From pv magazine Germany

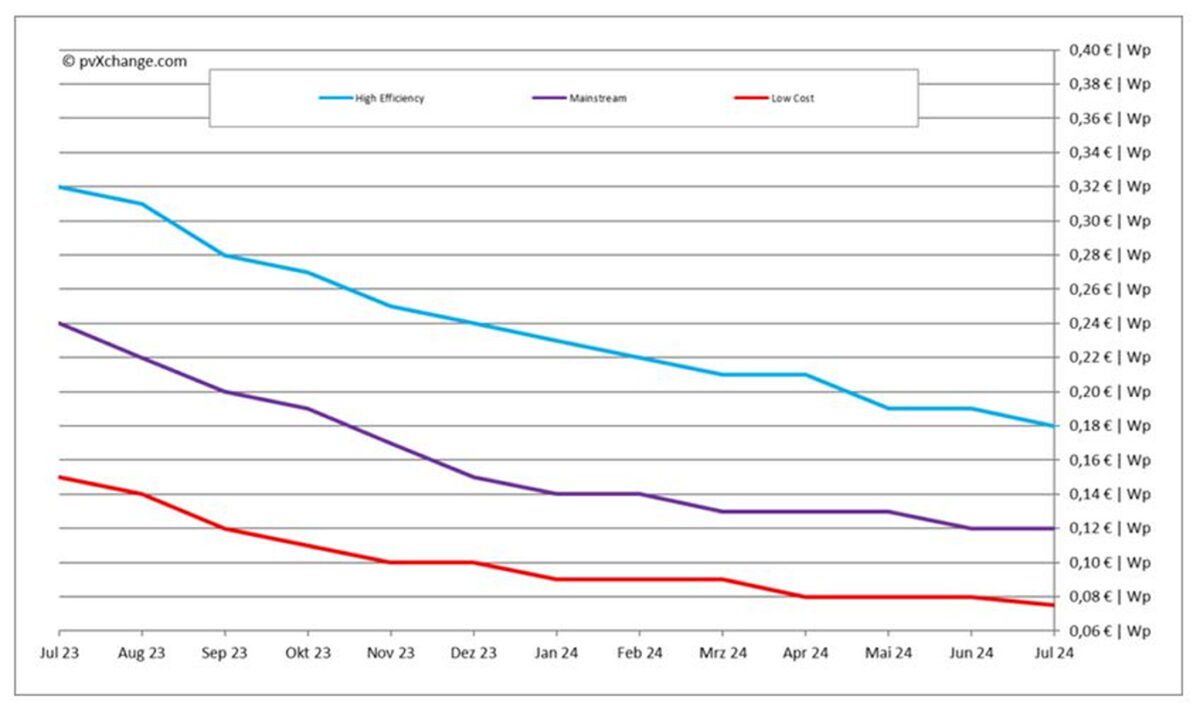

Module prices have remained stable or slightly declined this month, with no sign of change. Both residential and C&I demand continues to fall short of expectations, reaching lows not seen since late last year. Installers should prepare for a slow summer and consider new business models to keep their staff engaged. Without short-term orders, they will need to explore alternative approaches.

Solar leasing, especially in combination with C&I systems, offers significant potential. Wenzel Gerstner, a co-founder of German startup Hellgrün, says the company secures roofs of commercial centers and creates energy solutions that help businesses cut their energy costs with photovoltaic electricity. It leases roof space from property owners and installs solar systems funded by private investors. Hellgrün handles the full process, from administration and operation to energy distribution, while planning and technical management are managed by partners.

To sell generated electricity profitably and above the current feed-in tariff, system operators need long-term purchase contracts with commercial property tenants. These agreements allow tenants to secure solar power at a preferential rate, covering only their remaining energy needs from the grid. Matching generation and consumption profiles closely increases self-consumption and profitability for both parties.

pv magazine

A model with partial feed-in and direct delivery to on-site tenants is preferable, but securing long-term contracts can be challenging due to high tenant turnover. Despite this, investor risk remains manageable as long as Germany's renewable energy law (EEG) ensures fixed tariffs, allowing for full feed-in as a fallback. The ability to switch between partial and full feed-in is available once a year. Additionally, the legislature has recently increased the feed-in tariff for roof systems between 40 kW and 750 kW by €0.0157/kWh, pending European Commission approval.

For a medium-sized PV system of 100 kW, built with a decent equity share on a leased roof at €100,000 to €120,000, the return is around 5% to 6% with full feed-in. Choosing lower-remunerated surplus feed-in can boost returns to 7% to 8%, assuming no long-term consumption shortfalls and revenue staying above €0.10/kWh. The commercial tenant electricity model is about 30% more profitable than full feed-in under current conditions.

The leasing concept is not highly profitable, but it opens a new market segment and presents an opportunity for installers to offer commercial customers options such as direct purchase or leasing with external financing. This approach helps customers avoid initial costs and operational risks while securing orders for installers, even during tough market conditions.

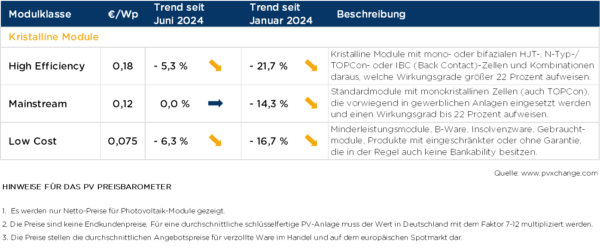

Image: pvXchange.com

About the author: Martin Schachinger has studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he set up the pvXchange.com online trading platform. The company stocks standard components for new installations and solar modules and inverters that are no longer being produced.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.