Headed for oversupply?

Mark Hutchins headed over to Infolink Consulting’s booth for a look at the numbers behind the growing markets for solar technology, as exemplified by relentless activity across the exhibition floor.

Analyst Amy Fang said Infolink expects global installations this year to come in at between 385 GW and 450 GW, capped by a late surge in numbers from China as large projects are expected to reach completion in Q4.

InfoLink expects Europe to install between 90 GW and 120 GW this year and Fang notes the region remains somewhat constrained by project delays, with investors waiting for promised price declines to materialize.

Module prices are expected to fall with InfoLink forecasting levels of $0.17 to $0.18/W by the end of the year. This will be driven by polysilicon moving into oversupply, with enough to produce 50 GW of solar modules expected to be available in the fourth quarter, against demand for 42 GW.

Manufacturing capacity grows – can Europe keep up?

pv magazine‘s Mark Hutchins has met with one manufacturer that, tucked away in the back of hall C4, is nursing big expansion plans.

Having first moved into PV cell and module production in 2020 – after several years providing engineering, procurement, and construction (EPC) services to large solar projects in China – QN Solar today has manufacturing capacity of 28 GW for cells and 25 GW for modules up and running, and expects to reach 69 GW for cell and 40 GW for modules this year.

As QN Solar Chairman Stephen Cai explained, even China’s domestic PV market is not large enough to absorb that amount of production capacity so the company is looking to supply projects further afield. Cai says QN Solar is moving into Latin American markets, Japan, and the Middle East – where it has signed contracts to supply a 2.5 GW project in Abu Dhabi to be completed by 2025.

The manufacturer also places Europe among its top target markets and Cai says he is considering setting up an EPC business on the continent – convinced QN’s experience working on large scale projects with utilities in China would make it a valuable player in this market.

Cai sees Romania, Slovakia and several other countries in Eastern Europe as under-developed in terms of PV and offering significant opportunities for the types of project – ideally around the 100 MW mark – that QN is used to dealing with.

The company has also begun supplying batteries to projects in China and says it will roll this out globally from next year, given batteries are increasingly a requirement when it comes to developing solar projects.

Those numbers – and the speed at which QN Solar’s manufacturing plans are taking shape – show we can expect China to remain the clear leader in solar manufacturing at scale. They also outline the size of the challenge ahead for Europe if the region wishes to meet a significant chunk of its PV demand with locally produced modules.

Go big or go home

Chinese lithium-ion battery manufacturer Hithium has entered the European market with a new office in Munich and a debut at the Smarter E show, writes Marija Maisch. Established only four years ago, the company is growing at a breakneck pace.

“We are expanding from the current 15 GWh to 70 GWh by the year’s end, and up to 135 GWh by 2025,” says Hithium VP for Sales and Marketing, Mizhi Zhang. Manufacturing in Europe is also on the cards.

The Chinese unicorn company has attracted a long list of investors. “More than 50% of them are institutional investors and the rest is coming from strategic investors, such as downstream application and mining companies,” Zhang adds.

He says Hithium, which does not make EV batteries and solely specializes in static energy storage systems, has attracted funding by virtue of its innovative technology. Hithium’s lithium iron phosphate (LFP) cathodes are designed to slowly release lithium ions, resulting in lower cell degradation.

“Unlike other LFP cells, Hithium’s 300 Ah battery cell displays less than 2% of degradation in the first 10o0 cycles,” Zhang says.

So far, the company has deployed more than 9 GW of battery energy storage system (BESS) capacity, more than 85% of which is in China. For this year, Hithium expects to another single-digit GW to be deployed.

Deals dry up in switch to buyers’ market

While the Intersolar halls are thronged with visitors, sales appear hard to come by – according to analyst reports – making the market dynamic in 2023 the polar opposite of the previous year.

The S&P Global Commodities Insight team swung by the pv magazine booth and told editors Mark Hutchins and Jonathan Gifford that changing supply and demand dynamics have led to purchase orders for module makers being hard to come by.

They explained that when a rapid change in supply-and-demand occurs, activity grinds to a halt.

The S&P team said that when there is a sizeable market correction it slows down investment decisions, causing delays as both buyers and sellers recalibrate what they believe is the right price.

Home sweet solar home

For the German balcony-solar market, Solis has a new mini inverter series designed to connect solar panels to a low voltage battery. The S6-GR1P(0.6-0.8)K-UM inverter has a 2 m EU-type plug and a rack mounting that enables easy plug and play installation. The system comes in two models – a 600 W and an 800 W version – each with a rated voltage of 60 V and a maximum efficiency of 96.6%.

