The result of this surge in demand was a spike in poly prices. The contract price of solar-grade poly soared, from $40/kg in 2004 to more than $200/kg by 2008 – and the poly spot price at moments during that year went beyond $400. But while polysilicon manufacturing capacity wasn’t keeping up with demand, the ultimate raw material (quartz) was abundant, and the gap between the spot price of polysilicon and its manufacturing cost was unsustainably high.

Drawn by the high profit margins and lack of capacity, a host of Chinese manufacturers swept into the market, aggresively ramping capacity and optimizing manufacturing processes to reduce electricity usage. In addition, many of these manufacturers sprang up in coal-rich parts of northwest China, allowing access to electricity at lower prices than before.

By the end of 2013, the manufacturing cost of polysilicon had tumbled to below $20/kg among industry leaders. Meanwhile, capacity had grown from less than 50,000 MT per year in 2007 to over 350,000 MT per year by 2013. Overcapacity had taken hold, and many manufacturers were forced to sell at cash cost to remain in business.

Both polysilicon manufacturing costs and prices then followed a relatively steady downward trend – prices fell to around $15/kg by 2018, with only minor bumps along the way. Following the May 2018 announcements of changes to the Chinese government’s policies on support for PV projects, prices fell below $10/kg and remained there for over two years. In mid-2020, Covid-related uncertainty then pushed even mono-quality polysilicon spot prices down to record lows of just over $7/kg.

Uncompetitive producers

Uncompetitive producers

Against the backdrop of these relentlessly low prices, some polysilicon manufacturers chose to exit the market or scale back production. Nowhere was this more apparent than with South Korean manufacturers, where the problems caused by low selling prices were exacerbated by the struggles of the non-Chinese ingot manufacturers that had previously formed part of their customer base.

Hanwha Chemical closed down its polysilicon manufacturing in 2020. Hankook Silicon’s production, which had been dwindling for a number of years, finally came to an end. And OCI – previously a giant in the polysilicon world – made a strategic move to cease production of solar-grade polysilicon in Korea, bringing its total global capacity down from 79,000 MT/year to 36,500 MT/year. As well as this reduction in capacity outside of China, some smaller Chinese manufacturers have also exited the polysilicon market in recent years. And if that weren’t enough, in the first half of 2020, GCL-Poly reduced the capacity of its Jiangsu production base to transition some production to Fluidized Bed Reactor (FBR) technology.

![]()

New decade

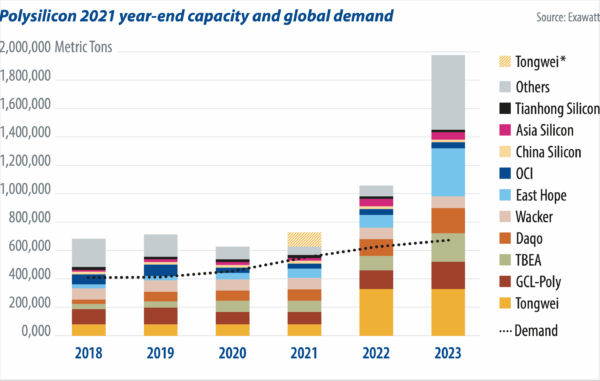

Set against the reduction in manufacturing capacity has been an increasing demand for polysilicon, with strong growth in end demand for PV modules more than offsetting the decline in silicon usage per watt that has been driven by reduced wafer thickness, reduced kerf loss, and increased cell efficiencies.

In the middle of 2020, a series of unexpected incidents at polysilicon manufacturing facilities (including a fire, a flood, and an explosion) caused a decline in Chinese polysilicon production and a rise in polysilicon prices. Chinese polysilicon production rapidly bounced back and has since set a number of records for monthly production volumes (see chart, p. 53), but the reduction in global capacity has left the market with little room for maneuver in times of high demand.

The reduction in supply has also left some ingot manufacturers with little confidence that sufficient polysilicon (and especially polysilicon of the right quality) can be relied upon to be available when they require it. This has been exacerbated by the fact that ingot and wafer capacities have increased vastly out of proportion to polysilicon, with multiple new entrants to the market vying for wafer sales and scrambling for polysilicon supply. And while polysilicon production in the first half of 2020 appears to have been enough to satisfy end demand from module purchasers, there has been overproduction from ingot to module, with manufacturers building up inventory in expectation of very strong demand in the second half of the year.

Lean times

So, when can the industry expect to see relief from the current high prices? Several polysilicon capacity expansions from industry cost-leaders are due to ramp up production in early 2022, which should bring some balance back to the market. These include 40,000 MT/year of capacity from Daqo, due to ramp to full production in the first quarter of 2022, and 100,000 MT from Tongwei, notionally due online in late 2021, but not ramping to full output until the first two quarters of 2022. It also includes 30,000 MT from Asia Silicon, due to ramp in the first quarter of 2022, and expansions from East Hope and GCL-Poly in early 2022.

Beyond this, just how much prices fall later in 2022 will depend on the exact timings of other new capacity expansions, and how quickly they can ramp to full production of mono-quality material. Although there is some uncertainty around the exact timeframes for some of these expansions, not to mention whether planned timeframes will be met, it’s clear that through 2022 and 2023 there is a very significant volume of new capacity due online from the leading manufacturers.

Besides the established suppliers, the high polysilicon prices seen over the past 12 months have driven interest from new entrants to the industry. Of course, some of these plans may not come to fruition, and some may take longer than hoped to reach the quality requirements of the ingot manufacturers, which will only get more stringent as n-type cell manufacturing expands.

Still, with so much capacity in the pipeline, even if a significant proportion of the pipeline falls away, a major shift in the supply-demand balance in favor of polysilicon purchasers seems inevitable. With overcapacity looming and manufacturing costs at industry leaders such as Daqo and Tongwei being below $6/kg in 2020, we believe that the long-term outlook is for low polysilicon prices, much to the relief of those further downstream in the PV industry.

Alex Barrows is research director at Exawatt. He focuses on when and how new technologies will influence the PV market, and oversees PV market data analysis for the company. He obtained his PhD in the physics of perovskite-based solar cells from the University of Sheffield.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.