From pv magazine 03/2021

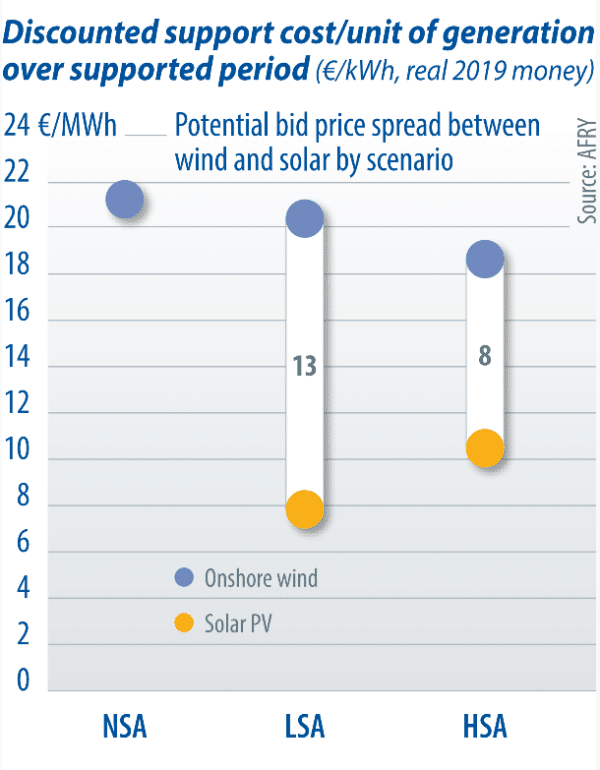

New analysis of the value solar delivers in Ireland is changing the way solar is viewed in the country. Crucially, it found that that the solar bid price, in the next auction of the Renewable Electricity Support Scheme (RESS), could be €8-13 higher per megawatt-hour than for onshore wind projects – and the cost to Irish consumers would be the same. The bid price for solar could be substantially higher than competing technologies, and Irish society would still benefit.

When the Irish Solar Energy Association (ISEA) challenged AFRY Management Consulting to model the system, the scale of the effects that they found were not predicted. The view at the outset was that perhaps solar had potential benefits that were not captured in the RESS price. In other words, there was a “hidden value” that was not reflected in the actual price.

This topic is important both in the near and medium term. In the first auction (RESS-1), close to 800 MW of utility-scale solar was successful, meaning that over the course of 2021-23, these projects will be rolling out at volumes previously unseen in the market. In the jargon of the sector, Ireland plans to be a “fast follower,” with the second auction (RESS-2) coming later this year.

With a further 1 GW of solar potentially qualifying for RESS-2, the two main competing technologies are expected to be onshore wind and solar. The auction results are determined based on the levelized cost of energy, on a €/MWh basis, with wind being widely recognized to hold an advantage. Policy decisions around auction design will be key to energizing renewables across the mid-2020s and achieving 2030 energy targets.

Using independently sourced assumptions and their market modeling software, AFRY modeled three scenarios: No Solar Ambition (NSA) – existing and RESS-1; Low Solar Ambition (LSA) – 2.5 GW by 2030; and Higher Solar Ambition (HSA) – 5 GW by 2030.

A compelling result was the difference in emissions between the NSA and the HSA scenarios. In the HSA, annual emissions are reduced by 7% in 2035. This effect is due to the solar assets running during the day, which work to displace gas assets in the merit order. AFRY admitted that both the effect and its scale were surprising.

This timing effect also impacts the cost of support. The PSO levy is payable by electricity consumers and is used to support the deployment of renewables. The levy is determined by the difference between the power price and the achieved auction price (adjusted for capacity market revenues). Solar assets tend to run during traditionally higher price periods, meaning the gap between the auction price and the power price is lower on average, reducing the level of support.

This is how solar can simultaneously secure a higher auction price and a lower cost of support – an effect that AFRY found to be substantial.

When the combined carbon and support savings are compared to the costs of buying that power, it results in a net annual saving in the scenarios where solar deployment increases. This outcome ranges between €54 million and €106 million in 2035, which is equivalent to €10-21 per Irish citizen.

The research also found reduced levels of curtailment for renewables in the HSA, compared to the NSA. Therefore, increased levels of PV positively impact both the solar and wind sectors.

While this research found a solar diversification effect for the system, the question is what to do about it as a society? ISEA favors an option whereby the technologies face competitive pressure from peer projects, with the maintenance of a solar preference category in the next RESS auction. An alternate mechanism would be the use of a factor (termed Evaluation Correction Factor in the RESS-1 ruleset) which could adjust the auction price offered by solar projects to account for the €8-13/MWh pricing effect. While it may affect auction price, it may not drive out the true price for all technologies.

In the past few years, Ireland’s electricity network has achieved significant milestones, with up to 70% renewable penetration achieved regularly, due to the large volume of wind on the system. It is now time for Irish solar to contribute to this success story. As the report shows, there are significant benefits to doing so. With the correct policy framework, solar will contribute to both the electricity sector and wider society. The sun could shine brightly for the sector. How often is that said about Ireland?

About the author

Conall Bolger is the recently appointed CEO of the Irish Solar Energy Association. He has 15 years of markets and policy expertise, working across the energy value chain from community and behind-the-meter projects to large-scale onshore and offshore wind development. He founded and developed Cornwall Insight’s Irish operations, and has advised policymakers and regulators in Ireland and Northern Ireland. His international experience in renewable energy includes Poland, Canada, and Great Britain.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.