Reporting under the EU taxonomy has begun and the results aren’t pretty. As of Sept. 16, only 25.6% of companies’ revenue, on average, 32% of capital expenditure (capex), and 25.3% of operating expenditure (opex) were eligible for the taxonomy – generated by or invested in activities considered green by the EU, or which have the potential to be green. Some 834 companies made taxonomy-related disclosures in their 2021 financial results. Of those businesses, 793 disclosed the percentage of revenue eligible for the taxonomy, 777 their green capex, and 747 their eco-friendly opex, according to Bloomberg.

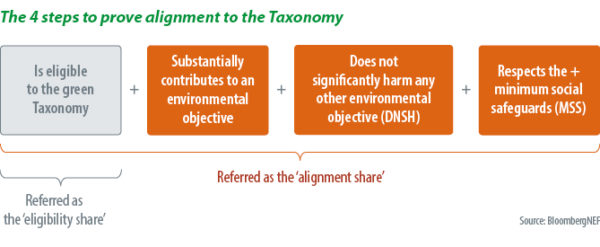

Taxonomy reporting rules came into effect a year ago and focus on companies and asset managers. For both groups, reporting will ramp in future. Companies, in particular, will need to report the “alignment” of revenue, capex, and opex by next year, revealing the extent to which they are considered environmentally sustainable under the taxonomy.

Main impact

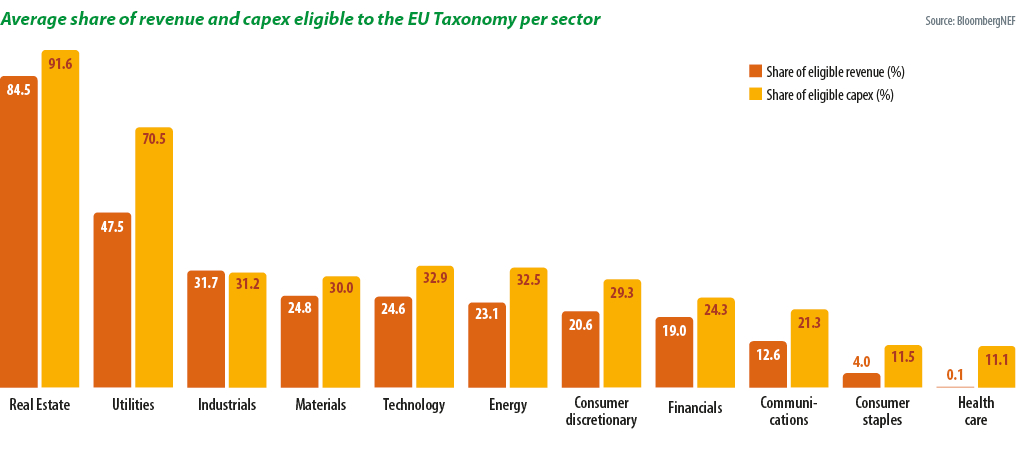

With investors and banks potentially withdrawing support from companies with low taxonomy eligibility, early reporting has revealed big differences in the taxonomy alignment of different business sectors. While an average 84.5% of real estate revenue is taxonomy-eligible – and 47.5% from utilities – only 4% of revenue from consumer staples meets the threshold, and only 0.1% of healthcare trade. Of the 793 companies that reported revenue eligibility, 37% announced no eligibility, with the figure falling to 22% for capex.

Asset managers could also be affected by the taxonomy as they may struggle to find investments that meet green revenue, capex, and opex requirements. This could become a reputational risk. Indeed, the asset managers that must report their taxonomy alignment at the moment are the ones that claim they take into account environmental factors, whether it is just a part of a wider investment process (referred to as Article 8 funds under the taxonomy) or because their funds have an environmental objective such as financing climate change mitigation (Article 9 funds). As most of the company data so far are either unavailable or show poor levels of eligibility, fund managers fear they could be accused of inflating sustainability claims due to a low share of taxonomy-eligible investment products.

