How will PV’s intellectual-property scuffles shake out?

Lawyers are doing brisk business as tunnel oxide passivated contact (TOPCon) solar technology moves into the mainstream. A series of patent infringement cases have been launched in the United States and Europe and their impacts are reverberating through the marketplace. How likely is it that winners will emerge?

Weekend Read: Thin prospects

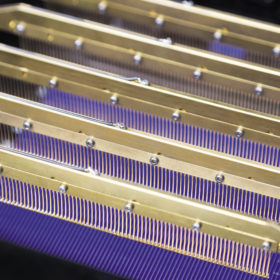

The production of PV ingots and wafers remains the most highly concentrated of all the production stages in the silicon solar supply chain. Yet efforts to re-establish production in Europe and the United States are not for the faint-hearted.

Weekend Read: Connecting HJT

The application of busbarless cell interconnection approaches could unlock the potential of heterojunction (HJT) technology, primarily by reducing the historically high silver usage of negatively-doped, “n-type” cell technology. As HJT manufacturing increases, a wave of applications may very well be on the horizon.

The overproduction conundrum

Solar manufacturing capacity has been ramping up so quickly that even impressive installation growth cannot keep pace. Molly Morgan, senior research analyst at UK-based research firm Exawatt, explores the relationship between PV supply and demand and assesses the likelihood of overproduction.

PV InfoLink forecasts polysilicon prices to be halved by end of 2023

The consulting firm expects prices to decline gradually through the first semester of 2023, followed by an accelerated decline in the second half of the year, with prices falling from the current CNY 300 ($36.64)/kg to below CNY 150/kg by the end of 2023. Polysilicon production capacity may increase from 500 GW in 2022 to 975 GW next year.

New technologies, new opportunities

UK-based analyst Exawatt and Germany’s Nexwafe published a white paper this week that takes a close look at the current state of PV manufacturing worldwide, and how Nexwafe’s innovative wafer production tech might fit into it. They said that if the potential of its Epiwafer can be realized, the PV industry may yet see “another revolution in wafer manufacturing.”

What’s next for polysilicon?

The past 12 months have proved profitable for polysilicon manufacturers, as selling prices have soared to levels not seen since 2011. However, with major new capacity expansions on the horizon from most of the leading manufacturers, and new players planning to enter the scene, the market balance looks set to shift. Exawatt’s Alex Barrows rounds up where the industry stands and what might happen next.

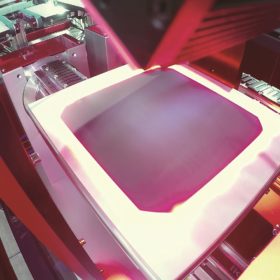

The implications of a messy Meyer Burger-Oxford PV divorce for European perovskites

Last week’s announcement Oxford PV wants to wind up its “exclusive cooperation” with Meyer Burger after the fit out of its 100 MW German factory points to a potential divergence in strategies. And with Meyer Burger considering legal action in response, it could result in a messy, disruptive separation.

The mainstreaming of mono

In the second half of 2018, monocrystalline silicon technology passed an important milestone: Quarterly production of monocrystalline ingots, wafers, cells, and modules overtook that of multicrystalline for the first time in the mainstream PV era. This milestone was tracked by PV technology and market forecasting firm exawatt. CEO Simon Price sets out how mono’s rapid growth could have been, and was, predicted.