On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy protection, setting in motion a chain of events that would wreak havoc on the financial markets and have profound impacts on the lives of homeowners around the world. The Dow Jones Index fell 4.4% on that day, at the time the largest daily drop by points in a single day since September 11, 2001.

In that same month, I found myself at my first PV trade show – EUPVSEC, in Valencia, Spain – for a due diligence project on novel cell passivation technologies. While the world at large seemed to be falling apart, PV appeared to be in rude health. The European industry was awash in feed-in tariffs, making Spain the world’s largest PV market in 2008. Demand for modules and materials was growing so fast that capacity expansions could not keep up. Polysilicon was in critically short supply and its spot price was soaring past $400/kg. This explained, in part, why thin film technologies such as Sunfab, Applied Materials’ lofty investment in thin film (amorphous silicon) equipment, enjoyed such prominence at the show.

A lot has changed since 2008. Almost immediately after the Valencia show, Spain’s PV market collapsed (from close to 3 GW in 2008 to almost zero in 2009), foreshadowing years of acrimony in the European courts. As global capacity expansions began to outstrip relatively lukewarm demand growth in 2009, the price of polysilicon, wafers, cells, and modules fell significantly for the first time in years, a fall that has continued almost continuously for every year since.

In 2019, I celebrated my 11th anniversary in PV and my firm, Exawatt, marked the completion of its fourth year forecasting the manufacturing cost and performance of PV technologies. From a consumer and environmental perspective, the PV industry is much healthier now, but for most manufacturers, struggles persist and show few signs of abating.

Late-mover advantage

The first-mover advantage often seen in many other technology industries has not been especially critical in PV manufacturing, due to a combination of relatively low technical barriers to entry and rapidly declining equipment costs that favored late entrants. To some extent, last-mover advantage – of the kind attributed to Microsoft (the last operating system) and Google (the last browser) – or at least late-mover advantage has seemed more apt to describe successful PV manufacturing strategies. Of the leading module manufacturers in 2008, a handful – including First Solar, Trina Solar, and Canadian Solar – remain prominent, but a number of manufacturers that barely existed (or had not even been founded) in 2008 have ascended to dominant positions, including Longi Green Energy and Risen Energy.

Some of the early entrants in PV’s Chinese expansion phase, from about 2005 onward, incurred significantly higher capex costs than more recent market entrants in a bid to hedge against high polysilicon prices. Yingli, for example, attempted to establish internal polysilicon manufacturing capability in 2009, which subsequently became uncompetitive as the price of polysilicon fell rapidly. Those Chinese manufacturers from the late 2000s that have maintained their leadership status tended to operate a module-heavy integration strategy that did not require significant expensive upstream investment – Canadian Solar is a good example of this.

But more recent changes in the PV market prompt us to ask whether late-mover advantage may be a thing of the past, at least for crystalline PV in its current iteration. As we argued in our previous article, The Mainstreaming of Mono (pv magazine 02/2019), we believe the PV industry has transitioned from the cost-reduction era (2008-2015), in which the goal was acceptable performance at the lowest cost, to the performance-driven era (2016 and onward), in which the goal is high cell/module efficiency at acceptable cost.

