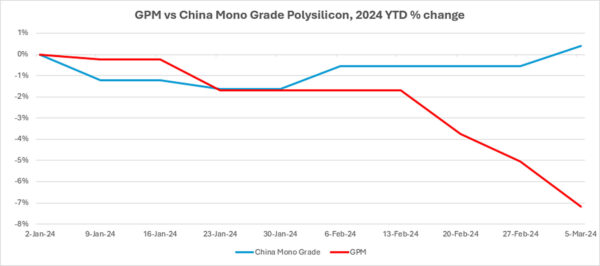

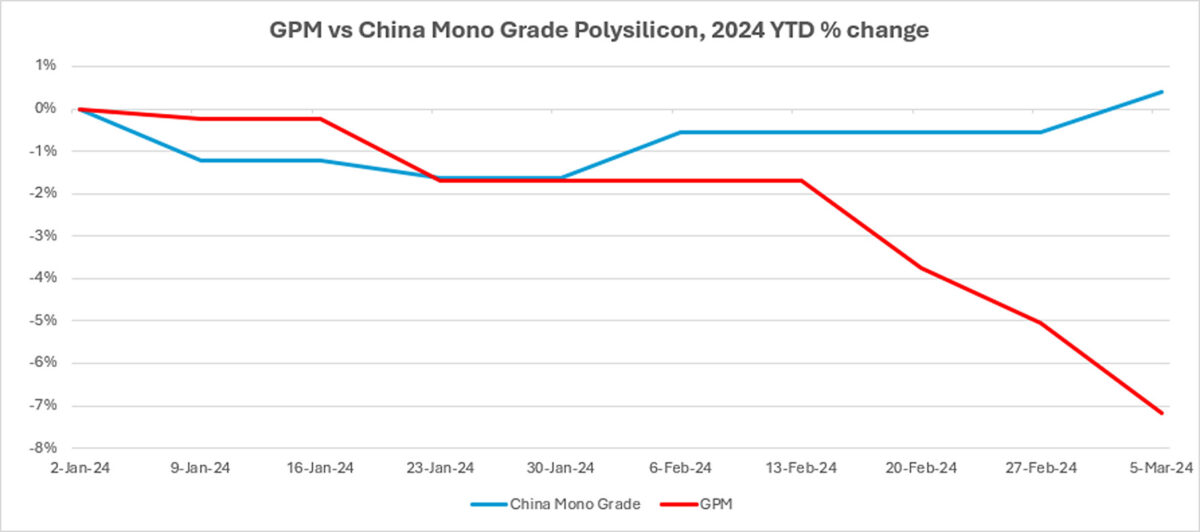

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $24.25/kg this week, down $0.55/kg, or 2.22% from the previous week, reflecting buy-sell indications heard.

According to market sources, conversations regarding contract negotiations between buyers and certain non-Chinese polysilicon vendors have encountered challenges. It has been reported that there are disagreements between the buyer and seller regarding certain aspects of the new long-term contract, as stated by an integrated player.

According to a China-based source, the pricing mechanism is considered the most challenging aspect of long-term contracts for both buyers and sellers to agree upon. The source further explained that disputes may arise between the parties regarding whether the pricing mechanism should be linked to the fluctuations in Chinese polysilicon prices.

An industry veteran has highlighted the high manufacturing costs as another major obstacle for the operation of polysilicon producers outside of China. The insider explained that the production cost for polysilicon manufactured outside of China has risen to a range between $15 and over $20. Factors contributing to this increase include global inflation and the growing trend of certain firms purchasing metal silicon from sources outside of China.

China Mono Grade, OPIS’ assessment for polysilicon prices in the country were assessed at CNY61.25 ($8.52)/kg, up CNY0.58/kg, or 0.96% from the previous week amid a rise in wafer producers' demand for p-type polysilicon.

As per an upstream source, the product quality of certain polysilicon manufacturers, particularly the newer ones, has reached a stable level. Consequently, wafer producers have augmented their procurement of premium p-type polysilicon and blended them with n-type polysilicon to generate n-type wafers, thereby reducing production costs.

To produce n-type wafers, it is technically required that the metal impurities in the n-type polysilicon do not exceed 0.5 parts per billion by weight (ppbw). However, in practice, wafer producers usually blend n-type polysilicon in a specific ratio with polysilicon that contains metal impurities up to 10 ppbw, the source added.

Popular content

The increase in production costs, primarily manifested by the rise in power prices, has played a role in driving up the price of polysilicon in China. A market observer asserts that Yunnan and Sichuan, which are home to several significant polysilicon factories, have seen an increase in electricity prices due to their low hydropower output during the current dry season.

Nevertheless, the duration of the rising polysilicon pricing trend in the domestic market of China is uncertain. A market participant notes that the sales volume of polysilicon for the previous week was moderate, suggesting that there is still a divergence of opinion between buyers and sellers regarding the pricing of polysilicon for the upcoming round. Furthermore, polysilicon factories currently hold approximately 80,000 MT of inventory, equivalent to approximately two weeks' worth of production. It is important to note that this figure does not include the stock of polysilicon held by wafer companies.

According to this source, the present circumstances place a lot of strain on the new polysilicon players. This source further mentioned that a brand-new, 100,000 MT polysilicon project, whose construction had begun in February last year, was recently found to have been put on hold midway through. In addition, the producer of a 50,000 MT polysilicon project, which commenced production in June of last year, is presently seeking buyers; however, the process was said to have encountered some difficulties.

As per a market expert specializing in the polysilicon segment, it is projected that polysilicon prices will likely remain around the current level until June. However, as production of polysilicon intensifies in the second half of the year, prices are expected to decrease again, potentially falling within the range of CNY50 to CNY55/kg. At this point, there may be a possibility of certain capacities being phased out.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.