EV charging companies to ramp up installations

The market for EVs is experiencing robust uptake worldwide with companies, governments and municipalities implementing policies to drive development. EVN and EVBox announced plans for expansion this week, and the UK government is also pouring investment subsidies into the electric vehicle market.

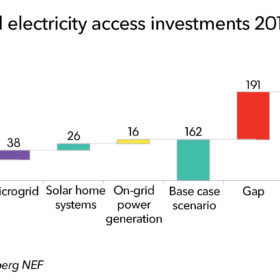

BNEF: Micro-grids could ‘leapfrog’ the grids for universal power supply

UN delegates are meeting in New York to negotiate further realization of the Sustainable Development Goals. One of the goals is to ‘Ensure access to affordable, reliable, sustainable and modern energy for all.’ And Bloomberg NEF argues that thanks to new technology this goal is more feasible than ever, and that delegates should focus on building financial and regulatory frameworks to enable large scale micro-grid development.

Q4 could be a ‘hot market’ for solar contract negotiations following China’s changes – BNEF Q&A

In a Q&A with Bloomberg NEF (BNEF), two solar analysts tell pv magazine they see no PV module price rebound, continuing oversupply, and falling utilization rates. They expect Q4 could be a “hot market” for contract negotiations, while Chinese developers will start overseas construction earlier than planned for two key reasons.

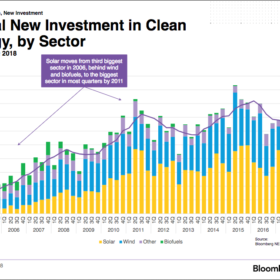

Global solar investment drops due to low project costs, China policy change

While overall global investment in clean energy saw a decrease of just 1% YoY in the first half of 2018, solar’s share dropped 19% following changes to China’s PV policy and lower project costs, says Bloomberg NEF (BNEF). It forecasts this trend to continue throughout the year.

Intersolar Europe, The Smarter E kicks off to a positive start

The 2018 Smarter E event, of which Intersolar Europe is now a part, opened its doors today in Munich, Germany, with positive news that visitor numbers are up. From the conference sessions, the big topics were PPAs and unsubsidized solar. Meanwhile, the Indian Government made some interesting announcements, and kerfless solar is on track to become the next disruptive technology.

Falling battery costs to push solar, wind to 50% electricity generation by 2050, but electricity still failing CO₂ reduction targets – BNEF

Solar PV capacity is set to grow 17-fold, and wind six-fold, by 2050, to account for nearly half of global electricity generation, predicts BNEF, while investments will reach US$11.5 trillion. Cost reductions will drive this charge, particularly in the battery market, which will benefit from the EV manufacturing ramp up. Despite this, the electricity sector is still failing to bring CO₂ emissions down to the required levels, with its continued dependence on gas.

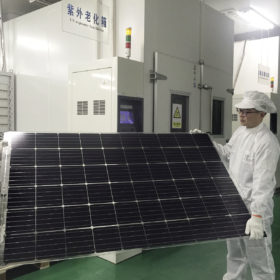

2018 global PV market to see negative growth following China backtrack

Global solar PV demand this year will be less than in 2017, on the back of China’s latest policy decision, says TrendForce. Overall, it sees new installs dropping 40% in China to 31.6 GW. The protectionist measures taken by the U.S. will also be weakened by the resulting falling module prices.

BNEF expects 34% fall in PV module prices in 2018

The organization is expecting carnage throughout the solar value chain as the result of reduced policy support for deployment in China.

Blockchain could significantly shape management of renewables, but challenges remain – report

The evolving outlook for project finance, as well as the gradual maturation of technologies, such as blockchain, present new challenges and opportunities for renewables, EY says in its latest Renewable Energy Country Attractiveness Index (RECAI) report. Uncertainty in the sector continues to drive a “relentless focus on cost” to soften the impact of protectionism, subsidy cuts and rising interest rates throughout the world, it adds.

Global investments in small-scale solar rise 16% in Q1, one of few sectors to buck downward trend, finds BNEF

New quarterly figures from Bloomberg New Energy Finance (BNEF) show that investments in solar PV arrays of less than 1 MW hit US$14.3 billion worldwide in Q1 against 10% year-on-year contraction in global renewable investments.