The global $6 billion-plus residential energy storage market is expected to grow significantly over the next decade. In mature solar PV markets, changing regulations and policies – such as the expiration of solar feed-in tariffs (FITs) and net-energy metering schemes – are creating the desire for customers to increase their self-consumption rather than feeding power into the grid. Research firm IHS Markit projects that the residential energy storage market will grow from annual installations of 792 MW in 2019 to 2.7 GW in 2025. The largest distributed-generation (DG) storage markets will be Japan and Germany, with Australia and the United States rapidly emerging as key growth countries.

“The major market driver for residential energy storage are a mix of high retail electricity rates, high penetration of residential solar PV and a desire by customers to increase their energy independence,” says Julian Jansen, head of energy storage research at IHS Markit.

Last year’s wildfires in California – with subsequent widespread preventative power shutoffs – and severe bushfires in Australia led to billions of dollars in estimated losses from power outages, pushing utility customers across the globe to seek backup power. Events such as these are driving homeowners and businesses to look to solar and storage, not just as a cost-effective source of power, but more importantly to ensure reliability during outages.

Under the pressures of unforseen power outage events, residential solar PV owners’ rooftop systems were unable to power their homes, as safety shut-off protocols were put in place to protect utility line workers. The addition of battery storage has therefore become a more and more attractive option for solar generators. A battery storage system plus software can create a grid for the home – islanding it off from the local utility – for homeowners to have energy when the grid fails.

“As climate change is increasing the frequency and strength of natural disasters, this has elevated the crucial role that energy storage plays not only in providing resilience for end-customers, but also supporting the rebuild of power infrastructure in the aftermath of natural disasters,” notes Jansen.

Storage solutions

One example of storage stepping in as a solution to catastrophe is the response to 2017’s Hurricane Maria in Puerto Rico, which devastated infrastructure and caused long-term supply challenges. This drove uptake of solar+storage not only for residential customers, but also for microgrids restoring power supply. Overall, microgrid formation is flying.

As of the first quarter of 2020, Navigant Research identified 6,610 projects representing more than 31 MW of planned power capacity to be installed. The Asia-Pacific region has recently emerged as the global leader in microgrid capacity, followed by North America and the Middle East and Africa region, Navigant researchers say.

The development of self-generation capability is rising, with homes being wired with solar+storage to shield themselves from the grid. Microgrids (or nanogrids, as some call residential microgrids) are seeing significant uptake. And while DG market projects used to be seen as competition to electric utilities’ business models, today, they are seen as an opportunity to further support the needs of utilities.

For instance, South Africa’s weak transmission and distribution (T&D) foundation is resulting in regular planned outages, impacting commercial and residential customers alike. This is driving up the demand for DG battery energy storage systems and helping to alleviate the grid.

In an ever more digitalized world, cloud-based smart technology is being adopted with rigor in conjunction with today’s increased number of distributed energy resources (DERs) – such as solar, battery storage, and electric vehicles. By pairing together smart energy technologies and software, the emergence of virtual power plants (VPPs) is quickly supporting utility challenges of the past – while providing greater independence for homeowners and communities alike.

“The emergence of virtual power plant (VPP) business models and utilities looking to procure balancing services from aggregated distributed storage assets, is creating additional revenue streams for customers and improving financial returns,” says Jansen.

Brand names

The swell in sales of residential battery storage systems has encouraged many manufacturers to jump into the fray. “Pioneers of turnkey residential battery storage products – Outback, SMA, SolarEdge, Enphase – have been joined by just about every company that manufacturers inverters or batteries, including Fronius, Delta, LG Electronics, Q-Cells, Panasonic, Sonnen, Generac and others,” according to solar PV analyst Barry Cinnamon.

While some of these vendors are vertically integrated – producing everything from solar panels to batteries to inverters to software – few do it all. Tesla is one of the most integrated among the suppliers, but even it has had supply chain issues. Key to the provision of integrated residential battery storage systems is the software platform that operates the system in conjunction with energy generation assets.

