Renewable energy project financing in Chile analyzed

Taking a renewable energy project into its operational phase calls for several workstreams to be synchronized. The one that perhaps jumps out the most is permitting processes: correctly navigating the intricate and time-sensitive steps for licenses and permits. Regardless, each workstream calls for a different set of skills, and because of interlinked chicken-or-egg causality, it is difficult to say which single element is most important in a project’s development. However, there is an unsung element of the financial closing which has as much, if not more, impact on a project’s profitability than the cost of debt does: the underlying terms and conditions.

Global actions delivering electricity for rural households through off-grid renewable energy

The Sustainable Development Goal set forth in SDG 7.1 calls for universal access to affordable, reliable, and modern energy services by 2030. It is estimated that currently 789 million people do not have access to electricity in their homes or communities. Rural inhabitants encompass 80% of the total number of people lacking household electricity access. On a global scale, rural inhabitants have been gaining access to electricity at a rapid rate over the past couple decades (IRENA 2020, 23). However, certain regions have seen little improvement in this area. Sub-Saharan Africa (SSA) is the starkest example.

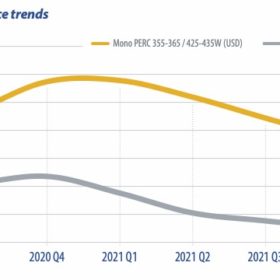

Xinjiang sanctions and the PV supply chain

Due to forced labor concerns, a ban on imports from Xinjiang to the United States appears likely. This could be another blow for polysilicon producers hit by industrial accidents and the threat of floods in the third quarter of 2020. Chinese polysilicon prices have surged more than 50% in a matter of a months. Consequently, wafer prices have skyrocketed, bringing increasing costs to the solar cell and PV module segments. In the face of price hikes, some projects are now postponed until the first half of 2021.

The world won’t wait – Biden needs to catch up

The inauguration of Joe Biden as the 46th President of the United States has brought hope the country will play a central role in the world’s energy transition and combating climate change. However, rather than teaching other countries lessons, the U.S. will need to catch up with the rest of the world, and it needs to do so quickly – the world won’t wait for the U.S.

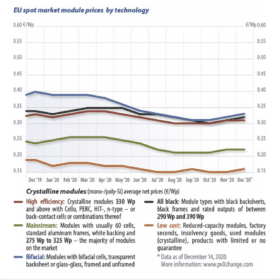

Module Price Index: 2020 – Taking the time to say ‘thanks’…

Alongside all of the problems, 2020 has brought us a few promising solar module manufacturer initiatives and developments. Martin Schachinger of pvXchange.com looks back over the second half of the year and offers a quick look at what could be in store for 2021.

Turkish PV manufacturer report reveals country’s annual production capacity is 5,610 MW/year

In September 2020, Stantec Turkey launched a market assessment report for the Turkish solar PV panel manufacturing sector. The English version of the “Market Report for Turkey’s Photovoltaic Panel Manufacturing” followed in November. The report, based on collected data from local manufacturers, depicts the history of the market since its inception in 2011 and provides unique insights into its development and future potential.

Guggenheim Solar Index: More to come in ‘21

With the wholesale transformation of the power industry from the inside out and other energy transition mega-trends, capital will continue to flow into renewables from ESG, energy funds, and retail, writes ROTH Capital Analyst Jesse Pichel. Look for a greater mix of unsubsidized economic solar projects to support improving revenue visibility, increasing earnings quality, and multiple expansions.

Solar set to shine in a post-pandemic world

The world is still combating Covid-19, with Europe now impacted by a second wave of the virus. While the market reported delays for a few projects, the impacts on the PV sector remain unclear. But if the world fails to curb the Covid-19’s spread, governments may be forced to reintroduce strict measures, thereby sapping PV demand. PV InfoLink’s Mars Chang expects module demand to hit 126 GW by the end of this year.

What is the UK government’s problem with solar?

You’ll need to pay close attention to find the few mentions of solar in the long-awaited White Paper issued by the government to outline how it plans to hit net zero by mid century.

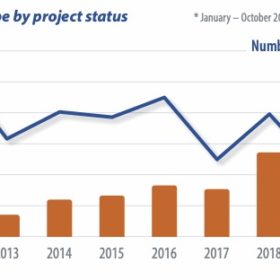

Acquisition activity in Europe remains heated

The European solar market saw around 11 GW of projects, and pipelines change hands in 2019. The positive trend is expected to last, as investors remain optimistic about the future of the industry. Project acquisition activity is seen as a key indicator of financial health in many sectors, including the PV market. It reflects optimism among investors and points to a particularly high degree of liquidity, writes IHS Markit analyst Martina Assereto.