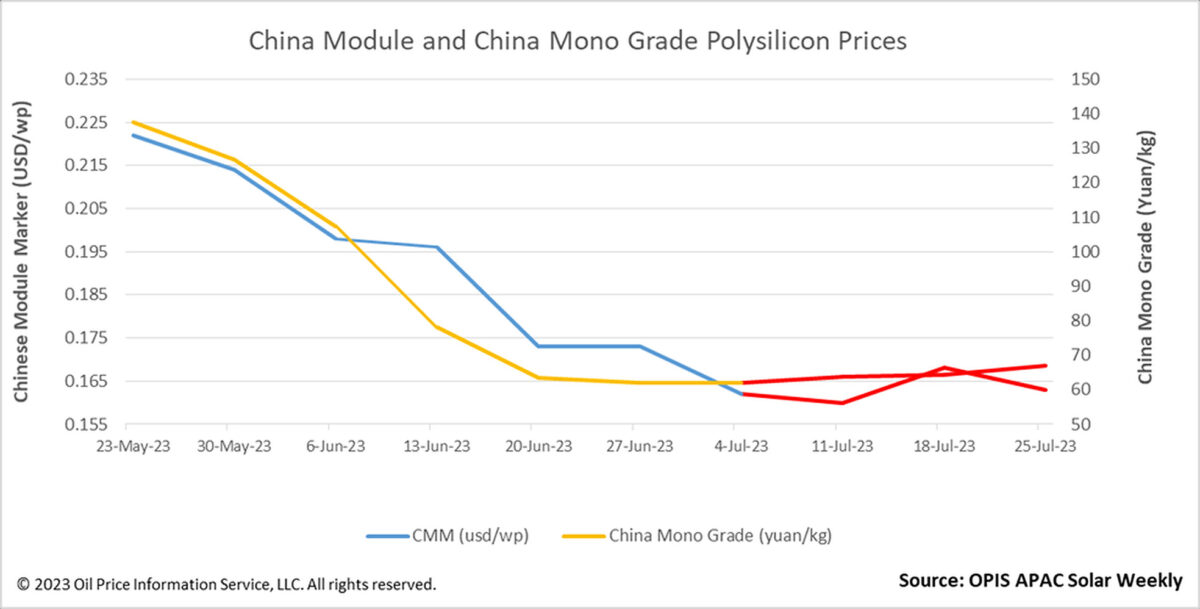

The Chinese Module Marker (CMM), the OPIS benchmark assessment for Mono PERC modules from China, fell to $0.163 per W in the aftermath of a major industry event in the country that saw market players reiterate that there is intense competition in the module sector.

The 2.98% drop – paring much of last week’s gains – comes as market players, following the China Photovoltaic Industry Association forum in Anhui, contemplated reduced bid prices for the country’s solar power projects. According to one business contact, prices in China are “crappy” and there have been “a lot of low price bids recently.” According to market participants and outcomes observed by OPIS, winning bids for Mono PERC tenders have been as low as CNY1.23 ($0.17)/W, with many significant tier-1 businesses represented.

The competition has put a strain on non-vertically integrated players, a situation exacerbated by the sheer number of module manufacturers in China. Recent bids mean “module manufacturers without their own cell lines cannot survive,” a contact said. A separate source at a smaller business described it as “the monks are many, but the porridge is little” because each bid portion is shared among more than ten companies.

Intense competition and low prices are not hallmarks of just China, however, but extend to other export markets. A source trying to expand into the Australian market noted that prices there are “incredibly low.” According to him, “some major players have already completely penetrated that market,” making it “impossible to find an opportunity to enter.”

Popular content

Different from the volatility in module pricing, China Mono Grade, OPIS’ price assessment for polysilicon in the country, continues its upward movement, rose 4.13% for a third week running to CNY67.08/kg, or $8.31/kg, on the back of short-term bullish factors like delays in new producers' production ramping up and the production disruption brought on by regional power rationing. However, sources believe that this does not change the overall picture of oversupply in the China polysilicon market in the long term.

The module segment also features the same prediction view. Looking ahead, module prices are expected to decline as oversupply remains the overarching economic factor, according to sources. However, given previous comments that developers eye procurement when prices have stabilized for a few weeks, the recent notch down might put them in wait-and-see mode in the short term until prices find a floor.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.