BNEF’s take

In many ways, the low eligibility and alignment observed in the initial reporting points to the positive impact the EU taxonomy could have. The instrument reflects how far economies are from aligning with the Paris Agreement on capping global temperature rises, but investors and companies can take solace from the following factors.

The decarbonization challenge: We’re a way off but taxonomy disclosures can help the financial industry target sectors with the lowest levels of green eligibility and alignment to prioritize the financing of their transition. It can also help regulators identify sectors that need the most decarbonization incentives.

Low alignment is not disastrous: Thus far, the taxonomy is only a reporting framework. It does not mandate a minimum level of alignment or define eligibility for sustainability funding. That may lay ahead, though, if the EU advances plans for an ecolabel for retail funds – requiring asset managers to have a certain share of green investments to be able to make sustainability claims. For now, that European Commission project is on hold.

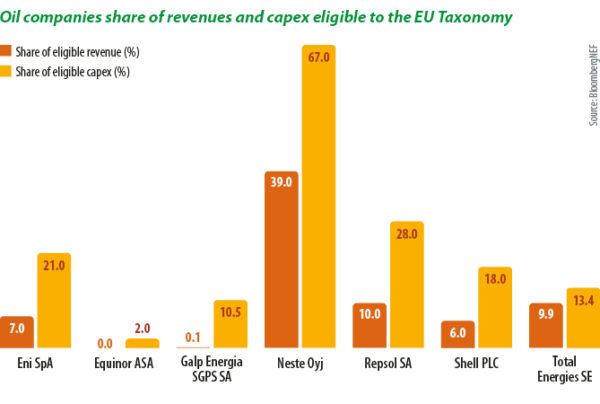

Capex signals transition plans: Investors and companies with low taxonomy eligibility should focus on their capex reporting. While the green share of revenue highlights how companies are already aligned with the Paris Agreement, the score for capital expenditure captures how much a business is investing in future low-carbon activity. Capex can be a proxy to assess how companies are preparing for the transition. Companies with low revenue alignment can point to their capex percentage to back claims that they are investing in the transition.

Some 51% of companies reporting under the taxonomy today have higher eligibility percentages for capex than for revenue. Noticeable differences can be found in the energy sector which, on average, reported 23.1% of revenue eligibility but 67% capex alignment. For instance, oil and gas companies such as Eni and Repsol, despite having a very low level of revenue generated by activities eligible for inclusion in the taxonomy, invest 21% and 13.4%, respectively, of their capex in activities that are covered by the green rulebook. The most significant insight comes from Finnish oil refiner Neste Oyj, which generates 39% of its revenues from taxonomy-eligible activity and invests 67% of its capex in such expenditure. Neste explains in its financial statements that the relevant capex is invested in activities related to its biofuels business, including sustainable aviation fuel.

Asset managers with article 8 and 9 funds could opt to invest in the companies with low levels of revenue alignment but which show greater alignment of their capital expenditure with the EU green framework. This is why some asset managers who have a transition mandate choose to report on the capex alignment of their investments, to tell the story from a different angle.

About the author: Maia Godemer is an associate at BloombergNEF. Her research focuses on sustainable finance and the regulations governing that market. Godemer was formerly a member of the ICMA Advisory Council for Green and Social Bond Principles. She has worked as an account manager for a major investment bank in London and Paris, as well as the referent for sustainable finance for the key sell-side institutions in Europe. Godemer holds master’s degrees in management and finance.

About the author: Maia Godemer is an associate at BloombergNEF. Her research focuses on sustainable finance and the regulations governing that market. Godemer was formerly a member of the ICMA Advisory Council for Green and Social Bond Principles. She has worked as an account manager for a major investment bank in London and Paris, as well as the referent for sustainable finance for the key sell-side institutions in Europe. Godemer holds master’s degrees in management and finance.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.