Additionally, the S6-GR1P(2.5-6)K-S 6th generation single-phase inverter, by Solis, was designed especially for smaller balcony and residential PV installations. The inverter allows for self-consumption by homeowners as well as time-of-use optimization and whole-home backup power. This solution is IEEE 1547-2018 and UL 1741 SA & SB certified, and it is supported by the Solis Cloud mobile app, which provides real-time monitoring for both solar installers and homeowners.

Other inverters on display at the company’s booth at Intersolar include the S6 Advanced Power Hybrid Inverter, which was recently launched to support South African residential and C&I uses, in conditions where grids are particularly unstable. This advanced inverter supports multiple parallel machines to form single-phase or three-phase systems.

pv magazine covered the launch of the inverter for South Africa here.

The S6 series of inverters is on display at the Solis booth in Hall B3 (B3.430).

A novel approach to panel reuse

Artist Polona Petek is giving Bisol's booth some creative inspiration with large-scale solar module painting taking place across Intersolar, writes Tristan Rayner.

Petek, well-known in Slovenian art circles, told a curious stream of onlookers that the glass on an old Bisol polysilicon module was a perfect canvas, good for acrylics and oil.

Katja Ertl, marketing manager at Bisol, said the idea leaned into the company's marketing of its Made In Europe modules being “European art,” and she is enjoying the conceptual approach.

Risen inks 1 GW heterojunction deal with One Stop Warehouse

While TOPCon is surging to become the largest n-type [negatively-doped] technology, heterojunction (HJT) is achieving some impressive results with “champion” cell efficiencies above 25%, according to manufacturer reports.

On the back of this technological progress, some sizeable deals are beginning to flow, writes Jonathan Gifford.

Risen was one of the first large Chinese manufacturers to adopt HJT technology and it has signed a 1 GW supply deal for its HJT Hyper-ion modules at Intersolar.

The deal was signed with distributor One Stop Warehouse, which first got its foothold in the Australian solar market and is now expanding into the United States and Europe.

Risen’s strategy for gaining market acceptance for its HJT technology aims to first address the utility-scale market segment before moving onto rooftops. The Hyper-ion utility scale module has over 700 W in peak power, with a smaller module available for commercial and industrial (C&I) rooftops to be introduced to the market in September.

Fire safety? We've got it covered

Conduct Technical Solutions, Dutch specialists in rooftop solutions for fire safety on solar rooftops, has presented a new shelter design for inverters at Intersolar, writes Tristan Rayner.

The new PV Shelter Angled solves a problem of traditional shelters by removing shadow from rooftops while maintaining easy installation features, designed specifically with a wide range of inverter manufacturers in mind with a simple adjustable height and technical guides for easy installation.

Its bright orange paint job possibly leans into its Dutch origins…

Pieter Kremer, founder and managing director of the business, showed pv magazine the product's design features, noting cautious cable management design to avoid bending, special Magnelis galvanizing of steel, and more.

SolarEdge launches new commercial battery

The new DC-coupled commercial battery from Israel-based SolarEdge will be available in the second half of next year.

Designed for small- to medium-sized commercial PV installations, the storage solution provides 58 kWh of capacity and is suitable for indoor use.

Up to eight batteries can be connected per inverter to deliver up to 460 kWh of storage capacity.

SolarEdge is touting an industry leading round-trip efficiency for the product through a shared DC bus, noting that hard figures will be released at a later stage. It would allow for DC/AC oversizing of 175%.

The system is compact and its modular architecture enables ease of installation and transportation, which can be handled by a two-person team.

The battery is suitable for indoor use in Europe and is expected to be certified for UL 9540A.

The system features nickel-manganese-cobalt (NMC) cells made by SolarEdge subsidiary Kokam.

“As a vertically integrated battery manufacturer, we have the advantage of designing the cells in a way that they would fit the new systems and its applications,” says Ido Ginodi, VP for global products at SolarEdge.

“A battery without an energy management system (EMS) is a body without a soul,” says Ginodi. “These commercial battery systems want to be able to consider revenue stacking, time-of-use tariffs, EV chargers, self-consumption optimization, and grid services and this is what our SolarEdge ONE can deliver. ”

Small is beautiful

Is this the smallest inverter at Intersolar, asks Cornelia Lichner. It weighs only 350 g and fits completely into the frame of a PV module.

Solarnative produces its Power Sticks near Frankfurt, in Germany. The start-up wants to launch the microinverter, with an output of 350 W, next month, initially for balcony solar systems.