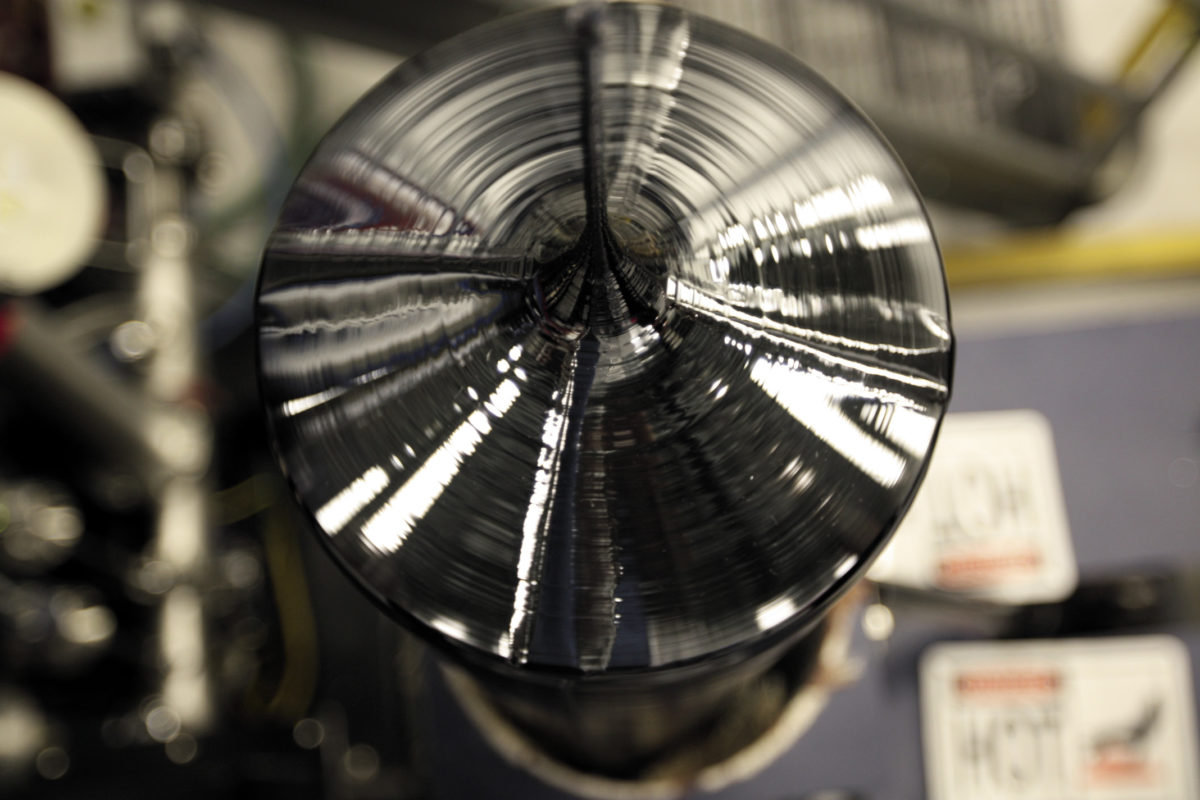

Future cost reductions for the materials and consumables that dominate PV module total costs are likely to be limited – with the exception of polysilicon. Production costs for these items are largely dominated by raw materials costs, and gross margins have already been squeezed in most cases as far as they can go, especially since China’s May 2018 policy announcement, which put the brakes on Chinese PV deployment and sent prices throughout the supply chain tumbling. By way of illustration, take diamond wire – one of the few consumables or input materials that still commanded a high gross margin in early 2018. One major Chinese diamond wire manufacturer achieved a gross margin of 44% for its PV wire in the first half of that year. For the second half of 2018 this plummeted to -2%.

The coming years

To assess whether late-mover advantage still applies in PV, it’s necessary to understand what the key module cost drivers will be over the next few years.

At Exawatt, we believe that future module cost per watt reductions will be driven by three main areas: polysilicon cost reduction (per kg); ingot/wafer cost reduction (per kg/per piece, driven by further productivity improvements and reduced kerf loss); and cell/module efficiency improvements.

So what does this mean for PV manufacturers today? Where in the previous cost-reduction era, a number of industry leaders came up against problems due to getting stuck with legacy cost structures, in today’s performance-driven era, players must avoid getting stuck with legacy efficiency limitations.

This challenge most obviously impacts companies with significant multicrystalline ingot manufacturing capacity, and explains why quasi-mono technology – which, in a different technical guise, surfed a wave of enthusiasm several years ago – is resurgent among these manufacturers. Meanwhile, kerfless wafering technologies – chasing a moving target as polysilicon costs decline – must ensure that they can match the performance road maps of their Czochralski-focused rivals if they are to provide a boost to a wafer manufacturer that adopts the technology, rather than be a drag on its future progress.

Integration implications

Unlike their multicrystalline competitors, companies with significant mono ingot capacity currently look reasonably ‘future-proofed’ against any transition to n-type, as their pullers are essentially dopant-agnostic, although n-type has yet to benefit from the multiple cycles of learning that have been applied to p-type ingot processes. Cautionary tales of those that integrated upstream into polysilicon, only to find themselves struggling to compete with the large scale and low pricing of emerging giants like GCL, may now apply to those who are operating small monocrystalline ingot/wafer operations. These small companies will struggle to keep up in a world where the likes of Longi and Tianjin Zhonghuan Semiconductor are expanding to unprecedented scale, combining high quality with low cost.

Further down the supply chain, the impact is less clear. The vastly lower capex required to establish module lines, allied to the fact that they can be switched almost seamlessly between mono and multi cells, means these are at lower risk. Even newer innovations such as half-cut cells require low up-front investment.

Cell lines can often be upgraded – from BSF to PERC, and perhaps later to TOPCon – mitigating the risk of being stuck with legacy efficiencies in an era when efficiency will be key. Perhaps here heterojunction (HJT) provides an interesting counterpoint, requiring entirely fresh investment rather than being just an upgrade to existing lines.

Given the uncertainty about whether any transition to n-type is more likely to be driven by TOPCon or by HJT, cell manufacturers are in a tricky position. Will an early entry into HJT leave them with legacy capex issues (in the form of high depreciation charges and potentially higher debt interest burdens), echoing the first-mover challenges of the past?

Or will it put them ahead of the curve, allowing a move to dominance as we’ve seen with Longi and Zhonghuan in the mono ingot/wafer market? Now, more than ever, cell efficiency – delivered at acceptable cost – will be the key.

Author: Simon Price

Simon Price is CEO of Exawatt, whose consulting services combine detailed market tracking, cost analysis, and performance forecasting with a deep understanding of the technical issues at play in all facets of PV manufacturing, from polysilicon to modules and inverters. A former electrical engineer, business journalist, management consultant, and interactive entertainment software CEO, Price has been involved in solar since 2008. In 2017, Exawatt expanded its coverage to include silicon carbide semiconductors and battery storage, with a particular focus on applications in electric vehicles.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.