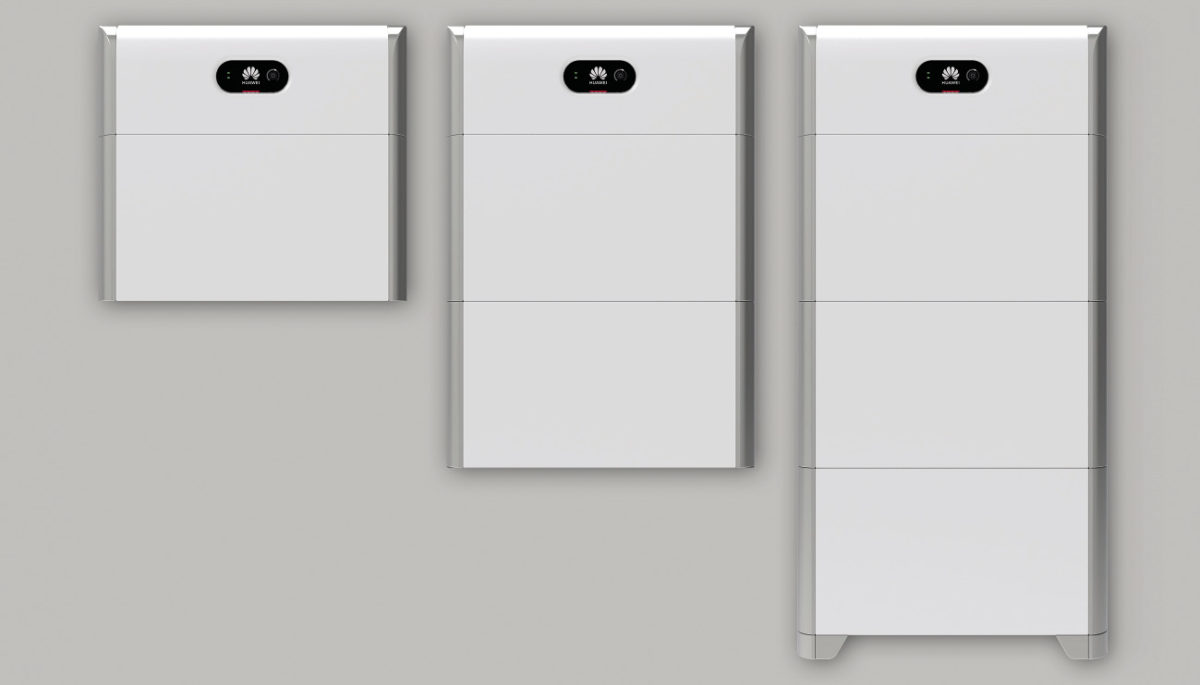

Among the many well-known brands that have entered the market over the past year is Huawei, which is globally known as an innovator in the smart PV market segment for its inverters, artificial intelligence, and software platforms. Its Smart Energy Storage System, available in the fourth quarter of 2020, offers a plug-and-play solution with an inverter, battery bank, monitoring, and mobile software controls.

Integrated approach

As the deployment of solar+storage grows rapidly, one of the key challenges for developers and system owners alike has been dealing with warranty claims and liability issues that can arise between different inverter companies and battery energy storage suppliers.

“By expanding FusionSolar and adding Smart ESS into Huawei’s residential offerings, we will provide an upgraded experience for both installers and end users,” says George Qiwei Zhang, the company’s storage solutions expert. “While other competing solution providers need to source components from different vendors, that leads to higher procurement and stocking costs, and no clear line of warranty responsibility in the case of inverter or battery failure,” he adds.

By bringing together the two systems, Huawei believes it will provide end-customers with an optimal solution. “The addition of a residential battery into the Smart PV Solution will allow Huawei to offer a one-stop, end-to-end solution with a simple interface for sales, fulfillment and after service,” says Zhang.

Next level

Huawei’s FusionSolar Smart PV and Storage System creates an integrated approach to residential storage, by combining its Smart ESS, Smart PV Optimizer, Smart Energy Center, Smart Energy Power Sensor, FusionSolar Smart PV Management System, and Smart Dongle.

The system includes the capability of mobile remote inverter and battery diagnosis, along with troubleshooting guidance. The cloud-based data link also enables automatic firmware upgrades to the system, according to Zhang. The homeowner interface with the system is centralized and already on the market.

For safety, Huawei says its system uses lithium-iron phosphate (LFP) batteries, which provide more heat tolerance than basic lithium-ion batteries and pose less of a fire risk. “We are offering BoostLi, an enhanced battery technology with pack-level charge/discharge optimization, which not only allows homeowners to fully utilize battery energy during its lifecycle but also facilitates future system expansion with perfect compatibility,” Zhang says.

The battery banks are available in modular 5 kWh units, and are scalable up to 30 kWh. The system is available in a single-phase design for the broad residential market and a three-phase design for large homes and small business applications. The battery packs permit a 100% depth of discharge, unlike many competitor systems, in which much lower discharge levels are permitted to uphold the product warranty.

Part of the consumer decision to select an integrated software platform for energy storage is the faith that the vendor will be around 10 years down the road. Huawei, with more than $100 billion in annual sales, is able to guarantee its 10-year warranty for many years to come, unlike a half a dozen other inverter companies that have exited the U.S. market over the past decade. Huawei says that it is putting customers first in its design smart design processes.

“Our AI self-learning battery is helping customers to achieve an optimal electricity cost,” says Zhang. “The FusionSolar Smart PV Management System estimates how much energy your PV system will generate in the near future, it considers a customer’s previous energy usage data, and it automatically recommends adding additional or replacement batteries to increase self-consumption.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.