The product is suitable for modules with a generation capacity of up to 440 Wp, says marketing expert Florina Thaler.

The launch for the on-roof segment will follow in the autumn.

There are many advantages to using microinverters, says Thaler. Since each module stands alone, shading is no longer a problem. In addition, only a small amount of voltage is required to start feeding.

The new product has already integrated grid and system protection and DC overvoltage protection.

At the end of a module string, a communication unit connects the system to the internet, whereby individual inverters are recognized and automatically mapped without scanning a product code.

Anyone who would like to try the product can register for the introductory campaign (with a discount) at booth B4.470.

'Policymakers need staying power'

Tariffs alone will not save European solar production, writes Marian Willuhn. Jürgen Reinert, CEO of inverter manufacturer SMA, says it is important to price in factors such as sustainability, durability, quality and access to raw materials. Policymakers need staying power for this, Reinert says. Investment security is best implemented when programs are in place for many years.

The SMA boss is well-disposed toward the European Net-Zero Industry Act. The right signals are being sent, even if the program in its current form provides less money directly to companies than President Biden's IRA. “If it's done sensibly and looked at in a long time horizon, then we should be able to achieve similar successes as with the IRA,” Reinert says.

It would be important for funding to ensure that as much of the value chain as possible also benefits in Europe. SMA is currently doubling its manufacturing capacity from 20 GW to 40 GW. Reinert says that this will not only create 250 jobs in Kassel, at SMA, but around three times as many jobs at suppliers.

That would be significantly better for the economy than assembling an inverter that was developed in Asia and merely bolted together in Europe.

SMA is also showing a new development from Kassel at Intersolar. The new single-phase hybrid inverter Sunny Boy Smart Energy comes in four power classes ranging from 3.6 kW to 6 kW.

The Sunny Boy Smart Energy is equipped with three MPP [maximum power point] trackers and a “Shade-Fix” function for optimized yields. The hybrid inverter is compatible with high-voltage batteries from a number of manufacturers.

For the first time, SMA is also introducing its own battery, the SMA Home Storage product. The unit is available with capacities from 3.2 kWh to 16.2 kWh. An emergency power outlet is available on the storage system and a separate circuit can be defined for devices that need to continue to be powered in the event of a power outage.

In addition, the SMA inverter can directly, continuously control heat pumps from Stiebel Eltron, Vaillant, and Tecalor.

Both products will be available from the fourth quarter.

Futura plans

Futurasun has said work on its cell production factory in Suzhou will begin next month, writes Sergio Matalucci. The factory is expected to be up and running in March.

“The panels will also be for the local market, not only Chinese, but in general Asian,” said Alessandro Barin, MD of the Cittadella-headquartered business.

How Intersolar can help Ukraine

@yulianaonishch1 tells @MarianWilluhn how solar companies can donate cash and equipment to an NGO which equips Ukrainian schools and hospitals with solar.#pvmagazine #intersolar #liveblog pic.twitter.com/xDeYX6ecrs

— pv magazine (@pvmagazine) June 15, 2023

A competitive edge

Not only module manufacturers are expanding, at the same time connector manufacturers have to scale up maintaining the reliability. Stäubli is keeping its market share of approximately 50%, says Vice-President Renewable energy Matthias Mack, explaining how to assure reliability. pic.twitter.com/6k5MbDyaex

— pv magazine (@pvmagazine) June 16, 2023

Clamping down on mounting system materials

The internet-of-things (IoT) is conquering the solar mounting system segment, as can be seen at the stand of manufacturer K2, writes Michael Fuhs.

Modules are getting bigger and that's a challenge when they have to be mounted to withstand high loads.

If you clamp standard modules, with a format of 1.8 m by 1.11 m, for example, the long side of the module often only withstands a load of 1,800 pascals. In areas where snow falls, this value load is quickly exceeded. Therefore, many installers clamp on the short side. This increases time and material consumption considerably, according to K2.

The company therefore offers a pressure sensor for its flat-roof system. “This allows you to clamp the modules on the long side,” K2's Lars Kreemke says.

The sensor is connected to a monitoring system. It sounds an alarm as soon as the pressure load is exceeded. In case of doubt, someone will have to shovel snow.

“In this way, you can reduce the cost of materials by up to 50%,” adds Kreemke.

It is not for nothing that he works for K2 in Switzerland. There are areas in the Alpine nation where you have to reckon with loads of 6,000 pascals.

Speeding up ground-mounted projects

Engineers have been planning ground-mounted solar systems for a long time but, surprisingly, there are still things that cannot be easily implemented with planning software, according to Julian Scheer, from RatedPower.

