Democrats are looking to decarbonize American homes with a slim majority in the U.S. Congress, introducing measures to drive the electrification of American households. According to the House Select Committee on the Climate Crisis, 42% of U.S. energy-related emissions are generated in the home, largely from heating, cooling, cooking and transportation. As the Biden administration targets a clean energy grid by 2035, and zero emissions by 2050, new sweeping legislation is being proposed.

U.S. Senator Martin Heinrich (D-New Mexico) introduced the Zero-Emission Homes Act to the Senate this past summer, with 11 Democrat colleagues as co-sponsors. Under the bill, up-front rebates would be provided for the purchase and installation of electric appliances and equipment in U.S. homes.

The bill would support both single-family and multi-unit residences and provide additional financial support to low- and moderate-income (LMI) households. So far, the bill has won support from nearly 200 organizations and nonprofits.

Under the bill, products and projects associated with household electrification would be designated as “qualified electrification projects” (QEPs). Those devices would be eligible for up to $10,000 in price relief for purchase and installation. Contractors installing QEPs in LMI communities would receive additional incentives to take on these projects.

Electrification data

In a study by Rewiring America, an electrification advocacy group, around 85% of households in the United States were found to be in line to save money on monthly energy bills today if they were using modern all-electric equipment. The report estimated that manufacturing, installing, and servicing those electric appliances would create and sustain over one million U.S. jobs. The proposed Senate act primarily lists electric load or service center upgrades, heat pumps, electric cooking appliances, electric clothes dryers as QEPs. It also includes other upgrades to residences, including solar.

The bill would allow for the installation and use of EV chargers, home rewiring, and rooftop PV systems. If solar were to qualify as QEPs, which in the language of the bill must be “determined appropriate by the Secretary [of Energy]” residential solar could be made more affordable for many Americans.

A QEP designation for solar would be a timely measure. According to the Solar Energy Industries Association (SEIA), the federal solar investment tax credit is set to provide a 26% credit for solar projects interconnected in 2021 and 2022, to step down to 22% in 2023, and then to be removed entirely for the residential sector in 2024. Meanwhile, commercial and utility scale solar would retain a 10% tax credit through 2024.

Advocates for Zero-Emissions Home bill are enthusiastic that carbon emissions reduction goals can be met while also providing financial relief to the public. Rewiring America estimates that 103 million households could save a combined $37.3 billion per year under its model of over 120 million fully electrified homes across the United States. About 44% of those households provided with savings would be LMI households, saving an average of $377 a year, the analysis found.

