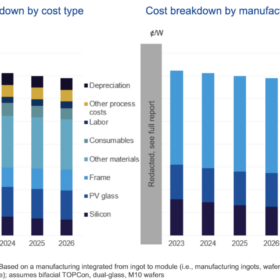

‘Sustainable’ module prices unlikely to fall further

PV manufacturing analysis is revealing that module prices can not “sustainably” fall significantly in 2024 without producers selling below cost. UK-based analysts Exawatt delivered the development last week, in a trend observed by Australian market participants.

Qcells exits Australian market

South Korean solar module maker Qcells told its local team this week that its Australian subsidiary will be closed. The decision underscores the highly competitive nature of the Australian solar marketplace and the company’s strategic decision to focus on its home market, the United States, and Europe.

Rooftop solar’s success results in ‘struggling’ large-scale segment in Australia

As rooftop solar racks up records in Australia, price cannibalization has resulted in a “struggling” large-scale market segment. Bruce Mountain, head of the University of Victoria’s Energy Policy Centre, says that increasingly depressed wholesale electricity prices during the day are squeezing out big PV.

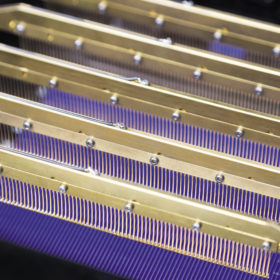

Weekend Read: Connecting HJT

The application of busbarless cell interconnection approaches could unlock the potential of heterojunction (HJT) technology, primarily by reducing the historically high silver usage of negatively-doped, “n-type” cell technology. As HJT manufacturing increases, a wave of applications may very well be on the horizon.

Stepping into the European utility-scale market: an interview with Gregory Lukens, Director Utility Europe for Solis

At this year’s Intersolar Europe conference in Munich, pv magazine caught up with Gregory Lukens, the new Director Utility Europe for Solis, a brand of Ginlong Technologies. He discussed his background in solar, and how the company is looking to build its footprint in the European utility scale segment.

Solar Leaders at Intersolar 2023: ‘Making modules cheaper will benefit buyers, but it won’t create demand’

At Intersolar in Munich, pv magazine spoke with Jenny Chase, solar analyst at BloombergNEF, about falling solar module prices, oversupply, bottlenecks in the European markets, and labor issues. According to Chase, lower panel prices won’t instantly create demand, and manufacturers should prepare to deal with very low margins. She also said we can expect to see more consolidation in the industry, and bankruptcies for uncompetitive producers may be unavoidable.

Weekend Read: Flex generation

A new generation of flexible, lightweight modules is entering the market. With back contact technology offering its own form of design flexibility and robustness, the new products could crack a hard-to-address market segment.

Weekend Read: A manufacturing bridge between Europe and Asia

A combination of protectionist measures, attractive profit margins, and domestic content incentives has revitalized Turkey’s solar manufacturing industry. Jonathan Gifford asks whether the resurgent sector can become a player on the world stage.

Weekend Read: Shingle all the way

While shingled cells have been around for a while, Tongwei’s adoption of the technology is notable as it is a manufacturer with considerable scale. If shingling can overcome some hurdles, it could prove a welcome solution as unshaded sites for PV become elusive in mature solar markets.

EU solar manufacturers’ ESG credentials could bolster revival

With calls for a revival in European PV manufacturing becoming more urgent, the Environmental, Social, and Governance credentials of its PV producers are being touted as a way in which manufacturing can be supported or even protected. The case for the ESG credentials of European manufacturing was advanced by multiple speakers at the 2023 SolarPower Summit this week in Brussels.