Based at stand 450 in Hall A3, Scheer is one of the developers of the pvDesign software and strives to simplify and speed up the planning process, writes Cornelia Lichner.

As an example, Scheer cited small ground-mounted systems that usually cannot be planned without maintenance roads. He and his team, however, have already mastered many a challenge.

The new “enverus integration” makes it possible to simply select US parcels of land on a map instead of integrating the surveyed parcels via an Autocad file, as was previously the case.

If you are a planner and understand the advantage of this new feature, drop in and visit Julian to see the other innovations RatedPower has to offer.

Hold the PV page!

Our pv mag correspondents tell us our flagship print publication is in evidence at booths across the Munich show but don't worry if you can't be in Munich, you can sign up for a subscription here.

In the latest issue of pv magazine we turn the spotlight onto European solar with a comprehensive review of the state of the PV industry across the region’s key markets and a look at the legislation which aims to drive a solar rooftop boom. We also examine the difficulty of establishing a solar panel recycling industry in Australia, where industry backbiting isn’t helping matters.

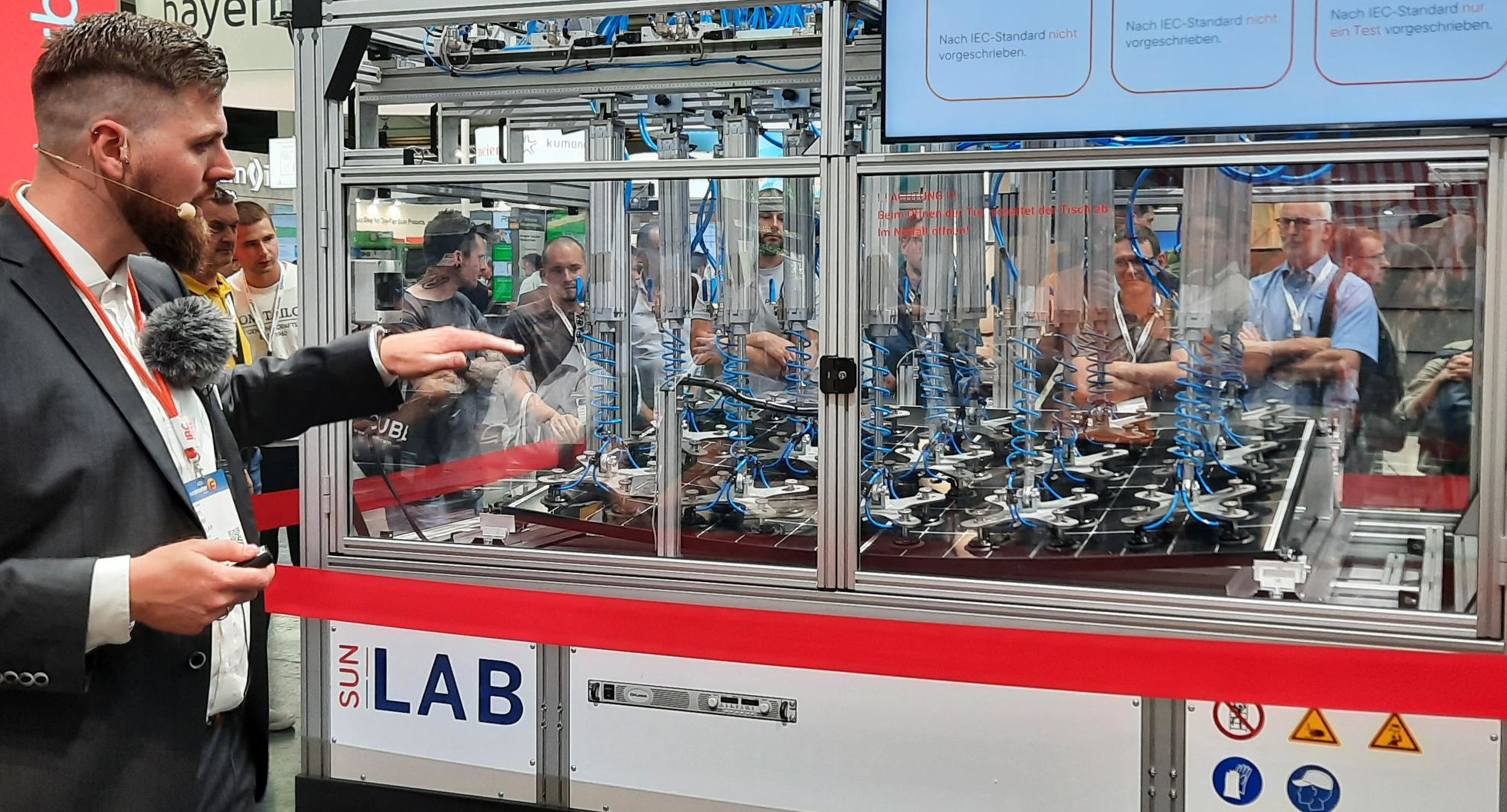

Can you crack the Sunlab test?