State policies

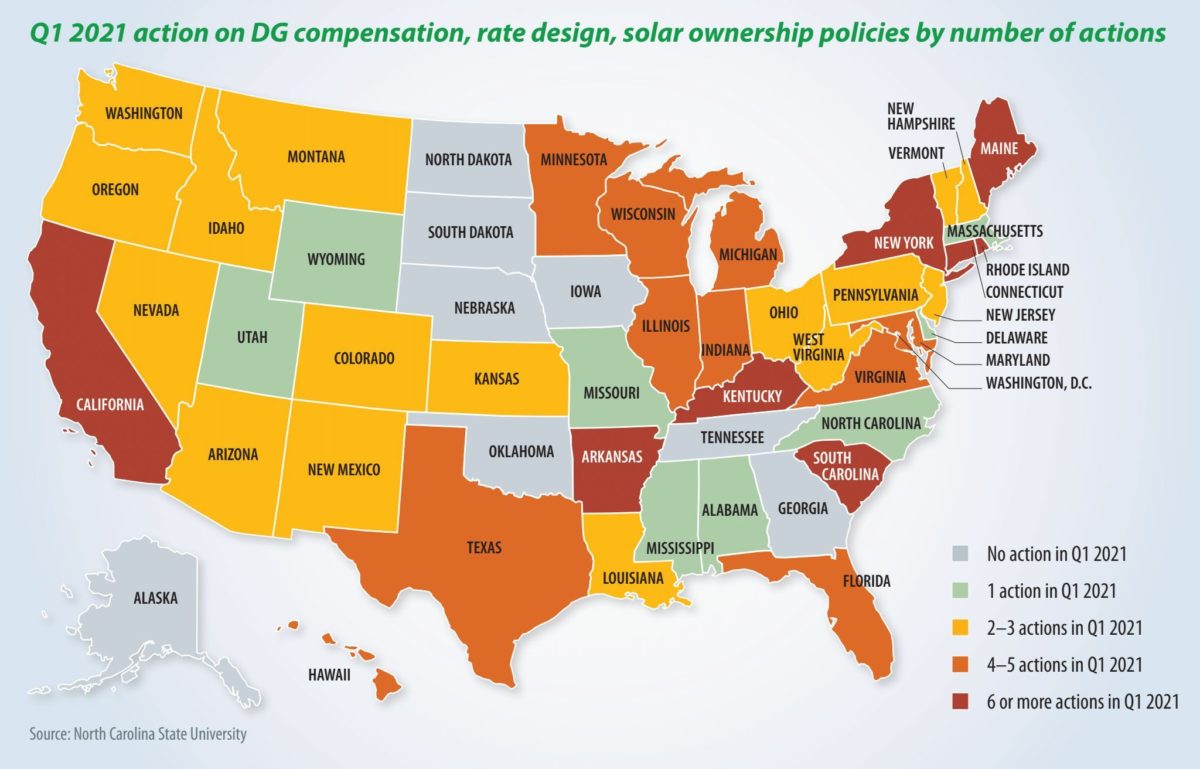

Distributed solar is being actively explored in nearly all 50 states. However, policies vary widely depending on the level of maturity solar has reached in each given state. Recent policy developments support initiatives like community solar, net metering tariff designs, or opening the door for alternative financing like third party-owned systems.

In Connecticut, solar proponents let out a sigh of relief as state regulators approved two net metering successor tariffs. The move eased fears that net metering was being wound down in the state. Additionally, the state’s clean energy investment platform, the Connecticut Green Bank, was set to expire, meaning the two tariff options came at a critical time.

Net metering involves customers selling excess power generation back to the utility company in exchange for credit on future utility bills. Twenty-nine of the fifty states have active net metering policies, said SEIA, and they are often essential to the cost-effectiveness of customer-sited solar.

Both net metering options in Connecticut will continue through 2022. One is a buy-all, sell-all tariff with a pre-determined fixed compensation rate for 20 years, and under which solar energy is metered separately from the customer’s electricity consumption – making it unattractive to those looking to add battery storage. The other tariff option is a netting tariff that uses a monthly netting interval and an export credit rate set at the applicable retail rate.

California has seen movement in net metering policy this year but in a direction solar proponents oppose. In March, Pacific Gas and Electric, Southern California Edison, and San Diego Gas & Electric filed a joint proposal for California’s Net Metering 3.0 design.

The utilities proposed a net billing structure with time-varying credits based on the avoided cost to the utility, effectively slashing the value of home solar, especially if it is not paired with smart energy storage. Also proposed was a fixed monthly grid benefits charge based on PV system capacity, further eroding the value of customer-sited solar projects.

There have been calls for community solar to be added to the net metering 3.0 design. Solar proponents have argued for a net metering policy more closely echoing the 2.0 structure – the policy that existed during California’s dominant foothold in the residential solar market. The California Public Utilities Commission is expected to make a decision by the end of this year, and the new net metering policy could be in place by late 2022.

Meanwhile, in West Virginia, the State House passed legislation authorizing the use of third-party PPAs for solar systems designed to meet the electrical needs of the premises. Around 93% of increased installed capacity nationwide since 2015 has come from states with enabled third-party ownership solar contracts (SEIA), and generally the allowance of PPAs is a signal of friendly solar policy.

The law was passed after years of advocacy and intends to give homeowners more options to install solar. What’s more, tax-exempt organizations now have a financing structure to enjoy the federal investment tax credit.

The enablement of PPAs helps West Virginia move further towards solar market maturity; it is now the 29th state to pass such laws.

In Maryland, Massachusetts, and Hawaii, net metering caps lifted, opening the gate for more installed capacity. In Montana and Colorado, system size limits for net metering lifted too. At least 12 states are considering capacity cap increases and size limit expansions.

In Maryland, Massachusetts, and Hawaii, net metering caps lifted, open-ing the gate for more installed capacity. In Montana and Colorado, system size limits for net metering lifted too. At least 12 states are considering capacity cap increases and size limit expansions.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.