Record solar numbers expected this year but IEA highlights pricing concern

The Paris-based body expects the world will have installed almost 160 GW of solar this year, a record number, but still not enough to keep the prospect of a net zero global economy by mid century in sight.

Forced sale of Shunfeng projects will remove biggest overdue debt

Creditor Chongqing, which has been owed more than $100 million by the embattled developer for 14 months, will force through a sale of 180 MW of solar capacity to a third party. Shunfeng had originally wanted to sell the projects to Chongqing six years ago.

Update: Jinko says it did not reduce PV panel prices in the last quarter

The company today told pv magazine it did not reduce any of its PV module prices in the July-to-September period.

Chinese developer offers $50m for renewables if Bangladesh frees up land

A Shanxi-based clean energy company has asked for 200 hectares so it can construct 50 MW of power generation projects.

Behind the price drops in lithium-ion batteries

Scientists in the United States pieced together data from hundreds of different sources, looking to establish the key factors that have led to consistently falling prices for lithium-ion technology since their commercialization thirty years ago. They find that public-funded research, primarily in chemistry and materials science, has made the largest contribution to cost reduction. And they offer suggestions on policy and investment to ensure that the research can continue to make these important contributions to reduction in battery costs.

A net-zero Canada would need 1.6 GW of solar per year from now on

Clean energy trade group the Canadian Renewable Energy Association has told policymakers CA$8 billion worth of solar and wind projects will be needed each year to decarbonize the electricity supply by 2035 and remove net emissions by mid century.

European Commission approves €2.3bn renewables incentive plan by Greece

Competitive bidding for onshore solar and wind will establish a clean-power strike price acceptable to successful developers under the contracts-for-difference approach. The incentive scheme is also applicable to biogas, biomass, landfill gas, hydropower, concentrated solar power, and geothermal plants.

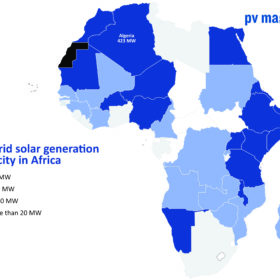

Cheaper wholesale solar equipment through $10m group-buying fund in Nigeria

Two investors backed by the charitable foundations set up by energy giants have seed-funded the cash pot to lend to African solar companies, who will be able to buy solar kit cheaper thanks to the economies of scale offered by the aggregation of orders.

African Energy Week highlights lack of support for renewables

The closing day of the African Energy Week event held in South Africa this month heard voices casting doubt on a renewables-only energy transition and calling for a gradual change and continued investment in petrochemical production.

London developer secures backing for 500 MW of solar in the UK

Queequeg Renewables says it has formed a joint venture with an Italian private equity investor to fund the first slice of a planned 1.3 GW solar-plus-storage portfolio in Britain.