pv magazine Deutschland‘s Cornelia Lichner writes: It was clear to me that photovoltaic modules have to withstand a lot but I was amazed at how much they can actually endure.

The modules of wholesaler IBC Solar's brand can sag up to 6.9 cm under heavy pressure without breaking. And you can see the bend – clearly. If it weren't so loud at Intersolar, you would definitely hear the module squeaking.

Three times a day, solar modules are subjected to a static-mechanical load test on the load table of the Sunlab test laboratory to prove their quality. Impressive live tests will take place every day of the trade fair, at 11:00 a.m., 2:00 p.m., and 4:00 p.m. in Hall A4 at stands A4.470 and A4.570.

More and more manufacturers are starting to test modules in an installation situation, as IBC has done for many years, says Sunlab's Florian Spinler. The frame must not deform, the clamps must not slip, the cells and glass must not break, and the module must not rest on the roof.

After such tests, more stringent than required by IEC standards, IBC gives a 15-year guarantee on its products.

Hydrogen hype

German electrolyzer companies are reporting a notable increase in interest for hydrogen systems since the invasion of Ukraine, writes Sergio Matalucci.

“What really changed is the speed of the decision making process,” Peter Podesser, chief executive of SFC Energy said at Intersolar.

Similar comments have been heard from other hydrogen companies present at the show. “The key element (for hydrogen development) is political will,” said Lhyfe’s David Uhde.

How much?

If you put up a sign at Intersolar saying “Factory Price,” you shouldn't be surprised when solar news hounds might want to know the figure, writes Tristan Rayner.

Shenzen-based Pcenersys had the sign but company representative Orien Xu was a little tight-lipped once it became clear we were keen to publish a pricetag for 10 kWh of storage, as opposed to putting in an order for several thousand units, for example.

Pushed to give rough pricing for the benefit of pv magazine readers across the industry, Xu let us know that a 10 kWh Powerwall, using 48 V 200 Ah LifePO4 batteries, would be around $2,000, with a wink or a nod that this price might fall for a larger order.

Selling on sustainability

PV module supplier sustainability credentials are increasingly influencing investor decisions, says Trina Solar. The company is set to close a major agreement with “a major fund,” to supply almost 1 GW of modules.

Trina’s president for Europe, the Middle East, and Africa – Gonzalo de la Viña – said that price “was not the top consideration” for the fund in question. He said that Trina’s environmental credentials, as featured in its annual sustainability report, played a major role in sealing the deal.

De la Viña highlighted Trina’s “zero-carbon park” in Qinghai, at which its first monocrystalline ingot was produced in February.

The vertically-integrated Qinghai facility is planned to have an ingot capacity of 20 GW once complete and at present sources more than 90% of its electricity from green energy sources. With the application of a smart grid, and through clean energy procurement, the facility is intended to source all of its energy from renewables.

Trina Solar has also established what it reports is the first certified net-zero fab in the PV industry, located in Yiwu – where its Vertex S modules are produced. “This is something I, personally, am very proud of,” said de la Viña. “This is what the future is. The EU wants net zero and we are already achieving this with one factory.”

“You always need a forecast"

pv magazine dropped by Reuniwatt’s booth for a look at the company’s Sky Insight thermal imager – which tracks the movement and temperature of clouds to provide a forecast of solar energy output up to 30 minutes ahead, combined with satellite data for forecasting further ahead.

Reuniwatt Business Development Manager Marion Lafuma says such forecasts offer can offer project owners various advantages in energy trading, avoiding curtailment and other areas, writes Mark Hutchins. This year the company is particularly targeting customers in the off-grid sector, and PV systems powering operations such as remote mining. Here, Lafuma explains, forecasts can be particularly valuable in enabling customers to optimize their use of backup diesel generators and significantly cut energy costs.

Read more about solar forecasting in a guest article from Reuniwatt’s Marion Lafuma, featured in the June edition of pv magazine – available at our booth and on trade press stands all over the exhibition.