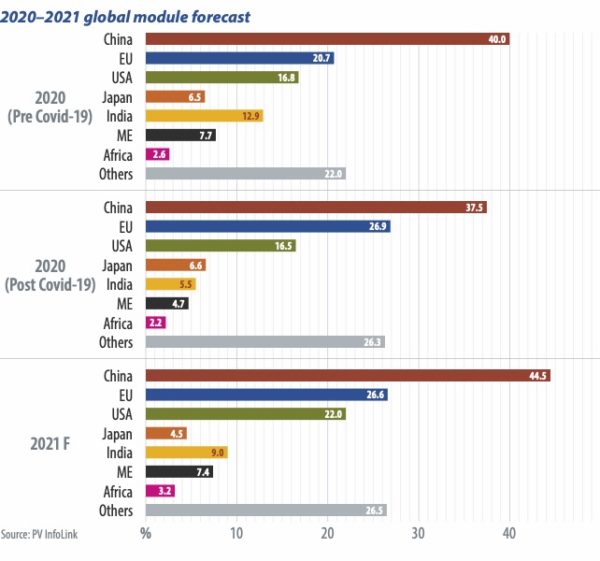

When the world enters the post-pandemic era, PV is expected to recover and prices to fall across the supply chain – with projects deferred by the crisis contributing to demand growth. In light of this, global solar demand looks bright. China is forecast to dominate 31% of the global market share. Europe and the United States will continue to lead demand growth, accounting for 19% and 15% of the market, respectively. The hard-hit Indian market is likely to bounce back from its Covid-19 slump next year. Demand in both the Middle East and Latin America is also optimistic. PV InfoLink estimates that global module demand will reach almost 144 GW in 2021.

Grid parity

Under China’s policy direction for 2021, the government will no longer provide solar incentives, except for residential projects. This means that unsubsidized projects will gradually become the main driver for demand growth in the Chinese market. China’s 14th Five-Year Plan also hints that ultra-high voltage and demonstration projects might be issued next year. Against this backdrop, PV InfoLink expects China to see 44.5 GW of module demand in 2021.

Chinese auctioned projects that postponed installation until next year will be connected to the grid by June 30, 2021. This will allow them to secure payments, and demand will come from projects due to commission by the deadline in the first half of the year. Demand is likely to rise to the peak of the year in the second quarter.

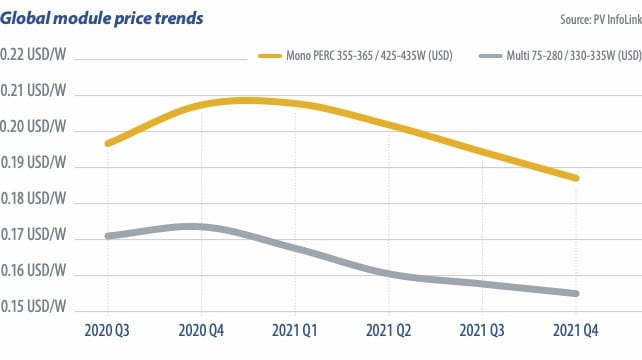

When the remaining auctioned projects are grid-connected in the second half of the year, China will officially enter the grid parity era. With unsubsidized projects becoming the major market force by then, the degree of module price decreases will determine the grid parity demand level. PV InfoLink predicts that module prices will decline to RMB 1.45 ($0.22)/W in the second half due to continued capacity ramps across the supply chain. Driven by grid parity projects, the last three months will become the busiest season in the second half of the year.

Overseas growth

In the face of the crisis, many governments outside of China have either postponed grid-connection deadlines or auction timelines to minimize impacts on the renewables sector. The price hikes caused by accidents at polysilicon fabs and pandemic-induced logistical hiccups in Xinjiang in the third quarter, and module price increases caused by PV glass shortages, also added to the crisis. As a result, developers postponed projects to avoid extra costs incurred by increased module prices. As glass prices skyrocket, module manufacturers may have to renegotiate the terms for orders signed with lower prices earlier, where it is possible to postpone delivery until next year.

In 2021, the markets in Europe and the United States will shine brightly. India is set to bounce back, the Middle East and Latin America will see strong utility-driven demand, as well as demand from grid parity projects. Overall, demand in non-China markets will be stronger than this year. PV InfoLink expects non-China demand to hit 99.2 GW next year, with the U.S., Europe, and India contributing 22 GW, 26.7 GW, and 9 GW of demand, respectively.

Some developers in Europe and the United States have postponed projects until the first half of 2021, in anticipation of declining module prices. Among projects deferred by Covid-19, C&I rooftop projects accounted for the majority in the United States. Considering the U.S. election outcome, there won’t be an immediate impact on demand next year, given that most projects have already been planned. Under a Biden administration, the U.S. long-term growth prospects look optimistic.

European countries such as Germany, the Netherlands, and Sweden have relaxed the timelines for solar system construction this year, and so most projects will be commissioned in the first half of 2021. While a second Covid wave began to sweep through Europe in mid-October, measures imposed by European governments thus far are less restrictive compared with the beginning of the year, with projects still underway. However, construction may face delays again if governments reintroduce strict lockdowns.

In the Middle East, the United Arab Emirates is likely to complete the construction of a 900 MW utility-scale PV plant during the first half of 2021. Coupled with other factors, strong demand will persist in the region from the second half of this year through the first half of next year.

Since deferred as well as new projects will complete installation in the second quarter of 2021, markets outside of China will experience a short period of lower demand in the third quarter, but climb to a second half peak in the final quarter, as the traditional high season will fall upon the U.S. and demand grows in the Middle East and Latin America.

Spurred by deferred projects, demand will remain strong from the second half of this year through the first half of 2021. China’s grid parity projects and traditional high season in overseas markets will lead solar growth in the second half, with demand reaching a peak in the last three months of the year. Overall, the global market will be the busiest in the second and the final quarter.

The projected 33 GW of global demand in the first three months of 2021 is slightly lower than the level in the last quarter of 2020. While leading glass suppliers Xinyi Solar Holdings and Flat Glass Group will bring new capacity online, glass shortages will ease somewhat amid weakened module demand and increasing glass capacity. It’s expected that module prices start to decline gradually after the Lunar New Year and the downward trend will be accelerated when large volumes of wafer, cell and module capacity come online in the third quarter.

The Covid-19 resurgence in Europe has cast a cloud on the market, but the pandemic will have a limited impact on the solar PV sector over the long term. Carbon neutrality, grid parity, and subsidy-free solar will remain global trends, and with significant solar cost reductions, they will continue to drive the growth of renewables.

About the author

Mars Chang is responsible for research and analysis on the Chinese and global solar markets. His major areas of coverage include policy, market demand, installation capacity, and solar tenders in the global renewable energy market. In addition to providing market insights and forecast, Chang writes feature articles covering solar development in countries supported by the Belt and Road Initiative, as well as emerging solar markets.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.