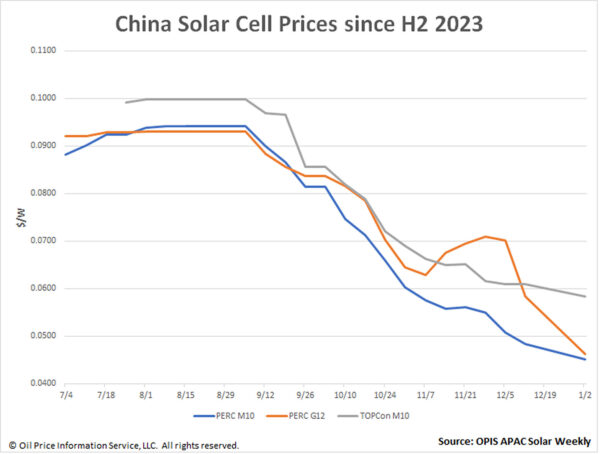

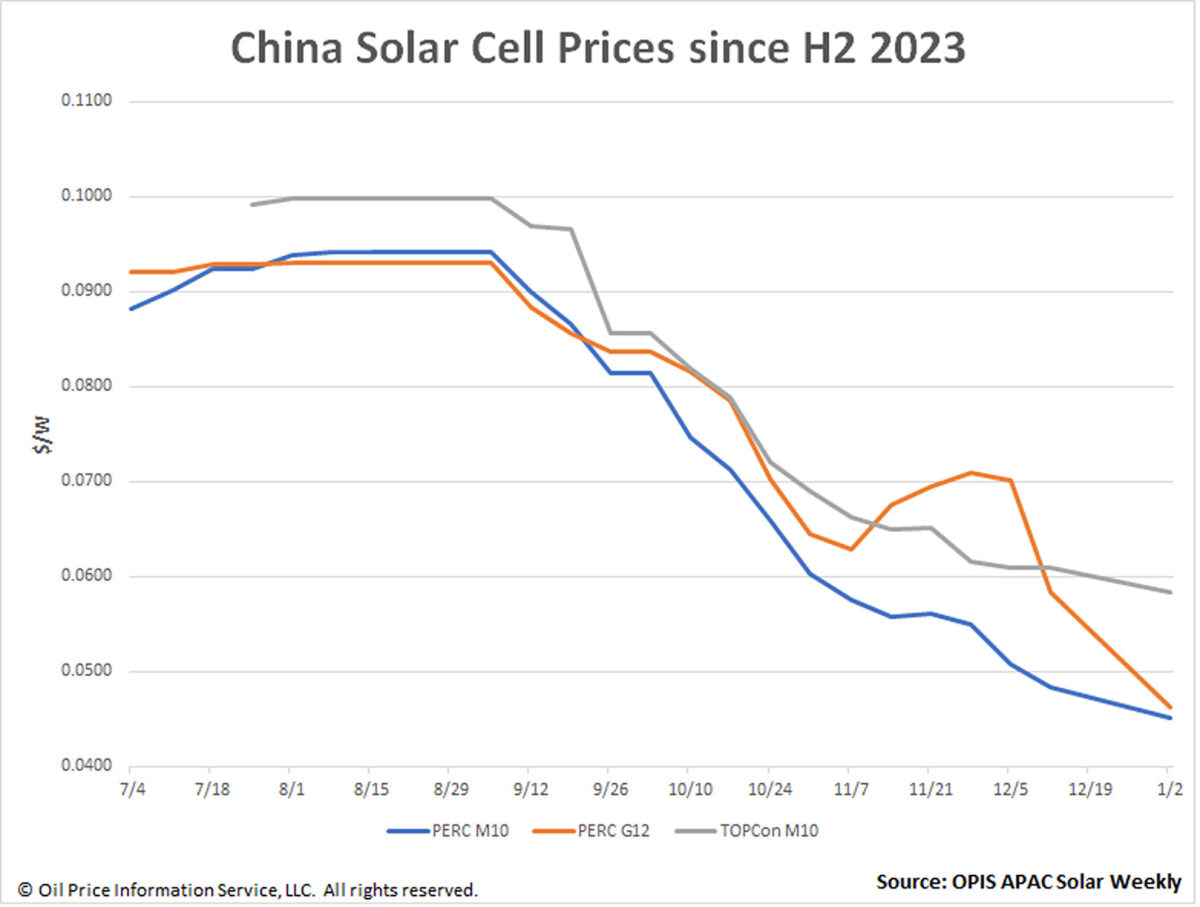

China cell prices decreased across the board as downstream demand remains sluggish. Monocrystalline PERC M10 and G12 cell prices were assessed at $0.0452/W and $0.0462/W respectively, down 6.61% and 20.89% from their last 2023 assessment on Dec. 12. TOPCon M10 cells also declined this week, falling 4.26% to $0.0584/W.

Cell producers have adjusted their operating rates to correspond to that of module factories downstream, which are expected to be less than 50% this December as this is currently the global off-season for solar installations, a solar market veteran said.

Cell makers no longer frequently receive PERC cell orders, and one major cell manufacturer has over 100 million pieces of PERC cells in stock, according to an upstream contact.

We may subsequently witness two scenarios in the cell market, the contact added. First, cell makers will concentrate on selling PERC M10 cells at a discount to clear their stocks. Second, demand downstream for n-type cells is anticipated to become mainstream soon in 2024.

TOPCon will continue to be their primary technical pathway in 2024, a major cell producer said. But as customer expectations for cell sizes have become increasingly varied, with growing demand for G12 and rectangular cells for example, 2024 may see cell makers continually alter production output for different-sized cells to suit client needs, the producer said.

Popular content

Perhaps surprisingly, there is market chatter about an impending price hike for PERC cells. A slight and temporary price increase may occur when PERC cell inventories are successfully cleaned out amid low cell operating rates and several manufacturers notably reducing PERC cell production lines, a downstream contact said.

According to a market expert, PERC cells have reached their development limit as their efficiency can be improved no further. Subsequently, cell manufacturers may concentrate on enhancing and expanding the production capacity, efficiency and manufacturing yield of n-type cells, the expert said.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Very interesting article for solar panel prices and cells tyoes information

All the time helpful to understand the market trends