Talesun: Focus on solar tech and product innovation to survive

Several black swans have been circling over this year’s solar PV industry: rising raw material and product prices; supply chain issues and international logistics holdups; and power shortages in China, to name but the most disruptive. How is it possible for solar companies to survive under these conditions? According to Dong Shuguang, a PV veteran and President of Talesun Solar, they must focus on solar technologies like PERC, TOPCon and HJT, and product innovations that provide customer value.

Chinese PV Industry Brief: Shuangliang secures another major wafer supply deal

The Chint group has also agreed to sell a portfolio of distributed solar projects with a capacity of 493 MW.

Chinese PV Industry Brief: Longi considers overseas factory, GCL-Poly switches on 20,000 MT polysilicon fab

Furthermore, DaSolar has unveiled a plan to build a 5 GW module factory in Fujian and Maxwell Technology said it will provide a 500 MW heterojunction solar cell production line to Anhui Huasun New Energy.

Chinese PV Industry Brief: Two major deals for PV production equipment

JSG has sold several ingot furnaces to Shuangliang Eco-Energy and Jinchen Machinery will provide Yingli with production equipment totaling 3.5 GW.

Chinese PV Industry Brief: TBEA wants to set up 400,000 MT metal silicon production

TBEA unveiled a plan to build a 400,000 MT metal silicon factory in Baotou City, in the Inner Mongolia province. Furthermore, EnergyTrend reported polysilicon prices increased slightly this week.

Chinese PV Industry Brief: Daqo wiped debts as poly price continued to rise

The worldwide solar boom is proving so profitable the polysilicon manufacturer is even thinking of turning to PV panels to power its manufacturing operations, rather than cheap coal.

Chinese PV Industry: Government announces deployment of 30 GW of renewables in northwestern China

Furthermore, TBEA has announced a plan to invest in four solar power plants and Flat Glass has agreed to acquire two quartz mines.

Chinese PV Industry Brief: Government confirms plan to install 1.2 TW of renewables by 2030

Elsewhere, cell maker Aikosolar has announced two major wafer purchase agreements with manufacturers Shuangliang and Shangji, and Zhonghuan Semiconductor has reported solid financials for the third quarter.

China PV Industry Brief: Installations slow, deals continue despite rising prices

This week saw prices in the polysilicon segment, and further downstream, rise again, with no end in sign. National Energy Agency statistics show a slowdown in installations for the second consecutive month in September. Manufacturers, however, continue to purchase components and materials in the expectation that prices will rise even further.

Chinese PV Industry Brief: Shuangliang signs billion-dollar wafer contract

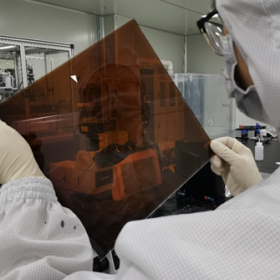

This week, Shuangliang Eco-Energy has signed a multi-year sales contract for delivery of its PV wafers to solar cell manufacturer Jiangsu Runergy, and Wuxi-based perovskite start-up UtmoLight Technology has won a Pre-A round investment of RMB 220 million from several private equity funds.