Siemens wants to take over Kaco

After announcing its entry into residential storage a week ago, the Munich-based multinational has now unveiled a plan to acquire inverter manufacturer Kaco. Siemens has not provided details about the value of the transaction.

Prices rise slightly in Germany’s first PV tender of the year

Last year’s trend continued in the first 2019 round of PV tenders. The average final price was €0.0480/kWh. Almost all the selected projects will be on arable land in disadvantaged areas of Bavaria.

PI Berlin findings say little about module quality in Europe

PI Berlin analysis has suggested the quality of modules is particularly high in Asian factories with a large throughput. However, just 2% of the 67 GW of production capacity audited for the study originated in Europe. The audits for the white paper were mostly carried out by Solarbuyer between 2012 and 2018.

Shell moves to acquire German storage business Sonnen

In May, oil giant Shell invested in German manufacturer Sonnen. Now the 112-year-old company wants to fully acquire the business, subject to Germany’s monopoly authorities. Sonnen said it hopes the deal will accelerate its growth by expanding its market reach and capacity.

EnBW and Energiekontor ink PPA for subsidy-free PV plant in Germany

The companies have entered a 15-year agreement for the plant, probably the first PPA for a project that size in Germany. Last week, EnBW said it was considering constructing a subsidy-free solar park in Brandenburg.

Amprion and OGE announce 100 MW power-to-gas project in Germany

The €150 million project is entering the approval phase. Using the new facility, expected by 2023, the two companies will test how electricity from renewable energy can be converted into green hydrogen and green methane via electrolysis.

Investor search for Solarworld failed, module factory to be auctioned-off

The manufacturer’s insolvency administrator has declared the investor search over. By March at the latest, all production equipment at the German module factory in Freiberg, as well as the buildings themselves, should come under the hammer.

Swiss manufacturer Meyer Burger sells wafer business to PSS

Precision Surfacing Solutions is paying $50 million to take over most of the production facilities as well as 100 employees working in wafer technology in Thun and in service locations worldwide. Meyer Burger wants to focus on PV cell coating and interconnection technologies.

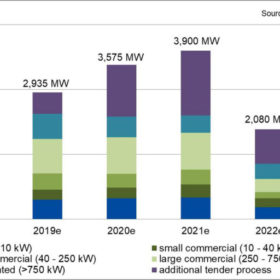

Germany to install more than 10 GW of PV before 2022 contraction

Extraordinary PV tenders by the federal government will provide for more growth. Market research company EuPD Research expects newly installed capacity of 4 GW in 2021. After that, however, the market could see a sharp reduction, after the 52 GW cap for solar subsidies is reached.

Germany installed almost 3 GW of solar in 2018

PV demand grew 68% year-on-year from the level seen in 2017 as Germany’s cumulative installed solar generation capacity reached 45.92 GW.