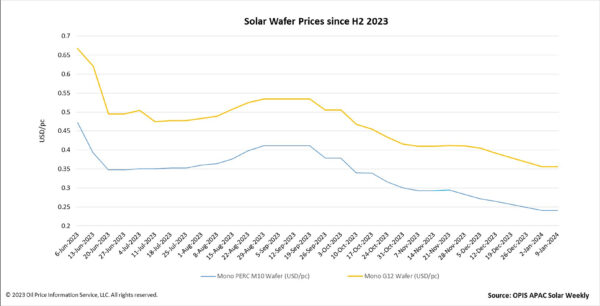

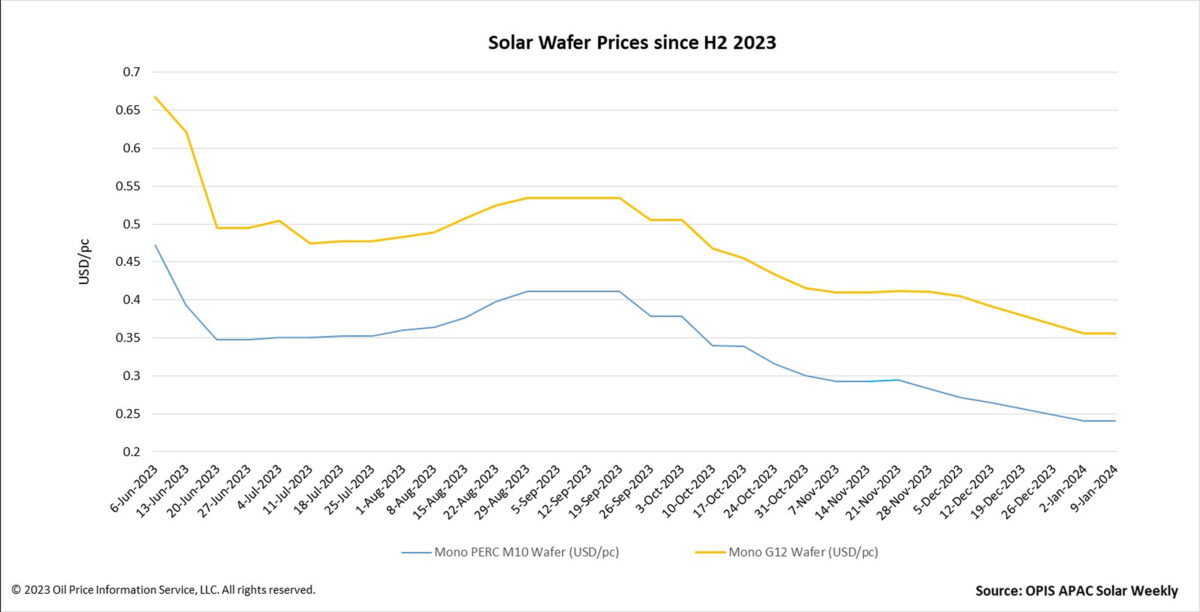

Solar wafer prices this week held steady following four consecutive weeks of falling prices. FOB China prices of Mono PERC M10 wafers trended flat on-week at $0.241 per piece (pc), while Mono PERC G12 wafer prices remained at $0.356/pc.

The primary cause of stable prices is a notable reduction in the availability of Mono PERC wafers, according to numerous sources. Multiple wafer producers have reportedly aggressively decreased operating rates for Mono PERC wafers in favor of switching their manufacturing lines from Mono PERC to n-type wafers.

In addition, some small and medium-sized wafer producers that have been selling their Mono PERC M10 wafers at low EXW pricing of between CNY1.8 ($0.25)/pc and CNY1.85/pc on the Chinese domestic market have successfully lowered their stock, according to a market observer. Consequently, the low-price portion for such wafers has vanished, with the majority of the price negotiation focused on the mainstream CNY1.93/pc, according to OPIS’ market survey.

There have also been reports of an impending price hike for Mono PERC wafers in the market. Multiple sources stated that a slight and temporary price increase for Mono PERC wafers may occur as a result of their decreasing supply.

Furthermore, the wafer market's total operating rate has decreased as a result of some companies' unstable n-type wafer production lines. According to the projection of the Silicon Industry of China Nonferrous Metals Industry Association, China's overall wafer production output in January might range from 54 GW to 56 GW, indicating a decline of 7.92% month over month.

Popular content

According to a market expert, wafer manufacturers still try their best to maintain operating rates at a particular level despite the continuous wafer overcapacity. At present, polysilicon prices make up about half of wafer production costs, the source added, and went on to say that when polysilicon prices are nearly at their floor, it is essential for wafer makers to maintain specific operating rates to reduce non-silicon costs by as much as possible.

It’s an undeniable fact that the market for wafers is currently experiencing a severe overcapacity, according to a source in the polysilicon segment, who added that she is not optimistic about Chinese wafer businesses expanding into production overseas as one of the biggest obstacles is the high cost of producing abroad. Selecting a factory location in regions appropriate for labor-intensive businesses is crucial, said the source, who concluded that the best investment destination for this industry may still be Southeast Asia.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.