Mercom Capital has released a new analysis which finds an ongoing fall in lending rates for solar projects in India, which it says it making solar projects with lower-priced contracts more viable.

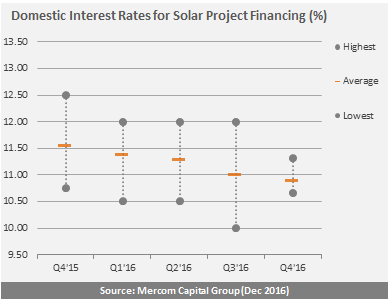

The clean energy consultancy estimates that average domestic interest rates for solar project financing fell below 11% in the fourth quarter of 2016, as part of a steady decline from above 11.5% a year prior. It further states that this fall in rates is making projects with contracts below INR 5 (US$0.073) per kilowatt-hour (kWh) viable.

Of course, large corporations with big balance sheets continue to get capital more cheaply.

Of course, large corporations with big balance sheets continue to get capital more cheaply.

Mercom also says that internal rates of return (IRR) are starting to improve due to falling module and system prices, with developers expecting 13-20% IRR. The company notes that the more conservative estimates from banks fall in the 11-19% range.

One factor in all of this was India’s process of demonetization, which has had several impacts on the sector. One detail is that old 500 and 1000 rupee notes were allowed for paying utility bills until December 31, which has helped utilities recover unpaid bills.

As such the process is bringing in extra funds to both utilities and banks, and Mercom says that the latter could lead to lower interest rates.

India’s solar sector continues to grow rapidly, with Mercom estimating that 4.2 GW was installed in 2016 and forecasting that more than 9 GW will be installed this year.

Along with this investments in the sector are also booming, with $736 million invested in the sector in the final quarter of 2016 and the first initial public offering for an Indian solar developer.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.