobalt content compared with nickel does indeed bring down material costs, as well as increase cathode capacity and energy density – but with the caveat of reduced cycle performance,” says Max Reid, senior research analyst at Wood Mackenzie. “However, with an ever-maturing industry, cell makers are able to reach very low cobalt and high nickel contents by using a number of mechanisms, such as surface coatings, playing with crystallinity and particle size.”

One of the most prominent efforts is the nickel-manganese-cobalt-aluminum (NMCA) cathode developed by LG Energy Solution. It contains 89% nickel, 5% cobalt, 5% manganese, and a small but relevant 1% aluminum share that plays a big role in lowering chemical instability. On top of this, LGES recently announced its transition to LFP in its future stationary storage products. Once developed, the LFP batteries will be part of the company’s portfolio which will still include its existing lineup of NMC batteries.

“LG Energy Solution is devoted to providing power solutions tailored to each customer’s needs, and these are not just restricted to cobalt-free solutions,” a spokesperson for the company said. “For instance, in order to maintain competitiveness in our pouch-type batteries, we aim to apply single crystal NMCA cathode and silicon anode to the premium segment, and at the same time, apply cost-competitive technologies such as LFP and manganese-rich chemistries to the mainstream segment.” The company also said it was working on polymer-based and sulfide-based solid-state batteries.

Earlier this year, Samsung SDI said it would secure price competitiveness of its products by developing a cobalt-free and manganese-rich ternary battery cell. The company is already producing high-nickel content batteries called Gen.5 featuring a nickel-cobalt-aluminum (NCA) cathode with 88% nickel. It also plans to begin mass production of the Gen.6 batteries with 91% nickel content from 2024, the Gen.7 battery with 94% nickel content by 2026 and an all-solid-state battery by 2027. Its South Korean competitor SK On said earlier this year that it aims to unveil a next-generation NMC9 battery with up to 98% nickel content by 2029. Ford Motor’s all-electric F-150 Lightning, which has vehicle-to-grid charging capabilities, already uses SK On’s NMC9 battery with 90% nickel content, 5% cobalt and 5% manganese.

Meanwhile, Chinese battery manufacturer SVOLT has focused on its proprietary nickel-manganese (NMX) battery cells that are completely free of cobalt. Series production of the novel NMX batteries started in July last year in two battery sizes (115 Ah and 226 Ah) with 75% nickel and 25% manganese content. Thereby, the company became the first to succeed in bringing a cobalt-free high nickel cell chemistry to mass industrial production readiness in what has been touted as “an important milestone on the road to sustainable electromobility.”

The speed at which new cathode chemistries can gain momentum should not be underestimated as previously shown by the quick transition from NMC111, which used equal amounts of each metal, to NMC532, NMC622, all the way to NMC811 that needs only 10% cobalt. “The cathodes on the horizon certainly contain little or no cobalt at all,” says Reid, predicting that the market share of cobalt free chemistries, such as NMX, but also LFP, LMO, and so on, will increase from 30% in 2022 to 57% by 2030, on a GWh demand basis.

Geopolitical tailwinds

Geopolitical developments also need to be factored in when considering the ongoing shifts in battery composition and de-risking of the supply chain. For instance, the newly adopted Inflation Reduction Act (IRA) in the US envisages that electric vehicles will need to have 80% of critical materials sourced domestically or from a country with which the US has a free trade agreement in order to access a $7,500 tax credit.

According to some industry analysts, the long-term effects of the newly signed legislation could include changes in battery composition and even accelerate the shift away from cobalt. That said, the decreasing percentage use of cobalt in cells may give companies room to continue to use the metal, while achieving IRA targets for lithium, and with some more difficulty, nickel.

“Essentially, with reducing cobalt content there is a reducing need to ensure cobalt is produced to the IRA restrictions,” Reid says. “Instead, it will be easier for OEMs to focus on lithium, nickel, and graphite supply chains – which make up a much greater proportion of a cell’s mineral value. Therefore, we can expect to see cobalt-containing cathodes, such as NMCA, being produced over the next 10 years and still meet the IRA requirements.”

The challenge of cutting out cobalt

- Due to overall battery demand driven by EVs, demand for cobalt is still forecast to rise, despite lowering cobalt use and the shrinking market share of cobalt-containing battery chemistries

- The transition to nickel-rich ternary batteries is intensifying, driven by lower costs and higher energy density

- The reduction of cobalt brings technical hurdles in terms of cycle lifetimes and thermal stability

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.